TIDMNTQ

RNS Number : 2220O

Enteq Technologies PLC

29 September 2023

Enteq Technologies plc

("Enteq" or the "Company" or the "Group")

Final results for the year ended 31 March 2023

Enteq (AIM: NTQ.L), the energy services technology supplier,

today announces its audited final results for the year ended 31

March 2023

Key features

-- Total revenue $6.2m ($7.3m for year ended 31 Mar 2022)

-- Gross and net cash balance increased to $5.4m

-- Sale of freehold facility in Houston for $2.5m

-- Post year-end sale of XXT intellectual property and assets

for up to $3.16m (Initial cash consideration of c.$1.89m plus up to

c.$1.27m to be paid in cash over a 12-month period).

-- Continued investment in SABER project ($2.6m)

-- The SABER Tool (SABER), successfully completed downhole

drilling testing, proving the system to be effective in an

operational test environment.

Financial metrics

Years ended 31 March ($m):

2023 2022

Continued Discontinued Continued Discontinued

operations operations operations operations

Revenue 0.0 6.2 0.0 7.3

Gross profit margin 0.0 23% 0.0 36%

Underlying overheads

** (1.5) (1.1) (1.3) (1.0)

Adjusted EBITDA (1.5) 0.3 (1.3) 1.6

Exceptional items 0.0 (0.5) 0.0 0.0

Total post tax profit/(loss)* (1.4) (1.4) (1.6) 0.8

Post tax profit/(loss)

per share (cents) (2.0) (2.0) (2.2) 1.1

Cash balance 5.4 0.0 4.8 0.0

Investment in engineering

projects 2.6 0.0 2.7 0.0

*prior to intercompany

interest charges

**all central costs allocated to

the continued operation

Outlook

-- Ongoing investment in the development and deployment of

technologies with significantly enhanced market size and

differentiation.

Andrew Law, CEO of Enteq Technologies plc, commented:

"The SABER project has reached a pivotal milestone, having

achieved proof of SABER's novel concept whilst drilling in an

operational test environment. The engineering programme and Norway

testing during the year led up to the successful testing in

Oklahoma which has provided us with validation needed to advance

with SABER commercialisation.

A number of efforts were realised during the year to focus on

generating cash to support the SABER project, notably the sale of

the XXT product line and the sale of the property.

We look forward to working alongside selected customers and

industry partners in different regions to bring this technology to

the oil and gas, geothermal and methane abatement markets and to

deliver a positive and disruptive impact."

(1) The reconciliation between Underlying overheads and

Administrative expenses before amortisation is follows:

Year to 31 March 2023 Year to 31 March 2022

$m $m

Total underlying overheads 2.6 2.3

Depreciation - fixed assets 0.2 0.2

Depreciation - rental fleet 0.6 0.5

PSP Share charge 0.2 0.2

Administrative expenses before amortisation 8.6 3.2

(2) The reconciliation between Loss attributable to shareholders

and Adjusted EBITDA is follows:

Year to 31 March 2023 Year to 31 March 2022

$m $m

Loss attributable to shareholders (2.8) (0.8)

Exceptional items 0.5 -

Amortisation 0.4 0.2

Depreciation - fixed assets 0.2 0.2

Depreciation - rental fleet 0.6 0.5

PSP Share charge 0.2 0.2

Tax (0.3) -

Interest - -

Adjusted EBITDA (1.2) 0.3

Both the above alternative performance measures are shown as the

Board consider these to be key to the management as the business as

a whole.

(3) The cash balance includes:

Year to 31 March 2023 Year to 31 March 2022

$m $m

Cash and cash equivalents 5.4 3.3

Bank deposits - 1.5

Cash balance 5.4 4.8

The Company also separately issued today an AGM Trading

Statement.

