RNS Number:3662F

Dart Group PLC

18 November 2004

DART GROUP PLC

Interim Results for the Six Months Ended 30 September 2004

Dart Group PLC, the aviation services and distribution group, announces its

interim results for the six months ended 30 September 2004.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the six months ended 30

September 2004. Profit before tax and amortisation of goodwill has risen to

#11.1m (2003 - #7.4m) on turnover of #140.4m (2003 - #119.7m). It is

anticipated that the seasonal pattern of profitability seen last year will be

repeated this year as Jet2.com is profitable in the summer months and will make

a loss in the weaker winter period.

First half capital expenditure amounted to #22.8m, and primarily related to the

purchase of three Boeing 737-300 aircraft. A fourth aircraft was delivered in

October 2004. Net borrowings at 30 September 2004 were #14.4m (31 March 2004 -

#15.0m), representing gearing of 30.5% (31 March 2004 - 37%).

The Group's policy is to borrow US dollars in order to finance its US dollar

denominated Boeing 737 aircraft fleet. This provides a natural balance sheet

hedge as assets are largely equal and opposite to liabilities. At 30 September

2004 US dollar assets and liabilities amounted to US$ 130.9m. This structure

has also contributed to the net interest receivable in the profit and loss

account as the Group has been able to deposit sterling at higher rates of

interest than its US dollar borrowing costs.

All known fuel requirements for Jet2.com have been hedged for the rest of this

financial year together with a significant proportion of the current forecast

requirements for 2005/6, at average rates lower than the current market price.

Neither the Aviation Services Division's contract charter operations nor the

Distribution Division currently has any material exposure to oil price risk, as

this is substantially covered in fuel escalation clauses in our commercial

contracts.

The Board is pleased to declare an interim dividend of 2.04p per share (2003 -

1.85p), an increase of 10.3%. The dividend will be paid on 6 January 2005 to

shareholders on the register as at 26 November 2004.

Aviation Services

The Aviation Services Division comprises Channel Express (Air Services) and

Benair Freight International, the Group's freight forwarder. Channel Express

operates contract charter passenger and freight air services and, trading as

Jet2.com, scheduled low cost services from the North of England and Northern

Ireland.

The company's aircraft fleet consists of Airbus A300B4 Eurofreighters and Boeing

737-300 passenger and Quick Change aircraft. The final three Fokker F27

freighters will be withdrawn from service in January 2005. The Eurofreighters

are contracted to leading express parcel companies and operate night freight

services into their European hubs.

The Boeing 737-300 Quick Change aircraft fly night freight services for Royal

Mail, after which they are quickly changed back into passenger configuration for

daytime operations. We have experienced a stronger than expected demand for

these aircraft from our passenger charter customers which has contributed to the

improved results.

The company's Jet2.com scheduled low cost services have also experienced higher

than expected demand at its Leeds Bradford and Belfast International Airport

bases. Over half a million passengers were flown between the UK and city break

and Mediterranean sun destinations during the six months to 30 September 2004.

Capacity at Leeds Bradford and Belfast International Airports is being increased

for the summer of 2005 in order to serve more destinations with greater

frequency.

On 29 September we announced a third base, at Manchester Airport, where

initially six aircraft will serve at least ten European destinations by May

2005. Additionally, a three times daily low cost Manchester - London Gatwick

service will commence on 17 January 2005. We expect to continue to develop

Jet2.com services in the North, providing our customers with a friendly and

efficient low cost service.

It is very pleasing to be able to report Benair Freight International's

continued success. Profitable growth has been sustained in both its core

freight operations and specialist ornamental fish importing business. This is a

reflection of the competitive and customer focused service the company offers.

Distribution

Fowler Welch-Coolchain, the Group's temperature-controlled distributor of fresh

produce, horticulture and food products, primarily on behalf of supermarkets and

their suppliers, trades in a challenging market. Pricing is always under

pressure whilst service levels must remain high. However, the company is

organised to deliver excellent transportation services at competitive rates and

is continually seeking new business for both its UK and European operations.

The trend for supermarkets to source direct from overseas producers is helping

the division's European business and relationships are being formed with

continental hauliers to meet this demand cost-effectively.

