RNS Number:5776K

Petaling Tin Berhad

25 September 2001

Quarterly Report on Consolidated Results For the Third Quarter Ended 31st

July 2001

(The figures have not been audited)

CONSOLIDATED INCOME STATEMENT

INDIVIDUAL QUARTER CUMULATIVE QUARTER

CURRENT PRECEDING CURRENT PRECEDING

YEAR YEAR YEAR TO CORRESPONDING

QUARTER CORRESPONDING DATE YEAR TO

QUARTER DATE

31/7/01 31/7/00 31/7/01 31/7/00

RM'000 RM'000 RM'000 RM'000

1 (a) Revenue 11,320 11,910 21,939 17,471

(b) Investment income 7 - 15 -

(c) Other income 503 587 1,074 791

2 (a) Profit/(loss) before

finance cost, depreciation

and amortisation,

exceptional items, income

tax, minority interests

and extraordinary items 4,476 3,748 8,372 4,608

(b) Finance cost (28) (43) (44) (467)

(c) Depreciation and

amortisation (470) (432) (1,412) (1,387)

(d) Exceptional items - - - -

(e) Profit/(loss) before

income tax, minority interests

and extraordinary items 3,978 3,273 6,916 2,754

(f) Share of profits and losses

of associated companies - - - -

(g) Profit/(loss) before income

tax, minority interests and

extraordinary items after share

of profits and losses of

associated companies 3,978 3,273 6,916 2,754

(h) Income tax (1,112) (1,182) (1,795) (2,808)

(i) i) Profit/(loss) after

income tax before deducting

minority interests 2,866 2,091 5,121 (54)

ii) Minority interests - - - -

(j) Pre-acquisition profit/(loss) - - - -

(j) Net profit/(loss) from

ordinary activities

attributable to members of the

Company 2,866 2,091 5,121 (54)

(l) i) Extraordinary items - - - -

ii) Minority interests - - - -

iii) Extraordinary items - - - -

attributable to members

of the Company

(m) Net profit/(loss) attributable

to members of the Company 2,866 2,091 5,121 (54)

3 (a) Earnings per share based

on 2 (m) above after deducting

any provision for preference

dividends, if any

i) Basic (based on

ordinary shares - sen) 1.64 2.07 3.61 (0.07)

ii) Fully diluted (based on

ordinary shares - sen) 0.83 - 1.48 -

Remark:

Earning per share

(i) Basic

(a) current year quarter - based on 174,421,646 weighted ordinary shares.

(b) Preceding year quarter (restated) - based on 100,842,060 weighted

ordinary shares.

(c) current year-to-date - based on 141,720,497 weighted ordinary shares.

(d) Preceding corresponding year (restated) - based on 75,293,945 weighted

ordinary shares.

(ii) Fully diluted

(a) current year quarter and current year-to-date - based on 346,102,681

weighted ordinary shares.

CONSOLIDATED BALANCE SHEET

(UNAUDITED) (AUDITED)

AS AT CURRENT AS AT PRECEDING

QUARTER ENDED FINANCIAL YEAR

31 Jul 2001 ENDED 31 Oct 2000

RM'000 RM'000

1. Fixed Assets 15,428 16,630

2. Investment in Associated Companies - -

3. Long Term Investments 249,203 249,124

4. Intangible Assets - -

5. Current Assets

Development properties and expenditure 127,577 119,826

Stocks 15,938 18,225

Trade debtors 38,291 30,096

Short term investments 349 373

Other debtors, deposits and prepayments 3,600 3,386

Fixed deposits with financial institutions 13,283 33,724

Cash and bank balances 728 4,858

199,766 210,488

6. Current Liabilities

Trade creditors 3,399 5,882

Other creditors and accrued liabilities 31,984 46,316

Hire purchase creditors 77 71

Term loan 1,802 3,662

Taxation 10,313 8,170

47,575 64,101

7. Net Current Assets 152,191 146,387

416,822 412,141

8. Shareholders' Funds

Share Capital 174,422 100,844

Reserves

Share Premium 16,485 4,712

Capital Reserve 2,584 2,584

Retained Loss (16,318) (21,438)

