TIDMJTC

RNS Number : 0819M

JTC PLC

12 September 2023

12 September 2023

JTC PLC

(the "Company") together with its subsidiaries (the "Group" or

"JTC")

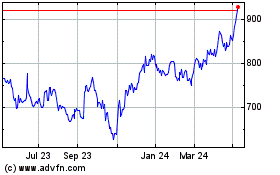

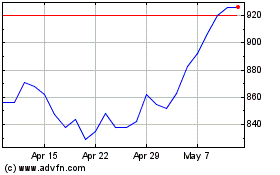

Interim results for the period ended 30 June 2023

Outstanding financial performance, alongside further strategic

M&A, outlook ahead of market expectations

As reported Underlying*

H1 2023 H1 2022 Change H1 2023 H1 2022 Change

------------------------------- ------- ------- ------ ------- ------- ------

Revenue (GBPm) 121.5 93.0 +30.6% 121.5 93.0 +30.6%

------------------------------- ------- ------- ------ ------- ------- ------

EBITDA (GBPm) 36.5 25.3 +44.0% 40.2 30.7 +30.8%

------------------------------- ------- ------- ------ ------- ------- ------

EBITDA margin 30.0% 27.2% +2.8pp 33.1% 33.0% +0.1pp

------------------------------- ------- ------- ------ ------- ------- ------

Operating profit/EBIT (GBPm) 24.7 14.8 +66.7% 28.4 20.2 +40.5%

------------------------------- ------- ------- ------ ------- ------- ------

Profit before tax (GBPm) 11.9 21.0 -43.3% 19.7 16.9 +16.3%

------------------------------- ------- ------- ------ ------- ------- ------

Earnings per share (p)** 7.61 14.21 -46.5% 18.16 16.23 +11.9%

------------------------------- ------- ------- ------ ------- ------- ------

Cash conversion 113% 101% +12pp 113% 101% +12pp

------------------------------- ------- ------- ------ ------- ------- ------

Net debt (GBPm) 44.6 104.1 -59.5 28.0 92.2 -64.2

------------------------------- ------- ------- ------ ------- ------- ------

Interim dividend per share (p) 3.5 3.1 +12.9% 3.5 3.1 +12.9%

------------------------------- ------- ------- ------ ------- ------- ------

* For further information on our alternative performance

measures (APM) see the appendix to the CFO Review.

** Average number of shares (thousands) for H1 2023: 147,075 (H1 2022: 144,429)

OUTSTANDING FINANCIAL PERFORMANCE

-- Very strong net organic revenue growth of 21.0% (H1 2022:

9.5%), driven by the highly successful implementation of the

Group's growth strategies

-- Revenue +30.6% to GBP121.5m (H1 2022: GBP93.0m)

-- Underlying EBITDA +30.8% to GBP40.2m (H1 2022: GBP30.7m) with

an underlying EBITDA margin of 33.1% (H1 2022: 33.0%)

-- Record new business wins +15.9% to GBP14.6m (H1 2022: GBP12.6m)

-- Strong underlying cash conversion of 113% (H1 2022: 101%)

alongside the SDTC equity fundraise in June has resulted in a

significant reduction in leverage to 0.37x underlying EBITDA at

period end

-- Following completion of the SDTC deal post period end,

leverage is still expected to be below 2.0 times reported

underlying EBITDA by the year-end, as previously announced

-- Interim dividend +12.9% to 3.5p (H1 2022: 3.1p)

SUCCESSFUL STRATEGIC EXECUTION

-- Both the Group's ICS and PCS divisions performed extremely

well, delivering organic growth of 22.4% and 18.6% respectively

-- The lifetime value of the JTC client book now stands at

GBP1.6bn with an average lifespan of 14 years

-- The Group strengthened its position in the strategically

important US market through the acquisition of SDTC, which

completed on 2 August 2023. JTC is now the leading independent

provider of trust and administration services to the large, high

growth, US private trust market

-- H1 2023 strong organic performance was supported by greater

penetration of the Group's centrally developed offerings such as

Banking, Tax Compliance, and its Strategic Transformation services,

which together contributed incremental revenues in the period,

which we expect to continue to contribute to Group growth

STRONG GROWTH OUTLOOK AHEAD OF MARKET EXPECTATIONS

-- Strong growth momentum will continue with net organic growth

through 2023 expected to remain well above the top end of the

Group's medium-term revenue guidance, and the Group expects to

deliver full year results ahead of current market expectations

-- The addition of the SDTC business to JTC is expected to offer

significant growth synergies post the completion of integration

-- Galaxy era growth strategy to be achieved by the year end, two years ahead of plan

-- Continued strong pipeline of further consolidation

opportunities across both Divisions over the medium-term

-- New Cosmos era growth ambition to double the size of the

Group, relative to performance delivered at FY 2023, by 2027

-- All medium-term guidance metrics to remain as JTC commences

the Cosmos era: net organic revenue growth of 8% - 10% per annum;

underlying EBITDA margin of 33% - 38%; cash conversion of 85% - 90%

and net debt of between 1.5x - 2.0x underlying EBITDA

Nigel Le Quesne, CEO of JTC PLC, said:

"Today's excellent results and the continued growth of our

platform, including the successful acquisition of SDTC, which

further enhances our platform in the important US market, yet again

demonstrate the significant earnings power of JTC. Organic revenue

growth in the period has been outstanding and we continue to

successfully acquire and integrate great businesses that deliver

increasing returns, particularly from capturing incremental share

of wallet from our growing client base. The fact that this is being

achieved in a more challenging global environment proves how

powerful JTC's business model, and ability to innovate, really is.

At the core of this is our people, whose commitment to raise the

bar results after results, as collective owners of our Company, is

incredible.

By the end of 2023, we will have delivered our Galaxy era

business plan, resulting in a quadrupling of the size of the Group

since listing in 2018. The momentum in the business, coupled with

the long-term structural drivers in our sector, mean that we remain

as ambitious for the Group as ever and aim to once again double in

size during the Cosmos era, which will commence in 2024 and is

expected to run until 2027. We look forward to continuing to

deliver strong, consistent results, with compounding revenues, for

all of our shareholders year in and year out."

ENQUIRIES

JTC PLC +44 (0) 1534 700 000

Nigel Le Quesne, Chief Executive

Officer

Martin Fotheringham, Chief Financial

Officer

David Vieira, Chief Communications

Officer

Camarco

Geoffrey Pelham-Lane +44 (0) 7733 124 226

Sam Morris +44 (0) 7796 827 008

A presentation for analysts will be held at 09:30 BST today via

Zoom video conference. The slides and an audio-cast of the

presentation will subsequently be made available on the JTC website

www.jtcgroup.com/investor-relations

FORWARD LOOKING STATEMENTS

This announcement may contain forward looking statements. No

forward-looking statement is a guarantee of future performance and

actual results or performance or other financial condition could

differ materially from those contained in the forward looking

statements. These forward-looking statements can be identified by

the fact they do not relate only to historical or current facts.

They may contain words such as "may", "will", "seek", "continue",

"aim", "anticipate", "target", "projected", "expect", "estimate",

"intend", "plan", "goal", "believe", "achieve" or other words with

similar meaning. By their nature forward looking statements involve

risk and uncertainty because they relate to future events and

circumstances. A number of these influences and factors are outside

of the Company's control. As a result, actual results may differ

materially from the plans, goals and expectations contained in this

announcement. Any forward-looking statements made in this

announcement speak only as of the date they are made. Except as

required by the FCA or any applicable law or regulation, the

Company expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained in this announcement.

ABOUT JTC

JTC is a publicly listed, global professional services business

with deep expertise in fund, corporate and private client services.

