Kenmare Resources Holding(s) In Company

July 28 2016 - 11:30AM

UK Regulatory

TIDMKMR

Standard Form TR-1

Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the

relevant issuer and to the Central Bank of Ireland)(i)

1. Identity of the issuer or the underlying issuer

of existing shares to which voting rights are attached(ii)

: Kenmare Resources plc

2. Reason for the notification (please tick the appropriate

box or boxes):

[X] An acquisition or disposal of voting rights

[ ] An acquisition or disposal of financial instruments

[ ] An event changing the breakdown of voting rights

[ ] Other (please specify)(iii) :

3. Details of person subject to the notification obligation(iv)

:

Name: City and country of registered office (if applicable):

The Capital Group Companies, Inc. Los Angeles, CA, U.S.A.

4. Full name of shareholder(s) (if different from

3.)(v) :

See Box 10

5. Date on which the threshold was crossed or reached(vi)

:

26 July 2016

6. Date on which issuer notified:

27 July 2016

7. Threshold(s) that is/are crossed or reached:

Above 6%, 7%, 8%, 9%, 10% and 11% - Aggregate of voting

rights from shares

8. Total positions of person(s) subject to the notification

obligation:

% of voting

rights

attached to

shares (total % of voting rights through financial instruments Total of both in

of 9.A) (total of 9.B.1 + 9.B.2) % (9.A + 9.B) Total number of voting rights of issuer(vii)

Resulting situation on the date on which threshold

was crossed or reached 11.0974% 0.0000% 11.0974% 95,278,349

Position of previous notification (if applicable) 5.9196% 0.0000% 5.9196%

9. Notified details of the resulting situation on

the date on which the threshold was crossed or reached(viii)

:

A: Voting rights attached to shares

Class/type of

shares

ISIN code (if possible) Number of voting rights(ix) % of voting rights

Direct Indirect Direct Indirect

Ordinary Shares

(ISIN: IE00BDC5DG00) 10,573,393 11.0974%

SUBTOTAL A 10,573,393 11.0974%

B 1: Financial Instruments according to Regulation

17(1)(a) of the Regulations

Expiration Exercise/ Number of voting rights that may be acquired if the

Type of financial instrument date(x) Conversion Period(xi) instrument is exercised/converted. % of voting rights

Not applicable

SUBTOTAL B.1

B 2: Financial Instruments with similar economic effect

according to Regulation 17(1)(b) of the Regulations

Expiration Exercise/ Conversion Number of voting

Type of financial instrument date(x) Period (xi) Physical or cash settlement(xii) rights % of voting rights

Not applicable

SUBTOTAL B.2

10. Information in relation to the person subject

to the notification obligation

[ ] Person subject to the notification obligation

is not controlled by any natural person or legal entity

and does not control any other undertaking(s) holding

directly or indirectly an interest in the (underlying)

issuer.(xiii)

[ X ] Full chain of controlled undertakings through

which the voting rights and/or the

financial instruments are effectively held starting

with the ultimate controlling natural person or legal

entity(xiv) :

% of voting rights if it equals or is higher than % of voting rights through financial instruments if Total of both if it equals or is higher than the notifiable

Name(xv) the notifiable threshold it equals or is higher than the notifiable threshold threshold

The Capital Group Companies, Inc.

Holdings by CG Management companies set out below: 11.0974% 0.0000% 11.0974%

Capital Research and Management Company(1) ("CRMC"),

break down by fund below. 11.0974% 0.0000% 11.0974%

-- SMALLCAP World Fund, Inc.2 (see section 12)

-- American Funds Insurance Series - Global Small

Capitalization Fund2 (see section 12)

1. Wholly owned subsidiary of The Capital Group

Companies, Inc.

2. Mutual fund managed by Capital Research and

Management Company.

11. In case of proxy voting: [name of the proxy holder]

will cease to hold [% and number] voting rights as

of [date]

12. Additional information(xvi) :

CGC is the parent company of Capital Research and

Management Company ("CRMC"). CRMC is a U.S.-based

investment management company that manages the American

Funds family of mutual funds. CRMC manages equity

assets for various investment companies through three

divisions, Capital Research Global Investors, Capital

International Investors and Capital World Investors.

CRMC in turn is the parent company of Capital Group

International, Inc. ("CGII"), which in turn is the

parent company of five investment management companies

("CGII management companies"): Capital Guardian Trust

Company, Capital International, Inc., Capital International

Limited, Capital International Sàrl and Capital

International K.K. The CGII management companies primarily

serve as investment managers to institutional clients.