For further information, please contact:

Enteq Technologies plc +44 (0)20 8087 2202

www.enteq.com

Andrew Law, Chief Executive Officer

Mark Ritchie, Chief Financial Officer

Cavendish Capital Markets Limited (NOMAD and Broker) +44 (0)20

7220 0500

Ed Frisby, Fergus Sullivan (Corporate Finance)

Andrew Burdis, Barney Hayward (ECM)

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Combined Chief Executive and Chairman's report

Introduction

Enteq develops and provides downhole electronics and

technologies for measurement, data and control, which are used by

the geothermal, methane capture, oil and gas sectors around the

world.

Specialist directional technologies, including Rotary Steerable

Systems (RSS) and Measurement While Drilling (MWD) are used by

service companies around the world who either purchase or rent

equipment from third parties such as Enteq or develop systems

themselves.

The international RSS market is the target for new Enteq

technology and is currently estimated at over $2bn annually.

Enteq has a proven track record of providing extremely reliable

and respected technology to regional and independent service

companies globally. Enteq is commercialising game-changing

technologies to deliver improvements in efficiency, operating cost

and reduced environmental impact in drilling. Enteq's SABER

technology is a novel RSS originated by Shell and subsequently

developed by Enteq under an exclusive IP and technology license

agreement.

Enteq now has a rented operations facility in Houston, (having

sold a freehold in year-ending March 2023) and a technology centre

in the UK. International business is supported through a network of

sales representatives.

Enteq plans to maximise growth through the commercialisation of

SABER and associated technologies in the substantial global

directional drilling market.

Sale of XXT

The sale was a result of a strategic focus to improve the

Company's medium term cash position to underpin investment in

product line development, primarily the deployment of SABER, the

rotary steerable drilling solution.

The XXT intellectual property (previously amortised over time to

a book value of nil) and associated product lines and trademark,

together with selected technology agreements, customer account

receivable balances, and inventory have been sold for a cash

consideration of c.$1.89m; further selected customer account

receivables and inventory have also been sold for up to c.$1.27m to

be paid in cash over a 12 month period.

The Disposal reflects Enteq's focus on differentiated specialist

MWD technologies, and the rotary steerable sector (SABER) where

there is a larger addressable market.

Review of the Year

This year has been one of increasing the focus on the SABER

technology development project, resulting in a critical milestone

being successfully accomplished.

The SABER development project has progressed well during the

year with the most important milestone being the successful

downhole drilling testing in North America post financial year end,

proving that the novel concept underpinning SABER can steer

effectively in operational test conditions. A simplified design of

the SABER control system was implemented during the year, to widen

the operating range and to improve operating effectiveness.

Continued customer and industry engagement on the SABER project

confirmed there is a high degree of appetite for this technology.

SABER remains on-track for commercialisation, with existing

resources in place to complete the remaining phase of the

development project. A phased roll out is planned in 2024.

As a result of a strategic focus to improve the Company's cash

position to underpin investment in the development of SABER, Enteq

sold the freehold property in South Houston for $2.5m and sold the

XXT intellectual property and associated assets for an initial cash

consideration of $1.89m (with selected account receivables and

inventory for up to c.$1.27m to be paid in cash over a 12-month

period).

As significant overhead reductions were made in recent years,

the underlying overheads have remained steady in comparison to the

previous year.

Staff

There were a total of 13 employees at the end of the year, down

from the 15 at the previous year end. The Board would like to

recognise the on-going loyalty, dedication, and support of the

staff as Enteq continues with its excellent reputation for the

reliability of equipment and commitment to customer support.

Prospects

Enteq has continued investment in the SABER RSS project

development, having achieved successful downhole drilling field

test performance, to significantly reduce the technical risk.

Sustained testing has confirmed that the system has performed to

the design criteria and met all requirements to date.

Continued engineering of the project has resulted in an

enhanced, simplified design with a wider range of operation and a

low cost to operate.

Extensive industry engagement with existing and new customers

and partners, both internationally and across North America, has

confirmed that SABER is on-track to meeting the market requirements

for the geothermal, methane capture and oil and gas sectors.

