RNS No 8492n

DART GROUP PLC

19th November 1998

DART GROUP PLC

Interim Results for the Six Months Ended 30 September 1998

Dart Group PLC, the distribution and aviation services group,

announces its interim results for the six months ended 30

September 1998.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading during the six months

to 30 September 1998. Profit before tax has risen to #3.09m

(1997: #2.61m) on turnover of #49.4m (1997: #42.6m) and earnings

per share have risen to 6.55p (1997: 5.65p re-stated). The Board

has declared a dividend of 1.27p per share (1997: 1.15p re-stated)

which will be paid on 8 January 1999 to shareholders on the register

as at 8 December 1998. The results reflect continued growth in

both our divisions.

Distribution

Fowler Welch, the Division's specialist temperature-controlled

distributor of fresh produce and horticultural products, has

continued to gain business from the UK's leading multiple retailers

who regard the company as a preferred provider of high-quality

distribution services for perishable products.

To facilitate this increasing business, the company's main

consolidation centre at Spalding, Lincs, is being further

developed to handle the growing volumes stored, processed and

then delivered throughout the UK and Ireland on behalf of

retailers, importers and growers.

The Division's new 40,000 sq.ft. temperature-controlled

distribution facility at Portsmouth is now due to become

operational in the Spring of 1999. This will allow Fowler

Welch, and its sister company, Channel Express (CI), to introduce

new and improved road transport services for south coast and

Channel Island growers, as well as for the large volumes of

produce imported through the ports of Southampton and Portsmouth.

We believe that the Distribution Division, which is widely

recognised as a market leader, is ideally positioned to continue

its growth within its specialist distribution sector.

Aviation Services

Channel Express (Air Services) took delivery of its third A300

Eurofreighter following its conversion from a passenger aircraft

to a freighter on 4 September 1998. The aircraft immediately

went into service with a leading European express parcel delivery

company. Each of the company's three Eurofreighters is contracted

to an express operator with additional cargo contracts also being

undertaken on behalf of other European airlines.

The Group has decided to defer the purchase of further A300s for

conversion to freighters. Several aircraft leasing companies

have undertaken speculative A300 conversions and it is our belief

that suitable aircraft will be available for lease to meet our

foreseeable needs.

The Group's seven Fokker F27 and three Lockheed Electra freighters,

supplemented as required by leased aircraft, are also fully utilised

on European cargo services on behalf of express parcel companies,

postal authorities and freight forwarders. The demand for the

rapid transportation of air cargo to meet the needs of modern,

lean, manufacturing processes continues to grow and the Group is

confident of its future prospects in this business.

Our international freight management company, Benair Freight

International, has continued to progress well in the first half

of this year. Despite the difficulties being experienced by the

industry as a whole as a result of the Far East economic downturn,

Benair is continuously developing and managing new business.

The company is also working closely with Fowler Welch and Channel

Express (Air Services) to offer our customers the overall benefits

of the Group's resources and expertise. This is expected to be of

particular significance to our produce and horticultural importing

and distribution customers.

Year 2000

I have every confidence that the team led by the Group's Chief

Financial Officer, and fully supported by myself and senior

management representatives from our operating businesses, is taking

all reasonable precautions to ensure that we experience no

disruption to our business in the year 2000. Our formal

statement on this issue is contained in Note 4.

Finally, I am pleased to report that trading in the second half of

the year continues satisfactorily.

Philip Meeson, Chairman

19 November 1998

For further information please contact:

Philip Meeson,

Chairman on 0385 258 666 (today and tomorrow)

Or Mike Forder,

Chief Financial Officer on 0421 865 850 (today);

01202 597 676 (thereafter)

UNAUDITED INTERIM

CONSOLIDATED RESULTS

for the half year to 30 September 1998

Half year to Half year to Year to

30 September 30 September 31 March

1998 1997 1998

(unaudited) (unaudited) (audited)

Notes #'000 #'000 #'000

TURNOVER 1 49,350 42,619 87,809

Net operating

expenses (45,751) (39,908) (82,174)

