TIDMMLVN

RNS Number : 8024J

Malvern International PLC

26 August 2021

26 August 2021

Malvern International PLC

("Malvern", the "Group" or the "Company" )

Interim results for the six months ended 30 June 2021

Malvern International plc (AIM: MLVN), the global learning and

skills development partner, announces its interim results for the

six months ended 30 June 2021 ("H1").

Results

-- H1 revenues from continuing operations of GBP1.42m (H1 2020: GBP1.37m).

-- H1 operating profit (before depreciation, amortisation and

finance charges) of GBP9k (H1 2020: loss GBP53k)

-- H1 loss before tax on continuing operations was GBP0.35m (H1 2020: loss GBP0.44m).

-- Loss per share on continuing activities of 0.02p (H1 2020: loss 0.16p).

-- GBP1.70m gross raised (GBP1.60m net of expenses) by way of placing and subscription.

-- Cash as at 30 June 2021 was GBP1.28m (31 December 2020: GBP0.10m and 30 June 2020: GBP0.06m).

*In August 2020, the Group announced the closure of Singapore

operations. The Singapore company was formally placed in

liquidation in April 2021, this is reported in the current and

prior periods as a discontinued operation. Financial information

relating to the discontinued operation for the period to the date

of the closure is set out in note 7 of the interim statements.

Operating highlights and outlook

-- English Language Training ("ELT") schools are currently

operating at approximately 20% of pre-pandemic levels, in line with

management expectations.

-- Provisional bookings for ELT are encouraging, demonstrating

the pent-up demand in this area, however many student start dates

remain subject to easing of travel restrictions.

-- University Pathways deposits for 2021/22 academic year are

currently ahead of the previous year. However, with the current

restrictions in place for international travel, there has been a

significant level of deferrals to a January 2022 start .

-- The Group's NCUK offering was launched in H1 2021. Student

applications are currently being processed for September 2021 term

start and we have received the first deposits. The sales and

marketing teams are focused on building the brand and reputation of

this area of the business.

-- The Group received a significant number of bookings for the

2021 summer camps prior to being put on hold, which points to a

strong demand for our product. Our expectation is that this demand

will return for summer 2022 as the border restrictions are

relaxed.

-- It has been announced that the Hungarian Government's

Language Learning Scholarship Programme for Hungarian Students,

Tempus Public Foundation will open again for summer 2022. We can

expect to accept bookings for summer 2022 from December 2021.

Commenting on the results and prospects, Richard Mace, Chief

Executive Officer, said:

" We have continued to provide tuition to students throughout

the period through face-to-face, online and blended learning. While

the pandemic has continued to disrupt bookings and the timing of

start dates, we are pleased that we have managed to keep our ELT

schools open and that provisional bookings for both ELT and

University Pathways are rebuilding. There is a clear back-log of

demand for all our education services and we expect a robust return

once restrictions are eased and in-class teaching can resume. In

the meantime we continue to strengthen our sales and marketing

teams and ensure the quality of our education services remains

high."

This announcement contains information which, prior to its

disclosure by this announcement, was inside information for the

purposes of the Market Abuse Regulation

For further information please contact:

Malvern International Plc www.malverninternational.com

Richard Mace - Chief Executive Via Communications Portfolio

Officer

NOMAD and Broker www.whirelandcb.com

WH Ireland Limited

Mike Coe / Sarah Mather +44 20 7220 1666

Media enquiries

Communications Portfolio ariane.comstive@communications-portfolio.co.uk

Ariane Comstive +44 7785 922 354

Notes to Editors:

Malvern International is a learning and language skills

development partner, offering international students essential

academic and English language skills, cultural experiences and the

support they need to thrive in their academic studies, daily life

and career development.

University Pathways - on and off-campus university pathway

programmes helping students progress to a range of universities, as

well as in-sessional and pre-sessional courses.

Malvern House Schools - British Council accredited English

Language Training at English UK registered schools in London,

Brighton and Manchester.

Malvern Online Academy - British Council accredited online

school, offering supported tuition to students from around the

world in English language, higher education, and professional

education.

