Dart Group PLC - Interim Results

November 20 1997 - 1:33AM

UK Regulatory

RNS NO 6572H

DART GROUP PLC

20th November 1997

DART GROUP PLC

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 1997

Dart Group PLC, the distribution and aviation services group, announces

its interim results for the six months ended 30 September 1997.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading during the six months to

30 September 1997. Profit before tax has risen to #2.61m (1996:

#2.41m) on turnover of #42.6m (1996: #36.9m) and earnings per share have

risen to 11.3p (1996: 10.1p). The Board has declared a dividend of 2.3p

per share (1996:2.1p) which will be paid on 9 January 1998 to shareholders

on the register as at 9 December 1997. The results reflect continued growth

in both our divisions.

Distribution

Our principal distribution company, Fowler Welch, which distributes

fresh produce and cut flowers throughout the UK on behalf of supermarkets,

growers and importers, has continued to gain new business and increase its

share of this specialised market. Since the beginning of the financial

year, the company has completed the development of its Spalding depot by

the conversion of the remaining 55,000 sq.ft. warehouse into a fully

temperature controlled facility and has also taken over a customer's

transport operations in Cambridgeshire. These developments have increased

the volumes the company can handle and widened its business base.

The division's south coast facilities, which primarily serve the

Channel Islands, are also to be developed by the acquisition of a new

temperature controlled depot at the main Channel Islands' ferry port of

Portsmouth. This will further improve the services that Fowler Welch and

its sister company, Channel Express (CI), offer to southern England and

Channel Islands growers. We are confident that these developments within our

distribution business will enable the division to continue to expand

profitably.

Aviation Services

Our first A300 "Eurofreighter" entered commercial service with our

cargoairline, Channel Express (Air Services) on 1 August 1997 and has had

a most successful start to its operations. In addition to its

contractual commitments, the company has had the opportunity to demonstrate

the aircraft's capabilities to several potential customers and is confident

that there will be considerable demand for the type in both the general

airfreight market, which is growing at a rate of approximately 7% per

annum, and the express parcels sector, which continues to see a volume

growth rate of nearly 20% per annum.

The Group has now completed the purchase of two further A300s which are now

with Daimler-Benz Aerospace Airbus (DASA) in Dresden, Germany, where

they are undergoing conversion into freighters. The first of these aircraft

is now due for delivery to Channel Express in early 1998 with the second

following in the Spring. We are confident that the A300 fleet will

make a considerable contribution to the Group's future profitability.

In the meantime, the Group's 7 Fokker F27 and 3 Lockheed Electra

freighters, supplemented as required by leased-in aircraft, are fully

utilised on intra-European cargo services.

Our air, sea and road freight forwarder, Benair Freight International,

continues to make progress in a favourable market. Considerable effort is

being devoted to building the company's infrastructure and systems to enable

it to continue to develop its specialist business areas profitability.

Finally, I am pleased to report that trading in the second half of the year

continues satisfactorily.

Philip Meeson

Chairman 20 November 1997

UNAUDITED INTERIM

CONSOLIDATED RESULTS

for the half year to 30 September 1997

Half year Half year Year to

30 September 30 September 31 March

1997 1996 1997

(unaudited) (unaudited) (audited)

#'000 #'000

TURNOVER 42,619 36,864 72,119

Net operating expenses (39,908) (34,533) (67,585)

OPERATING PROFIT 2,711 2,331 4,534

Net interest (113) 30 40

(payable)/receivable

Profit on sale of fixed 13 46 64

assets

PROFIT ON ORDINARY 2,611 2,407 4,638

ACTIVITIES BEFORE

TAXATION

Taxation (794) (795) (1,540)

PROFIT ON ORDINARY 1,817 1,612 3,098

ACTIVITIES AFTER

TAXATION

Dividends (370) (337) (1,045)

RETAINED PROFIT FOR THE 1,447 1,275 2,053

PERIOD

EARNINGS PER SHARE 11.3p 10.1p 19.3p

- basic and normalised

DIVIDEND PER SHARE 2.3p 2.1p 6.5p

CONSOLIDATED BALANCE SHEET

at 30 September 1997

1997 1997

30 September 31 March

(unaudited) (audited)

#'000 #'000 #'000 #'000

FIXED ASSETS

Tangible assets 28,399 21,686

Investments 106 106

28,505 21,792

CURRENT ASSETS

Stock 1,343 777

Debtors 11,709 12,624

Cash at bank and in hand 1,870 3,320

14,922 16,721

CURRENT LIABILITIES

CREDITORS : amounts falling (18,408) (16,212)

due within one year

NET CURRENT (3,486) 509

(LIABILITIES)/ASSETS

TOTAL ASSETS LESS CURRENT 25,019 22,301

LIABILITIES

CREDITORS : amounts falling (4,410) (4,013)

due after more than one year

PROVISION FOR LIABILITIES AND (4,832) (3,954)

CHARGES

(9,242) (7,967)

15,777 14,334

CAPITAL AND RESERVES

Called up share capital 1,610 1,608

Share premium account 4,492 4,479

Profit and loss account 9,675 8,247

SHAREHOLDERS' FUNDS

equity interests 15,777 14,334

NOTES TO THE INTERIM RESULTS

at 30 September 1997

The financial information for the year to 31 March 1997 does not

constitute statutory accounts, as defined in Section 240 of the Companies Act

1985, but is based on the statutory accounts for the year then ended. Those

accounts, upon which the auditors issued an unqualified opinion, have been

delivered to the Registrar of Companies.

Earnings per share has been calculated by reference to earnings of

#1,817,000 (1996: #1,612,000) and a weighted average number of ordinary shares

in issue of 16,082,782 (1996: 16,030,214).

This report is being sent to all shareholders and copies are available from

the Company Secretary at the registered office of the Company, Building

470,Bournemouth International Airport, Christchurch, Dorset, BH23 6SE.

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

Half year to Year to

30 September 31 March

1997 1997

(unaudited) (audited)

#000's #000's

Profit on ordinary activities after 1,817 3,098

taxation

Foreign exchange loss on foreign equity (19) (44)

investments

Total gains and losses recognised in 1,798 3,054

the period

PROFIT AND LOSS ACCOUNT

Half year to Year to

30 September 31 March

1997 1997

(unaudited) (audited)

#000's #000's

Balance at the beginning of the period 8,247 6,238

Retained profit for the period 1,447 2,053

Currency translation differences (19) (44)

9,675 8,247

END

IR NFKFNFLLXFFN

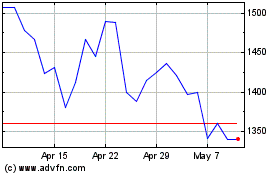

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

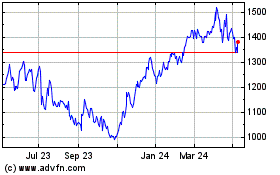

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024