Every JTC person is an owner of the business, and this fundamental

part of our culture aligns us with the best interests of all our

stakeholders. Our purpose is to maximize potential and our success

is built on service excellence, long-term relationships and

technology capabilities that drive efficiency and add value.

www.jtcgroup.com

CHIEF EXECUTIVE OFFICER'S REVIEW

Consistently delivering year in and year out

NIGEL LE QUESNE

CHIEF EXECUTIVE OFFICER

JTC has delivered uninterrupted growth for every one of its 35

years. This has been achieved in all conditions, regardless of

whether the global economy is strong or weak, or equity markets are

confident or uncertain. If further evidence of this was needed

during what has proved to be a period of significant macro-economic

and geopolitical instability, then our half year results are

precisely that, demonstrating yet again the consistent earnings

power of our business model through economic cycles. The fact that

we will achieve our Galaxy era goal of doubling the size of the

Group (in terms of revenue and EBITDA) by the end of 2023, some two

years earlier than originally anticipated, is a fantastic team

effort and provides great energy and momentum to the business.

H1 2023 FINANCIAL PERFORMANCE

Revenue grew 30.6% to GBP121.5m driven by record net organic

growth of 21.0% (H1 2022: 9.5%), significantly above our

medium-term guidance range of between 8% and 10%. Underlying EBITDA

rose by 30.8% to GBP40.2m (H1 2022: GBP30.7m), with an underlying

EBITDA margin to 33.1% (H1 2022: 33.0%). The very strong net

organic revenue growth was driven by strong annualised new business

wins (from both new and existing clients), which increased 15.9% to

a record GBP14.6m (H1 2022: GBP12.6m). There was also an impressive

improvement in underlying cash conversion to 113% (H1 2022: 101%),

reflecting the continued cash generative nature of our business

model. While leverage at the period end was very low at 0.37x, this

was due to the proceeds of the equity fundraise for the acquisition

of the South Dakota Trust Company ("SDTC"), which didn't complete

until after the period end on 2 August 2023. By the year end,

leverage is expected to be below 2.0x underlying EBITDA, consistent

with our medium-term guidance of between 1.5x and 2.0x underlying

EBITDA. Based on these results and the Board's confidence in JTC's

ability to continue to deliver consistent returns to shareholders,

our interim dividend has increased by 12.9% to 3.5 pence per

share.

INSTITUTIONAL CLIENT SERVICES DIVISION

Revenue increased 27.0% to GBP80.7m (H1 2022: GBP63.5m) and

underlying EBITDA was up 27.4% to GBP25.5m (H1 2022: GBP20.0m). The

underlying EBITDA margin rose by ten basis points to 31.6% (H1

2022: 31.5%). The Division delivered excellent net organic growth

on a last twelve months basis ("LTM") of 22.4% (H1 2022: 14.1%),

and the annualised value of new business wins rose 28% to a record

GBP10.9m (H1 2022: GBP8.5m), providing good revenue visibility of

future growth.

The ICS Division has benefited from a number of initiatives

delivered over a period of time to improve and extend the service

offering, talent and 'go to market' strategy. The strong net

organic growth was driven in particular by performance in the US,

the Channel Islands & UK and Luxembourg and through revenues

generated by our centrally developed banking, tax and regulatory

compliance and strategic transformation services. The Division

continues to invest in scaling its offering in Ireland and during

the period launched a consolidated Global AIFM Solutions service,

which currently spans Luxembourg, Ireland and Guernsey.

This performance is all the more impressive in that it has been

achieved without the benefit of any recent acquisitions,

demonstrating the increasing returns on capital being generated

from previously acquired businesses as they have been successfully

integrated within the ICS Division and the valuable synergies

realised. Stand out performers from the acquisitions completed in

recent years include the Employer Solutions business (formerly RBC

cees) and SALI Fund Services in the US, which completed in

2021.

PRIVATE CLIENT SERVICES DIVISION

Revenue increased strongly by 38.3% to GBP40.8m (H1 2022:

GBP29.5m) with a similarly impressive increase of 37.1% in

underlying EBITDA to GBP14.7m (H1 2022: GBP10.7m), with

contributions from strategic transformation services mandates such

as Amaro, Campari and Ottawa. The underlying EBITDA margin reduced

slightly to 36.0% (H1 2022: 36.3%), reflecting the first half

impact of the acquisition of New York Private Trust Company

("NYPTC"), which completed on 1 November 2022. Excluding this, the

Division's underlying EBITDA margin would have been 36.5%. LTM net

organic growth was a sector-leading 18.6% (H1 2022: 4.0%), driven

in part by the Amaro mandate coming on-stream, but even without

this, the Division would have delivered organic growth well above

guidance, reflecting growth in banking and tax and regulatory

compliance services, which demonstrate the important connection to

our Group Commercial Office. The annualised value of new business

wins was GBP3.7m (H1 2022: GBP4.1m), which whilst a lower figure is

due to an exceptional H1 2022 comparator, when the Amaro mandate

was won.

The acquisitions of NYPTC, which completed just prior to the

start of the period and SDTC, which completed just after the period

end, slightly ahead of schedule, have significantly strengthened

the Division's market leadership in the global trust company

industry. The integration of Delaware-based NYPTC, which offers a

broad range of fiduciary services, is progressing well. The

acquisition of SDTC, makes JTC the leading independent provider of

trust and administration services to the US private trust sector,

providing the benefits that come from scale in the very large and

fast-growing US market.

Our US PCS offering can now service both international and

domestic clients, it is worth noting that the US is home to the

largest number of ultra-high net worth individuals (UHNWI) of any

country in the world and it is estimated that the core addressable

market captures approximately US$1.2 trillion of assets. This

market has grown at a compound annual growth rate ("CAGR") of 9.4%

from 2018 to 2022 and is forecast to grow at a CAGR of 8.2% from

2023 to 2028 (source: Cerulli Associates). Similar to JTC, and a

key part of the strategic rationale for acquiring the business,

SDTC has a 22-year track record of consistent growth, with revenues

increasing at a CAGR of 33% from 2000 to 2022 while steadily

increasing its market share. SDTC also delivers high margins and

benefits from highly predictable fees, which when coupled with the

opportunities from an enormous and growing market, creates a

transformational platform opportunity for JTC in the US over the

medium to long-term.

OTHER GROWTH INITIATIVES

Key to our culture at JTC is that we never stand still or take

continued profitable growth for granted. Through investment in our

Group Commercial Office, which acts as a catalyst for both

Divisions, we have introduced other services of value to our

clients, including; banking, treasury, tax and regulatory

compliance, and our strategic transformation services. What all

these have in common is that they are complementary to our core

fund, corporate and private client business lines, which are the

bedrock of JTC. Our client book now has an average lifespan of some

14 years and the Lifetime Value Won (LVW)[1] in the period, based

on this lifespan, was a record GBP195.1m, up 16% (H1 2022:

GBP168.2m). This gives us visibility of at least GBP1.6 billion of

forward revenues from our existing client book, which is without

the addition of any new future mandates.

OUR GREATEST ASSET

I have also said before that none of what JTC has achieved to

date would be possible without the commitment and expertise of our

people. As we conclude our Galaxy era and look ahead to the Cosmos

era beginning in 2024, the same could be said about what is to

come. This is why having a business where every one of your

employees are also owners is so important. What I have said in the

past about the benefit of and commitment to ownership for all

employees couldn't be more relevant today when navigating the

current macro-economic volatility and as always, I extend my

sincere thanks to every member of our growing global team.

