TIDMDTG

RNS Number : 5089X

Dart Group PLC

20 November 2014

DART GROUP PLC

Interim Results

Dart Group PLC, the Leisure Travel and Distribution &

Logistics Group ("the Group"), announces its interim results for

the half year ended 30 September 2014. These results are presented

under International Financial Reporting Standards ("IFRS").

Financial Highlights Half year ended Half year ended Change

30 September 30 September

2014 2013

(Unaudited) (Unaudited)

------------------------------------------- ---------------- ---------------- ----------

Group revenue GBP902.2m GBP787.1m +15%

------------------------------------------- ---------------- ---------------- ----------

Group operating profit (underlying(1) ) GBP89.4m GBP81.2m +10%

Operating profit margin (underlying(1) ) 9.9% 10.3% (0.4ppt)

------------------------------------------- ---------------- ---------------- ----------

Group operating profit GBP72.4m GBP81.2m (11%)

Operating profit margin 8.0% 10.3% (2.3ppts)

------------------------------------------- ---------------- ---------------- ----------

Profit before tax (underlying(1) ) GBP88.7m GBP78.1m +14%

Profit before tax GBP71.7m GBP78.1m (8%)

------------------------------------------- ---------------- ---------------- ----------

Basic earnings per share (underlying(1) ) 48.25p 41.51p +16%

Basic earnings per share 38.93p 41.51p (6%)

------------------------------------------- ---------------- ---------------- ----------

Interim dividend per share 0.75p 0.60p +25%

------------------------------------------- ---------------- ---------------- ----------

Note 1: Underlying profit references are stated excluding

Separately disclosed items (Note 6)

* Group revenue increased 15% to GBP902.2m (2013: GBP787.1m)

whilst underlying Group operating profit increased 10% to GBP89.4m

(2013: GBP81.2m) underpinned by continued growth in the Leisure

Travel business.

* Underlying profit before tax grew 14% to GBP88.7m (2013:

GBP78.1m). Interim dividend per share increased by 25% to 0.75p

(2013: 0.60p).

* As a result of a Supreme Court ruling delivered on 31 October

2014 on EU Regulation 261, the Group has made an exceptional

provision of GBP17.0m for possible passenger compensation claims,

which may be payable in certain circumstances, for historical

flight delays which occurred over the past six years due to

technical reasons. After accounting for this exceptional item,

overall profit before tax fell 8% to GBP71.7m.

* Leisure Travel revenue growth of 16% to GBP824.1m (2013:

GBP708.9m) reflects a 12% increase in total passengers flown, which

is marginally below the increased seat capacity of 13%, and

includes a 21% increase in package holiday customers.

* Distribution & Logistics contributed GBP78.1m of revenue (2013: GBP78.2m).

* With winter 14/15 Leisure Travel bookings continuing to

perform in line with expectations, the Board is optimistic that

current market expectations for full year operating profit, before

adjusting for the exceptional provision of GBP17.0m, will be

achieved.

Chairman's Statement

I am pleased to report on the Group's trading performance for

the half year ended 30 September 2014 in our two businesses,

Leisure Travel - incorporating Jet2.com, the North's leading

leisure airline and Jet2holidays, our ATOL protected package

holidays operator - and Distribution & Logistics, comprising

Fowler Welch, one of the UK's leading logistics providers.

Underlying Group operating profit increased 10% to GBP89.4m

(2013: GBP81.2m) and underlying profit before tax by 14%, to

GBP88.7m (2013: GBP78.1m). After accounting for an exceptional

provision of GBP17.0m, in relation to possible passenger

compensation claims, which may be payable in certain

circumstances,for historical flight delays under EU Regulation 261,

Group profit before tax, fell by 8% to GBP71.7m.

The increase in underlying Group operating profit reflects

improved trading in our Leisure Travel business in the later summer

months, which was in contrast to the challenging market conditions

experienced earlier in the season. However, increased losses are to

be expected in the second half of the year as our expanding Leisure

Travel operations, which concentrate on high volume leisure

destinations in the Mediterranean, the Canary Islands and European

Leisure Cities, invest in additional aircraft, advertising and

people in readiness for the summer 15 season.