Financial Review

Income Statement

This is a pro-forma statement which is different in presentation

to the statutory format shown on page 35.

Year to 31 March: Continued Discontinued Continued Discontinued

2023 2023 2022 2022

$ million $ million $ million $ million

Revenue 0.0 6.2 0.0 7.3

Cost of Sales 0.0 (4.8) 0.0 (4.7)

Gross profit 0.0 1.4 0.0 2.6

Overheads (1.5) (1.1) 1.3 1.0

------------------- ---------- ------------- ---------- -------------

Adjusted EBITDA (1.5) 0.3 (1.3) 1.6

Depreciation

& amortisation 0.0 (1.2) 0.0 (0.8)

Other charges 0.2 0.0 0.3 0.0

Ongoing operating

loss 1.7 (0.9) (1.6) 0.8

Exceptional items 0.0 (0.5) (0.3) 0.0

Operating Loss (1.7) (1.4) (1.6) 0.8

Interest - - - -

------------------- ---------- ------------- ---------- -------------

Loss before

tax (1.7) (1.4) (1.6) 0.8

Tax 0.3 0.0 - -

------------------- ---------- ------------- ---------- -------------

Loss after tax (1.4) (1.4) (1.6) 0.8

=================== ========== ============= ========== =============

The North American market saw a steady increase during the year

with the rig count rising from 673 as at 31 March 2022 to 758 as at

31 March 2023 an increase of 85 (13%). This compares to an increase

243 (57%) in the previous year. This was against a background of

the price of a barrel of WTI falling during the year to 31 March

2023 from $104 to $73 compared to a rise from $64 as of 31 March

2022. The oil price was at levels during the year under review to

be profitable for the operating companies that require the services

of Enteq's customers.

North American revenue was steady at $5.8m compared to the $6.2m

reported last year. The North American revenue was largely driven

by demand for specific third-party technologies, with revenues

deliberately controlled by the Company to maintain working capital

efficiency. The international market continued to experience

challenges of capital availability, with international revenue at

$0.4m, down from the $1.1m reported last year.

The full year gross margin was 23%, down from last year's 36%,

due to an increasing proportion of revenue coming from the third

party components mentioned above.

Total underlying overheads, at $2.3m were at the same level as

last year's figure. This reflected the concentration on reducing

all levels of overheads in previous years without impacting the

level of customer support given.

The combined depreciation and amortisation charge was up on the

previous year due to an increased level of amortisation on

previously capitalised software enhancements plus a higher level of

depreciation on both the rental fleet and the underlying

assets.

The "Other charges" shown above relate, primarily, to the

non-cash cost associated with the Performance Share Plan.

Statement of Financial Position

This is a pro-forma statement which is different in presentation

to the statutory format shown on page 36.

Enteq's net assets at the financial year-end comprised of the

following items:

As at 31 March: 2023 2022

$million $million

Intangible assets 6.4 4.1

Property, plant & equipment 0.1 2.2

Rental fleet - 0.3

Net working capital (1.0) 4.1

Assets held for sale 2.2 -

Cash balance 5.4 4.8

----------------------------- ----------- -----------

Net assets 13.1 15.5

============================= =========== ===========

Both the closing balance and the increase in the year in the

intangible assets relate to the on-going spend on the SABER rotary

steerable system.

The net book value of property, plant & equipment at $0.1m

is $2.1m down primarily due to sale of the freehold Houston site

plus the annual depreciation charge.

The reduction in net book value of the rental fleet reflects the

disposal of all the rental kits during the year.

The net working capital of ($1.0m) has decreased by $5.1m during

the year. This is primarily due to a decrease in all major

components; debtors down by $3.3m; inventory down $2.4m countered

by creditors down $0.6m. All these movements relate to the

strategic decision to move away from the lower margin MWD market

and no longer offering extended credit terms to the major

customers.

Cash flows

This is a pro-forma statement which is different in presentation

to the statutory format shown on page 38.