RISK

The principal risks facing the Group remain as set out in the

JTC Annual Report and Accounts 2022 (pages 50 to 53). The Group's

principal risks are periodically re-examined and reported by the

Chief Risk Officer to the Governance and Risk Committee with an

assessment on (i) their impact if they were to occur and (ii) the

likelihood of occurrence, together with a description of the

controls and mitigation in place to manage those controls and any

actions deemed necessary by the risk owner to further reduce the

assessed residual risk. Ongoing material risks include acquisition

risk, competitor and client demand risk, strategy risk, performance

of business risk, client and process risk, data security risk,

political/regulation risk, financial crime risk, fiduciary risk and

adequate resource risk.

Global macroeconomic developments and geopolitical tensions

heightened by the conflict in Ukraine, high inflation, higher

interest rates, the energy crisis, supply chain shortages and the

risk of a global economic downturn all present a particular set of

risks that have the potential to slow investment and global growth.

Whilst the Group is unable to control these risks we remain

vigilant to their impact and react accordingly e.g. to attract and

retain talent in a competitive employment market beset by wage

inflation, we believe that the business will continue to prove

resilient in the face of these challenges. Overall, we remain

satisfied as to the effectiveness of the Group's risk analysis,

management and culture, developed over 35 years of JTC

operations.

DIVID

The Board has declared an interim dividend of 3.5p per share, an

increase of 0.4p period on period (H1 2022: 3.1p). The interim

dividend will be paid on 20 October 2023 to shareholders on the

register as at close of business on the record date of 22 September

2023. The shares will become ex-dividend on 21 September 2023.

OUTLOOK

Based on these results, our step up in the delivery of

additional recurring revenues in H1, the exciting opportunities

from our latest acquisitions in the US, delivered by a highly

committed team, we remain confident in the Group's continued

success. As before, we will deliver this through a combination of

organic and inorganic growth. In terms of the M&A pipeline, we

continue to see potential opportunities (including some off market

such as the recent SDTC transaction) and will maintain our

selective and disciplined approach. Strong growth momentum will

continue with net organic growth through 2023 expected to remain

well above the top end of the Group's medium-term revenue guidance,

and the Group expects to deliver full year results ahead of current

market expectations

We are particularly pleased that we will achieve our Galaxy era

goal of doubling the business from where we finished 2020, by the

end of this year; some two years' earlier than planned and having

previously delivered a similar result in the Odyssey era, which ran

from 2018 to 2020. Our next business plan era, which we are calling

Cosmos, will commence in 2024 and we are again aiming to double the

Group by 2027, with a particular focus on leveraging the US

platform built during Galaxy. And, in the meantime, our medium-term

guidance metrics for responsible compounding delivery of achieving

between 8% to 10% net organic revenue growth, a 33% to 38%

underlying EBITDA margin, cash conversion of between 85% to 90% and

net debt of between 1.5 times and 2 times underlying EBITDA remain

intact.

In summary, JTC continues to extend its excellent track record

of profitable growth driven by consistent and innovative organic

growth, a disciplined approach to M&A, a robust and scalable

global platform, exceptional talent and our unique shared ownership

culture. Since our listing on the stock market in 2018, we will

have quadrupled the size of the Group and we aim to double it again

no later than the end of 2027. As such, we look forward to

continuing to deliver the performance our shareholders expect, year

in and year out.

NIGEL LE QUESNE

CHIEF EXECUTIVE OFFICER

Chief Financial Officer's review

Delivering long term value through exceptional revenue

growth

Martin Fotheringham

CHIEF FINANCIAL OFFICER

REVENUE

In H1 2023, revenue was GBP121.5m, an increase of GBP28.5m

(+30.6%) from H1 2022. Revenue growth on a constant currency basis

was +27.9% (H1 2022: +37.4%).

Net organic growth for the last twelve months (LTM) ended 30

June 2023 was a record 21.0% (H1 2022: 9.5%) with the rolling three

year average now reporting 12.7% (H1 2022: 9.1%).

Within organic growth, we have seen particularly strong volume

growth with a significant contribution coming from the expansion of

our Tax Compliance offering (heavily involved with Project Amaro)

as well as the introduction of our Treasury Services. The latter is

a positive endorsement of the creation and investment we have made

in the Group Commercial Office. We have embedded the revenues

associated with these services into the underlying business and can

see further opportunities for growth.

Our largest 15 clients represent only 11.5% (H1 2022: 11.6%) of

our annual revenue thereby demonstrating the lack of customer

concentration in the business. The new business pipeline was

healthy and at the period end was reported at GBP47.1m (31.12.2022:

GBP45.8m) increasing to GBP54.1m as at 1 September.

Net organic growth was driven by gross new business revenues for

the proceeding twelve months of 26.7% (H1 2022: 16.2%). This was

offset by reduced attrition of 5.7% (H1 2022: 6.7%), with the

three-year average now having fallen to 6.9% (H1 2022: 7.6%).

Notably, attrition levels have decreased for five successive

reporting periods, reflecting the increased lifetime value of our

book of business and long-term earnings stability. This is further

enhanced with the SDTC acquisition completed in August 2023.

The retention of revenues that were not end of life increased to

98.6% (H1 2022: 97.9%) and the rolling three-year average has now

improved to 97.9% (H1 2022: 97.5%).

As demonstrated by the geographical breakdown below, all regions

generated good growth with the US showing the highest growth by

region.

H1 2023 H1 2022

Revenue Revenue GBP +/- % +/-

--------------------- ---------- --------- ---------- ------

UK & Channel Islands GBP64.7m GBP51.6m +GBP13.1m +25.3%

US GBP25.3m GBP16.2m +GBP9.1m +55.6%

Rest of Europe GBP18.6m GBP16.4m +GBP2.2m +13.3%

Rest of the World GBP12.9m GBP8.8m +GBP4.2m +47.8%

GBP121.5m GBP93.0m +GBP28.5m +30.6%

---------- --------- -------------------------------- ------

LTM revenue growth, on a constant currency basis, is summarised

as follows:

LTM revenue Jun 22 GBP178.0m

------------------------------------- ---------

Lost - JTC decision (GBP0.4m)

------------------------------------- ---------

Lost - Moved service provider (GBP1.8m)

------------------------------------- ---------

Lost - End of life/no longer required (GBP7.1m)

------------------------------------- ---------

Net more from existing clients GBP33.5m

------------------------------------- ---------

New clients GBP10.6m

------------------------------------- ---------

Acquisitions* GBP14.7m

------------------------------------- ---------

LTM revenue Jun 23 GBP227.5m

------------------------------------- ---------

* When JTC acquires a business, the acquired book of clients are

defined as inorganic for the first two years of JTC ownership.

Acquired clients contributed an additional GBP14.7m in the LTM to

30 June 2023 and is broken down as follows: NYPTC GBP4.2m, EFS

GBP1.3m, SALI GBP8.2m, Ballybunion GBP0.6m, perfORM GBP0.1m, and

Segue GBP0.3m.

UNDERLYING EBITDA AND MARGIN PERFORMANCE

Underlying EBITDA in H1 2023 was GBP40.2m, an increase of

GBP9.5m (30.8%) from H1 2022.

The underlying EBITDA margin was 33.1% (H1 2022: 33.0%) and

although the macroeconomic environment remained uncertain, we are

pleased to have continued to deliver margins in line with our

medium-term guidance range.

As highlighted in the 2022 results, during periods of heightened

revenue growth above our medium-term guidance range, the required

upfront investment can inherently slow down margin progression.

Management considers this initial investment as a key allocation of

capital in order to ensure the continued longevity of our client

relationships and support future margin enhancements.

Management re-iterates its medium-term guidance range of 33% -

38%, albeit with the short-term expectation that performance will

continue to be towards the lower end of this guidance range during

periods of heightened revenue growth.