The Group generated increased net cash flow from operating

activities of GBP93.2m (2013: GBP89.5m), reflecting the improved

Leisure Travel trading performance. Total capital expenditure of

GBP25.5m (2013: GBP42.7m), included continued investment in the

long-term maintenance of our aircraft fleet. The business will be

adding a further four aircraft in the second half of the financial

year in readiness for summer 15, two of which will be leased.

Cash and money market deposits increased by GBP68.1m (2013:

GBP48.9m), resulting in total cash held at the reporting date of

GBP331.8m (2013: GBP269.8m), which included advance payments from

Leisure Travel customers of GBP145.0m (2013: GBP134.4m).

Underlying basic earnings per share increased to 48.25p from

41.51p. However, after accounting for the exceptional provision of

GBP17.0m, overall basic earnings per share fell to 38.93p. In view

of the outlook for the full year, the Board has decided to pay an

increased interim dividend of 0.75p per share (2013: 0.60p). The

dividend will be paid on 2 February 2015 to shareholders on the

register at 5 January 2015.

Leisure Travel

In the first half of the year, flight-only passengers grew by 8%

to 3.07m (2013: 2.84m), whilst Jet2holidays took 0.77m (2013:

0.64m) customers on holiday, an increase of 21%. This growth is a

reflection of the popularity of both our flight-only and package

holiday products with package holiday customers now making up 33%

of all passengers flown (2013: 31%).

Our leisure airline, Jet2.com, flew 5.0m sector seats at an

overall load factor of 91.8% equating to 4.6m flown passengers, an

increase of 12% over the same period last year. Overall net ticket

yield of GBP79.99 was 1.6% down as early season demand was slower

than expected, which was particularly pronounced in relation to our

Canary Islands and Eastern Mediterranean destinations. Retail

revenue (non-ticket revenue) per passenger increased by 5% to

GBP34.04 (2013: GBP32.32); a result of continued focus on

pre-departure, in-flight and ancillary product sales. The average

price of a package holiday grew 3%.

As a result, Leisure Travel revenue grew by 16% to GBP824.1m

(2013: GBP708.9m) at an underlying operating margin of 10.7% (2013:

11.2%). Underlying operating profit grew 10.6% to GBP87.8m (2013:

GBP79.4m).

During summer 2014 the Leisure Travel business operated 54

aircraft (2013: 49) from its eight Northern UK bases - Belfast

International, Blackpool, East Midlands, Edinburgh, Glasgow, Leeds

Bradford, Manchester and Newcastle airports. In early October 2014,

the owners of Blackpool Airport announced that the airport was to

close on 15 October 2014, ending a long-standing relationship

established in 2005. The two aircraft which were based at Blackpool

Airport have since been redeployed into other existing bases.

We will continue to develop our customer-focused flying

programme into summer 15, which will also include the addition of

four new destinations - Antalya in Turkey, Enfidha in Tunisia,

Kefalonia in Greece, and Malta.

EU Regulation 261

Subsequent to a judgment given on 11 June 2014, in which the

Court of Appeal held that a technical defect was not in itself an

extraordinary circumstance and that compensation for delay may be

payable, Jet2.com had its application to the Supreme Court, to

appeal the Court of Appeal's earlier decision, rejected.

Accordingly, the Consolidated Group Income Statement includes an

exceptional provision of GBP17.0m in relation to possible passenger

compensation claims, which may be payable in certain circumstances,

for historical flight delays over the past six years.

KPIs

Half Year Half Year

Ended Ended Year Ended

30 Sept 30 Sept Half Year 31 Mar

14 13 End Change 14

----------------------------------------- ---------- ---------- ------------ -----------

Owned aircraft at 30 September 44 44 0% 44

----------------------------------------- ---------- ---------- ------------ -----------

Aircraft on operating leases at 30

September 10 5 100% 6

----------------------------------------- ---------- ---------- ------------ -----------

Total sector seats available (capacity) 5.03m 4.44m 13% 6.16m

----------------------------------------- ---------- ---------- ------------ -----------

Total sectors seats flown 4.62m 4.11m 12% 5.61m

----------------------------------------- ---------- ---------- ------------ -----------

Flight-only passenger sectors flown 3.07m 2.84m 8% 3.95m

----------------------------------------- ---------- ---------- ------------ -----------

Package holiday passenger sectors

flown 1.54m 1.27m 21% 1.66m

----------------------------------------- ---------- ---------- ------------ -----------