177,173 86,702

9. Deferred Taxation 40,490 40,884

10.Long Term Borrowings 9 55

11.Irredeemable Convertible Unsecured

Loan Stocks 2000/2010 ("ICULS") 199,150 284,500

416,822 412,141

12.Net Tangible Assets Per Share (RM) 1.02 0.86

QUARTERLY REPORT ENDED 31/07/2001

Notes

1. Accounting Policies

The accounts of the Group are prepared using the same accounting policies,

method of computation and basis of consolidation as those used in the

preparation of the latest audited annual financial statements.

2. Exceptional items

There were no exceptional items for the financial quarter under review.

3. Extraordinary items

There were no extraordinary items for the financial quarter under review.

4. Taxation

Individual Quarter Cumulative Quarter

Current Current Preceding

Year Year Year

Quarter To Date To Date

31.07.2001 31.07.2001 31.07.2000

RM'000 RM'000 RM'000

Taxation comprises of the followings:

Malaysian taxation based on profit

for the period:

Current 1,563 3,024 2,457

Deferred (298) (423) 2,247

1,265 2,601 4,704

Over provision in prior period: (153) (806) (1,896)

1,112 1,795 2,808

The Group effective tax rate for the current quarter and financial year to

date is higher than the standard tax rate as there is no Group relief for

losses suffered by the Company and certain subsidiary companies and certain

expenses were disallowed for tax purposes.

5. Profit on sales of Investments and/or Properties

There were no profit on sales of investments and/or investment properties for

the current financial year to date.

6. Quoted securities

a) There were no purchases nor disposal of quoted securities for the current

financial year to date.

b) Total investments in quoted securities as at 31 July 2001 are as follows:

RM'000

At cost 1,152

Provision for diminution in value (803)

At book value 349

Market value 379

7. Changes in the Composition of the Group

There were no changes in the composition of the Group for the current quarter

and financial year to date.

8. Status of Corporate Proposals

Detailed below is the status of corporate proposals that have been announced

as at the date of the report:

a) The rescue exercise duly approved by the shareholders at an Extraordinary

General Meeting held on 20 August 1999 ("Rescue Proposals") has been

completed, save and except for the transfer of land title of the

Ulu Kelang Project, which is in progress.

b) On 12 September 2000, Petaling Tin Berhad ("PTB") had announced the

proposed acquisition of 62,400,000 ordinary shares of HKD1.00 each

representing 80% equity interest in the capital of Naga Resorts & Casinos

Limited ("NRCL") from Sharpwin International Limited ("Sharpwin") for a

purchase consideration of RM 1,307,200,000. The application to the

Securities Commission in respect of the Proposed Acquisition has been

withdrawn, pursuant to the Company's announcement on 23 July 2001.

9. Issuance and Repayment of Debt and Equity Securities

On 5 March 2001, RM85,350,000 nominal value of ICULS (2000/2010) was converted

into 73,577,586 new ordinary shares of RM1.00 each in the Company at a

conversion price of RM1.16 per share.

Other than the above, there were no other issuance and repayments of debt and

equity securities, share buy-backs, share cancellations, shares held as

treasury shares and resale of treasury shares for the financial year to date.

10. Group Borrowings and Debt Securities

Total Group borrowings as at 31 July 2001 are as follows:

Secured RM'000

Long Term Borrowings

Total outstanding balances 1,888

Repayment due within the next 12 months (1,879)

Total 9

Short Term Borrowings

Current portion of term loan and hire purchase 1,879

The above borrowings are denominated in Ringgit Malaysia.

11. Contingent Liabilities (secured)

The Group does not have any contingent liability since the preceding financial

year ended 31 October 2000.

12. Off Balance Sheet Financial Instruments

The Group does not have any financial instruments with off balance sheet

risk as at the date of this report.

13. Material Litigation

Save as disclosed below, the Group is not engaged in any material litigation

as at the date of this report.

