TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

Kenmare Preliminary Results

For the year ended 31 December 2008

(LSE/ISE: KMR)

17 April 2009

Chairman's Statement

Dear Shareholder,

Over the past year we have worked with one main focus: to improve

production. We are now in a much improved position to deliver on our

targets for the Moma Titanium Minerals Mine.

While we have made significant improvements in production levels over

the past year, there have also been significant challenges. These

included Cyclone Jokwe, successive missed deadlines by our

construction contractor and aspects of the plant which were

demonstrated as not being 'fit for purpose' frustrating our ability

to reach full production. However, the Board remains confident that

the mine will reach full production by the end of this year and that

the plan to get there is both achievable and realistic.

Key steps taken by the Board and Kenmare's management team to ensure

that these targets are reached by late 2009 include:

-Development of a detailed plan which addresses production issues and

their solutions;

-Implementation of a detailed Performance Improvement Project ("PIP")

to rectify deficiencies in the plant and equipment, 75% complete; and

-Appointment of a new Chief Operating Officer and a new General

Manager for the mine.

In November 2008, Kenmare required the construction contractor to

participate in a set of performance tests on the facilities at the

mine. These tests were witnessed by a jointly appointed independent

observer and, as we anticipated, failed to achieve the required

performance criteria outlined in the contract in a number of key

areas. This enabled Kenmare to present the contractor with a set of

projects we considered necessary to reach full production, and to

insist that implementation commenced immediately.

This set of projects, known collectively as the PIP, is being

implemented largely by the contractor with close involvement by a

dedicated Kenmare project team to ensure adherence to the agreed

schedule and scope of work. In the three months since it was

initiated, the PIP has been 75% completed across 326 action areas

with all necessary new equipment either delivered, in transit or in

manufacture. While most tasks within the PIP fall under the

contractor's responsibility, Kenmare is itself responsible for a

sub-set of tasks necessary to achieve full production of 800,000

tonnes per annum of ilmenite plus co-products rutile and zircon.

The PIP is addressing key areas that are vital to achieving

production targets, including the upgrade of the dredge hydraulics,

slimes and tailings disposal pumping systems, material handling

systems in the mineral separation plant, and provision of additional

separation equipment in the ilmenite, zircon and rutile circuits,

combined with a new ilmenite reject scavenging system to optimise

recoveries and product quality. Most of the work has to be completed

before achieving significantly higher production levels and

implementation involves some disruption of production as work is

carried out. Nonetheless, production of heavy mineral concentrate,

the limiting parameter, increased by 18% in quarter 1, 2009 compared

with quarter 4, 2008.

Kenmare has recruited a new Chief Operating Officer and General

Manager for the mine. Both have successful track records and

considerable experience in the mineral sands industry in South Africa

and Australia, which will benefit the mine. They have, in turn,

appointed a number of experienced personnel to key mining and

processing positions, further strengthening the capacity of the mine

to deliver on production targets.

Drilling completed during 2008 resulted in an upgrade of an Inferred

Resource at Namalope, the orebody on which the dredges are working,

to a Probable Reserve. As a result, the heavy mineral reserves for

the Namalope orebody increased from 21 million tonnes to 26 million

tonnes of total heavy minerals, despite the consumption of 0.6

million tonnes during 2008. The new reserves have added an estimated

five years of mine life to the Namalope deposit.

At our Board meeting on 16 April 2009, Dr. Alastair Brown retired

both from his executive position as Director of Geology and from the

Board. Alastair was with Kenmare from 1987, providing the resource

definition which has enabled the financing and construction of the

mine. He worked in difficult circumstances with limited resources,

but with rigorous methodology which has withstood examination by

third party experts throughout the financing process. We all wish

Alastair well in his retirement and thank him for his enormous

contribution.

The present difficulties faced by the world's economies are impacting

on the uptake of titanium mineral products. In particular there has

been strong inventory de-stocking, reducing demand by pigment

producers, our key market. The bulk of the mine's planned production

for 2009 is covered under marketing contracts and the shipment

schedule for the coming months remains busy. We are hopeful that

this inventory de-stocking cycle is nearing completion and that

normal market conditions, even if at reduced levels, will soon

resume.