To bring further efficiencies, the division's businesses continue to be

streamlined and costs reduced, lowering the fixed cost base. Incremental

volumes, which our enthusiastic distribution team wins, directly enhance the

division's profitability. Fowler Welch-Coolchain has recently won additional

business that requires storage and picking services prior to onward

distribution. We are currently competing for further opportunities of this

nature. There is considerable optimism for the future profitable growth of our

distribution business.

Outlook

Each of the markets in which the Group trades is, of course, extremely

competitive. However, I believe that shareholders will be encouraged by our

anticipated full year financial performance.

Philip Meeson,

Chairman 18 November 2004

www.dartgroup.co.uk

Enquiries: Philip Meeson, Chairman

Tel: 01202 597676 Mobile: 07785 258666

Mike Forder, Group Finance Director

Tel: 01202 597676 Mobile: 07721 865850

UNAUDITED INTERIM CONSOLIDATED RESULTS

for the half year to 30 September 2004

Half year to Half year to Year to

30 September 30 September 31 March

2004 2003 2004

(unaudited) (unaudited) (audited)

Note #'000 #'000 #'000

Turnover - continuing operations 1 140,381 119,661 228,200

Net operating expenses,

excluding amortisation of goodwill (129,365) (112,496) (219,195)

Amortisation of goodwill (248) (248) (497)

Net operating expenses (129,613) (112,744) (219,692)

Operating profit - continuing operations 10,768 6,917 8,508

Profit on disposal of fixed assets 40 446 365

Net interest receivable/(payable) 2 60 (237) (353)

Profit on ordinary activities before taxation 10,868 7,126 8,520

Taxation (3,535) (2,368) (2,868)

Profit on ordinary activities after taxation 7,333 4,758 5,652

Dividends (701) (636) (2,099)

Retained profit for the period 3 6,632 4,122 3,553

Earnings per share

- basic 21.34p 13.86p 16.46p

- basic, excluding the amortisation of goodwill 22.06p 14.58p 17.91p

- diluted 21.27p 13.83p 16.43p

Dividend per share

2.04p 1.85p 6.11p

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

Half year to Half year to Year to

30 September 30 September 31 March

2004 2003 2004

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Profit on ordinary activities after taxation

7,333 4,758 5,652

Foreign exchange movement on foreign equity investments 19 (13) (63)

Total gains and losses recognised in the period 7,352 4,745 5,589

CONSOLIDATED BALANCE SHEET

at 30 September 2004

30 September 31 March

2004 2004

(unaudited) (audited)

Note #'000 #'000

Fixed assets

Intangible assets 7,532 7,780

Tangible assets 86,353 75,264

93,885 83,044

Current assets

Stock 1,648 2,216

Debtors 34,118 31,221

Cash at bank and in hand 18,409 13,362

54,175 46,799

Current liabilities

Creditors: amounts falling due

within one year (61,131) (55,793)

Net current liabilities (6,956) (8,994)

Total assets less current liabilities 86,929 74,050

Creditors: amounts falling due after more than one year (29,554) (25,093)

Provision for liabilities and charges (10,055) (8,293)

(39,609) (33,386)

Net assets 47,320 40,664

Capital and reserves

Called up share capital 1,718 1,718

Share premium account 7,707 7,702

Profit and loss account 3 37,895 31,244

Shareholders' funds - equity interests

47,320 40,664

CONSOLIDATED CASH FLOW STATEMENT

for the half year to 30 September 2004

Half year to Half year to Year to

30 September 30 September 31 March

2004 2003 2004

(unaudited) (unaudited) (audited)

Note #'000 #'000 #'000

Net cash inflow from operating activities 4 24,369 19,939 36,111

Returns on investment and servicing of finance

Interest paid: bank and other loans (282) (333) (853)

Interest received: bank 292 96 302

10 (237) (551)

Taxation

Corporation and overseas tax paid (479) (1,462) (506)

Capital expenditure and financial investment

Purchase of tangible fixed assets (22,812) (19,008) (28,156)

Disposal of tangible fixed assets 1,885 453 2,137

(20,927) (18,555) (26,019)