(a) On 12 April 1996, Lam Hong Kee Sdn. Bhd. ("LHKSB") entered into a Sale

and Purchase Agreement with Magilds Industrial Park Sdn. Bhd. ("MIPSB"),

a subsidiary of the Company, for the purchase of an industrial lot held

under the land title HS(D) 37590 P.T. No. 19694, Mukim Batu, District of

Kuala Lumpur at the purchase price of RM786,258.00. LHKSB is claiming

among others for a refund of RM314,503.20 which they have paid in

respect of the progressive payment towards the purchase price and a

claim for the sum of RM69,398.01 being interest of the progressive

purchase price paid. The case has been fixed for hearing in Court on 12

December 2001.

(b) On 24 October 1996, Excel Chemical Trading Sdn. Bhd. ("Excel") entered

into a Sale and Purchase Agreement with MIPSB for the purchase of an

industrial lot held under the land title HS(D) 37590 P.T. No. 19694,

Mukim Batu, District of Kuala Lumpur at the purchase price of

RM996,912.00. Excel is claiming among others for a refund of

RM398,764.80 which they have paid in respect of the progressive

payment towards the purchase price and late delivery or vacant

possession in the sum of RM93,682.41. The case has yet to be fixed for

hearing in Court.

14. Segmental Reporting for the current financial year to date

Profit/(loss) before taxation,

minority interest and Assets

Turnover extraordinary items Employed

Analysis by activity RM'000 RM'000 RM'000

Investment holding 0 (2,052) 160,227

Manufacturing 0 (1,393) 13,241

Property and investment holding 21,939 10,361 290,929

21,939 6,916 464,397

The geographical analysis is not presented as the Group's operations are

solely based in Malaysia.

15. Material Changes in the Quarterly Results compared to the results of the

Preceding Quarter

The Group recorded a pre-tax profit of RM3.978 million in the quarter ended 31

July 2001 as compared to previous quarter's pre-tax profit of RM0.334 million.

The significant improvement is mainly due to income generated as a result of

progress of work in property development project, namely Magilds Industrial Park

in Sungai Buloh.

16. Review of Performance of the Company and its Principal Subsidiaries

For this quarter ended 31 July 2001, the Group has achieved a pre-tax profit

of RM3.978 million as compared to pre-tax profit of RM3.273 million for the

corresponding quarter ended 31 July 2000. The slight improvement is mainly

due to income generated as a result of progress of work in property

development projects.

The Group has achieved a pre-tax profit of RM6.916 million for this financial

year to date as compared to pre-tax loss of RM2.754 million for the

corresponding financial year to date. The significant improvement is mainly

due to income generated as a result of progress of work in property

development projects.

17. Material Events Subsequent to the Financial Year to Date

There were no material events subsequent to the third quarter ended 31 July

2001 till the date of this report.

18. Seasonal or Cyclical Factors

The business operations of the Group are generally affected by major festive

seasons. However, the Group's current quarter performance was not affected,

as there were no major festive seasons.

19. Prospects for the Remaining Period of the Financial Year

The Board of Directors has observed that the property development industry is

still in its recovery course and margins remain squeezed due to fierce

competition resulting from a prolonged oversupply situation. The weaker

economic forecast and generally weak consumer confidence is expected to

present challenges to the Group's property development business. However,

barring any unforeseen circumstances, the Board of Directors expects the

Group to remain profitable for the current financial year.

20. Variance of Actual Profit from Forecast Profit

Not applicable for the financial quarter under review.

21. Dividend

There was no dividend proposed for the current financial year to date.

By Order of The Board

PETALING TIN BERHAD

LAI GIN NYAP

Chief Financial Officer

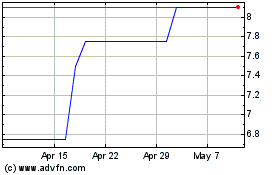

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

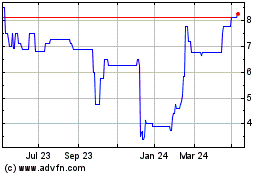

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024