Package holiday customers 0.77m 0.64m 21% 0.83m

----------------------------------------- ---------- ---------- ------------ -----------

Overall load factor 91.8% 92.5% (0.7 ppt) 91.0%

----------------------------------------- ---------- ---------- ------------ -----------

Overall net ticket yield per passenger GBP79.99 GBP81.30 (2%) GBP78.39

sector (excl. taxes)

----------------------------------------- ---------- ---------- ------------ -----------

Retail revenue per passenger sector GBP34.04 GBP32.31 5% GBP32.14

----------------------------------------- ---------- ---------- ------------ -----------

Average package holiday price GBP593.26 GBP577.80 3% GBP571.53

----------------------------------------- ---------- ---------- ------------ -----------

Advance Leisure Travel sales as at GBP266.8m GBP224.7m 19% GBP484.9m

the reporting date

----------------------------------------- ---------- ---------- ------------ -----------

Distribution & Logistics

Fowler Welch is one of the UK's leading providers of

distribution and logistics to the food industry supply chain,

serving retailers, growers, importers and manufacturers through its

distribution network.

The Company operates from a number of UK distribution sites,

with major operations in the key produce growing and importing

areas of Spalding in Lincolnshire, Teynham in Kent and Hilsea near

Portsmouth. Fowler Welch also operates a 500,000 square foot

ambient (non-temperature controlled) consolidation and distribution

centre near Bury, Greater Manchester and a regional distribution

centre in Washington, Tyne and Wear. A full range of added value

services is provided including storage, case level picking, produce

packing and an award-winning national distribution network.

Fowler Welchreported a slight revenue reduction of GBP0.1m to

GBP78.1m (2013: GBP78.2m) whilst like-for-like operating profit of

GBP2.1m was in line with the previous half year, at an operating

margin of 2.7% (2013: 2.7%).

Overall operating profit fell 11% to GBP1.6m (2013: GBP1.8m) as

a result of expected start up losses at our new joint venture

operation in Teynham, Kent which commenced operation in May 2014

storing, ripening and packing stone-fruit and exotic and organic

fruits. Margins are encouraging in this business and with volumes

now committed for the remainder of the current and following year,

the operation is expected to generate a profit in the second half,

which will continue into the financial year ending 31 March

2016.

A major distribution contract for a Danish pork product

processor, which builds on existing business, was successfully

implemented at Spalding making them Fowler Welch's second largest

customer. At Heywood, the implementation of a substantial beverages

contract was impacted by lower than anticipated stock holdings,

however, the operation has now stabilised and further new revenues

are planned for the final quarter.

The focus on operational efficiency following the roll out of

our Enterprise transport planning system, has contributed to

improved gross margins due to better visibility of vehicle

performance, important in the context of increasing cost pressures

in the industry in general.

The Fowler Welch business will continue to focus on growing its

revenue pipeline and the successful development of existing and new

business opportunities.

KPIs

Half Year Half Year Year

Ended Ended Ended

30 Sept 30 Sept Half Year 31 Mar

14 13 End Change 14

-------------------------------------- ---------- ---------- ------------ --------

Warehouse space (square feet) 847,000 847,000 - 847,000

-------------------------------------- ---------- ---------- ------------ --------

Number of tractor units in operation 450 450 - 450

-------------------------------------- ---------- ---------- ------------ --------

Number of trailer units in operation 640 640 - 640

-------------------------------------- ---------- ---------- ------------ --------

Miles per gallon 9.4 9.0 4% 8.9

-------------------------------------- ---------- ---------- ------------ --------

Fleet mileage 21.4m 21.9m (2%) 42.6m

-------------------------------------- ---------- ---------- ------------ --------

Outlook

We have been encouraged by the Group's underlying operating

profit growth of 10%, particularly in light of the less than

buoyant consumer demand and weak market pricing experienced in the

early summer months. And, with winter 14/15 Leisure Travel bookings

performing in line with expectations, the Board is optimistic that

current market expectations for full year operating profit, before

adjusting for the exceptional provision of GBP17.0m, will be

achieved.