______ ______ ______

OPERATING PROFIT 3,599 2,711 5,635

Net interest

payable (574) (113) (567)

Profit on sale

of fixed assets 62 13 57

______ ______ ______

PROFIT ON ORDINARY

ACTIVITIES BEFORE

TAXATION 3,087 2,611 5,125

Taxation (972) (794) (1,522)

______ ______ ______

PROFIT ON ORDINARY

ACTIVITIES AFTER

TAXATION 2,115 1,817 3,603

Dividends (410) (370) (1,178)

______ ______ ______

RETAINED PROFIT FOR

THE PERIOD 1,705 1,447 2,425

______ ______ ______

EARNINGS PER SHARE

- basic and

normalised 6.55p 5.65p * 11.19p *

- fully diluted 6.48p 5.62p 11.11p

______ ______ ______

DIVIDEND PER SHARE 1.27p 1.15p * 3.65p *

______ ______ ______

* Re-stated as a result of the 2 for 1 share split of August 1998

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

Profit on ordinary

activities after

taxation 2,115 1,817 3,603

Foreign exchange loss on

foreign equity

investments (23) (19) (57)

______ ______ ______

Total gains and losses

recognised in the

period 2,092 1,798 3,546

______ ______ ______

CONSOLIDATED BALANCE SHEET

at 30 September 1998

1998 1998

30 September 31 March

(unaudited) (audited)

Notes #'000 #'000 #'000 #'000

FIXED ASSETS

Tangible assets 43,530 38,959

Investments 106 106

______ ______

CURRENT ASSETS 43,636 39,065

Stock 1,568 1,478

Debtors 13,591 12,433

Cash at bank and

in hand 3,510 6,597

______ ______

18,669 20,508

CURRENT LIABILITIES

CREDITORS: amounts

falling due within

one year (19,517) (19,281)

______ ______

NET CURRENT

(LIABILITIES)/ASSETS

(848) 1,227

______ ______

TOTAL ASSETS LESS

CURRENT LIABILITIES 42,788 40,292

CREDITORS: amounts

falling due after

more than one year (18,607) (18,277)

PROVISION FOR

LIABILITIES AND

CHARGES (5,720) (5,256)

______ ______

(24,327) (23,533)

______ ______

18,461 16,759

______ ______

CAPITAL AND RESERVES

Called up share capital 1,614 1,614

Share premium account 4,550 4,530

Profit and loss

account 2 12,297 10,615

______ ______

SHAREHOLDERS' FUNDS -

equity interests 18,461 16,759

______ ______

CONSOLIDATED CASH FLOW STATEMENT

for the half year to 30 September 1998

Half year to Half year to Year to

30 September 30 September 31 March

1998 1997 1998

(unaudited) (unaudited) (audited)

Notes #'000 #'000 #'000

NET CASH INFLOW

FROM OPERATING

ACTIVITIES 3 4,427 4,876 9,360

______ ______ ______

RETURNS ON INVESTMENT

AND SERVICING OF

FINANCE

Interest paid: bank

and other loans (709) (145) (651)

Interest element of

finance lease rental

payments (62) (26) (74)

Interest received: bank 197 58 158

______ _______ _______

(574) (113) (567)

TAXATION

Corporation and

advance corporation

tax paid (173) (156) (1,037)

CAPITAL EXPENDITURE

AND FINANCIAL INVESTMENT

Purchase of tangible

fixed assets (4,451) (8,262) (17,894)

Disposal of tangible

fixed assets 615 107 160

______ _______ _______

(3,836) (8,155) (17,734)

EQUITY DIVIDENDS PAID (807) (707) (1,078)

______ _______ _______

CASH OUTFLOW BEFORE

FINANCING (963) (4,255) (11,056)

FINANCING

Ordinary share capital

issued 20 15 57

Other loans repaid (209) - (401)

Bank loans repaid (1,735) (234) (284)

Other loans advanced - - 14,250

New bank loans advanced - 600 1,000

Capital elements of

finance lease rental

payments (200) (119) (289)