INSTITUTIONAL CLIENT SERVICES

Revenue increased by 27.0% when compared with H1 2022.

Net organic growth improved significantly to 22.4% (H1 2022:

14.1%) with strong growth in the US, Channel Islands & UK, and

Luxembourg. The rolling three year average for net organic growth

now stands at 14.1% (H1 2022: 9.6%).

Attrition for the Division was lower at 6.0% (H1 2022: 7.1%), of

which 5.0% were for end of life losses.

LTM revenue growth, on a constant currency basis, is summarised

below.

The Division's underlying EBITDA margin increased from 31.5% in

H1 2022 to 31.6% in H1 2023 and we are pleased that the margin

continues to improve given the ongoing momentum in the

division.

LTM REVENUE GROWTH ICS

------------------------------------- ---------

LTM revenue Jun 22 GBP118.9m

------------------------------------- ---------

Lost - JTC decision (GBP0.2m)

------------------------------------- ---------

Lost - Moved service provider (GBP0.9m)

------------------------------------- ---------

Lost - End of life/no longer required (GBP5.3m)

------------------------------------- ---------

Net more from existing clients GBP23.4m

------------------------------------- ---------

New clients GBP6.9m

------------------------------------- ---------

Acquisitions* GBP10.5m

------------------------------------- ---------

LTM revenue Jun 23 GBP153.3m

------------------------------------- ---------

* When JTC acquires a business, the acquired book of clients are

defined as inorganic for the first two years of JTC ownership.

Acquired clients contributed an additional GBP10.5m in the LTM to

30 June 2023 and is broken down as follows: EFS GBP1.3m, SALI

GBP8.2m, Ballybunion GBP0.6m, perfORM GBP0.1m, and Segue

GBP0.3m.

PRIVATE CLIENT SERVICES

Revenue increased by 38.3% when compared with H1 2022.

Net organic growth was 18.6% (H1 2022: 4.0%) with strong growth

in the Caribbean, US, and Channel Islands & UK. The rolling

three year average now stands at 10.8% (H1 2022: 8.6%).

Attrition for the Division was also lower at 4.9% (H1 2022:

6.1%), of which 3.0% were for end of life losses.

Net organic growth for the Division in H1 2022 had been

supressed whilst we onboarded the Amaro mandate. Note that even

without the Amaro revenues coming in during the current LTM period,

the Division would have been well above our medium-term guidance

range.

LTM revenue growth, on a constant currency basis, is summarised

below.

The Division's underlying EBITDA margin decreased slightly from

36.3% in H1 2022 to 36.0% in H1 2023. The Division continues to

perform well and excluding the recent NYPTC acquisition, the

underlying EBITDA margin would have been 36.5% and both of these

are comfortably within our medium-term guidance range.

LTM REVENUE GROWTH PCS

------------------------------------- ---------

LTM revenue Jun 22 GBP59.1m

------------------------------------- ---------

Lost - JTC decision (GBP0.2m)

------------------------------------- ---------

Lost - Moved service provider (GBP0.9m)

------------------------------------- ---------

Lost - End of life/no longer required (GBP1.8m)

------------------------------------- ---------

Net more from existing clients GBP10.1m

------------------------------------- ---------

New clients GBP3.7m

------------------------------------- ---------

Acquisitions* GBP4.2m

------------------------------------- ---------

LTM revenue Jun 23 GBP74.2m

------------------------------------- ---------

* When JTC acquires a business, the acquired book of clients are

defined as inorganic for the first two years of JTC ownership.

Acquired clients contributed an additional GBP4.2m in the LTM to 30

June 2023 and all of which can be attributed to NYPTC GBP4.2m.

PROFIT BEFORE TAX

The reported profit before tax was GBP11.9m (H1 2022:

GBP21.0m).

The depreciation and amortisation charge increased to GBP11.8m

from GBP10.5m in H1 2022. Of the GBP1.3m increase, GBP0.6m was as a

result of previously acquired intangible assets and GBP0.7m as a

result of increased software and customer contracts, the latter

driven by costs incurred in 2022 to fulfil the Amaro mandate.

Adjusting for non-underlying items, the underlying profit before

tax increased by 16.3% to GBP19.7m (H1 2022: GBP16.9m).

The relative increase was lower than the 30.8% growth reported

in underlying EBITDA and this was due to the increased interest

expense on our borrowings that fund M&A activity and an

underlying foreign exchange rate loss of GBP1.4m (H1 2022: GBP2.2

gain).

The interest rate applied to our loan facilities is determined

using SONIA plus a margin based on net leverage calculations and

the base rate increases have resulted in a GBP2.4m increase in H1

2023 to the interest expense on our borrowings.

NON-UNDERLYING ITEMS

Non-underlying items incurred in the period totalled a GBP7.8m

debit (H1 2022: GBP4.1m credit) and comprised the following:

H1 2023 H1 2022

GBPm GBPm

---------------------------------------------------- ------- -------

EBITDA

---------------------------------------------------- ------- -------

Acquisition and integration costs 3.5 0.5

---------------------------------------------------- ------- -------

Office start-up costs 0.1 -

---------------------------------------------------- ------- -------

Revision of ICS operating model - 0.4

---------------------------------------------------- ------- -------

Employee Incentive Plan (EIP) - 4.5

---------------------------------------------------- ------- -------

Other costs 0.1 -

---------------------------------------------------- ------- -------

Total non-underlying items within EBITDA 3.7 5.4

---------------------------------------------------- ------- -------

Profit before tax

---------------------------------------------------- ------- -------

Items impacting EBITDA 3.7 5.4

---------------------------------------------------- ------- -------

Gain on revaluation of contingent consideration (0.2) (0.4)

---------------------------------------------------- ------- -------

Foreign exchange losses/(gains) 4.3 (9.0)

---------------------------------------------------- ------- -------

Total non-underlying items within profit before tax 7.8 (4.1)

---------------------------------------------------- ------- -------

Acquisition and integration costs were significantly higher

(+GBP3.0m) than the prior period due to GBP2.6m of costs incurred

in relation to the SDTC acquisition, which was announced pre period

end but completed in early August. There were also GBP0.2m of costs

incurred in relation to the NYPTC acquisition that completed in Q4

2022.

The business incurred GBP0.1m of non-underlying office start-up

costs in relation to establishing the infrastructure to trade in

new offices in Austria and the Bahamas. Our experience is that

these require significant up-front investment in personnel in

advance of trading and the generation of revenues.

The H1 2022 EIP expense related to the second tranche of the

awards made in 2021 which vested in July 2022.

The foreign exchange loss of GBP4.3m relates to the revaluation

of intercompany loans (GBP9.0m gain in H1 2022). Management

consider these foreign exchange movements to be non-underlying as

they are unrealisable losses/(gains) as the loans are eliminated

upon consolidation.

EARNINGS PER SHARE

Basic EPS decreased by 46.5% to 7.61p but this was as a result

of the above non-underlying items. Adjusted underlying basic EPS

increased by 11.9% and was 18.16p (H1 2022: 16.23p).

Adjusted underlying basic EPS reflects the profit for the period

adjusted to remove the impact of non-underlying items, amortisation

of acquired intangible assets and associated deferred tax,

amortisation of loan arrangement fees and unwinding of net present

value discounts in relation to contingent consideration.

CASH FLOW AND DEBT

Underlying cash generated from operations was GBP45.2m (H1 2022:

GBP30.9m) and the underlying cash conversion was 113% (H1 2022:

101%).