Philip Meeson

Chairman

20 November 2014

For further information please contact:

Dart Group PLC Tel: 0113 239 7817

Philip Meeson, Group Chairman and Chief

Executive

Gary Brown, Group Chief Financial Officer

Smith & Williamson Corporate Finance Tel: 020 7131 4000

Limited

Nominated Adviser

David Jones

Canaccord Genuity - Joint Broker Tel: 020 7523 8000

Peter Stewart / Mark Whitmore

Arden Partners - Joint Broker Tel: 020 7614 5900

Christopher Hardie

Buchanan - Financial PR Tel: 020 7466 5000

Richard Oldworth

Consolidated Group Income Statement (Unaudited)

For the half year ended 30 September 2014

Description Note Half year Half year Year ended

ended ended 31 March

30 September 30 September 2014

2014 2013 Audited

Unaudited Unaudited

--------------------------- ----- ------------ ----------- -------------- -------------- -----------

Results Separately Total Total Total

before disclosed

separately items

disclosed

items GBPm GBPm GBPm GBPm

GBPm

--------------------------- ----- ------------ ----------- -------------- -------------- -----------

Turnover 4 902.2 - 902.2 787.1 1,120.2

4,

Net operating expenses 6 (812.8) (17.0) (829.8) (705.9) (1,071.0)

--------------------------- ----- ------------ ----------- -------------- -------------- -----------

4,

Operating profit 6 89.4 (17.0) 72.4 81.2 49.2

--------------------------- ----- ------------ ----------- -------------- -------------- -----------

Finance income 1.1 - 1.1 0.8 1.4

Finance costs (0.6) - (0.6) (0.7) (1.4)

Revaluation of derivative

hedges (1.8) - (1.8) (3.2) (3.3)

Revaluation of foreign

currency balances 0.6 - 0.6 - (3.8)

---------------------------------- ------------ ----------- -------------- -------------- -----------

Net financing costs 7 (0.7) - (0.7) (3.1) (7.1)

Profit before taxation 88.7 (17.0) 71.7 78.1 42.1

--------------------------- ----- ------------ ----------- -------------- -------------- -----------

Taxation 9 (18.3) 3.4 (14.9) (17.9) (6.2)

Profit for the period 70.4 (13.6) 56.8 60.2 35.9

All attributable to equity

shareholders

of the parent company

---------------------------------- ------------ ----------- -------------- -------------- -----------

Earnings per share 5

- basic 48.25p 38.93p 41.51p 24.68p

- diluted 47.56p 38.37p 40.75p 24.28p

Consolidated Group Statement of Comprehensive Income

(Unaudited)

For the half year ended 30 September 2014

Half year Half year Year ended

ended ended 31 March

30 September 30 September 2014

2014 2013 Audited

Unaudited Unaudited GBPm

GBPm GBPm

Profit for the period attributable

to equity holders of the

parent company 56.8 60.2 35.9

Effective portion of changes

in fair value movements in

cash flow hedges (19.5) (14.4) (33.8)

Net change in fair value

of effective cash flow hedges

transferred to profit 21.4 (24.7) (16.9)

Taxation on components of

other comprehensive income (0.4) 9.0 11.5

-------------- -------------- -------------

Other comprehensive income

& expense for the period,

net of taxation 1.5 (30.1) (39.2)

Total comprehensive income

for the period attributable

to equity holders of the

parent company 58.3 30.1 (3.3)

============== ============== =============

Consolidated Group Balance Sheet (Unaudited)

