RNS Number:7195X

Kenmare Resources PLC

19 April 2004

Kenmare Resources plc ("Kenmare" or "the Company")

Kenmare Preliminary Results

For the year ended 31st December 2003

Chairman's Statement

Dear Shareholder,

The key objective we have been pursuing over the last 9 months has been the

signing of a Fixed Price Contract to develop the Moma project. I was very

pleased to announce on the 8th of April that we had entered into such a contract

with a Joint Venture formed between Multiplex Ltd and Bateman BV. I cannot think

of a more suitable combination of key skills to implement the project. Multiplex

is a large contracting group with operations stretching around the globe and

which specialises in large complex construction projects. Bateman is an

international engineering group with specific mineral sands expertise and

experience of working in Mozambique. These best in class companies are bringing

their expertise together to deliver the project for Kenmare under the agreed

terms of the contract.

The contract, which is denominated in a number of currencies, is established on

a base price of US$220 million with provisions for cost overruns up to US$240

million at which point it becomes totally fixed. Between US$220 and US$240

million the JV shoulders a progressively greater proportion of the costs. Hence

there is a great incentive for it to ensure overruns above US$220 million are

minimal. From commencement of the work programme under the contract it will take

two years to complete the construction of the Moma project.

The contract is subject to a number of conditions precedent before it becomes

effective. The most significant of the conditions precedent is the making

available of debt financing, which is itself conditional on the availability of

an equity financing component. Hence the next step is to complete the funding

process.

A debt funding package has been negotiated with a lender group comprising the

European Investment Bank (EIB), The African Development Bank (ADB), FMO (a Dutch

development finance institution), KfW (a German development finance institution)

and ABSA (a South African Commercial Bank) lending under an ECIC (Export Credit

Insurance Agency of South Africa) export guarantee. The EIB, and the ADB have

received board approvals for their loans to the project. The remaining lenders

required the signing of the construction contract before they could take it to

their boards. They are expected to do so in the coming weeks. Political risk

guarantees are being provided to the project by MIGA, an arm of the World Bank,

and are expecting to be supplemented by Hermes, an arm of the German Government.

It is intended that a placing to institutional investors will be performed to

cover the required equity component of the financing. All shareholders will also

be given an opportunity to participate in the equity financing component by way

of partial claw back of this placing.

Kenmare accounts for the year ended 31 December 2003 show a profit of US$120,551

arising mainly from deposit interest income net of an operating loss of

US$42,877.

Charles Carvill

Chairman

For more information:

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: + 353 1 671 0411

Mob: + 353 87 6740110

Conduit PR Ltd

Leesa Peters

Tel: +44 (0) 207 936 9095

Mob: + 44 (0) 781 215 9885

Murray Consultants Ltd

Tom Byrne

Tel: + 353 1 498 0339

Mob: +353 86 810 4224

www.kenmareresources.com

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31st DECEMBER 2003

2003 2002

US$ US$

Turnover - -

Operating (Loss)/Income (42,877) 707,037

Operating (Loss)/Profit (42,877) 707,037

Interest Receivable 163,428 261,483

Profit On Ordinary Activities Before Taxation 120,551 968,520

Taxation - -

Profit On Ordinary Activities After Taxation 120,551 968,520

Earnings per share: Basic 0.05c 0.41c

Earnings per share: Diluted 0.04c 0.36c

CONSOLIDATED BALANCE SHEET

AS AT 31st DECEMBER 2003

2003 2002

US$ US$

FIXED ASSETS

Mineral Interests 27,431,163 18,618,309

Tangible Assets 41,622,440 41,630,810

69,053,603 60,249,119

CURRENT ASSETS

Debtors 90,322 95,473

Cash at Bank and In Hand 4,574,490 8,040,751

4,664,812 8,136,224

CREDITORS:

Amounts falling due within one year (3,224,907) (1,453,021)

NET CURRENT ASSETS 1,439,905 6,683,203

TOTAL ASSETS LESS CURRENT LIABILITIES 70,493,508 66,932,322

CREDITORS:

Amounts falling due after one year (1,730,161) (1,431,903)

PROVISION FOR LIABILITIES AND CHARGES - (2,826,000)

68,763,347 62,674,419

CAPITAL AND RESERVES

Called Up Share Capital - (Equity & Non-Equity) 26,269,539 24,556,528

Share Premium Account 29,848,262 25,592,896

Profit and Loss Account - (Deficit) (21,891,727) (22,012,278)

Revaluation Reserve 30,141,002 30,141,002

Other Reserve 3,642,080 3,642,080

Capital Conversion Reserve Fund 754,191 754,191

Shareholders' Funds 68,763,347 62,674,419

GROUP CASH FLOW STATEMENT

FOR THE YEAR ENDED 31st DECEMBER 2003

2003 2002

US$ US$

Net cash (outflow)/inflow from operating activities (1,092,221) 1,948,541

Returns on Investments & Servicing of Finance

Interest received 163,428 261,483

Net cash inflow from Returns on Investment &

Servicing of Finance 163,428 261,483

Capital expenditure & financial investment

Addition of Mineral Interests (8,812,854) (7,583,927)

Net cash outflow from capital expenditure &

financial investment (8,812,854) (7,583,927)

Net cash outflow before use of liquid resources & financing (9,741,647) (5,373,903)

Financing

Issue of Ordinary Share Capital 6,513,083 14,530,686

Cost of share issues (544,706) (1,369,388)

Finance Lease (2,254) (15,690)

