(b) deferred land rights acquisition costs representing the cost

associated with the legal transfer or renewal for titles of land

rights such as, among others, legal fees, land survey and

re-measurement fees, taxes and other related expenses. Such costs

are also deferred and amortised on a straight-line basis over the

tenure of the related land rights.

Acquisition during the financial year

On 19 August 2013, the Group acquired a piece of long-term

leasehold agricultural land through the acquisition of Grand

Performance Sdn. Bhd. as disclosed in Note 1(b).

Assets pledged as security

The land use rights were pledged to secure the bank overdrafts,

short term revolving credit, term loans facilities and the MTN

Programme as disclosed in Note 25.

18. Goodwill on consolidation

2013 2012

USD'000 USD'000

At 1 January 7,619 7,335

Arising from the acquisition of a

subsidiary (Note 1(b)) - 5

Impairment of goodwill - (5)

Exchange differences (520) 284

At 31 December 7,099 7,619

Goodwill has an indefinite useful life and is subject to annual

impairment testing.

(a) Impairment testing of goodwill

Goodwill arising from business combinations is allocated to the

cash-generating unit for the purpose of impairment testing. The

cash-generating unit is as follows:

2013 2012

USD'000 USD'000

Plantation Estates

Goodwill 7,099 7,619

The recoverable value of the goodwill of plantation estates as

at 31 December 2013 was determined based on value-in-use

calculations using cash flow projections, covering a period of 25

productive years of oil palms, from financial budgets approved by

management. The calculations were based on the following key

assumptions:

2013 2012

Discount rate (pre-tax) 9.5% to 10.5% 10.5% to 11.3%

Projected CPO price USD868/tonne USD907/tonne

(b) Key assumptions used in value-in-use calculations

The calculations of value-in-use are most sensitive to the

following assumptions:

CPO price - The long term average CPO price is based on

delivered price as published by the Malaysia Palm Oil Board.

Discount rate - The discounted rate reflects the current market

assessment of the risk specific to palm oil industry. The discount

rate applied to the cash flow projection is pre-tax and derived

from the weighted average cost of equity and cost of debt,

calculated based on the subsidiaries' actual composition of the

equity and debt of the plantation estates.

Based on the above analysis, management has assessed that the

goodwill is not impaired as at 31 December 2013 and 2012. Changes

to the assumptions used by management to determine the recoverable

amounts can have an impact on the results of the assessment.

Management is of the opinion that no reasonably possible change in

any of the key assumptions stated above would cause the carrying

amount of the goodwill for each of the CGUs to materially exceed

their recoverable amount.

19. Inventories

2013 2012

USD'000 USD'000

At cost:

Crude palm oil 223 -

Palm kernel 72 -

Chemicals and fertilisers 729 1,020

Consumable supplies 518 704

1,542 1,724

20. Trade and other receivables

2013 2012

USD'000 USD'000

Trade receivables 386 259

Other receivables:

Deposits 5,312 5,820

Sundry receivables 1,040 635

Total trade and other receivables 6,738 6,714

Add: Cash and short-term deposits (Note

22) 10,813 15,785

Total loans and receivables carried

at amortised cost 17,551 22,499

Trade receivables

Trade receivables are non-interest bearing and are generally 30

days' (2012: 30 days') terms. They are recognised at their original

invoice amounts which represent their fair values on initial

recognition.

Deposits

Included in deposits is amount totalling USD4,025,000 (2012:

USD4,828,000) paid for the proposed acquisition of Malaysian

companies and land use rights.

Other receivables that are not denominated in the functional

currencies of the respective entities are as follows:

2013 2012

USD'000 USD'000

Singapore Dollars ("SGD") 25 25

Other information on financial risk of trade and other

receivables is disclosed in Note 33(a).

21. Prepayments

Prepayments comprise prepaid operating expenses.

22. Cash and short-term deposits

2013 2012

USD'000 USD'000

Cash at banks and on hand 4,289 5,255

Short-term deposits 6,524 10,530

10,813 15,785

Short-term deposits earn interest at 3% (2012: 3%) p.a.

As at 31 December 2013, the amount of undrawn committed credit

facilities that may be available in the future amounts to

USD17,261,000 (2012: USD53,609,000).

The Group has pledged a part of its short-term deposits

amounting to USD62,000 (2012: USD149,000) to fulfil collateral

requirements for supply of goods and USD801,000 (2012: USD835,000)

as security for a term loan facility as disclosed in Note 25.

Cash and bank balances that are not denominated in the

functional currencies of the respective entities are as

follows:

2013 2012

USD'000 USD'000

SGD 20 1,188

USD 3,155 2,088

GBP 172 1,725

For the purpose of the consolidated statement of cash flows,

cash and cash equivalents comprise the following at the end of the

reporting period:

2013 2012

USD'000 USD'000

Cash and short-term deposits 10,813 15,785

Less: Short-term deposits pledged for

supply of goods (62) (149)

Less: Short-term deposits pledged for

a banking facility (Note 25) (801) (835)

9,950 14,801

Bank overdraft (Note 25) (2,477) (613)

7,473 14,188

23. Issued capital

2013 2012

No. of shares No. of shares

'000 USD'000 '000 USD'000

Issued and fully

paid ordinary shares

At 1 January 46,511 88,594 46,175 87,321

Issuance during

the year 250 1,137 336 1,273

At 31 December 46,761 89,731 46,511 88,594

The holders of ordinary shares are entitled to receive dividends

as and when declared by the Company. Each ordinary share carries

one vote per share without restriction. The ordinary shares have no

par value.

Issuance of shares

On 17 May 2013, a director exercised 250,000 Initial Options

that were granted in accordance with the Company's share option

scheme (Note 29) and these shares were subsequently listed on AIM

on 22 May 2013.

On 16 April 2012, the Board approved the allotment of 23,000

shares pursuant to the exercise of initial options granted to a

consultant in accordance with the Company's share option scheme

(Note 29) and these shares were subsequently listed on AIM on 30

April 2012.

On 28 May 2012, the Board approved the conversion of the

convertible bond with face value of USD1,000,000 to 313,383

ordinary shares of the Company and these shares were subsequently

listed on AIM on 7 June 2012.

24. Other reserves

The composition of other components of other reserves is as

follows:

2013 2012

USD'000 USD'000

Merger reserve (20,256) (20,256)

Foreign currency translation reserve (2,213) 1,736

Share-based payment transaction reserve

(Note 29) 9,982 10,604

(12,487) (7,916)

Merger reserve

Pursuant to an agreement dated 9 November 2009, the Company

acquired the entire issued and paid-up capital of APS at par,

comprising 22,500,000 ordinary shares of RM1 each, in exchange for

22,500,000 shares of the Company. As this arrangement constitutes a

combination of entities under common control, the pooling of

interest method of accounting was adopted in the preparation of the

consolidated financial statements of the Group. Under this method

of accounting, the results and cash flows of the Company and its

subsidiaries and their assets and liabilities are combined at the

amounts at which they were previously recorded as if they had been

part of the Group for the whole of the current and preceding

periods.

Merger reserve represents the difference between the

consideration paid and the share capital of the "acquired" entity,

APS.

Foreign currency translation reserve

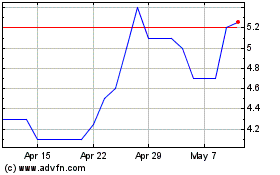

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

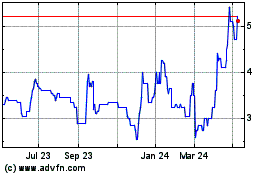

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024