As at 30 September 2014

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

GBPm GBPm GBPm

Non-current assets

Goodwill 6.8 6.8 6.8

Property, plant and

equipment 274.6 276.9 291.6

Derivative financial

instruments 2.3 1.5 0.4

283.7 285.2 298.8

------------- ------------- ---------

Current assets

Inventories 2.4 2.2 3.1

Trade and other receivables 185.0 140.7 285.9

Derivative financial

instruments 4.7 2.6 1.4

Money market deposits 29.5 19.0 52.5

Cash and cash equivalents 302.3 250.8 211.2

523.9 415.3 554.1

------------- ------------- ---------

Total assets 807.6 700.5 852.9

------------- ------------- ---------

Current liabilities

Trade and other payables 194.3 183.1 107.0

Deferred revenue 263.9 224.7 484.5

Borrowings 0.8 0.8 0.8

Provisions 24.4 2.4 2.4

Derivative financial

instruments 31.6 22.1 35.0

515.0 433.1 629.7

------------- ------------- ---------

Non-current liabilities

Other non-current liabilities 12.7 8.9 10.7

Borrowings 8.6 9.4 9.0

Derivative financial

instruments 10.7 8.2 2.2

Deferred tax liabilities 20.3 23.5 19.7

------------- ------------- ---------

52.3 50.0 41.6

------------- ------------- ---------

Total liabilities 567.3 483.1 671.3

Net assets 240.3 217.4 181.6

============= ============= =========

Shareholders' equity

Share capital 1.8 1.8 1.8

Share premium 11.6 11.2 11.4

Cash flow hedging reserve (25.3) (17.7) (26.8)

Retained earnings 252.2 222.1 195.2

---------

Total shareholders'

equity 240.3 217.4 181.6

============= ============= =========

Consolidated Group Cash Flow Statement (Unaudited)

For the half year ended 30 September 2014

Half year Half year Year ended

ended 30 ended 30 31 March

September September 2014

2014 2013 Audited

Unaudited Unaudited GBPm

GBPm GBPm

Cash flows from operating activities

Profit on ordinary activities before

taxation 71.7 78.1 42.1

Adjustments for:

Finance income (1.1) (0.8) (1.4)

Finance costs 0.6 0.7 1.4

Revaluation of derivative hedges 1.8 3.2 3.3

Revaluation of foreign currency

balances (0.6) - 3.8

Depreciation 42.5 34.9 60.7

Equity settled share based payments 0.2 0.2 0.4

Operating cash flows before movements

in working capital 115.1 116.3 110.3

Decrease / (increase) in inventories 0.7 (0.9) (1.8)

Decrease / (increase) in trade and

other receivables 101.0 85.1 (59.7)

Increase in trade and other payables 77.9 73.5 10.3

(Decrease) / increase in deferred

revenue (218.2) (182.4) 77.5

Increase in provisions 22.0 0.4 0.3

Cash generated from operations 98.5 92.0 136.9

Interest received 1.1 0.7 1.4

Interest paid (0.6) (0.6) (1.4)

Income taxes paid (5.8) (2.6) (6.1)

Net cash from operating activities 93.2 89.5 130.8

----------- ----------- -----------

Cash flows from investing activities

Purchase of property, plant and

equipment (25.5) (42.7) (83.5)

Proceeds from sale of property,

plant and equipment - - 0.2

Net decrease / (increase) in money

market deposits 23.0 11.0 (22.5)

Net cash used in investing activities (2.5) (31.7) (105.8)

----------- ----------- -----------

Cash flows from financing activities

Repayment of borrowings (0.4) (8.3) (8.7)

New loans advanced - 10.0 10.0

Proceeds on issue of shares 0.2 0.5 0.7

Equity dividends paid - - (2.8)

Net cash (used in) / from financing

activities (0.2) 2.2 (0.8)

----------- ----------- -----------

Effect of foreign exchange rate

changes 0.6 (0.1) (3.9)

Net increase in cash in the period 91.1 59.9 20.3

Cash and cash equivalents at beginning

of period 211.2 190.9 190.9

Cash and cash equivalents at end

of period 302.3 250.8 211.2

=========== =========== ===========

Consolidated Group Statement of Changes in Equity

For the half year ended 30 September 2014

Share Share premium Cash flow Retained Total reserves

capital hedging reserve earnings

GBPm GBPm GBPm GBPm GBPm

--------- -------------- ----------------- ---------- ---------------

Balance at 1 April 2013

- Audited 1.8 10.7 12.4 161.7 186.6

Total comprehensive income

for the period - - (30.1) 60.2 30.1

Share based payments - - - 0.2 0.2

Issue of share capital - 0.5 - - 0.5

Balance at 30 September

2013 - Unaudited 1.8 11.2 (17.7) 222.1 217.4

Total comprehensive income

for the period - - (9.1) (24.3) (33.4)

Dividends paid in the period - - - (2.8) (2.8)

Share based payments - - - 0.2 0.2

Issue of share capital - 0.2 - - 0.2

Balance at 31 March 2014

- Audited 1.8 11.4 (26.8) 195.2 181.6

Total comprehensive income

for the period - - 1.5 56.8 58.3

Share based payments - - - 0.2 0.2

Issue of share capital - 0.2 - - 0.2

Balance at 30 September

2014 - Unaudited 1.8 11.6 (25.3) 252.2 240.3

========= ============== ================= ========== ===============

Notes to the consolidated financial statements

For the half year ended 30 September 2014 (Unaudited)

1. General information

The accounts for Dart Group PLC (the "Group") have been prepared

and approved by the Directors in accordance with International

Financial Reporting Standards ("IFRS") as adopted by the European

Union ("Adopted IFRS"). The Group's accounts consolidate the

accounts of Dart Group PLC and its subsidiaries.