Neither CGC nor any of its affiliates own shares for

its own account. Rather, the shares reported on this

Notification are owned by accounts under the discretionary

investment management of one or more of the investment

management companies described above.

SMALLCAP World Fund, Inc. ("SCWF") and American Funds

Insurance Series - Global Small Capitalization Fund

("VISC") are mutual funds registered in the United

States under the Investment Company Act of 1940.

SCWF is the legal owner of 5,424,863 shares (5.6937%

of outstanding shares) and VISC is the legal owner

of 5,148,530 shares (5.4037% of outstanding shares).

SCWF and VISC have granted proxy voting authority

to CRMC, its investment adviser.

Please note that SCWF and VISC have submitted separate

notifications disclosing holdings as of 26 July 2016.

Done at Los Angeles, California on 27 July 2016

Standard Form TR-1

Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the

relevant issuer and to the Central Bank of Ireland)(i)

1. Identity of the issuer or the underlying issuer

of existing shares to which voting rights are attached(ii)

: Kenmare Resources plc

2. Reason for the notification (please tick the appropriate

box or boxes):

[X] An acquisition or disposal of voting rights

[ ] An acquisition or disposal of financial instruments

[ ] An event changing the breakdown of voting rights

[ ] Other (please specify)(iii) :

3. Details of person subject to the notification obligation(iv)

:

Name: City and country of registered office (if applicable):

SMALLCAP World Fund, Inc. ("SCWF") Irvine, CA, U.S.A.

4. Full name of shareholder(s) (if different from

3.)(v) :

See Box 10

5. Date on which the threshold was crossed or reached(vi)

:

26 July 2016

6. Date on which issuer notified:

27 July 2016

7. Threshold(s) that is/are crossed or reached:

Above 4% and 5% - Aggregate of voting rights from

shares

8. Total positions of person(s) subject to the notification

obligation:

% of voting rights

attached to shares % of voting rights through financial instruments Total of both in

(total of 9.A) (total of 9.B.1 + 9.B.2) % (9.A + 9.B) Total number of voting rights of issuer(vii)

Resulting situation on the date on which threshold 0.0000% 0.0000%

was crossed or reached (see section 12) 0.0000% (see section 12) 95,278,349

Position of previous notification (if applicable) 0.0000% 0.0000% 0.0000%

(see section 12) (see section 12)

9. Notified details of the resulting situation on

the date on which the threshold was crossed or reached(viii)

:

A: Voting rights attached to shares

Class/type of Number of voting rights(ix) % of voting rights

shares

ISIN code (if possible)

Direct Indirect Direct Indirect

Ordinary Shares 5,424,863 0.0000%

(ISIN: IE00BDC5DG00) (see section 12)

SUBTOTAL A 5,424,863 0.0000%

(see section 12)

B 1: Financial Instruments according to Regulation

17(1)(a) of the Regulations

Type of financial Expiration Exercise/ Number of voting rights that may be acquired if the % of voting rights

instrument date(x) Conversion Period(xi) instrument is exercised/converted.

Not applicable

SUBTOTAL B.1

B 2: Financial Instruments with similar economic effect

according to Regulation 17(1)(b) of the Regulations

Type of financial Expiration Exercise/ Conversion Physical or cash settlement(xii) Number of % of voting rights

instrument date(x) Period (xi) voting

rights

Not applicable

SUBTOTAL B.2

10. Information in relation to the person subject

to the notification obligation

[X ] Person subject to the notification obligation

is not controlled by any natural person or legal entity

and does not control any other undertaking(s) holding

directly or indirectly an interest in the (underlying)

issuer.(xiii)

[ ] Full chain of controlled undertakings through

which the voting rights and/or the

financial instruments are effectively held starting

with the ultimate controlling natural person or legal

entity(xiv) :

Name(xv) % of voting rights if it equals or is higher than % of voting rights through financial instruments if Total of both if it equals or is higher than the notifiable

the notifiable threshold it equals or is higher than the notifiable threshold threshold

11. In case of proxy voting: [name of the proxy holder]

will cease to hold [% and number] voting rights as

of [date]

12. Additional information(xvi) :

SCWF is a mutual fund registered in the United States

under the Investment Company Act of 1940. SCWF is

the legal owner of 5,424,863 shares (5.6937% of outstanding

shares).

SCWF has granted proxy voting authority to Capital

Research and Management Company, its investment adviser.

SCWF previously disclosed (as of 16 October 2013)

a shareholding of 109,972,782 shares (3.9531% of the

outstanding shares).