Debt due within one year 11,005 (1,027,945)

Debt due beyond a year 298,258 57,461

Net cash inflow from financing 6,275,386 12,175,124

(Decrease)/Increase in cash (3,466,261) 6,801,221

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE YEAR ENDED 31st DECEMBER 2003

2003 2002

US$ US$

Income attributable to Group shareholders 120,551 968,520

Movement in Revaluation Reserve - (1,408,750)

Total Recognised Gains/(Losses) for the year 120,551 (440,230)

RECONCILIATION OF MOVEMENTS IN SHAREHOLDERS' FUNDS

FOR THE YEAR ENDED 31st DECEMBER 2003

2003 2002

US$ US$

Total Recognised Gains/(Losses) for the year 120,551 (440,230)

Issue of Shares - at par 1,713,011 3,872,024

Share premium, net of costs 4,255,366 9,289,274

Net change in Shareholders' funds 6,088,928 12,721,068

Opening Shareholders' funds 62,674,419 49,953,351

Closing Shareholders' funds 68,763,347 62,674,419

NOTES TO THE PRELIMINARY RESULTS

Note 1 Basis of Accounting

The preliminary results have been prepared in US Dollar under the historical

cost convention, as modified by the revaluation of certain fixed assets, and in

accordance with the accounting policies set out on page 23 of the 2002 Annual

Report and Accounts.

Note 2 Basis of Preparation

The financial information presented above does not constitute statutory accounts

within the meaning of the Companies Acts, 1963 to 2001. An audit report has not

yet been issued on the accounts for the year ended 31st December 2003, nor have

they been delivered to the Registrar of Companies. The comparative financial

information for the year ended 31st December 2002 has been derived from the

statutory accounts for the year. Those statutory accounts, upon which the

auditors have issued an unqualified opinion, have been filed with the Registrar

of Companies.

Note 3 Earnings and fully diluted earnings per share

The calculation of the earnings and fully diluted earnings per share is based on

the profit after taxation of US$120,551 (2002: Profit US$968,520) and the

weighted average number of shares in issue during 2003 of 270,684,123(2002 -

238,468,595 shares).

The calculation of fully diluted earnings per share is based on the profit for

the period after taxation as for basic earnings per share. The number of shares

is adjusted to show the potential dilution if share options and share warrants

are converted into ordinary shares. The weighted average number of shares in

issue is increased to 299,560,810.

Note 4 Mineral Interests

The recovery of deferred development expenditure is dependent upon the

successful development of economic ore reserves, which in turn depends on the

availability of adequate funding being made available. The Directors are

satisfied that deferred expenditure is worth not less than cost less any amounts

written off and that the exploration projects have the potential to achieve mine

production and positive cash flows.

Note 5 Tangible Assets

Tangible Assets are stated at cost or valuation less accumulated depreciation.

GRD Minproc Limited, an independent Australian engineering group, has appraised

the Mining and Processing Plant on a depreciated replacement cost basis of

valuation as at 30 June 2000. An inspection of the Mining and Processing Plant

was carried out by GRD Minproc Limited in March 2002 concluding that no material

alteration to the plants had taken place. Confirmation of the existence of the

Processing Plant and the Mining Plant at the year end has been provided by

Bateman Engineering, an international engineering group.

The recovery of the plant valuation is dependent upon the successful development

of the Moma Titanium Minerals Project, which in turn depends on the availability

of adequate funding being made available. The historical cost net book value of

these assets at 31 December 2003 is US$11,473,067. The surplus arising on

revaluation amounts to US$30,141,002.

Note 6 Reconciliation of Operating Loss to Net Cash flow from Operating

Activities

2003 2002

US$ US$

Operating (Loss)/Income (42,877) 707,037

Depreciation 8,370 8,367

Decrease/(Increase) in Debtors 5,151 (18,647)

Increase in operating creditors 1,763,135 1,007,297

(Decrease)/Increase in Provision for Liabilities & Charges (2,826,000) 1,550,490

Impairment/Write off of Minerals Interests - 102,747

Decrease in Revaluation Reserve - (1,408,750)

Net Cash Flow from Operating Activities (1,092,221) 1,948,541

Note 7 Analysis of Net Debt

At 1 Jan 2003 Cash Flow At 31 Dec 2003

US$ US$ US$

Cash at Bank and in hand 8,040,751 (3,466,261) 4,574,490

Debt due after 1 year (1,431,903) (298,258) (1,730,161)

Debt due within 1 year (98,617) (11,005) (109,622)

6,510,231 (3,775,524) 2,734,707

Note 8 Reconciliation of Net Cash flow to Movement in Net Debt

2003 2002

US$ US$

(Decrease)/Increase in cash during the year (3,466,261) 6,801,221

(Inflow)/Outflow from movements in debt & lease financing (309,263) 970,484

Movement in net cash in the year (3,775,524) 7,771,705

Net cash/(debt) at start of year 6,510,231 (1,261,474)

Net cash at end of year 2,734,707 6,510,231

Note 9 2003 Annual Report and Accounts

The Annual Report and Accounts will be posted to shareholders in due course.

19 April, 2004

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR IFMFTMMABBBI

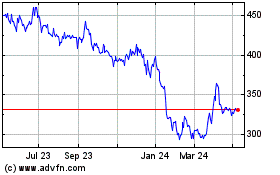

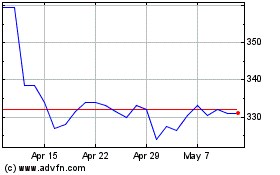

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024