This interim financial report does not fully comply with IAS 34

"Interim Financial Reporting", which is not currently required to

be applied by AIM companies.

The interim report for the half year ended 30 September 2014 was

approved by the Board of Directors on 19 November 2014.

2. Accounting policies

Basis of preparation of the interim report

The unaudited consolidated interim financial report for the half

year ended 30 September 2014 does not constitute statutory accounts

as defined in s435 of the Companies Act 2006. The accounts for the

year ended 31 March 2014 were prepared in accordance with IFRS and

have been delivered to the Registrar of Companies. The report of

the auditor on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under s495(2) nor (3) of the Companies Act 2006. In this report,

the comparative figures for the year ended 31 March 2014 have been

audited, with the exception of the revised segmental disclosure in

Note 4. The comparative figures for the half year ended 30

September 2013 are unaudited.

The financial statements have been prepared under the historical

cost convention except for derivative financial instruments, which

have been measured at fair value.

The Group uses forward foreign currency contracts and aviation

fuel swaps to hedge exposure to foreign exchange rates and aviation

fuel price volatility. The Group also uses forward EU Allowance

contracts and forward Certified Emissions Reduction contracts to

hedge exposure to Carbon Emissions Allowance price volatility. Such

derivative financial instruments are stated at fair value.

Ineffectiveness in qualifying cash flow hedges under IAS 39 can

arise as a result of the difference between the contractual profile

of a hedge and the profile of transactions defined as the hedged

item. IAS 39 requires ineffectiveness in qualifying cash flow

hedges to be recorded in the income statement.

The Group's accounts are presented in pounds sterling and all

values are rounded to the nearest GBP100,000 except where indicated

otherwise.

Going concern

The Directors have prepared financial forecasts for the Group,

comprising operating profit, balance sheet and cash flows through

to 31 March 2017.

For the purposes of their assessment of the appropriateness of

the preparation of the Group's unaudited interim accounts on a

going concern basis, the Directors have considered the current cash

position, the availability of bank facilities, forecasts of future

trading through to 31 March 2017, including performance against

financial covenants, and the assessment of principal risks and

uncertainties.

Having considered the points outlined above, the Directors have

a reasonable expectation that the Company and the Group will be

able to operate within the considered levels of available

facilities and cash for the foreseeable future. Consequently, they

continue to adopt the going concern basis in preparing the

financial statements for the half year ended 30 September 2014.

3. Adoption of new and revised standards

The following new or revised International Financial Reporting

Standards and IFRIC interpretations will be adopted, where

applicable, for the purpose of preparing future financial

statements. The Group does not anticipate that the adoption of

these new or revised standards and interpretations will have a

material impact on its financial position or results from

operations.

International Financial Applies to

Reporting Standards periods

beginning after

-------------------------------------------- -----------------

IAS 27 - Separate Financial Statements January 2016

Annual Improvements to IFRS - 2012-14 cycle January 2016

IFRS 9 - Financial Instruments January 2018

4. Segmental information

Business Segments

The Chief Operating Decision Maker ("CODM") is responsible for

the overall resource allocation and performance assessment of the

Group. The Board of Directors approves major capital expenditure,

assesses the performance of the Group and also determines key

financing decisions. Consequently, the Board of Directors is

considered to be the CODM.

The Group's operating segments have been identified based on the

internal reporting information provided to the CODM in order for

the CODM to formulate allocation of resources to segments and

assess their performance. Previously, the Leisure Airline, Package

Holidays and Distribution & Logistics businesses were

determined to represent operating segments. However, the Leisure

Airline and Package Holidays businesses have been working

progressively closer together as one Leisure Travel business and,

following on from changes in the operational structure of the

business, internal financial reporting to the CODM now represents

one Leisure Travel operating segment. Consequently, the Group now

has two operating segments: Leisure Travel and Distribution &

Logistics.