In September 2008, we initiated a dialogue with our lenders with the

objective of preserving liquidity. As a result, I am pleased to

report that lenders agreed to a deferment of capital repayments

during 2009, to allow us use funds in the Contingency Reserve Account

(US$15 million) for project purposes, and to defer the date by which

we would otherwise have been required to achieve financial

completion. This arrangement, along with existing financial resources

and an invoice discounting facility being arranged with one of the

lenders, will provide the additional liquidity necessary to enable

Kenmare to achieve production ramp-up plans.

The profit after tax for the year is US$0.3 million and arises from

deposit interest earned and foreign exchange gains, less corporate

and exploration costs. During 2008, operating and financial costs net

of revenue earned for the period, totalling US$60.1 million, were

capitalised in property, plant and equipment as construction was not

yet complete and as the mine was not yet capable of operating close

to design capacity. Senior and subordinated loans drawn at the year

end amounted to US$334.8 million, US$121.7 million of which were

Euro-denominated loans.

At full production, we expect the mine's operating cost will be in

the lowest quartile for titanium feedstock producers. The resource

base, one of the largest in the world, will support successive

expansions of capacity. We remain confident that, despite the

disappointing delays in achieving full production, the mine's

potential is enormous and we expect it will provide huge value to our

shareholders.

Charles Carvill

Chairman

This release incorporates Kenmare's Interim Management Statement

relating to the period from 1 January 2009 to 16 April 2009.

For more information:

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 6710411

Mob: + 353 87 674 0110

Tony McCluskey, Financial Director

Tel: +353 1 6710411

Mob: + 353 87 674 0346

Murray Consultants

Elizabeth Headon

Tel: +353 1 498 0345

Mob: + 353 87 989 7234

Conduit PR Ltd

Leesa Peters/Fiona Hyland

Tel: +44 207 429 6614

Mob: +44 781 215 9885

www.kenmareresources.com

KENMARE RESOURCES PLC

PRELIMINARY RESULTS

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2008

2008 2007

US$'000 US$'000

Continuing Operations

Revenue - -

Operating expenses (957) (12,557)

Finance income 1,302 2,925

Profit/(loss) before tax 345 (9,632)

Income tax expense - -

Profit(loss) after tax for the financial 345 (9,632)

year

Attributable to Equity holders 345 (9,632)

US$ cent per US$ cent per

share share

Earnings/(loss) per share: Basic 0.045c (1.40c)

Earnings/(loss) per share: Diluted 0.042c (1.40c)

KENMARE RESOURCES PLC

PRELIMINARY RESULTS

CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2008

2008 2007

US$'000 US$'000

Assets

Non-Current Assets

Property, plant and equipment 539,672 486,960

Current Assets

Inventories 6,405 5,631

Trade and other receivables 3,033 4,842

Cash and cash equivalents 40,536 56,203

49,974 66,676

Total Assets 589,646 553,636

Equity

Capital and reserves attributable to the

Company's equity holders

Called Up Share Capital 66,178 61,496

Share Premium 145,088 121,501

Retained Losses (30,791) (31,136)

Other Reserves 42,668 41,562

Total Equity 223,143 193,423

Liabilities

Non-Current

Liabilities

Bank loans 299,982 299,570

Obligations under finance lease 2,264 2,292

Provisions 4,179 2,505

306,425 304,367

Current Liabilities

Bank loans 34,842 26,273

Trade and other payables 25,236 29,573

60,078 55,846

Total Liabilities 366,503 360,213

Total Equity and Liabilities 589,646 553,636

KENMARE RESOURCES PLC

PRELIMINARY RESULTS

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2008

2008 2007

US$'000 US$'000

Cashflows from operating activities

Profit/(loss) for the year 345 (9,632)

Adjustment for:

Foreign exchange movement (5,472) 1,680

Operating cash outflow (5,127) (7,952)

Decrease/(increase) in inventories 408 (5,631)

Decrease/(increase) in trade and other 1,809 (4,032)

receivables

(Decrease) in trade and other payables (4,414) (7,896)

Increase in provisions 1,674 140

Cash used by operations (5,650) (25,371)

Finance costs (13,739) (12,249)

Net cash used in operating activities (19,389) (37,620)

Cashflows from investing activities

Addition to property, plant and equipment (39,050) (67,027)

