TIDMMLVN

RNS Number : 0575O

Malvern International PLC

29 September 2023

29 September 2023

Malvern International PLC

( " Malvern" the "Company")

Interim results for the six months ended 30 June 2023

Malvern International plc (AIM: MLVN), the global learning and

skills development partner, announces its interim results for the

six months ended 30 June 2023 ("H1 2023").

H1 2023 results

-- Revenues from operations increased 110% to GBP4.85m (H1 2022: GBP2.31m)

-- Operating profit (before depreciation, amortisation and

finance charges) of GBP0.58m (H1 2022: loss GBP0.34m).

-- Profit before tax from operating activities increased to

GBP0.22m (H1 2022: loss GBP0.68m), largely due to an increase in

strategic investment in the Company's sales structure and

significant recruitment travel to key feeder markets including

India and Nepal.

-- Profit per share from operating activities of 0.92p (H1 2022: loss 3.16p).

-- Cash at 30 June 2023 was GBP2.12m (FY 2022: GBP1.18m and H1

2022: GBP0.88m) and the Company's debt facility with BOOST&CO

remained at GBP2.6m.

Operating highlights

-- University Pathways student numbers increased by 247% in H1

2023 to 500 students (H1 2022: 144 students) studying in our

centres.

-- English Language Training ("ELT") centre revenues were 66% ahead of H1 2022.

-- Junior summer camps returned once again over the summer

months with a record number of camps and students. Payments in

advance for these camps account for the high level of cash held at

30 June 2023.

Commenting on the results and prospects, Richard Mace, Chief

Executive Officer, said:

"We are extremely pleased with our performance in H1 2023 which

has been driven by a combination of a strong return in the

international study market and our strategy to invest in our sales

and marketing function over the last three years. The momentum has

continued in the second half as we welcomed the new cohort of 450

University Pathways Students in September, and we experienced

record performances from our ELT and Junior Summer camps in July

and August.

We are also investing in highly experienced people in the

Pathways sector to continue to expand our reach, whilst improving

our systems of control and reporting. As a result of this

investment we are expecting break-even or a small loss for H2

2023.

Our forward bookings and revenue visibility in H2 2023 and for

the start of 2024 gives us confidence in Malvern's near and

longer-term prospects. We expect to see growth in all divisions in

2024."

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

For further information please contact:

Malvern International Plc www.malverninternational.com

Richard Mace - Chief Executive Via W H Ireland

Officer

NOMAD and Broker www.whirelandcb.com

WH Ireland Limited

Mike Coe / Sarah Mather +44 117 945 3470

Notes to Editors:

Malvern International is a learning and language skills

development partner, offering international students essential

academic and English language skills, cultural experiences and the

support they need to thrive in their academic studies, daily life

and career development.

University Pathways - on and off-campus university pathway

programmes helping students progress to a range of universities, as

well as in-sessional and pre-sessional courses.

Malvern House Schools - British Council accredited English

Language Training at English UK registered schools in London,

Brighton and Manchester.

Juniors and summer camps - fully-immersive summer residential

English language camps and bespoke Company programmes for 13- to

18-year-old students.

For further investor information go to

www.malverninternational.com .

Chief Executive ' s review

Malvern has seen a significant improvement in revenues, student

numbers and business pipeline in H1 2023 and we are pleased to have

posted a small profit for the period.

The number of students studying in our University Pathways

programmes in H1 2023 (500) was significantly higher than H1 2022

(144), which included 461 at the University of East London (UEL)

International Study Centre. The performance in student recruitment

is driven by our expanded international sales team and our

expertise in managing and converting the student pipeline from

across the world. We continue to invest in staffing and operational

arrangements with a focus on learning, teaching and pastoral

excellence to maximise student attainment and progression. This

investment will increase once we have successfully concluded

negotiations for a contract longer than the one year that currently

exists.

During the period we ran joint marketing and recruitment trips

to India and Nepal with UEL. The response to these events was very

positive as we were able to showcase the quality of our offering to

this key audience.

English Language Training (" ELT ") centre revenues were 66%

ahead of H1 2022. The wider ELT market is still recovering from the

Covid-19 pandemic and is currently operating below 2019 levels.

Consequently, we are very pleased with our performance.

Junior Summer Camps returned this summer stronger than ever,

with five camps running during the June to August 2023 peak season.