Following the identification of the operating segments, the

Group has assessed the similarity of their characteristics. Given

the different performance targets, customer bases and operating

markets of each of the operating segments, it is not currently

appropriate to aggregate the operating segments for reporting

purposes. Accordingly, both of the identified operating segments

are disclosed as reportable segments for the half year ended 30

September 2014.

Group eliminations include the removal of intercompany assets

and liabilities. Revenue from reportable segments is measured on a

basis consistent with the income statement and is principally

generated from within the UK, the Group's country of domicile.

Distribution Leisure Group Consolidated

& Logistics Travel Eliminations Total

GBPm GBPm GBPm GBPm

Half year to 30 September 2014 (Unaudited)

Turnover 78.1 824.1 - 902.2

EBITDA 2.7 129.2 - 131.9

------- -------- -------------- -------------

Underlying operating

profit 1.6 87.8 - 89.4

------- -------- -------------- -------------

Finance income - 1.1 - 1.1

Finance costs - (0.6) - (0.6)

Revaluation of derivative

hedges - (1.8) - (1.8)

Revaluation of foreign

currency balances - 0.6 - 0.6

Underlying profit

before taxation 1.6 87.1 - 88.7

Separately disclosed

items - (17.0) - (17.0)

------- -------- -------------- -------------

Profit before taxation 1.6 70.1 - 71.7

------- -------- -------------- -------------

Taxation (0.3) (14.6) - (14.9)

------- -------- -------------- -------------

Profit after taxation 1.3 55.5 - 56.8

======= ======== ============== =============

Assets and liabilities

Segment assets 76.7 737.3 (6.4) 807.6

Segment liabilities (32.9) (540.8) 6.4 (567.3)

Net assets 43.8 196.5 - 240.3

======= ======== ============== =============

Other segment information

Property, plant and

equipment additions 1.3 24.2 - 25.5

Depreciation and amortisation (1.1) (41.4) - (42.5)

Share based payments - (0.2) - (0.2)

Half year to 30 September 2013 (Unaudited)

Turnover 78.2 708.9 - 787.1

EBITDA 2.8 113.3 - 116.1

------- -------- -------------- -------------

Operating profit 1.8 79.4 - 81.2

------- -------- -------------- -------------

Finance income - 0.8 - 0.8

Finance costs (0.1) (0.6) - (0.7)

Revaluation of derivative

hedges - (3.2) - (3.2)

Revaluation of foreign

currency balances - - - -

Profit before taxation 1.7 76.4 - 78.1

Taxation (0.3) (17.6) - (17.9)

------- -------- -------------- -------------

Profit after taxation 1.4 58.8 - 60.2

======= ======== ============== =============

Assets and liabilities

Segment assets 74.2 633.0 (6.7) 700.5

Segment liabilities (34.6) (455.2) 6.7 (483.1)

------- -------- --------------

Net assets 39.6 177.8 - 217.4

======= ======== ============== =============

Other segment information

Property, plant and

equipment additions 0.6 42.1 - 42.7

Depreciation and amortisation (1.0) (33.9) - (34.9)

Share based payments - (0.2) - (0.2)

Year to 31 March 2014 (Unaudited)

Turnover 153.2 967.0 - 1,120.2

EBITDA 5.7 104.2 - 109.9

------- -------- -------------- -------------

Operating profit 3.6 45.6 - 49.2

------- -------- -------------- -------------

Finance income - 1.4 - 1.4

Finance costs (0.3) (1.1) - (1.4)

Revaluation of derivative

hedges - (3.3) - (3.3)

Revaluation of foreign

currency balances - (3.8) - (3.8)

Profit before taxation 3.3 38.8 - 42.1

Taxation (0.6) (5.6) - (6.2)

------- -------- -------------- -------------

Profit after taxation 2.7 33.2 - 35.9

======= ======== ============== =============

Assets and liabilities

Segment assets 71.0 789.8 (7.9) 852.9

Segment liabilities (32.7) (646.5) 7.9 (671.3)

------- -------- --------------

Net assets 38.3 143.3 - 181.6

======= ======== ============== =============

Other segment information

Property, plant and

equipment additions 1.0 82.5 - 83.5

Depreciation and amortisation (2.1) (58.6) - (60.7)