Overall, the Group saw a net cash inflow of $0.6m (2022: outflow

of $3.3m) increasing the Group's closing cash balance as at 31

March 2023 to $5.4m. The major elements of the non-operational

cashflow relates to the $3.0m of on-going investment in the

engineering projects, primarily the SABER tool and the disposal of

the freehold Houston site for a net $2.3m.

Year to 31 March: 2023 2022

$ million $ million

Adjusted EBITDA (2.0) 0.3

Change in net operational working

capital 2.9 (0.2)

------------------------------------ ------------- -------------

Operational cash generated 0.9 0.1

Net investment in rental fleet - (0.8)

Investment in engineering projects (2.6) (2.7)

Investment in fixed assets - (0.1)

Interest and share issues - 0.2

Disposal of fixed assets 2.3 -

Net cash movement 0.6 (3.3)

Opening cash balances 4.8 8.1

Closing cash balance 5.4 4.8

==================================== ============= =============

Financial Capital Management

Enteq's financial position continues to be robust. Enteq had no

bank borrowings, or other debt, and had a closing cash position of

$5.3m as at 31 March 2023 ($4.8m as at 31(st) March 2022).

Enteq monitors its cash balances daily and operates under

treasury policies and procedures which are set by the Board.

The financial statements are presented in US dollars as the

Company's primary economic environment, in which it operates and

generates cash flows, is one of US dollars. Apart from its UK based

overhead costs, substantially all other transactions are transacted

in US dollars.

Enteq is subject to the foreign exchange rate fluctuations to

the extent that it holds non-US Dollar cash deposits. The year-end

GBP denominated holdings are approximately 3% of total cash

holdings, down from the 5% of last year's balance.

Annual General Meeting

The Company's Annual General Meeting was held on 29 September

2023 at 11am at the offices of Cavendish Capital Markets, 1

Bartholomew Close, London, EC1A 7BL.

Annual Report and Notice of General Meeting

The Company's 2023 Annual Report and Accounts (together with a

notice of General Meeting proposing an ordinary resolution to

receive the report of the directors, the audited annual accounts

and the auditors' report), will be available on the Company's

website later today, and will today be posted to those shareholders

who have requested to receive copies. The General Meeting will take

place at 11.00 a.m. on Monday 30 October 2023 at the offices of

Cavendish Financial plc, 1 Bartholomew Close, London, EC1A 7BL.

Mark Ritchie

Chief Financial Officer

29 September 2023

Enteq Technologies Plc

Consolidated Statement of profit or loss and other comprehensive

income

Year to Year to

31 March 31 March

2023 2022

Notes $ 000's $ 000's

Total Total

Continued Operations

Revenue - -

Cost of Sales - -

Gross Profit - -

Administrative expenses before amortisation 8 (1,680) (1,530)

Foreign exchange (loss)/profit on operating

activities 8 5 (40)

Total Administrative expenses (1,675) (1,570)

Operating loss (1,675) (1,570)

Finance income 7 37 16

Loss from continued operations (1,638) (1,554)

Tax expense 9 280 -

Loss from discontinued operations 24 (1,446) 767

----------------------------------------------- ------ ---------- ----------

Loss attributable to:

Total loss for the period (2,804) (787)

----------------------------------------------- ------ ---------- ----------

Earnings per share (in US cents) from

continuing operations:

Basic (2.0) (2.2)

Diluted (2.0) (2.2)

Earnings per share (in US cents):

Basic (4.0) (1.1)

Diluted (4.0) (1.1)