Approximately 10% of revenues from our camps are recognised in H1

2023 period, with the remainder falling in the six months to 31

December 2023 (H2 2023).

We continued to strengthen our teams, with the addition of new

Heads of Marketing and Juniors. Emiliano Sallustri, the former Head

of Juniors was promoted to Commercial Director of ELT and Juniors

in January 2023.

Financial performance

Revenues from operations for H1 2023 more than doubled to

GBP4.85m (H1 2022: GBP2.31m). Revenue growth was driven by higher

student numbers in ELT and University Pathways, and to a lesser

extent Junior summer camps which are predominately recognised in

July and August (H2 2023).

Operating profit (before depreciation, amortisation and finance

charges) was GBP0.58m (H1 2022: loss GBP0.34m) with operating

profit margin at 12%. As with previous years, the operating profit

margin is typically higher in the first half of the year than in

the second half of the year due to the mix of revenues in each

respective period.

We are pleased to report a small profit before tax of GBP0.22m

(H1 2022: loss GBP0.68m), reflecting the improved trading

conditions. The profit per share from operating activities was 0.92

p (H1 2022: loss 3.16p).

We continue to maintain tight cost controls whilst making

strategic investments in increasing the depth of our teams, systems

and processes to support growth.

Cash balances at 30 June 2023 were GBP2.12m (31 December 2022:

GBP1.18m and 30 June 2022: GBP0.88m). The growth of our Juniors

division in 2023 has led to an improved cash position in Q2 2023

relative to the prior year. We are also receiving payment sooner

from our Juniors agents and managing the outgoings around this.

These improvements help to support the broader Group's working

capital requirements.

The Company's debt facility with BOOST&CO remained at

GBP2.6m at 30 June 2023.

Considering these factors, the Board believes the Company's

working capital position is sufficient to fund the ongoing

investments in the business.

Summary and outlook

We are pleased with our performance in H1 2023, as we have taken

advantage of improved market conditions following our investment in

the business over the last three years. UEL University Pathways

enrolments for September 2023 increased by 96% to c. 450 students

(September 2022: 230 students) around a third of this income will

be recognised in H2 2023, and two thirds in H1 2024. We expect this

momentum to continue and we are currently anticipating the number

of starters in January 2024 to be ahead of the 230 students who

started in January 2023.

The peak months of July and August for ELT were c. 20% higher

than in the same months in 2022, reflecting a return in confidence

in the market with more Middle East and North Africa ("MENA")

students travelling, supported by relaxed visa conditions for Saudi

Arabian students coming to the UK and large groups of Italian

students in our London centre.

We delivered five Junior Summer camps to c. 2,500 students in

July and August 2023 (2022: 976 students) - a record for the

Company - and we are already taking bookings for 2024.

Our significantly improved results are allowing us to invest in

experienced higher education personnel to drive future sales, to

build expanded sales and marketing teams together with associated

business development , develop our teaching staff and operational

delivery, and grow our agent network . T he Company views these

investments as essential to maximise current opportunities and to

build on the solid base we now have for 2024 and bey ond. The scale

of this key strategic programme means we are expecting break-even

or a small loss for H2 2023.

Richard Mace

Chief Executive Officer

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

Six Six

months ended months ended Year ended

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Note Unaudited Unaudited Audited

Revenue 4,851 2,308 6,512

Cost of services sold & operating expenses (4,193) (2,687) (7,013)

Cost of services sold & operating expenses -

Exceptional Item 4 (115) - -

-------------- -------------- -------------------

Total cost of services sold and operating expenses (4,308) (2,687) (7,013)

Depreciation & amortisation (179) (188) (372)

Other income 35 39 84

Operating profit / (loss) before finance costs 399 (528) (789)

Finance costs (177) (148) (295)

Profit/(Loss) before taxation 222 (676) (1,084)

Income tax charge 2 - -

-------------- -------------- -------------------

Profit/(Loss) after tax for the period / year 224 (676) (1,084)

-------------- -------------- -------------------

Profit/(Loss) attributable to equity holders 224 (676) (1,084)

Total comprehensive profit/(loss) for the period / year 224 (676) (1,084)

-------------- -------------- -------------------

Profit/(Loss) per share Pence Pence Pence

Basic 3 0.92 (3.16) (4.95)

Diluted 3 0.80 (2.75) (4.95)

UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

As at

As at As at 31 December

30 June 2023 30 June 2022 2022

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Non-current assets

Property, plant & equipment 28 39 31

Goodwill 1,419 1,419 1,419

Right-of-use assets 2,046 2,384 2,215

-------------- -------------- --------------

3,493 3,842 3,665

Current assets

Debtors 706 945 406

Prepayments 1,310 224 1,136

Cash at bank and in hand 2,119 881 1,182

-------------- -------------- --------------

4,135 2,050 2,724

Total Assets 7,628 5,892 6,389

-------------- -------------- --------------

Non-current liabilities

Term loan 1,623 2,583 2,053

Warrants 190 225 190

Deferred tax liability 10 10 10

Lease liabilities 2,307 2,891 2,625

-------------- -------------- --------------

4,130 5,709 4,878

Current liabilities

Trade payables 460 346 417

Contract liabilities 3,574 1,812 2,200

Other payables and accruals 1,400 852 1,641

Convertible loan notes - 227 -

Provision for income tax (2) 5 -

Lease liabilities 588 386 451

Term loan 888 11 436

-------------- -------------- --------------

6,908 3,639 5,145

Total Liabilities 11,038 9,348 10,023

-------------- -------------- --------------

Equity

Share capital 11,331 11,252 11,331

Share premium 6,798 6,619 6,798

Reserves (21,539) (21,327) (21,763)

-------------- -------------- --------------

(3,410) (3,456) (3,634)

-------------- -------------- --------------

Total Equity and Liabilities 7,628 5,892 6,389

-------------- -------------- --------------

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Share Capital Share Premium Retained Convertible Total Reserves Attributable

Earnings Loan Reserve to Equity

Holders of the

Company

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------------- -------------- ---------------- ---------------- --------------- ---------------

Balance at 1

January 2022 11,217 6,604 (20,679) 29 (20,650) (2,829)

Total

comprehensive

income for the

period - - (676) - (676) (676)

-------------- -------------- ---------------- ---------------- --------------- ---------------

Balance at 30

June 2022 11,217 6,604 (21,355) 29 (21,326) (3,505)

-------------- -------------- ---------------- ---------------- --------------- ---------------

Direct costs

relating to

issue of

shares - (25) - - - (25)

New shares

issued 25 175 - - - 200

New shares from

share based

payments

including EMI

Options 4 - - - - 4

CLN Reserve

transferred to

Share Premium

Account - 29 - (29) (29) -

Convertible

Loan Notes 85 15 - - - 100

-------------- -------------- ---------------- ---------------- --------------- ---------------

Total

Comprehensive

income for the

period - - (408) - (408) (408)

-------------- -------------- ---------------- ---------------- --------------- ---------------

Balance at 31

December 2022

/ 1 January

2023 11,331 6,798 (21,763) - (21,763) (3,634)

-------------- -------------- ---------------- ---------------- --------------- ---------------

Total

comprehensive

income for the

period - - 224 - 224 224

-------------- -------------- ---------------- ---------------- --------------- ---------------

Balance at 30

June 2023 11,331 6,798 (21,539) - (21,539) (3,410)

-------------- -------------- ---------------- ---------------- --------------- ---------------

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 30 JUNE 2023

Six Six

months ended months ended Year ended

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Cash flows from operating activities

Profit/(Loss) after tax 224 (676) (1,084)

Adjustments for:

Depreciation of tangible assets 179 188 372

Fair value movements - - (40)

Share based payments - - 4

Loss on disposal of tangible assets - - 1

Impairment of trade receivables 54 132 114

Finance cost 177 148 295

Interest paid - (13) (41)

Tax paid - (16) -

-------------- -------------- -------------------

634 (237) (379)

Changes in working capital

Decrease / (increase) in debtors & prepayments (529) (307) (659)

Increase / (decrease) in creditors 1,108 1,118 2,171

-------------- -------------- -------------------

Net cash generated from operating activities 1,213 574 1,133

-------------- -------------- -------------------

Cash flows from investing activities

Purchase of property, plant and equipment (7) (8) (15)

-------------- -------------- -------------------

Net cash used in investing activities (7) (8) (15)

-------------- -------------- -------------------

Cash flows from financing activities

Decrease in finance lease liabilities (269) (176) (473)

New share issue - - 176

Term loan - Net - 114 (15)

-------------- -------------- -------------------

Net cash used in financing activities (269) (62) (312)

-------------- -------------- -------------------

Net increase in cash and cash equivalents 937 504 805

Cash and cash equivalents at beginning of period / year 1,182 377 377

-------------- -------------- -------------------

Cash and cash equivalents at end of period / year 2,119 881 1,182

-------------- -------------- -------------------

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION FOR THE SIX

MONTHS ENDED 30 JUNE 2023

1. General information

Malvern International plc (the "Company") is a public limited

liability company incorporated in England and Wales on 8 July 2004.

