As M&G Freezes Fund, Cash Buffers Dwindle at Rivals -Financial News

December 09 2019 - 5:49AM

Dow Jones News

By David Ricketts and Mark Cobley

Of Financial News

In the wake of M&G PLC (MNG.LN) gating its property fund,

U.K. real estate funds have sought to reassure investors by

pointing to large cash holdings they keep as a buffer against a

liquidity crunch. In fact, the cash held at many of the largest

funds has shrunk recently.

Cash has fallen at property funds from Columbia Threadneedle,

Aberdeen Standard Investments and Royal London, among others.

The sector was thrust into the spotlight last week when M&G

Investments suspended investor withdrawals from its flagship 2.5

billion pound ($3.3 billion) property fund, citing "unusually high

and sustained outflows" combined with "Brexit-related political

uncertainty and ongoing structural shifts in the U.K. retail

sector."

On Dec. 6, the problems spread to the Prudential M&G

Property Portfolio, which has links to the M&G fund, as the

company said it too would be suspended.

The moves sparked fears of similar problems at other funds,

especially because a handful of U.K. property funds were forced to

close in 2016 after the referendum on EU membership. Some fund

managers cited their cash holdings to reassure jittery investors

that they could avoid similar measures now.

But a closer analysis shows some of the largest funds--including

several that were forced to close in 2016--have let their cash

piles shrink.

Ryan Hughes, head of active portfolios at AJ Bell, the

investment platform, said: "Given [that] the risks to the U.K.

economy and the potential knock-on effect to commercial property

are so well flagged, it is a surprise that some managers have let

their cash levels run down."

The M&G Property Portfolio held 4.96% in cash at the end of

October, down from 17.8% two years earlier, according to data from

FE Analytics. The fund experienced GBP901 million of outflows in

the year to the end of October, according to Morningstar, the data

provider.

A spokesperson for M&G said the fund aims for a "cash range"

between 7.5% and 12.5% and has averaged around 13% in the past four

years. She said the fund avoids holding a high level of cash as

this would be an "excessive drag on performance."

At Columbia Threadneedle's GBP1.2 billion U.K. Property fund,

the level of cash fell by about two-thirds over the past two years.

The fund had 6.3% in cash at the end of October, down from 18.5% at

the end of October 2017, according to FE Analytics.

A Columbia Threadneedle spokesperson told Financial News that

fund's "liquidity corridor" had been reduced to between 5% and 15%.

"We feel that this liquidity range provides adequate liquidity

without diluting the property investment exposure," the

spokesperson said.

Aberdeen Standard Investments said last week its GBP1.3 billion

Aberdeen U.K. Property fund had 12.7% in cash. That fund, which

closed briefly following the EU referendum, held 23.13% in cash two

years ago, data from FE Analytics show.

According to Morningstar data, investors pulled GBP31 million

from Aberdeen's U.K. Property fund the day after M&G announced

its suspension. Aberdeen Standard said its property funds aim to

have at least more than 10% in cash.

At Royal London and Janus Henderson, cash holdings in U.K.

property funds have also fallen over the past two years. FE

Analytics data show Royal London's Property fund held 7.7% in cash

in October 2017. Royal London said the current level is 6.5%.

Janus Henderson's GBP2.2 billion U.K. Property fund held 19% in

cash at the end of October 2017, according to FE Analytics, higher

than the 16.7% at the end of October this year. A Janus Henderson

spokesman said the fund held 18.5% in cash at the end of

November.

A Royal London spokesperson said its property fund, which is

targeted at institutional investors, requires three months' notice

for redemptions. The cash level is "appropriate to the profile of

these types of investors," the spokesperson added.

Some other large property fund managers have increased their

cash reserves over the past two years. At Aviva Investors, the

proportion of the GBP542 million U.K. Property fund held in cash

has almost doubled to 30.9% at the end of October from two years

previously.

Legal & General Investment Management said cash levels in

its U.K. Property fund increased to 25.2% at the end of October, up

from 23% two years ago.

BMO's GBP416 million U.K. Property has upped its cash buffer to

25.3% from 16.5% at the end of October 2017.

Guy Glover, manager of the BMO U.K. Property fund, said: "Cash

levels are above our longer-term target and we are actively, but

carefully, pursuing acquisitions to match the quality of the

existing portfolio."

Website: www.fnlondon.com

(END) Dow Jones Newswires

December 09, 2019 06:34 ET (11:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

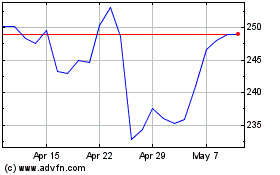

Legal & General (LSE:LGEN)

Historical Stock Chart

From Apr 2024 to May 2024

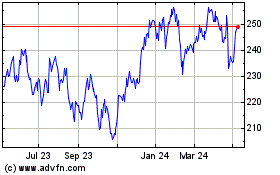

Legal & General (LSE:LGEN)

Historical Stock Chart

From May 2023 to May 2024