Equity dividends paid (1,464) (1,463) (2,099)

Cash inflow/(outflow) before financing 1,509 (1,778) 6,936

Financing

Ordinary share capital issued 5 15 30

Other loans repaid (4,794) (5,777) (18,553)

Other loans advanced 8,842 12,941 16,052

4,053 7,179 (2,471)

Increase in cash in the period 5 5,562 5,401 4,465

NOTES TO THE INTERIM RESULTS

at 30 September 2004

1. Turnover

Half year to Half year to Year to

30 September 30 September 31 March

2004 2003 2004

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Distribution 51,048 58,005 112,076

Aviation Services 89,333 61,656 116,124

140,381 119,661 228,200

Turnover arising within:

The United Kingdom and the Channel Islands 137,091 116,374 222,804

Mainland Europe 2,777 2,753 4,368

The Far East 513 534 1,028

140,381 119,661 228,200

Analyses of profit before taxation and net assets between the

different segments of the Group are not given as, in the opinion of the

directors, such analyses would be seriously prejudicial to the commercial

interests of the Group.

2. Net interest receivable/(payable)

Half year to Half year to Year to

30 September 30 September 31 March

2004 2003 2004

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

On bank loans and overdrafts (50) (178) (21)

On other loans (232) (265) (835)

Other interest payable - - (5)

(282) (443) (861)

Interest receivable 292 96 303

10 (347) (558)

Interest capitalised within tangible fixed assets 50 110 205

60 (237) (353)

3. Profit and loss account reserve

Half year to Half year to Year to

30 September 30 September 31 March

2004 2003 2004

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Balance at the beginning of the period 31,244 27,754 27,754

Retained profit for the period 6,632 4,122 3,553

Currency translation differences 19 (13) (63)

37,895 31,863 31,244

NOTES TO THE INTERIM RESULTS

at 30 September 2004

4. Reconciliation of operating profit to net cash flow from

operating activities

Half year to Half year to Year to

30 September 30 September 31 March

2004 2003 2004

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Operating profit 10,768 6,917 8,508

Depreciation 10,861 13,033 18,759

Amortisation of goodwill 248 248 497

Decrease in stock 568 153 236

(Increase) in debtors (2,897) (2,265) (309)

Increase in creditors 4,802 1,866 8,480

Exchange differences 19 (13) (60)

24,369 19,939 36,111

5. Reconciliation of net cash flow to movement in net debt

Half year to Half year to Year to

30 September 30 September 31 March

2004 2003 2004

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Increase in cash in the period 5,562 5,401 4,465

Cash (inflow)/outflow from (increase)/decrease in net

debt in the period (4,048) (7,164) 2,501

Change in net debt resulting from cashflows

in the period 1,514 (1,763) 6,966

Exchange differences (933) 1,467 6,196

Net debt at 1 April (15,032) (28,167) (28,167)

Net debt at end of period (14,451) (28,463) (15,032)

6. Other matters

The financial information for the year to 31 March 2004 does not

constitute statutory accounts, as defined in Section 240 of the Companies Act

1985, but is based on the statutory accounts for the year then ended. Those

accounts, upon which the auditors issued an unqualified opinion, have been

delivered to the Registrar of Companies.

The accounts to 30 September 2004 have been prepared using accounting

policies consistent with those adopted for the year to 31 March 2004.

Basic earnings per share has been calculated by reference to earnings

of #7,333,000 (2003: #4,758,000) and a weighted average number of ordinary

shares in issue of 34,358,217 (2003: 34,340,047).

This report is being sent to all shareholders and copies are available

from the Company Secretary at the registered office of the Company, Building

470, Bournemouth International Airport, Christchurch, Dorset, BH23 6SE.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAPFXFEELFFE

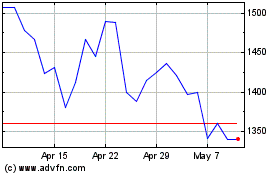

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

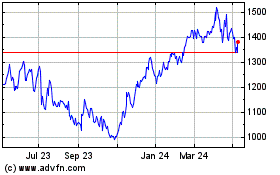

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024