Enteq Technologies Plc

Consolidated Statement of Financial

Position

As at 31 As at 31

March 2023 March 2022

Notes $ 000's $ 000's

Assets

Non-current

Intangible assets 11 6,484 4,143

Property, plant and equipment 12 63 2,506

Non-current assets 6,547 6,649

------------ ----------------

Current

Trade and other receivables 14 237 3,537

Inventories 15 - 2,410

Cash and cash equivalents 16 5,351 3,296

Bank deposits 16 - 1,500

Assets held for sale 25 2,184 -

Current assets 7,772 10,743

------------ ----------------

Total assets 14,319 17,392

============ ================

Equity and liabilities

Equity

Share capital 17 1,080 1,072

Share premium 17 92,037 91,919

Share based payment reserve 448 432

Retained earnings (80,489) (77,894)

Total equity 13,076 15,529

------------ ----------------

Liabilities

Current

Trade and other payables 18 1,243 1,863

Total liabilities 1,243 1,863

------------ ----------------

Total equity and liabilities 14,319 17,392

============ ================

Mark Ritchie

Director

Enteq Technologies Plc

Consolidated Statement of Changes in Equity

For year ended 31(st) March 2023

Share

Called

up based

share Retained Share payment Total

capital earnings premium reserve equity

$ 000's $ 000's $ 000's $ 000's $ 000's

As at 1 April 2022 1,072 (77,894) 91,919 432 15,529

Issue of share capital 8 - 118 - 126

Transfers between reserves - 209 - (209) -

Share based payment charge - - - 225 225

Transactions with owners 8 209 118 16 351

Loss for the year - (2,804) - - (2,804)

Other comprehensive income

for the year - - - - -

Total comprehensive income - (2,804) - - (2,804)

-------- --------- -------- -------- --------

Total movement 8 (2,595) 118 16 (2,453)

As at 31 March 2023 1,080 (80,489) 92,037 448 13,076

======== ========= ======== ======== ========

As at 1 April 2021 1,056 (77,324) 91,789 455 15,976

Issue of share capital 16 - 130 - 146

Transfers between reserves - 217 - (217) -

Share based payment charge - - - 194 194

Transactions with owners 16 217 130 (23) 340

Loss for the year - (787) - - (787)

Other comprehensive income

for the year - - - - -

Total comprehensive income - (787) - - (787)

-------- --------- -------- -------- --------

Total movement 16 (570) 130 (23) (447)

As at 31 March 2022 1,072 (77,894) 91,919 432 15,529

======== ========= ======== ======== ========

The accounting policies and notes on pages 40 to 64 form part of

these financial statements.

Enteq Technologies Plc

Consolidated Statement of Cash Flows

Year to Year to

31 March 31 March

2023 2022

$ 000's $ 000's

Cash flows from operating activities

Loss from continued activities (1,638) (1,554)

Loss from discontinued activities (1,446) 767

Finance income (37) (16)

Gain on disposal of FA's (292) (30)

Share-based payment non-cash charges 225 194

Foreign exchange difference 5 (40)

Depreciation/Amortisation 1,162 840

(2,021) 163

Tax received from continuing operations 280 0

Decrease/(Increase) in inventory 1,681 478

Decrease in trade and other receivables 1,853 (964)

Decrease in trade and other payables (617) 320

Increase in rental fleet assets (255) (817)

Net cash from operating activities 921 (822)

------------ ------------

Investing activities

Purchase of tangible fixed assets (25) (58)

Disposal proceeds of tangible fixed

assets 2,266 30

Purchase of intangible fixed assets (2,639) (2,614)

Funds place on interest nearing deposit 1,500 (1,500)

Interest received 37 16

Net cash from investing activities 1,139 (4,127)

------------ ------------

Financing activities

Share issue - 145

Net cash from financing activities - 145

------------ ------------

Increase in cash and cash equivalents 2,060 (4,803)

Non-cash movements - foreign exchange (5) 40

Cash and cash equivalents at beginning

of period 3,296 8,059

Cash and cash equivalents at end of

period 5,351 3,296

------------ ------------

1. BASIS OF PREPARATION

The Group's financial statements have been prepared on an

accrual basis and under the historical cost convention. Monetary

amounts are expressed in US dollars and are rounded to the nearest

thousands, except for earnings per share.

