Market Turmoil Slows China's Advance in Key Stock Index

March 24 2020 - 2:09AM

Dow Jones News

By Quentin Webb

One of the world's biggest index providers is slowing the

inclusion of Chinese stocks in its global benchmarks, sparing

investors from making big changes to their portfolios during a

period of market turbulence.

Last June, FTSE Russell began adding stocks listed in mainland

China to some of its major indexes, including some widely followed

emerging-market benchmarks. The inclusion was supposed to be a

three-stage process that would be complete this month, driving as

much as $10 billion of inflows from passive fund managers into

China's stock market, the company earlier estimated.

This week, FTSE Russell, which is part of LSE Group, said stocks

listed in Shanghai and Shenzhen have reached 70% of their final

weighting in its indexes and the remaining 30% will only be added

in June. It said client feedback persuaded it to introduce this

delay.

FTSE Russell previously estimated that Chinese stocks would make

up 5.6% of its FTSE Emerging Index when fully included. That was

before the plunge in global stock markets in the year to date.

U.S. asset manager Vanguard Group has multiple funds that track

FTSE indexes. Its FTSE Emerging Markets exchange-traded fund had

net assets of nearly $86 billion at the end of February.

Write to Quentin Webb at quentin.webb@wsj.com

(END) Dow Jones Newswires

March 24, 2020 02:54 ET (06:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

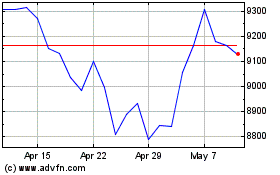

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2024 to May 2024

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From May 2023 to May 2024