Net cash used in investing activities (39,050) (67,027)

Cashflows from financing activities

Proceeds on the issue of shares 28,269 3,542

Proceeds on shares to be issued - 14,249

Repayment of borrowings (20,335) (4,424)

Increase in borrowings 29,316 59,691

Increase in obligations under finance leases 50 2,242

Net cash from financing activities 37,300 75,300

Net decrease in cash and cash equivalents (21,139) (29,347)

Cash and cash equivalents at beginning of the 56,203 87,230

year

Effect of exchange rate changes on cash and cash 5,472 (1,680)

equivalents

Cash and cash equivalents at the end of the year 40,536 56,203

NOTES TO THE PRELIMINARY RESULTS

Note 1. Basis of Accounting and Preparation of Financial Information

The preliminary results have been prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by the

European Union. The financial statements are prepared in US Dollars

under the historical cost convention.

The financial information presented above does not constitute

statutory accounts within the meaning of the Companies Acts, 1963 to

2006. A copy of the accounts in respect of the financial year ended

31 December 2008 will be annexed to the Annual Return for 2009. The

auditors have made a report without qualification of their audit of

the financial statements in respect of the year ended 31 December

2008. In forming their opinion they have considered the adequacy of

the disclosures made in the financial statements concerning the

recoverability of property, plant and equipment and amounts due from

subsidiary undertakings, the realisation of which is dependent on the

successful development of economic ore reserves, successful ramp-up

of production which includes the rectification of mining and

processing equipment, and the continued availability of adequate

financing including the waivers and amendments to the financing

documents referred to in note 6 below. Their opinion is not

qualified in this respect.

The Directors approved the financial statements in respect of the

financial year ended 31 December 2008 on 16 April 2009. The statutory

accounts for the year ended 31 December 2007 prepared under IFRS upon

which the auditors have issued an unqualified opinion, have been

filed with the Registrar of Companies.

Note 2. Earnings/(Loss) per share

The calculation of the basic and diluted earnings/(loss) per share

attributable to the ordinary equity holders of the parent is based on

the profit after taxation of US$345,000 (2007: loss US$9,632,000) and

the weighted average number of shares in issue during 2008 for the

purposes of basic earnings/(loss) per share of 760,160,548 (2007:

689,587,755) and for diluted earnings/(loss) per share of 825,386,342

(2007:755,652,168).

In 2007 the basic loss per share and the diluted loss per share are

the same, as the effect of the outstanding share options and warrants

are anti-dilutive.

Note 3. Property Plant and Equipment

Plant Buildings Mobile Fixtures Construction Development Total

&

& & Equipment Equipment In Progress Expenditure

Equipment Airstrip

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Cost

At 1 January - - - - 265,718 140,751 406,469

2007

Transfer from 255,175 3,812 5,919 1,949 (266,855) - -

construction in

progress

Additions during 2,327 - 103 586 47,219 37,069 87,304

the year

Impairment

during the year - - - - - (1,455) (1,455)

At 1 January 257,502 3,812 6,022 2,535 46,082 176,365 492,318

2008

Transfer from

construction in 2,403 - 177 78 (2,658) - -

progress

Reclassification (1,182) - - - - - (1,182)

to inventory

Additions during 793 - 525 135 2,281 60,041 63,775

the year

Impairment

during the year - - (486) - - - (486)

At 31 December 259,516 3,812 6,238 2,748 45,705 236,406 554,425

2008

Accumulated

Depreciation

At 1 January - - - - - - -

2007

Charge for the

year 2,775 74 2,207 302 - - 5,358

At 1 January 2,775 74 2,207 302 - - 5,358

2008

Charge for the 7,445 191 1,252 820 - - 9,708

year

Impairment

during the year - - (313) - - - (313)

At 31 December 10,220 265 3,146 1,122 - - 14,753

2008

Carrying Amount

At 31 December 249,296 3,547 3,092 1,626 45,705 236,406 539,672

2008

At 31 December 254,727 3,738 3,815 2,233 46,082 176,365 486,960

2007

A construction contract for the engineering, procurement, building,

commissioning and transfer of facilities at the Moma Titanium

Minerals Mine in Mozambique was entered into on 7 April 2004. The

Contractor is a joint venture formed for this project by subsidiaries

of Multiplex Limited and Bateman B.V. Construction in progress shown

in a separate note in 2007 has been included above.