Juniors and summer camps - fully-immersive summer residential

English language camps and bespoke group programmes for 13 to 18

year old students.

For further investor information go to

www.malverninternational.com .

Chief Executive's review

Trading in the six months ended 30 June 2021 ("H1") has been

significantly impacted by the effects of the Covid pandemic.

Nevertheless the Group has made good progress in the period.

Trading during the period for English Language Training ("ELT") and

University Pathways students was at its highest since the outbreak

of the pandemic in the UK in March 2020. ELT schools are currently

running at approximately 20% of pre-pandemic levels and student

numbers are expected to continue to rise, while University Pathways

delivered courses to 170 students during the 2021/22 academic

year.

During this time, Malvern Online Academy has provided tuition

both to students signed up to in-class courses in the form of

blended and remote learning, as well as providing full online

education.

Revenues from continuing operations for H1 were GBP1.42m (H1

2020: GBP1.37m). The loss before tax was GBP0.35m (H1 2020: loss

GBP0.44m). The loss per share on continuing activities was 0.02p

(H1 2020: loss 0.16p).

The Group has continued to implement strong cost control

measures throughout the period. In April, the Group raised GBP1.60m

after expenses by way of placing and subscription to support the

business through the prolonged period of difficult trading and to

build on the significant progress that has been made in many areas

of the business. Cash balances as at 30 June 2021 were GBP 1.28m

(31 December 20 20 : GBP 0.10 m and 30 June 2019: GBP0.43m).

Current trading

Language schools

There continues to be a significant backlog of demand for our

educational products. This is reflected in the growing number of

provisional bookings, which are subject to travel restrictions

being eased, for ELT in our London, Brighton and Manchester

schools. In light of this, the timing of individual start dates

remains dependent on each nation's approach to allowing

international travel to resume.

Malvern's schools continue to run at approximately 20% of

pre-pandemic levels which is in line with management expectations.

Forward bookings particularly from the Middle East are encouraging.

Middle East embassy bookings for Q4 are looking promising and

should continue to build as travel restrictions are eased. A number

of students quarantining in the UK, or yet to arrive, have elected

to commence their language course online. In light of Covid, the UK

government has extended concessions around student visa rules until

April 2022, which allow online studies to qualify for post-study

work rights.

Pathways

The demand for University Pathways courses is ahead of the

previous year, as reflected by the deposits taken by our university

partners for the September intake of the 2021/22 academic year.

However the delays in the easing of travel restrictions,

highlighted in our AGM update, and adjustments to admission

procedure timetables, have together resulted in a significant level

of start date deferrals to January 2022. As a result, September

2021 student numbers will be below last year but the number of the

students for the academic year as a whole is expected to be at a

higher level than 2020/21. We are partnering with UEL to refine the

admission process to assist in maximising acceptance numbers of

qualifying students for future cohorts.

The Group's first cohort of NCUK students are due to start in

the last week of September. Recruitment for this programme is on

budget. Our intention is to build our brand and reputation to grow

this area of the business. To support our NCUK offering we have

recruited an academic manager to ensure the quality of delivery of

courses. We are confident with the team we have in place for the

NCUK foundation programme that we have the platform for growth in

2022 and beyond.

Juniors

Due to anticipated international border issues we did not budget

for any summer camps in 2021. Not unexpectedly these have not gone

ahead. Pleasingly, before our plans for these camps were put on

hold, we had received a significant number of bookings pointing to

strong demand for our product. Our expectation is that this demand

will return for summer 2022 as border restrictions are relaxed. It

has been announced that the Hungarian Government's Language

Learning Scholarship Programme for Hungarian Students, Tempus

Public Foundation will open again for summer 2022. We can expect to

accept bookings for summer 2022 from December 2021. In 2019 we

received provisional bookings of approximately GBP1.5m for this

programme.

China

As part of our recruitment strategy we have appointed our first

sales manager in China, in Chengdu, with a second sales manager

post to be in place in Q4 2021. Our Chinese website is being

developed and will be ready for the next student recruitment

campaign in late 2021 / early 2022. China is the biggest

international student market to the UK for Higher Education

provision and junior summer camps.