The Company's financial statements are presented in US dollars

as the Company's primary economic environment, in which it operates

and generates cash flows uses this currency.

SEGMENTAL REPORTING

For management purposes, the Group is currently organised into a

single business unit, the Drilling Tools division, which is

currently based solely in the USA.

The principal activities of the group is the design, manufacture

and selling of specialised parts and products for Directional

Drilling and Measurement While Drilling operations for use in the

energy exploration and services sector of the Oil and Gas industry.

Revenue is only generated by the selling activity.

At present, there is only one operating segment and the

information presented to the board is consistent with

the consolidated profit and loss statement and the consolidated

statement of financial position.

The revenues, net assets and non-current assets of the Group can

be analysed by geographic location (post-consolidation adjustments)

as follows:

Revenues

31 March 31 March

2023 2022

$ 000's $ 000's

United States of America 5,846 6,201

China 278 187

Rest of the world 56 228

Europe 38 51

Central Asia 22 396

Australasia 3 243

Total Group revenue 6,245 7,306

------------- ---------

31 March 31 March

2023 2022

$ 000's $ 000's

Contracts with customers 5,701 6,364

Operating lease income 544 942

Total Group revenue 6,245 7,306

--------- ---------

Net Assets

31 March 31 March

2023 2022

$ 000's $ 000's

Europe (UK) 4,276 3,649

United States 8,800 11,880

Total Group net assets 13,076 15,529

--------- ---------

Non-current Assets

31 March 31 March

2023 2022

$ 000's $ 000's

Europe (UK) 63 -

United States 6,484 6,649

Total Group non-current

assets 6,547 6,649

--------- ---------

All of the Group's revenue arises from the sale and rental of

specialised parts and products for Directional Drilling and

Measurement While Drilling operations. The Group had 2 customers

that contributed in excess of 10% of the Group's total sales for

the year (2022: 2). These customers contributed $2,903k and $1,520k

respectively. (2022: $4,086k and $1,014k). No revenue relates to

customers based in the UK (2022: none).

2. EXCEPTIONAL ITEMS

The exceptional items can be analysed as follows:

31 March 31 March

2023 2022

$ 000's $ 000's

Reduction in value of inventory 554 -

Reduction in value of trade receivables 212 -

Bad debt written off 140 -

Severance payments and other

plant closure costs 14 37

Gain on sale of fixed assets (292) (30)

Other 68 -

Total exceptional items 696 7

========= =========

All exceptional items relate to discontinued activities.

3. INCOME TAX

Analysis of tax expense

No liability to UK corporation tax arose on ordinary activities

for the period.

Factors affecting the tax charge

The tax assessed for the period is different from the standard

rate of corporation tax in the UK. The difference is explained

below:

31 March 31 March

2023 2022

$ 000's $ 000's

Loss on ordinary activities before tax (3,084) (787)

--------- ---------

Loss on ordinary activities multiplied

by the

standard rate of corporation tax in

the UK of 19% (2022: 19%): (586) (149)

Effects of:

Items not subject to corporation tax 473 (31)

Tax losses to carry forward 113 181

R&D tax credit 280 -

Total income tax 280 -

========= =========

There has been no deferred taxation recognised in these

financial statements due to the uncertainty surrounding the timing

of the recovery of these amounts. The total losses available to the

Group in the relevant tax jurisdictions are as follows: UK $0.0m;

United States $22.6m (2022: UK $0.5m; United States $22.2m). There

were no significant deferred tax liabilities. These tax losses have

no expiry date. Tax losses for which no deferred tax balances have

been recognised are disclose in Note 14.

4. EARNINGS PER SHARE AND DIVIDS

Basic earnings per share

Basic earnings per share is calculated by dividing the loss

attributable to ordinary shareholders for the year of $2,804k (31

March 2022: loss of $787k) by the weighted average number of

ordinary shares in issue during the year of 69,484k (31 March 2022:

68,604k).

