Kistos Holdings PLC Directorate Change

October 02 2024 - 1:00AM

RNS Regulatory News

RNS Number : 6215G

Kistos Holdings PLC

02 October 2024

02 October 2024

Kistos

Holdings plc

("Kistos"

or the "Company")

Directorate

Change

Appointment of Deputy Chief

Financial Officer

Kistos (LSE: KIST) is pleased to

announce the appointment of James Thomson as Deputy Chief Financial

Officer with immediate effect. It is intended that Mr. Thomson will

become the Company's Chief Financial Officer and join the Board of

Directors on 1st January 2025 subject to the

satisfactory completion of due diligence by the Company's Nominated

Adviser. He will do so after Richard Slape steps down from the

Board at the end of the year.

Mr. Thomson has worked in natural

resources since March 2019, initially as Finance Director of

RockRose Energy and latterly in a senior finance role as Head of

Design & Implementation at Anglo American. Prior to that, Mr.

Thomson spent 14 years at PwC, the last four of which were as a

Partner based in Santiago, Chile. He qualified as a Chartered

Accountant in 2007.

Commenting, Andrew Austin, Kistos' Executive Chairman,

said:

"I am pleased to

announce that James has agreed to join the Kistos Holdings plc team

and look forward to welcoming him onto the Board at the start of

next year. His knowledge and experience will be invaluable as we

continue to grow the business for the benefit of all

stakeholders."

"I would like to express my

gratitude to Richard, who has served on Kistos' Board of Directors

for the last three years. His contribution since joining the

Company has helped the business navigate the integration of its

first acquisition, as well as the subsequent expansion into two new

countries and into the gas storage industry."

ENDS

Enquiries:

|

Kistos

Holdings plc

Andrew Austin / Peter Mann

|

via Hawthorn

Advisors

|

|

Panmure

Liberum (NOMAD, Joint Broker)

James Sinclair-Ford / Dougie McLeod / Mark

Murphy

|

Tel: 0207

886 2500

|

|

Berenberg

(Joint Broker)

Matthew Armitt / Ciaran Walsh

|

Tel: 0203 207

7800

|

|

Hawthorn

Advisors (Public Relations Advisor)

Henry Lerwill / Simon Woods

|

Tel: 0203 745

4960

|

|

Camarco

(Public Relations Advisor)

Billy Clegg

|

Tel: 0203

7574980

|

Notes to editors

Kistos plc was established to acquire

and manage companies in the energy sector engaging in the energy

transition trend. The Company has undertaken a series of

transactions including the acquisition of a portfolio of highly

cash generative natural gas production assets in the Netherlands

from Tulip Oil Netherlands B.V. in 2021. This was followed in July

2022, with the acquisition of a 20% interest in the Greater Laggan

Area (GLA) from TotalEnergies, which includes four producing gas

fields and a development project. In May 2023, Kistos completed its

third acquisition, acquiring the total share capital of Mime

Petroleum and its Norwegian Continental Shelf Assets. These

comprise a 10% stake in the Balder joint venture spanning Balder

and Ringhorne oil fields.

Kistos is a low carbon intensity gas

producer with Estimated Scope 1 CO₂ emissions from its operated

activities offshore of less than 0.01 kg/boe in 2022 (excluding

necessary flaring during drilling campaigns).

https://kistosplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

BOADZMGGKZVGDZG

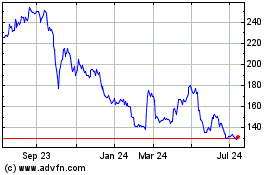

Kistos (LSE:KIST)

Historical Stock Chart

From Nov 2024 to Dec 2024

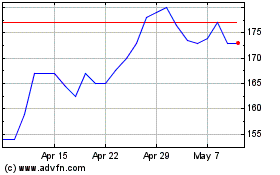

Kistos (LSE:KIST)

Historical Stock Chart

From Dec 2023 to Dec 2024