The construction contract was amended in December 2006 to provide for

among other things, taking-over the Moma Titanium Minerals Project

works in sections. At 31 December 2008, the only remaining section to

be taken over was the roaster.

During the year the mining reserve was increased to represent

approximately a 21 year life at expected production levels. This has

resulted in a change in the unit of production depreciation which is

calculated using the quantity of material extracted from the mine in

the period as a percentage of the total quantity of material to be

extracted in current and future periods based on the mining reserve.

Included in plant and equipment are capital spares of US$0.5 million.

The Company has reclassified consumable spares included in property,

plant and equipment of US$1.2 million into inventory.

Substantially all the property, plant and equipment will be mortgaged

to secure banking facilities granted, as detailed in note 6.

The recovery of property, plant and equipment is dependent upon the

successful operation of the Moma Titanium Minerals Mine, which in

turn is dependent on the successful ramp-up of production, including

rectification of mining and processing equipment and continued

availability of adequate funding for the mine. The Directors are

satisfied that at the balance sheet date the recoverable amount of

property, plant and equipment exceeds its carrying amount and based

on the planned mine production levels that the Moma Titanium Minerals

Mine will achieve positive cash flows. No impairment provision has

been made in respect of property, plant and equipment.

Note 4. Trade and Other Receivables

2008 2007

US$'000 US$'000

Trade receivables 593 2,922

Other receivables 2,343 1,851

Prepayments 97 69

3,033 4,842

During the year an invoice discounting facility was in place with

Barclays Bank plc. The invoice discounting fee was LIBOR plus 1%.

This facility expired in January 2009. The Group is arranging with

Absa Bank, an existing senior lender, a replacement of this facility.

The invoice discounting facility is an important component of the

Group's financing arrangements and the Group expects that a

replacement facility will be available later this year.

Of the US$0.593 million outstanding from trade receivables above,

US$0.52 million is less than 30 days and an amount of US$0.588

million has been received post year end. There has been no

impairment in trade receivables during the year and no allowance for

impairment has been provided for during the year or at the year end.

Included in other receivables is an amount US$1.3 million due from

the contractor, for repair and other costs incurred by the Group on

behalf of the contractor which are refundable under the terms of the

construction contract. The Directors are satisfied that these amounts

can be deducted from amounts due to the contractor.

Included in other receivables is an amount US$0.7 million due from an

insurance claim. The Directors are satisfied this amount is

recoverable.

Note 5. Cash and Cash Equivalents

2008 2007

US$'000 US$'000

Immediately available

without restriction 19,548 26,497

On fixed short-term deposit:

Contingency Reserve Account 15,292 26,048

Shareholder Funding Account 24 25

Other short-term deposit 5,672 3,633

40,536 56,203

Cash and cash equivalents comprise cash balances held for the

purposes of meeting short-term cash commitments and investments which

are readily convertible to a known amount of cash and are subject to

an insignificant risk of change in value. Where investments are

categorised as cash equivalents, the related balances have a maturity

of three months or less from the date of investment.

Cash at bank earns interest at floating rates based on daily deposit

bank rates. Short-term deposits are made for varying periods of

between one day and three months, depending on the cash requirements

of the Group, and earn interest at the respective short-term deposit

rates.

The Contingency Reserve Account and Shareholder Funding Account on

fixed short term deposit are amounts held in support of conditions

required for Senior and Subordinated Loans as detailed in note 6.

The amount required by the Senior and Subordinated Loan documentation

to be maintained in the Contingency Reserve Account from time to time

depends on a calculation involving capital and operating costs,

interest and principal payments, and reserve account contributions

required to achieve completion under the Project Loans as referred to

in note 6.