As the Group is loss making, any potential ordinary shares have

the effect of being anti-dilutive. Therefore, the diluted EPS is

the same as the basic EPS. As the year end share price is below the

weighted average option price of all the options issued, the

adjusted diluted EPS is the same as adjusted EPS.

The number of outstanding share options, including senior

managers, that are not included in the above figures are as

follows:

31 March 31 March

2023 2022

000's 000's

EMI plan 170 233

PSP plan 5,616 3,670

--------- ---------

Total 5,786 3,903

========= =========

.

March 2023: EPS Weighted

average number Per-share

Earnings of shares amount

$ 000's 000's US cents

Loss attributable to ordinary

shareholders 2,804 69,484 (4.0)

========== =============== =========

March 2022: EPS Weighted

average number Per-share

Earnings of shares amount

$ 000's 000's US cents

Loss attributable to ordinary

shareholders 787 68,604 (1.1)

========== =============== =========

During the year Enteq Technologies Plc did not pay any dividends

(2022: nil).

5. INTANGIBLE ASSETS

Other Intangible Assets

Developed IPR&D Brand Customer Total

technology technology names relationships

$ 000's $ 000's $ 000's $ 000's $ 000's

Cost:

As at 1 April 2022 13,237 15,267 1,240 - 29,744

Transfer 102 (102) - - -

Capitalised in

period - 2,639 - - 2,639

------------ ------------ -------- --------------- ---------

As at 31 March

2023 13,339 17,804 1,240 - 32,383

------------ ------------ ---------

Amortisation/Impairment:

As at 1 April 2022 13,041 11,320 1,240 - 25,601

Writte off during

the year (110) - - - (110)

Charge for the

year 408 - - - 408

------------ ------------ -------- --------------- ---------

As at 31 March

2023 13,339 11,320 1,240 - 25,899

------------ ------------ -------- --------------- ---------

Net Book Value:

------------ ------------ -------- --------------- ---------

As at 1 April 2022 196 3,947 - - 4,143

============ ============ ======== =============== =========

As at 31 March

2023 - 6,484 - - 6,484

============ ============ ======== =============== =========

Cost:

As at 1 April 2021 12,842 13,048 1,240 20,586 47,716

Transfers 275 (275) - - -

Disposal - - - (20,586) (20,586)

Capitalised in

period 120 2,494 - - 2,614

------------ ------------ -------- --------------- ---------

As at 31 March

2022 13,237 15,267 1,240 - 29,744

------------ ------------ -------- --------------- ---------

Amortisation/Impairment:

As at 1 April 2021 12,842 11,320 1,240 20,586 45,988

Disposal - - - (20,586) (20,586)

Charge for the

year 199 - - - 199

------------ ------------ -------- --------------- ---------

As at 31 March

2022 13,041 11,320 1,240 - 25,601

------------ ------------ -------- --------------- ---------

Net Book Value:

------------ ------------ -------- --------------- ---------

As at 1 April 2021 - 1,728 - - 1,728

============ ============ ======== =============== =========

As at 31 March

2022 196 3,947 - - 4,143

============ ============ ======== =============== =========

The main categories of Intangible Assets are as follows:

Developed technology:

This is technology which is currently commercialised and

embedded within the current product offering.

IPR&D technology:

This is technology which is in the final stages of field

testing, has demonstrable commercial value and is expected to be

launched within the foreseeable future.

Brand names:

The value associated with the various trading names used within

the Group.

Customer relationships:

The value associated with the on-going trading relationships

with the key customers acquired.

Impairment Review

Impairment Review

Due to the sale of the XXT business assets, there is now

considered to be only one main cash generating unit ("CGU") - that

is relating to the SABER project. This CGU is in the carried

forward value for IPR&D technology in the table above with a

value of $6,484k (2022: $3,947k)

The recoverable amount of the CGU at the balance sheet date was

assessed as a directors' valuation (2022: directors' valuation) and

is determined from value in use calculations both where the asset

is currently in use or will be in the near future. The directors

have applied a discounted cashflow approach to determine the

carrying value for the SABER project and intangible asset being

carried in these financial statements.