Share based payments (0.1) (0.3) - (0.4)

5. Earnings per share

The calculation of earnings per share is based on the

following:

Half year Half year Year to

to to

30 September 30 September 31 March

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

Underlying profit for the

period (GBPm) 70.4 60.2 35.9

Profit for the period (GBPm) 56.8 60.2 35.9

-------------- -------------- ------------

Weighted average number

of ordinary shares in issue

during the period used to

calculate basic earnings

per share 145,907,224 145,021,355 145,300,720

Weighted average number

of ordinary shares in issue

during the period used to

calculate diluted earnings

per share 148,032,833 147,727,104 147,703,529

6. Separately disclosed items

Separately disclosed items are presented in the middle column of

the half year ended 30 September 2014 Consolidated Group Income

Statement in order to assist the reader's understanding of

underlying business performance and to provide a more meaningful

presentation. The right hand column presents the results for the

half year showing all gains and losses recorded in the Consolidated

Group Income Statement.

EU Regulation 261

Subsequent to a judgment given on 11 June 2014, in which the

Court of Appeal held that a technical defect was not in itself an

extraordinary circumstance and that compensation for delay may be

payable, Jet2.com had its application to the Supreme Court, to

appeal the Court of Appeal's earlier decision, rejected.

Accordingly, the Consolidated Group Income Statement includes an

exceptional provision of GBP17.0m in relation to possible passenger

compensation claims, which may be payable in certain circumstances,

for historical flight delays over the past six years.

7. Net financing costs

Half year Half year Year to

to to 31 March

30 September 30 September 2014

2014 2013 Audited

Unaudited Unaudited

Finance income - interest receivable 1.1 0.8 1.4

Finance costs - borrowings (0.6) (0.7) (1.4)

Revaluation of derivative hedges:

-------------- -------------- ----------

- ineligible for cash flow

hedge accounting - (1.3) (1.4)

- change in fair value of ineffective

cash flow hedges (1.8) (1.9) (1.9)

-------------- -------------- ----------

(1.8) (3.2) (3.3)

Revaluation of foreign currency

balances 0.6 - (3.8)

Net financing costs (0.7) (3.1) (7.1)

============== ============== ==========

8. Dividends

The declared interim dividend of 0.75p per share (2013: 0.60p)

will be paid, out of the Company's available distributable

reserves, on 2 February 2015, to shareholders on the register at 5

January 2015. In accordance with IAS 1, dividends are recorded only

when paid and are shown as a movement in equity rather than as a

charge to the Income Statement.

9. Taxation

The tax charge for the period of GBP14.9m (2013: GBP17.9m)

reflects an estimated effective tax rate of approximately 21%

(2013: 23%). The Government has enacted a further reduction in the

headline rate of corporation tax to 20% from 1 April 2015.

10. Reconciliation of net cash flow to movement in net cash

Half year Half year Year to

to to 31 March

30 September 30 September 2014

2014 2013 Audited

Unaudited Unaudited

GBPm

GBPm GBPm

Increase in cash in the

period 91.1 59.9 20.3

Decrease / (increase)

in net debt in the period 0.4 (1.7) (1.3)

-------------- -------------- ----------

Change in net cash resulting

from cash flows in the

period 91.5 58.2 19.0

Net cash at beginning

of period 201.4 182.4 182.4

Net cash at end of period 292.9 240.6 201.4

============== ============== ==========

11. Contingent liabilities

The Group has issued various guarantees in the ordinary course

of business, none of which are expected to lead to a financial gain

or loss.

12. Other matters

This report will be posted on the Group's website,

www.dartgroup.co.uk and copies are available from the Group Company

Secretary at the registered office address: Low Fare Finder House,

Leeds Bradford International Airport, Leeds, LS19 7TU.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QKCDDCBDDKDD

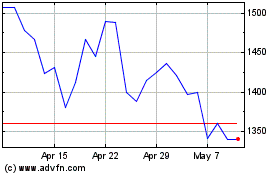

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

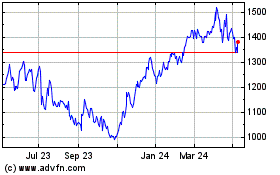

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024