Outlook

There is a clear back-log of demand for all our education

services and we expect a robust return once restrictions are eased

and in-class teaching can resume. Clearly a degree of uncertainty

over the gradual opening of international travel remains, but in

the meantime we are providing online and blended tuition where it

is required. Our high quality team continue to build relationships

with universities, agents, embassies and within countries

worldwide.

Our fundraising in April 2021, along with strong cost-control

measures has allowed us to weather the disruption caused by Covid

to date, to strengthen our sales and marketing teams and contribute

to other planned growth initiatives such that as restrictions ease

we expect the number of students across the Group to grow

substantially.

Richard Mace

Chief Executive Officer

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2021

Six Six

months ended months ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Note Unaudited Unaudited Audited

Revenue 1,424 1,366 1,901

Cost of services sold & operating

expenses (1,573) (1,612) (3,232)

Other Income 158 193 418

Operating profit / (loss) 9 (53) (913)

Finance costs (147) (178) (302)

Depreciation & amortisation (207) (204) (414)

Loss before taxation (345) (435) (1,629)

Income tax charge - - (31)

-------------- -------------- -------------

Loss for the period / year

from continuing operations

(1) (345) (435) (1,660)

Discontinued operations (1) 7 (21) 252 (480)

-------------- -------------- -------------

Loss for the period / year (366) (183) (2,140)

-------------- -------------- -------------

Loss attributable to equity

holders (366) (183) (2,140)

Loss for the period / year (366) (183) (2,140)

Translation movement (5) (272) 16

-------------- -------------- -------------

Total comprehensive loss for

the period / year (371) (455) (2,124)

-------------- -------------- -------------

Continuing operations (345) (435) (1,660)

Discontinued operations (26) (20) (464)

-------------- -------------- -------------

Total loss attributed to equity

holders (371) (455) (2,124)

-------------- -------------- -------------

Loss per share on continuing

activities Pence Pence Pence

Basic (2) 4 (0.02) (0.16) (0.23)

Diluted (2) 4 (0.02) (0.16) (0.23)

(1) The closure of the Singapore school was completed in August

2020 and all operations in the territory have now ceased (liquidation

commenced in April 2021). In line with the 2020 annual financial

accounts, the Group continues to present the Singapore operations

as discontinued.

(2) Calculated at the weighted average number of shares in issue

during the period at 1,648,655,085 (H1 2020: 263,776,243).

UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

As at

As at As at 31 December

30 June 2021 30 June 2020 2020

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Non-current assets

Property, plant & equipment 66 104 81

Goodwill 1,419 1,419 1,419

Right-of-use assets 2,426 2,800 2,613

3,911 4,323 4,113

Current assets

Inventory - - -

Debtors 542 1,413 1,033

Prepayments 133 289 162

Cash at bank and in hand 1,276 63 104

-------------- -------------- -------------

1,951 1,765 1,299

Assets classified for disposal 10 - 2

-------------- -------------- -------------

Total Assets 5,872 6,088 5,414

-------------- -------------- -------------

Non-current liabilities

Term loan 2,547 2,515 2,532

Warrants 64 68 64

Convertible loan notes 224 - 273

Lease liabilities 2,313 2,668 2,491

-------------- -------------- -------------

5,148 5,251 5,360

Current liabilities

Trade payables 408 457 604

Contract liabilities 221 269 676

Other payables and accruals 1,221 891 1,230

Amount due to related parties - - 40

Convertible loan notes 100 322 50

Provision for income tax 10 10 10

Lease Liabilities 354 344 351

Term Loan 19 - -

-------------- -------------- -------------

2,333 2,293 2,961

Liabilities directly associated

with assets classified

for disposal 211 - 218

-------------- -------------- -------------

Total Liabilities 7,692 7,544 8,537

-------------- -------------- -------------

Equity

Share capital 11,193 10,310 10,310

Share premium 6,575 5,782 5,782

Reserves (19,588) (17,548) (19,217)

-------------- -------------- -------------

(1,820) (1,456) (3,125)