The Company was admitted to AIM on 10 December 2004. Its registered

office is 3rd Floor, 1 Ashley Road, Altrincham, Cheshire WA14 2DT

and its principal place of business is in the UK. The registration

number of the Company is 05174452.

The principal activities of the Company are that of investment

holding and provision of educational consultancy services. The

principal activity of the Company is to provide an educational

offering that is broad and geared principally towards preparing

students to meet the demands of business and management. There have

been no significant changes in the nature of these activities

during the period.

2. Significant accounting policies

Basis of preparation

The Group's unaudited interim results for the 6 months ended 30

June 2023 ("Interim Results") are prepared in accordance with the

Group's accounting policies which are based on the recognition and

measurement principles of the UK-adopted International Accounting

Standards in conformity with the requirements of the Companies Act

2006. As permitted, the Interim Results have been prepared in

accordance with the AIM rules and not in accordance with IAS 34

"Interim financial reporting" and therefore the interim information

is not in full compliance with International Accounting

Standards.

The interim condensed consolidated financial statements are

prepared under the historical cost convention as modified to

include the revaluation of certain financial instruments. The

accounting policies adopted in the preparation of the interim

condensed consolidated financial statements are consistent with

those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 31 December

2022. The principal accounting policies of the Group have remained

unchanged from those set out in the Group's 2022 annual report and

financial statements. The Principal Risks and Uncertainties of the

Group are also set out in the Group's 2022 annual report and

financial statements and are unchanged in the period.

The financial information for the 6 months ended 30 June 2023

and 30 June 2022 has not been audited and does not constitute full

financial statements within the meaning of Section 434 of the

Companies Act 2006.

The Group's 2022 financial statements for the year ended 31

December 2022 were prepared under UK-adopted International

Accounting Standards. The auditor's report on these financial

statements was unqualified and did not contain statements under

Sections 498(2) or (3) of the Companies Act 2006 and they have been

filed with the Registrar of Companies. However, the auditor's

report did draw attention to a material uncertainty in relation to

going concern.

3. Profit/(Loss) per share

The basic profit/(loss) per share is calculated by dividing the

profit/(loss) attributable to ordinary shareholders by the weighted

average number of ordinary shares in issue during the relevant

period. The weighted average number of shares in issue during the

period was 24,442,400 (H1 2022: 21,382,000).

The diluted profit/(loss) per share is calculated by dividing

the profit/(loss) attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue during the

relevant period, diluted for the effect of share options and

warrants in existence at the relevant period. The weighted average

number of shares in issue (24,442,400 units) as at 30 June 2023,

diluted for the effect of share options (1,965,000 units) and

warrants (1,725,113 units) in existence during the period was

28,132,513 (H1 2022: 24,567,112). The weighted average number of

shares in issue for H1 2022 was restated from 2,138,199,951 to

21,382,000 for effect of the share combination that took place in

November 2022.

4. Exceptional Item

The separate reporting of exceptional items helps to provide an

indication of the Group's underlying business performance.

In H1 2023, the Group is reporting a charge (GBP0.11m) related

to revenue from the prior year. This is due to the late reporting

of actual course attendance by a major customer. We are currently

engaging with them over establishing better reporting systems from

them to enable more prompt accounting for sales credits when

required.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSEALITFIV

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

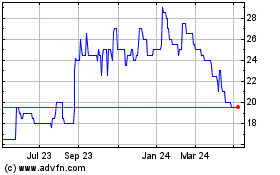

Malvern (LSE:MLVN)

Historical Stock Chart

From Dec 2024 to Jan 2025

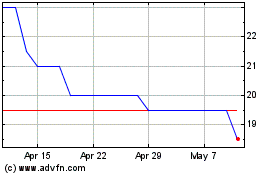

Malvern (LSE:MLVN)

Historical Stock Chart

From Jan 2024 to Jan 2025