______ _______ _______

(2,124) 262 14,333

(DECREASE)/INCREASE IN

CASH IN THE PERIOD (3,087) (3,993) 3,277

______ ______ ______

NOTES TO THE INTERIM RESULTS

at 30 September 1998

1. TURNOVER

Half year to Half year to Year to

30 September 30 September 31 March

1998 1997 1998

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Distribution 21,825 19,326 37,696

Aviation Services 27,525 23,293 50,113

______ ______ ______

49,350 42,619 87,809

______ ______ ______

Turnover arising within:

The United Kingdom and

the Channel Islands 48,840 41,950 86,547

The Far East 510 669 1,262

______ ______ ______

49,350 42,619 87,809

______ ______ ______

Analyses of profit before taxation and net assets between the

different segments of the Group are not given as, in the opinion

of the directors, such analyses would be seriously prejudicial

to the commercial interests of the Group. Turnover to third

parties by destination is not materially different to that by

source.

2. PROFIT AND LOSS ACCOUNT

Half year to Year to

30 September 31 March

1998 1998

(unaudited) (audited)

#'000 #'000

Balance at the beginning of

the period 10,615 8,247

Retained profit for the period 1,705 2,425

Currency translation differences (23) (57)

______ _____

12,297 10,615

______ ______

3. RECONCILIATION OF OPERATING PROFIT TO

NET CASH FLOW FROM OPERATING ACTIVITIES

Half year to Half year to Year to

30 September 30 September 31 March

1998 1997 1998

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Operating Profit 3,599 2,711 5,635

Depreciation 1,957 1,456 3,888

Increase in stock (90) (566) (701)

(Increase)/decrease in

debtors (1,158) 739 14

Increase in creditors 149 29 228

Provision for aircraft

maintenance 4,333 2,276 5,381

Aircraft maintenance

expenditure (4,340) (1,750) (5,028)

Exchange differences (23) (19) (57)

______ ______ ______

Net cash inflow from

operating activities 4,427 4,876 9,360

______ ______ ______

4. YEAR 2000 COMPLIANCE STATEMENT

The Group is fully aware of the serious implications of

disruption to business operations as a result of Year 2000

date problems.

Given the complexity of the problem, it is not possible for

any organisation to guarantee that no Year 2000 problems will

remain. The Group's compliance plans are well advanced. These

include all proper testing and implementation of computer

hardware, software and communications applications well before

the end of 1999, as well as necessary upgrades to equipment,

instrumentation and security.

The Group favours suppliers who are, or will be, compliant and

with whom an open and honest relationship exists, where

necessary reserving the right to seek alternative suppliers to

ensure Year 2000 readiness.

As a result of the action we have taken and will take, including

the drawing up of contingency plans, customers, suppliers and

investors can have every expectation that our businesses will

continue to function in such a way that no disruption to either

our own or our clients' business will result from the Year 2000

problem.

5. OTHER MATTERS

The financial information for the year to 31 March 1998 does not

constitute statutory accounts, as defined in Section 240 of the

Companies Act 1985, but is based on the statutory accounts for

the year then ended. Those accounts, upon which the auditors

issued an unqualified opinion, have been delivered to the

Registrar of Companies.

The accounts to 30 September 1998 have been prepared using

accounting policies consistent with those adopted for the year

to 31 March 1998.

Basic earnings per share has been calculated by reference to

earnings of #2,115,000 (1997 : #1,817,000) and a weighted average

number of ordinary shares in issue of 32,282,759 (1997: 32,165,564

restated). Prior year earnings per share has been restated to

take account of the share split which was carried out in August

1998.

This report is being sent to all shareholders and copies are

available from the Company Secretary at the registered office

of the Company, Building 470, Bournemouth International Airport,

Christchurch, Dorset, BH23 6SE.

END

IR NFPFPFDDPFFN

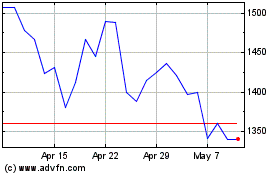

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

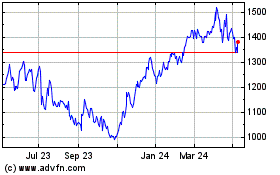

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024