The key assumptions made by the directors (2022: directors) for

the discounted cash flow workings are:

- the expected roll out of the technology over five years to 31

March 2028 (2022: not disclosed);

- an exit value at the beginning of year six on an estimated

multiple;

- that the roll out will not be significantly impacted by

competing technologies (2022: same assumption);

- that the Group will introduce a phased roll out of rental

units of between 5 and 20 in each key region from 1 April 2024

onwards (2022: not disclosed) with a typical number of days usage

per unit;

- each rental unit will generate a similar amount of revenue per

unit irrespective of the region in which it operates (2022: not

disclosed);

- the expected operating life of each rental unit is >5 years

and annual servicing costs for each have been included in the

workings (2022: not disclosed);

- that the expected revenues arise from projects based upon

agreements in place as well as agreements which currently do not

yet exist and that the Group will put in place an appropriate plan

to field the number of rental units in the model (2022: same

assumption);

- that the company currently has the financial resources to

build the number of rental units and that there is no requirement

at present to raise additional income from new fund raises (2022:

same assumption), whilst noting that additional scenarios are

continuously under evaluation to provide financing to further

accelerate fleet build-up;

- applying a discount rate to cashflow of 25% (2022: 13.4%)

assessed by a review of discount rates for projects within similar

and competing sectors which was considered to provide a reasonable

estimate of a weighted average cost of capital for a company

benefiting from the assumed roll out;

- that the field testing is successful and completed and that

the technology can be rolled out commercially from 1 January 2024

without any fundamental developmental challenges.

Changes to the above assumptions would impact the valuation

assessment.

The Directors believe that the key sensitivities in the

valuation are as follows:

(i) The directors have assumed a phased build-up of rental units

to be in operation in each key region from 1 April 2024 onwards.

Sensitivity workings with a reduction to the total of 10 rental

units showed a decrease in valuation by between $2 million to $4

million.

(ii) The discount rate applied to the cashflows. Sensitivity

workings with a discount rate 5% higher at 30% would decrease the

valuation by between $3.0 million and $6.0 million.

(iii) Inflation - an increase in the inflation assumption above

that assumed by the directors valuation of 5%.

(iv) Growth rates - The directors have assumed growth rates in

revenues of 33% once the SABER business has been established,

resulting from the fleet expansion.

The Directors have not accounted for the possibility of any

onerous obligations arising with the contracts as there is no

reason to expect that these will arise at this stage in the

business life cycle.

Currently the SABER project is towards the end of the

development phase and is forecast to be cash generating from 31 May

2024.

6. RESPONSIBILITY STATEMENT OF THE DIRECTORS

To the best of the knowledge of the Directors (whose names and

functions are set out below), the final results announcement has

been prepared using accounting policies and methods of computation

consistent with those used in the Group's annual report for the

year ended 31 March 2022 and adopted for the financial year ended

31 March 2023, gives a true and fair view of the assets,

liabilities, financial position and profits and losses for the

Company and the undertakings included in the consolidation taken as

a whole.

Executive Directors

Andrew Law Chief Executive Officer

Mark Ritchie Chief Financial Officer

Non-Executive Directors

Martin Perry Chairman

Neil Hartley

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UKAOROAUKUAR

(END) Dow Jones Newswires

September 29, 2023 09:20 ET (13:20 GMT)

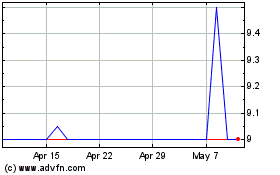

Enteq Technologies (LSE:NTQ)

Historical Stock Chart

From Apr 2024 to May 2024

Enteq Technologies (LSE:NTQ)

Historical Stock Chart

From May 2023 to May 2024