Note 6. Bank Loans

2008 2007

US$'000 US$'000

Senior Loans 188,844 210,694

Subordinated Loans 145,980 115,149

334,824 325,843

The borrowings are repayable as follows:

Within one year 34,842 26,273

In the second year 36,633 28,283

In the third to fifth years inclusive 109,899 101,299

After five years 153,450 169,988

334,824 325,843

Less: amount due for settlement within 12 months (34,842) (26,273)

Amount due for settlement after 12 months 299,982 299,570

2008 2007

US$'000 US$'000

Analysis of borrowings by currency

Euro 121,666 119,253

US Dollars 213,158 206,590

334,824 325,843

The Bank Loans have been made to the Mozambique branches of Kenmare

Moma Mining (Mauritius) Limited and Kenmare Moma Processing

(Mauritius) Limited (the Project Companies). Bank loans are secured

by substantially all rights and assets of the Company (other than

cash and cash equivalents listed in note 5 as "Immediately available

without restriction" of US$19.5 million at 31 December 2008 (31

December 2007: $26.5 million)) and the Moma Titanium Minerals Mine;

security agreements over shares in the Project Companies; and a

Contingency Reserve and Shareholder Funding Account as detailed in

note 5.

The Company has guaranteed the Bank Loans during the period prior to

completion. The final date for achieving completion was formerly 30

June 2009. The Deed of Waiver and Amendment dated 31 March 2009

extended this date to 31 December 2012. Completion occurs upon

meeting certain tests on a phased basis, including installation of

all required facilities, meeting certain cost and production

benchmarks and social and environmental requirements (which must take

place by 31 December 2010), meeting marketing requirements (which

must take place by 30 June 2011), and meeting legal and permitting

requirements, and filling of specified reserve accounts to the

required levels. Upon completion, the Company's guarantee of the Bank

Loans will terminate. Failure to meet any of the phased tests or,

subject to extension for force majeure not to exceed 365 days,

failure to achieve completion by 31 December 2012, would result in an

event of default under the Senior and Subordinated Loan documentation

which, following notice, would give Lenders the right to accelerate

the loans against the Project Companies, and to commence a two-stage

process allowing the Lenders to exercise their security interests in

the shares and assets (including accounts) of the Project Companies

and in the Contingency Reserve Account and the Shareholder Funding

Account.

On 30 January 2009 a Deed of Waiver and Amendment was entered into by

the Project Companies whereby the principal repayment due on the 2

February 2009 was deferred and spread over the remaining life of the

loan facilities commencing on 1 February 2010. On 31 March 2009 a

second Deed of Waiver and Amendment was entered into by the Project

Companies whereby the senior principal repayment due on the 4 August

2009 was also deferred and spread over the remaining life of the loan

facilities commencing on the 1 February 2010. The Subordinated

principal repayment due on the 4 August 2009 was deferred and rolled

up for repayment from future available project cash flow in

accordance with the terms of the initial loan agreements.

The revised repayment schedule based upon the Deeds of Waiver set out

above is as follows:

2008 2007

US$'000 US$'000

The borrowings are repayable as follows:

Within one year 5,160 26,273

In the second year 40,649 28,283

In the third to fifth years inclusive 121,946 101,299

After five years 167,069 169,988

334,824 325,843

Less: amount due for settlement within 12 months (5,160) (26,273)

Amount due for settlement after 12 months 329,664 299,570

The Directors have prepared cash flow projections for the estimated

life of the Moma Titanium Minerals Mine. These forecasts are based on

the planned mine production levels which are dependent on the

successful ramp-up of production through the project improvement

plans and continued adequate funding for the mine. The cash flow

projections based on planned mine production levels, arrangement of

an invoice discounting facility referred to in note 4 and revised

financing arrangements detailed above show that the mine operations

will result in positive cash flows, and that the mine will have

adequate funding for a period of not less than twelve months from the

date of this report. Accordingly the Directors have prepared the

financial statements on the basis that the Group is a going concern.

Note 7. 2008 Annual Report and Accounts

The Annual Report and Accounts will be posted to shareholders in due

course.

=--END OF MESSAGE---

This announcement was originally distributed by Hugin. The issuer is

solely responsible for the content of this announcement.

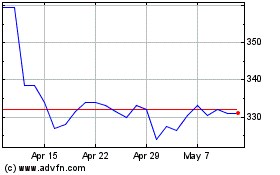

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

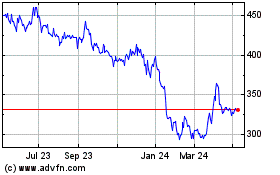

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024