Please note that the notification submitted on behalf

of The Capital Group Companies, Inc. disclosing holdings

as of 26 July 2016 included SCWF's holdings.

Done at Los Angeles, California on 27 July 2016

Standard Form TR-1

Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the

relevant issuer and to the Central Bank of Ireland)(i)

1. Identity of the issuer or the underlying issuer

of existing shares to which voting rights are attached(ii)

: Kenmare Resources plc

2. Reason for the notification (please tick the appropriate

box or boxes):

[X] An acquisition or disposal of voting rights

[ ] An acquisition or disposal of financial instruments

[ ] An event changing the breakdown of voting rights

[ ] Other (please specify)(iii) :

3. Details of person subject to the notification obligation(iv)

:

Name:

American Funds Insurance Series - Global Small Capitalization City and country of registered office (if applicable):

Fund ("VISC") Los Angeles, CA, U.S.A.

4. Full name of shareholder(s) (if different from

3.)(v) : See Box 10

5. Date on which the threshold was crossed or reached(vi)

: 26 July 2016

6. Date on which issuer notified: 27 July 2016

7. Threshold(s) that is/are crossed or reached:

Above 3%, 4% and 5% - Aggregate of voting rights from

shares

8. Total positions of person(s) subject to the notification

obligation:

% of voting rights

attached to shares % of voting rights through financial instruments Total of both in

(total of 9.A) (total of 9.B.1 + 9.B.2) % (9.A + 9.B) Total number of voting rights of issuer(vii)

Resulting situation on the date on which threshold 0.0000% 0.0000%

was crossed or reached (see section 12) 0.0000% (see section 12) 95,278,349

Position of previous notification (if applicable) Not applicable Not applicable Not applicable

9. Notified details of the resulting situation on

the date on which the threshold was crossed or reached(viii)

:

A: Voting rights attached to shares

Class/type of Number of voting rights(ix) % of voting rights

shares

ISIN code (if possible)

Direct Indirect Direct Indirect

Ordinary Shares 5,148,530 0.0000%

(ISIN: IE00BDC5DG00) (see section 12)

SUBTOTAL A 5,148,530 0.0000%

(see section 12)

B 1: Financial Instruments according to Regulation

17(1)(a) of the Regulations

Type of financial Expiration Exercise/ Number of voting rights that may be acquired if the % of voting rights

instrument date(x) Conversion Period(xi) instrument is exercised/converted.

Not applicable

SUBTOTAL B.1

B 2: Financial Instruments with similar economic effect

according to Regulation 17(1)(b) of the Regulations

Type of financial Expiration Exercise/ Conversion Physical or cash settlement(xii) Number of % of voting rights

instrument date(x) Period (xi) voting

rights

Not applicable

SUBTOTAL B.2

10. Information in relation to the person subject

to the notification obligation

[X ] Person subject to the notification obligation

is not controlled by any natural person or legal entity

and does not control any other undertaking(s) holding

directly or indirectly an interest in the (underlying)

issuer.(xiii)

[ ] Full chain of controlled undertakings through

which the voting rights and/or the

financial instruments are effectively held starting

with the ultimate controlling natural person or legal

entity(xiv) :

Name(xv) % of voting rights if it equals or is higher than % of voting rights through financial instruments if Total of both if it equals or is higher than the notifiable

the notifiable threshold it equals or is higher than the notifiable threshold threshold

11. In case of proxy voting: [name of the proxy holder]

will cease to hold [% and number] voting rights as

of [date]

12. Additional information(xvi) :

VISC is a mutual fund registered in the United States

under the Investment Company Act of 1940. VISC is

the legal owner of 5,148,530 shares (5.4037% of outstanding

shares).

VISC has granted proxy voting authority to Capital

Research and Management Company, its investment adviser.

Please note that the notification submitted on behalf

of The Capital Group Companies, Inc. disclosing holdings

as of 26 July 2016 included VISC's holdings.

Done at Los Angeles, California on 27 July 2016

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Kenmare Resources via Globenewswire

HUG#2031696

http://www.kenmareresources.com/

(END) Dow Jones Newswires

July 28, 2016 12:30 ET (16:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

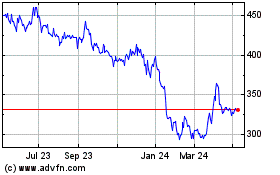

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

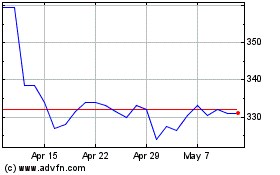

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024