Total Equity and Liabilities 5,872 6,088 5,414

-------------- -------------- -------------

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2021

Share Share Retained Translation Capital Convertible Total Attributable

Capital Premium Earnings Reserve Reserve Loan Reserves to Equity

Reserve Holders of

the Company

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------- ----------- ---------- ------------ --------- ------------ ---------- -------------

Balance at 1

January

2020 9,364 5,431 (17,564) 272 171 28 (17,093) (2,298)

Total

comprehensive

income for

the

period - - (183) (272) - - (455) (455)

New share

issue 946 351 - - - - - 1,297

---------- ----------- ---------- ------------ --------- ------------ ---------- -------------

Balance at 30

June

2020 10,310 5,782 (17,747) - 171 28 (17,548) (1,456)

---------- ----------- ---------- ------------ --------- ------------ ---------- -------------

Total

comprehensive

income for

the

period - - (1,957) 288 - - (1,669) (1,669)

Direct costs - - - - - - - -

relating

to issue of

shares

---------- ----------- ---------- ------------ --------- ------------ ---------- -------------

Balance at 31

December

2020 / 1

January

2021 10,310 5,782 (19,704) 288 171 28 (19,217) (3,125)

---------- ----------- ---------- ------------ --------- ------------ ---------- -------------

Total

comprehensive

income for

the

period - - (366) (5) - - (371) (371)

Direct costs

relating

to issue of

shares - (90) - - - - - (90)

New share

issue 883 883 - - - - - 1,766

---------- ----------- ---------- ------------ --------- ------------ ---------- -------------

Balance at 30

June

2021 11,193 6,575 (20,070) 283 171 28 (19,588) (1,820)

---------- ----------- ---------- ------------ --------- ------------ ---------- -------------

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2021

Six Six

months ended months ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Cash flows from operating activities

(Loss) / profit after tax from

Continuing activities (345) (435) (1,660)

Discontinued activities (21) 252 (480)

Adjustments for:

Depreciation & amortisation 207 204 414

Fair value movement on warrants - (57) (62)

Fair value movement on convertible loan

reserve - 6 -

Share based payments - - 175

Loss on disposal of discontinued operations (20) (398) -

Loss on disposal of tangible assets - - (115)

Impairment of trade receivables - - 124

Finance cost 147 178 302

Interest paid (54) (49) (51)

Tax paid - - -

-------------- -------------- -------------

(86) (299) (1,353)

Changes in working capital

Decrease in debtors & prepayments 520 278 95

Increase / (decrease) in creditors (848) 101 219

Decrease in inventories - 2 6

Decrease in related parties (40) (43) (7)

-------------- -------------- -------------

Net cash used in operating activities (454) 39 (1,040)

-------------- -------------- -------------

Cash flows from investing activities

Purchase of property, plant and equipment (5) - -

Investment in Intangible Assets - - -

Net cash used in investing activities (5) - -

-------------- -------------- -------------

Cash flows from financing activities

Decrease in finance lease liabilities (18) (259) (195)

New share issue 1,651 100 1,156

Term loan (2) 100 100

-------------- -------------- -------------

Net cash used in financing activities 1,631 (59) 1,061

-------------- -------------- -------------

Net increase in cash and cash equivalents 1,172 (20) 21

Effect of foreign exchange rate changes

on consolidation - - -

Cash and cash equivalents at beginning

of period / year 104 83 83

-------------- -------------- -------------

Cash and cash equivalents at end of

period / year 1,276 63 104

-------------- -------------- -------------

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION FOR THE SIX

MONTHSED 30 JUNE 2021

1. General information

Malvern International plc (the "Company") is a public limited

liability company incorporated in England and Wales on 8 July 2004.

The Company was admitted to AIM on 10 December 2004. Its registered

office is 100 Avebury Boulevard, Milton Keynes, MK9 1FH and its

principal place of business is in the UK. The registration number

of the Company is 05174452.

The principal activities of the Company are that of investment

holding and provision of educational consultancy services. The

principal activity of the Group is to provide an educational

offering that is broad and geared principally towards preparing

students to meet the demands of business and management. There have

been no significant changes in the nature of these activities

during the period

2. Significant accounting policies

Basis of preparation

The accounting policies adopted are consistent with those of the

previous financial year.