Reported net debt includes regulatory trapped cash. Underlying

net debt excludes this and at the period end was GBP28.0m compared

with GBP104.8m at 31 December 2022. This significant reduction was

driven by the aforementioned strong cash collection and the

proceeds from the June equity raise associated with the SDTC

acquisition.

In anticipation of the acquisition of SDTC, on 15 June 2023, our

lenders agreed to increase our revolving credit facility (RCF) by

GBP50m to a total commitment of GBP275m.

Leverage at the period end was 0.37x underlying EBTIDA. On 30

June 2023 the Group had undrawn funds of GBP169.3m available from

the GBP275m facility. On 1 August 2023 GBP118m was withdrawn from

the banking facility to provide the necessary proceeds to complete

the SDTC acquisition.

MARTIN FOTHERINGHAM

CHIEF FINANCIAL OFFICER

Statement of directors' responsibilities in respect of the

interim financial statements

For the 6 month period ended 30 June 2023

"The directors' confirm that these condensed interim financial

statements have been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting', as adopted

by the European Union and that the interim management report

includes a fair review of the information required by DTR 4.2.7 and

DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related-party transactions in the first six months and any material changes in the related-party transactions described in the last annual report."

Nigel Le Quesne Martin Fotheringham

Chief Executive Officer Chief Financial Officer

11 September 2023 11 September 2023

Appendix: Reconciliation of reported results to Alternative

Performance Measures (APM s )

In order to assist the reader's understanding of the financial

performance of the Group, APMs have been included to better reflect

the underlying activities of the Group excluding specific items as

set out in note 8 in the interim financial statements. The Group

appreciates that APMs are not considered to be a substitute for, or

superior to, IFRS measures but believes that the selected use of

these may provide stakeholders with additional information which

will assist in the understanding of the business.

An explanation of our key APMs and link to equivalent statutory

measures has been detailed below.

Alternative performance measure Closest equivalent statutory measure APM Definition

------------------------------- ------------------------------------ -----------------------------------------------

net Organic revenue growth % Revenue Definition: Revenue growth from clients not

acquired through business combinations and

reported

on a constant currency basis where the prior

year results are restated using current year

consolidated income statement exchange rates.

Acquired clients are defined as inorganic for

the first two years of JTC ownership.

Purpose and strategic link: Enables the

business to monitor growth excluding

acquisitions

and the impact of external exchange rate

factors. The current strategy is to double the

size

of the business by a mix of organic and

acquisition growth and the ability to monitor

and

set clear expectations on organic growth is

vital to the successful execution of its

business

strategy.

Management's medium-term guidance range is 8% -

10%.

------------------------------- ------------------------------------ -----------------------------------------------

Underlying EBITDA % Profit/(loss) Definition: Earnings before interest, tax,

depreciation and amortisation excluding

non-underlying

items (see note 8 of the financial statements).

Purpose and strategic link: An

industry-recognised alternative measure of

performance which

has been at the heart of the business since its

inception and therefore fundamental to the

performance management of all business units.

The measure enables the business to measure the

relative profitability of servicing clients.

Management's medium-term guidance range is 33%

- 38%.

------------------------------- ------------------------------------ -----------------------------------------------

Underlying cash conversion % Net cash from operating activities Definition: The conversion of underlying EBITDA

into cash excluding

non-underlying items.

Purpose and strategic link: Measures how

effectively the business is managing its

operating

cash flows. It differs to net cash from

operating profits as it excludes non-underlying

items

and tax, the latter in order to better compare

operating profitability to cash from operating

activities.

Management's medium-term guidance range is 85%

- 90%.

------------------------------- ------------------------------------ -----------------------------------------------

Underlying leverage Cash and cash equivalents Definition: Leverage ratio showing the relative

amount of third party debt (net of cash held

in the business) that we have in comparison to

underlying LTM EBITDA.

Purpose and strategic link: Ensures Management

can measure and control exposure to reliance

on third party debt in support of its inorganic

growth.

Management's medium-term guidance range is 1.5x

- 2.0x.

------------------------------- ------------------------------------ -----------------------------------------------

Adjusted underlying EPS (p) Basic Earnings Per Share Definition: Reflects the profit after tax for

the period adjusted to remove the impact of

non-underlying items. Additionally, a number of

other items relating to the Group's acquisition

activities, including amortisation of acquired

intangible assets and associated deferred tax,

amortisation of loan arrangement fees and

unwinding of NPV discounts in relation to

contingent

consideration, are removed.

Purpose and strategic link: Presents an

adjusted underlying EPS which is used more

widely

by external investors and analysts, and is in

addition the basis upon which the dividend is

calculated.

------------------------------- ------------------------------------ -----------------------------------------------

A reconciliation of our APMs to their closest equivalent

statutory measure has been provided below.

1. ORGANIC GROWTH

H1 2023 H1 2022

GBPm GBPm

-------------------------------------------------------------- ------- -------

Reported prior year full year revenue (2021 / 2020) 147.5 115.1

-------------------------------------------------------------- ------- -------

Less: reported prior year interim revenue (H1 2021, H1 2020) (67.0) (53.7)

-------------------------------------------------------------- ------- -------

Plus: reported interim revenue (H1 2022 / H1 2021) 93.0 67.0

-------------------------------------------------------------- ------- -------

Less: impact of exchange rate restatement* (4.5) 0.4

-------------------------------------------------------------- ------- -------

Less: acquisition revenues (12.4) (5.6)

-------------------------------------------------------------- ------- -------

a. Prior period LTM organic revenue 165.6 123.2

-------------------------------------------------------------- ------- -------

Reported prior year full year revenue (2022 / 2021) 200.0 147.5

-------------------------------------------------------------- ------- -------

Less: reported prior year interim revenue (H1 2022 / H1 2021) (93.0) (67.0)

-------------------------------------------------------------- ------- -------

Plus: reported interim revenue (H1 2023 / H1 2022) 121.5 93.0

-------------------------------------------------------------- ------- -------

Less: impact of exchange rate restatement* (1.1) 0.9

-------------------------------------------------------------- ------- -------

Less: acquisition revenues (27.1) (39.3)

-------------------------------------------------------------- ------- -------

b. Current period LTM organic revenue 200.3 135.1

-------------------------------------------------------------- ------- -------

Net organic growth % (b / a) -1 21.0% 9.5%

-------------------------------------------------------------- ------- -------

* Impact of restating LTM revenue on a constant currency basis

using the H1 2023 / H1 2022 average rates

2. UNDERLYING EBITDA

H1 2023 H1 2022

GBPm GBPm

------------------------------------ ------- -------

Reported profit 11.2 20.5

------------------------------------ ------- -------

Add:

------------------------------------ ------- -------

Income tax 0.8 0.5

------------------------------------ ------- -------

Finance cost 7.5 5.4

------------------------------------ ------- -------

Finance income (0.3) (0.0)

------------------------------------ ------- -------

Other losses/(gains) 5.5 (11.6)

------------------------------------ ------- -------

Depreciation and amortisation 11.8 10.5

------------------------------------ ------- -------

Non-underlying items within EBITDA* 3.7 5.4

------------------------------------ ------- -------

Underlying EBITDA 40.2 30.7

------------------------------------ ------- -------

Underlying EBITDA % 33.1% 33.0%

------------------------------------ ------- -------

* As set out in note 8 in the interim financial statements

3. UNDERLYING CASH CONVERSION

H1 2023 H1 2022

GBPm GBPm

--------------------------------------------- ------- -------

Net cash generated from operating activities 41.5 28.7

--------------------------------------------- ------- -------

Less:

--------------------------------------------- ------- -------

Non-underlying cash items* 1.6 1.5

--------------------------------------------- ------- -------

Income taxes paid 2.1 0.7

--------------------------------------------- ------- -------

a. Underlying cash generated from operations 45.2 30.9

--------------------------------------------- ------- -------

b. Underlying EBITDA 40.2 30.7

--------------------------------------------- ------- -------

Underlying cash conversion (a / b) 113% 101%

--------------------------------------------- ------- -------

* As set out in note 19.2 in the interim financial statements

4. UNDERLYING LEVERAGE

H1 2023 H1 2022

GBPm GBPm

-------------------------- ------- -------

Cash and cash equivalents 75.7 60.9

-------------------------- ------- -------

Bank debt (103.7) (153.1)

-------------------------- ------- -------

Other debt - -

-------------------------- ------- -------

a. Net debt - underlying (28.0) (92.2)

-------------------------- ------- -------

b. LTM underlying EBITDA 75.5 57.2

-------------------------- ------- -------

Leverage (a / b) 0.37 1.61

-------------------------- ------- -------

5. ADJUSTED UNDERLYING EPS

H1 2023 H1 2022

GBPm GBPm

----------------------------------------------------------------------------------------------- ------- -------

Profit for the year as per basic EPS 11.2 20.5

----------------------------------------------------------------------------------------------- ------- -------

Less:

----------------------------------------------------------------------------------------------- ------- -------

Non-underlying items* 7.8 (4.1)

----------------------------------------------------------------------------------------------- ------- -------

Amortisation of customer relationships, acquired software and brands 6.5 5.9

----------------------------------------------------------------------------------------------- ------- -------

Amortisation of loan arrangement fees 0.4 0.6

----------------------------------------------------------------------------------------------- ------- -------

Unwinding of NPV discounts for contingent consideration 1.6 1.7

----------------------------------------------------------------------------------------------- ------- -------

Temporary tax differences arising on amortisation of customer relationships, acquired software

and brands (0.8) (1.2)

----------------------------------------------------------------------------------------------- ------- -------

a. Adjusted underlying profit for the year 26.7 23.4

----------------------------------------------------------------------------------------------- ------- -------

b. Weighted average number of shares 147.1 144.4

----------------------------------------------------------------------------------------------- ------- -------

Adjusted underlying EPS (a / b) 18.16 16.23

----------------------------------------------------------------------------------------------- ------- -------

* As set out in note 8 in the financial statements

Independent review report to JTC PLC

Report on the condensed consolidated interim financial

statements

Our conclusion

We have reviewed JTC PLC's condensed consolidated interim

financial statements (the "interim financial statements") in the

Interim Financial Report (the "interim financial report") of JTC

PLC for the 6-month period ended 30 June 2023 (the "period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the Disclosure

Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority.

The interim financial statements comprise:

-- the condensed consolidated interim balance sheet as at 30 June 2023;

-- the condensed consolidated interim income statement for the period then ended;

-- the condensed consolidated interim statement of comprehensive

income for the period then ended;

-- the condensed consolidated interim statement of changes in equity for the period then ended;

-- the condensed consolidated interim statement of cash flows for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the interim

financial report have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the Disclosure

Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements 2410, 'Review of Interim Financial

Information Performed by the Independent Auditor of the Entity'

issued by the International Auditing and Assurance Standards Board.

A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the interim

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The interim financial report, including the interim financial

statements, is the responsibility of, and has been approved by, the

directors. The directors are responsible for preparing the interim

financial report in accordance with International Accounting

Standard 34, 'Interim Financial Reporting', and the Disclosure

Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority.

Our responsibility is to express a conclusion on the interim

financial statements in the interim financial report based on our

review. This report, including the conclusion, has been prepared

for and only for the company for the purpose of complying with the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority and for no other purpose. We

do not, in giving this conclusion, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

PricewaterhouseCoopers CI LLP

Chartered Accountants

Jersey, Channel Islands

11 September 2023

(a) The maintenance and integrity of the JTC PLC website is the

responsibility of the directors; the work carried out by the

auditors does not involve consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred to the financial statements since they were

initially presented on the website.

(b) Legislation in Jersey governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions .

JTC PLC

INTERIM FINANCIAL REPORT 30 JUNE 2023

UNAUDITED

Condensed consolidated interim income statement

Condensed consolidated interim statement of comprehensive

income

Condensed consolidated interim balance sheet

Condensed consolidated interim statement of changes in

equity

Condensed consolidated interim statement of cash flows

Notes to the condensed consolidated interim financial

statements

1. Reporting entity

2. Significant changes in the current reporting period

3. Basis of preparation

4. Significant accounting policies and standards

5. Critical accounting estimates and judgements

6. Segmental reporting

7. Staff expenses

8. Non-underlying items

9. Other net (losses)/gains

10. Finance cost

11. Income tax

12. Earnings Per Share

13. Goodwill and other intangible assets

14. Share capital and reserves

15. Trade and other payables

16. Loans and borrowings

17. Other non-financial liabilities

18. Financial risk and capital management

19. Cash flow information

20. Related party transactions

21. Contingencies

22. Events occurring after the reporting period

CONDENSED CONSOLIDATED INTERIM INCOME STATEMENT

GBP'000 Note H1 2023 H1 2022

---------------------------------------------- ---- -------- --------

Revenue 6 121,492 93,022

Staff expenses 7 (61,616) (51,666)

Other operating expenses (22,038) (15,213)

Credit impairment losses (1,466) (1,160)

Other operating income 22 21

Share of profit of equity-accounted investee 101 333

---------------------------------------------- ---- -------- --------

Earnings before interest, taxes, depreciation

and amortisation ("EBITDA") 36,495 25,337

---------------------------------------------- ---- -------- --------

Comprising:

Underlying EBITDA 40,174 30,714

Non-underlying items 8 (3,679) (5,377)

---------------------------------------------- ---- -------- --------

36,495 25,337

---------------------------------------------- ---- -------- --------

Depreciation and amortisation (11,813) (10,530)

---------------------------------------------- ---- -------- --------

Profit from operating activities 24,682 14,807

---------------------------------------------- ---- -------- --------

Other net (losses)/gains 9 (5,530) 11,622

Finance income 323 15

Finance cost 10 (7,536) (5,411)

---------------------------------------------- ---- -------- --------

Profit before tax 11,939 21,033

---------------------------------------------- ---- -------- --------

Comprising:

Underlying profit before tax 19,708 16,942

Non-underlying items 8 (7,769) 4,091

---------------------------------------------- ---- -------- --------

11,939 21,033

---------------------------------------------- ---- -------- --------

Income tax 11 (753) (513)

---------------------------------------------- ---- -------- --------

Profit for the period 11,186 20,520

---------------------------------------------- ---- -------- --------

Earnings per Ordinary share ("EPS") Pence Pence

---------------------------------------------- ---- -------- --------

Basic EPS 12.1 7.61 14.21

Diluted EPS 12.2 7.54 13.96

---------------------------------------------- ---- -------- --------

The above condensed consolidated interim income statement should

be read in conjunction with the accompanying notes.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

GBP'000 Note H1 2023 H1 2022

----------------------------------------------- ---- -------- -------

Profit for the period 11,186 20,520

----------------------------------------------- ---- -------- -------

Items that may be reclassified to profit

or loss:

Exchange differences on translation of foreign

operations (net of tax) 18.1 (10,665) 20,541

----------------------------------------------- ---- -------- -------

Total comprehensive income for the period

(net of tax) 521 41,061

----------------------------------------------- ---- -------- -------

The above condensed consolidated interim statement of

comprehensive income should be read in conjunction with the

accompanying notes.

