Manolete Partners PLC Update regarding the PACCAR Matter (9349H)

August 01 2023 - 5:33AM

UK Regulatory

TIDMMANO

RNS Number : 9349H

Manolete Partners PLC

01 August 2023

1 August 2023

Manolete Partners Plc

("Manolete" or the "Company")

Update regarding: PACCAR Inc & Ors v Competition Appeal

Tribunal & Ors, [2023] UKSC 28 ("the PACCAR Matter")

Manolete Partners plc (AIM:MANO), the leading quoted UK

insolvency litigation financing company, is pleased to provide the

following commentary regarding the above matter.

The Company has always stated that the key difference in

Manolete's business model is that it overwhelmingly purchases,

rather than funds, its case investments. This is because the

Insolvency Act 1986 uniquely allows a Liquidator and Administrator

("Office Holder") to sell an insolvent company's legal claims to

third parties, for the benefit of creditors. These powers were

further extended by the Small Business Enterprise and Employment

Act 2015, which allow the Liquidator and Administrator to sell the

claims that arise in their capacity as an Office Holder of the

insolvent company to a third party.

The PACCAR Matter is a Supreme Court ruling that relates to a

number of funded claims in relation to Truck Cartel price fixing

being heard in the UK's Competition Appeal Tribunal. Manolete also

has a number of claims in relation to the same matter. All of

Manolete's claims have been purchased by Manolete. None are funded.

The Supreme Court ruling therefore has no relevance to Manolete's

claims in this matter.

Looking at Manolete's total current portfolio of UK insolvency

claims: as at the end of June 2023, the Company had 390 live cases

with a combined Net Book Value of GBP31.5m. 94% by volume and 95%

by Net Book Value related to Purchased cases; 6% by volume and 5%

by Net Book Value related to Funded cases.

Of the 23 (out of a total of 390 live cases) that are Funded

cases, Manolete is working with specialist counsel to determine any

amendments that may be required to the terms of Manolete's standard

funding agreement.

Over 95% of Manolete's successfully completed cases are

completed by way of a consensual settlement agreement with the

defendant (often an individual previous company director). Very few

end at a trial. The Board considers that the prospect of any party

seeking to re-open a previously completed Funded Case as highly

remote.

If any further material matters arise from our work with

specialist counsel in this area, we will provide a further

update.

For further information, please contact:

Manolete Partners Plc via Instinctif Partners

Steven Cooklin (Chief Executive

Officer)

Peel Hunt (NOMAD and Broker)

Paul Shackleton +44 (0)20 7418 8900

Instinctif Partners (Financial +44 7949 939237

PR) manolete@instinctif.com

Tim Linacre

Victoria Hayns

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUAORROAUWRAR

(END) Dow Jones Newswires

August 01, 2023 06:33 ET (10:33 GMT)

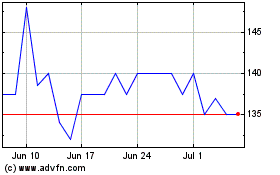

Manolete Partners (LSE:MANO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Manolete Partners (LSE:MANO)

Historical Stock Chart

From Apr 2023 to Apr 2024