This interim consolidated financial information for the six

months ended 30 June 2021 has been prepared in accordance with IAS

34, 'Interim financial reporting'. This interim consolidated

financial information is unaudited and is not the Group's statutory

financial statements and should be read in conjunction with the

annual financial statements for the year ended 31 December 2020,

which have been prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The auditors have reported on those accounts; their

report was unqualified, but did include, without qualifying their

report, references to which the auditors drew attention by way of

emphasis of matter in respect of the preparation of the financial

statements on a going concern basis.

The interim consolidated financial information for the six

months ended 30 June 2021 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 June 2020 are unaudited.

This interim consolidated financial information is presented in

GBP sterling, rounded to the nearest thousand.

3. Dividend

No interim dividend for this financial year is proposed.

4. Loss per share

The basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the relevant period. The

weighted average number of shares in issue during the period was

1,648,655,085 (H1 2020: 263,776,243).

The diluted loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the relevant period

diluted for the effect of share options and warrants in existence

at the relevant period. The weighted average number of shares in

issue diluted for the effect of share options and warrants in

existence during the period was 1,648,655,085 (H1 2020:

263,776,243).

5. Share capital

On 1 April 2021 the Group announced the issue of 620,150,000 new

ordinary shares through placing and a subscription to the Company

of 230,000,000 new ordinary shares at a price of 0.20 pence per

share to raise net proceeds of GBP1.60m. As at 30 June 2021, the

total number of Ordinary Shares held in the Company was

2,087,467,240 (30 June 2020: 1,204,967,240).

6. Subsequent events

In August 2021, the Company announced that it had allotted

21,551,724 new ordinary shares of 0.1p each pursuant to the

conversion of GBP50,000 of the loan notes at a conversion price of

0.232 pence per share (being the average price of the five business

days prior to the conversion date) that were otherwise redeemable

on 31 July 2021. Following the loan note conversion, a further

GBP272,817 Loan Notes remain outstanding of which a further

GBP50,000 is redeemable or convertible on each of 31 January 2022

and 31 July 2022 with the final balance redeemable or convertible

on 31 December 2022.

7. Discontinued operations

The financial details related to Singapore operations are for

the half year ended 30 June 2021. Following the decision to close

the Singapore operations in August 2020, the company was formally

placed in liquidation in April 2021.

i) Financial performance of discontinued operations

Six months ended Six months

30 June 2021 ended 30 June

GBP'000 2020

GBP'000

Revenue - 629

Other income 5 104

Expenses (26) (1,051)

---------------------- ---------------

Loss for the period (21) (318)

---------------------- ---------------

Other comprehensive income - 570

---------------------- ---------------

Total Comprehensive income (21) 252

---------------------- ---------------

ii) Assets and liabilities of entities classified for

disposal

Six months ended Six months

30 June 2021 ended 30 June

GBP'000 2020

GBP'000

Asset classified for disposal - -

Property plant and Equipment - 2,027

Other receivables - 312

Cash & cash equivalent 10 6

----------------- ---------------

Total assets classified for disposal 10 2,345

----------------- ---------------

Liabilities directly associated with assets - -

classified for disposal

Trade creditors (145) (699)

Other payables (66) -

Lease liability - (1,929)

----------------- ---------------

Total liabilities (211) (2,628)

----------------- ---------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLRTIIEFIL

(END) Dow Jones Newswires

August 26, 2021 02:00 ET (06:00 GMT)

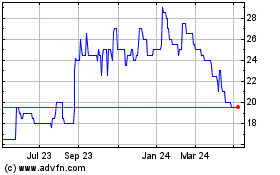

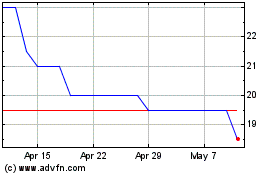

Malvern (LSE:MLVN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Malvern (LSE:MLVN)

Historical Stock Chart

From Jul 2023 to Jul 2024