CONDENSED CONSOLIDATED INTERIM BALANCE SHEET

GBP'000 Note 30.06.2023 31.12.2022

-------------------------------- ---- ---------- ----------

Assets

Property, plant and equipment 45,952 49,566

Goodwill 13 352,408 363,708

Other intangible assets 13 116,871 128,020

Investments 3,506 3,156

Other non-financial assets 2,218 2,369

Other receivables 226 535

Deferred tax assets 69 143

-------------------------------- ---- ---------- ----------

Total non-current assets 521,250 547,497

-------------------------------- ---- ---------- ----------

Trade receivables 32,891 33,290

Work in progress 12,262 12,525

Accrued income 28,436 23,911

Other non-financial assets 8,704 5,983

Other receivables 4,360 3,827

Cash and cash equivalents 75,726 48,861

-------------------------------- ---- ---------- ----------

Total current assets 162,379 128,397

-------------------------------- ---- ---------- ----------

Total assets 683,629 675,894

-------------------------------- ---- ---------- ----------

Equity

Share capital 14.1 1,595 1,491

Share premium 14.1 350,993 290,435

Own shares 14.2 (3,912) (3,697)

Capital reserve 25,654 24,361

Translation reserve 5,314 15,979

Retained earnings 14.3 72,776 71,648

-------------------------------- ---- ---------- ----------

Total equity 452,420 400,217

-------------------------------- ---- ---------- ----------

Trade and other payables 15 3,481 26,896

Loans and borrowings 16 103,741 153,622

Lease liabilities 37,438 40,602

Deferred tax liabilities 10,953 11,184

Other non-financial liabilities 17 950 788

Provisions 1,928 1,884

-------------------------------- ---- ---------- ----------

Total non-current liabilities 158,491 234,976

-------------------------------- ---- ---------- ----------

Trade and other payables 15 43,058 23,424

Lease liabilities 3,832 4,292

Other non-financial liabilities 17 22,017 8,628

Current tax liabilities 3,610 4,088

Provisions 201 269

-------------------------------- ---- ---------- ----------

Total current liabilities 72,718 40,701

-------------------------------- ---- ---------- ----------

Total equity and liabilities 683,629 675,894

-------------------------------- ---- ---------- ----------

The above condensed consolidated interim balance sheet should be

read in conjunction with the accompanying notes.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN

EQUITY

For the period ended 30 June 2023

-----------------------------------------------------------------------

Attributable to owners of JTC PLC

-----------------------------------------------------------------------

Share Share Own Capital Translation Retained Total

GBP'000 Note capital premium shares reserve reserve earnings equity

----------------------- ---- -------- -------- ------- -------- ----------- --------- --------

Balance at 1 January

2023 1,491 290,435 (3,697) 24,361 15,979 71,648 400,217

Profit for the period - - - - - 11,186 11,186

Other comprehensive

loss for the period - - - - (10,665) - (10,665)

----------------------- ---- -------- -------- ------- -------- ----------- --------- --------

Total comprehensive

income for the period - - - - (10,666) 11,186 520

----------------------- ---- -------- -------- ------- -------- ----------- --------- --------

Issue of share capital 14.1 104 60,558 - - - - 60,662

Share-based payment

expense 7 - - - 1,293 - - 1,293

Movement of own shares 14.2 - - (215) - - - (215)

Dividends paid 14.3 - - - - - (10,058) (10,058)

----------------------- ---- -------- -------- ------- -------- ----------- --------- --------

Balance at 30 June

2023 1,595 350,993 (3,912) 25,654 5,314 72,776 452,419

----------------------- ---- -------- -------- ------- -------- ----------- --------- --------

For the period ended 30 June 2022

----------------------------------------------------------------------

Attributable to owners of JTC PLC

----------------------------------------------------------------------

Share Share Own Capital Translation Retained Total

GBP'000 capital premium shares reserve reserve earnings equity

---------------------------- -------- -------- ------- -------- ----------- --------- -------

Balance at 1 January

2022 1,476 285,852 (3,366) 17,536 (5,335) 48,462 344,625

Profit for the period - - - - - 20,520 20,520

Other comprehensive income

for the period - - - - 20,541 - 20,541

---------------------------- -------- -------- ------- -------- ----------- --------- -------

Total comprehensive income

for the period - - - - 20,541 20,520 41,061

---------------------------- -------- -------- ------- -------- ----------- --------- -------

Issue of share capital 15 1,985 - - - - 2,000

Share-based payment expense - - - 977 - - 977

EIP share-based payment

expense - - - 4,330 - - 4,330

Movement of own shares - - (11) - - - (11)

---------------------------- -------- -------- ------- -------- ----------- --------- -------

Balance at 30 June 2022 1,491 287,837 (3,377) 22,843 15,206 68,982 392,982

---------------------------- -------- -------- ------- -------- ----------- --------- -------

The above condensed consolidated interim statement of changes in

equity should be read in conjunction with the accompanying

notes.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

GBP'000 Note H1 2023 H1 2022

----------------------------------------------- ---- -------- -------

Cash generated from operations 19.1 43,639 29,420

Income taxes paid (2,130) (740)

----------------------------------------------- ---- -------- -------

Net movement in cash generated from operations 41,509 28,680

----------------------------------------------- ---- -------- -------

Comprising:

Underlying cash generated from operations 45,219 30,906

Non-underlying cash items 19.2 (1,580) (1,486)

----------------------------------------------- ---- -------- -------

43,639 29,420

----------------------------------------------- ---- -------- -------

Investing activities

Interest received 322 15

Property, plant and equipment (777) (841)

Intangible assets (1,462) (3,606)

Business combinations (net of cash acquired) (1,392) (33)

Investment (250) -

Costs to obtain or fulfil a contract (465) (1,234)

Loans to related parties (160) -

Net cash used in investing activities (4,184) (5,699)

----------------------------------------------- ---- -------- -------

Financing activities

Proceeds from the issue of shares 62,000 -

Share issuance costs (1,713) (169)

Dividends paid (10,058) -

Repayment of loans and borrowings (50,000) -

Interest paid on loans and borrowings (4,668) (2,312)

Principal paid on lease liabilities (3,040) (2,983)

Interest paid on lease liabilities (645) (633)

----------------------------------------------- ---- -------- -------

Net cash used in financing activities (8,124) (6,097)

----------------------------------------------- ---- -------- -------

Net increase in cash and cash equivalents 29,201 16,884

----------------------------------------------- ---- -------- -------

Cash and cash equivalents at start of the

period 48,861 39,326

Effect of foreign exchange rate changes on

cash and cash equivalents (2,336) 4,738

----------------------------------------------- ---- -------- -------

Cash and cash equivalents at end of the period 75,726 60,948

----------------------------------------------- ---- -------- -------

The above condensed consolidated interim statement of cash flows

should be read in conjunction with the accompanying notes.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. REPORTING ENTITY

JTC PLC ("the Company") was incorporated on 12 January 2018 and

is domiciled in Jersey, Channel Islands. The address of the

Company's registered office is 28 Esplanade, St Helier, Jersey.

The condensed consolidated interim financial statements of the

Company for the period from 1 January 2023 to 30 June 2023 comprise

the Company and its subsidiaries (together "the Group" or "JTC")

and the Group's interest in an associate and investments.

2. SIGNIFICANT CHANGES IN THE CURRENT REPORTING PERIOD

"The business performance has remained at a consistently strong

level during the six months to 30 June 2023. Despite the depressed

global macroeconomic outlook and continued inflationary pressures

the business has continued to perform well and meet the

expectations of the Board."

There were no significant transactions or events during the

period that affected the financial position and performance.

For a detailed discussion about the Group's performance and

financial position, please refer to the Chief Financial Officer's

review.

3. BASIS OF PREPARATION

The condensed consolidated interim financial statements (the

"interim financial statements") for the six months to 30 June 2023

have been prepared in accordance with IAS 34 'Interim Financial

Reporting' as adopted by the European Union ("EU"), the Disclosure

Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority and Companies (Jersey) Law 1991. The

interim financial statements are presented in pounds sterling

(GBP), which is the functional and reporting currency of the

Company. They do not include all the information required for a

complete set of International Financial Reporting Standards

("IFRS") financial statements. Accordingly, the interim financial

statements should be read in conjunction with the annual

consolidated financial statements for the year ended 31 December

2022, which have been prepared in accordance with IFRS as adopted

by the EU. Selected explanatory notes are included to explain

events and transactions that are significant to an understanding of

the changes in the Group's financial position and performance since

the last annual consolidated financial statements as at and for the

year ended 31 December 2022.

The Group has adopted the going concern basis of accounting in

preparing the interim financial statements. The Directors are

confident that the Group will meet its day-to-day working capital

requirements through its cash-generating activities and bank

facilities. The Group's forecasts and projections, taking account

of possible changes in trading performance, show that the Group

should be able to operate within the level of its current

facilities. The Directors therefore have a reasonable expectation

that the Group has adequate resources to continue in operational

existence for the foreseeable future, being at least 12 months from

the date of approval of these interim financial statements.

These interim financial statements were approved by the Board on

11 September 2023 and have been reviewed but not audited by the

Group's external auditors.

4. SIGNIFICANT ACCOUNTING POLICIES AND STANDARDS

The accounting policies applied in these condensed consolidated

interim financial statements are the same as those applied in the

Group's consolidated financial statements as at and for the year

ended 31 December 2022.

To the extent relevant, all IFRS standards and interpretations

including amendments that were in issue and effective from 1

January 2023, have been adopted by the Group from 1 January 2023.

The Group has not early adopted any standard, interpretation or

amendment that has been issued but is not yet effective. Several

amendments apply for the first time in 2023, but they do not have

an impact on these condensed consolidated interim financial

statements.

5. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

In the application of the Group's accounting policies,

Management are required to make judgements, estimates and

assumptions about the carrying amounts of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are regularly evaluated based on historical

experience, current circumstances, expectation of future events and

other factors that are considered to be relevant. Actual results

may differ from these estimates.

In preparing these condensed interim financial statements, the

significant judgements made by Management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the consolidated financial

statements for the year ended 31 December 2022.

6. SEGMENTAL REPORTING

6.1. BASIS OF SEGMENTATION

The Group has a multi-jurisdictional footprint and the core

focus of operations is on providing services to its institutional

and private client base, with revenues from alternative asset

managers, financial institutions, corporates, high-net-worth and

ultra-high-net-worth individuals and family office clients.

Recognised revenue is generated from external customers.

The Chief Executive Officer and Chief Financial Officer are

together the Chief Operating Decision Makers of the Group and

determine the appropriate business segments to monitor financial

performance. Each segment is defined as a set of business

activities generating a revenue stream determined by divisional

responsibility and the management information reviewed by the

Board. They have determined that the Group has two reportable

segments: these are Institutional Client Services ("ICS") and

Private Client Services ("PCS").

6.2. SEGMENTAL INFORMATION

The table below shows the segmental information provided to the

Board for the two reportable segments (ICS and PCS) on an

underlying basis:

ICS PCS Total

------------------ ------------------ ------------------

GBP'000 H1 2023 H1 2022 H1 2023 H1 2022 H1 2023 H1 2022

------------------------- -------- -------- -------- -------- -------- --------

Revenue 80,692 63,521 40,800 29,501 121,492 93,022

Direct staff costs (33,729) (27,019) (15,672) (11,354) (49,401) (38,373)

Other direct costs (1,408) (1,061) (1,649) (722) (3,057) (1,783)

------------------------- -------- -------- -------- -------- -------- --------

Underlying gross profit 45,555 35,441 23,479 17,425 69,034 52,866

Underlying gross profit

margin % 56.5% 55.8% 57.5% 59.1% 56.8% 56.8%

Indirect staff costs (8,153) (5,290) (3,498) (3,955) (11,651) (9,245)

Other operating expenses (11,931) (10,160) (5,401) (3,101) (17,332) (13,261)

Other income 15 9 108 345 123 354

------------------------- -------- -------- -------- -------- -------- --------

Underlying EBITDA 25,486 20,000 14,688 10,714 40,174 30,714

Underlying EBITDA margin

% 31.6% 31.5% 36.0% 36.3% 33.1% 33.0%

------------------------- -------- -------- -------- -------- -------- --------

The Board evaluates segmental performance based on revenue,

underlying gross profit and underlying EBITDA. Profit before income

tax is not used to measure the performance of the individual

segments as items such as depreciation, amortisation of

intangibles, other net (losses)/gains and net finance costs are not

allocated to individual segments. Consistent with the

aforementioned reasoning, segment assets and liabilities are not

reviewed regularly on a by-segment basis and are therefore not

included in segmental reporting.

6.3. GEOGRAPHICAL INFORMATION

The table below shows revenue generated by the geographical

location of the contracting Group entity.

Increase/(decrease)

--------------------- -------- -------- ---------------------

H1 2023 H1 2022

GBP'000 GBP'000 GBP'000 %

--------------------- -------- -------- ------------ -------

UK & Channel Islands 64,675 51,605 13,070 25.3%

US 25,279 16,246 9,033 55.6%

Rest of Europe 18,613 16,423 2,190 13.3%

Rest of the World 12,925 8,748 4,177 47.8%

--------------------- -------- -------- ------------ -------

121,492 93,022 28,470 30.6%

--------------------- -------- -------- ------------ -------

6.4. SEASONALITY

There is no material change for seasonality or cyclicality in

the condensed consolidated interim income statement. The condensed

consolidated balance sheet is impacted where annual fees have been

billed in advance at the start of the calendar year, see deferred

income in note 17.

7. STAFF EXPENSES

GBP'000 H1 2023 H1 2022

----------------------------------------------------- ------- -------

Salaries and Directors' fees 50,163 38,719

Employer-related taxes and other staff-related

costs 4,850 4,192

Other short-term employee benefits 2,801 1,655

Pension employee benefits 2,461 1,793

Share-based payments 1,341 977

Employee Incentive Plan ("EIP") share-based payments - 4,330

----------------------------------------------------- ------- -------

Total staff expenses 61,616 51,666

----------------------------------------------------- ------- -------

8. NON-UNDERLYING ITEMS

GBP'000 H1 2023 H1 2022

--------------------------------------------------- ------- -------

EBITDA 36,495 25,337

Non-underlying items within EBITDA:

Acquisition and integration costs(1) 3,495 501

Office start-up costs(2) 141 -

Revision of ICS operating model - 351

EIP share-based payments - 4,511

Other 43 14

Total non-underlying items within EBITDA 3,679 5,377

--------------------------------------------------- ------- -------

Underlying EBITDA 40,174 30,714

--------------------------------------------------- ------- -------

Profit before tax 11,939 21,033

--------------------------------------------------- ------- -------

Total non-underlying items within EBITDA 3,679 5,377

Gain on revaluation of contingent consideration(3) (167) (424)

Foreign exchange losses/(gains)(4) 4,257 (9,044)

--------------------------------------------------- ------- -------

Total non-underlying items within profit

before tax 7,769 (4,091)

--------------------------------------------------- ------- -------

Underlying profit before tax 19,708 16,942

--------------------------------------------------- ------- -------

1 Acquisition and integration costs include deal and tax

advisory fees, legal and professional fees, any client-acquired

penalties, staff reorganisation costs and other integration costs.

This includes acquisition related share-based payment awards