TIDMPEG

RNS Number : 3411Z

Petards Group PLC

14 March 2017

14 March 2017

PETARDS GROUP PLC

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2016

Petards Group plc ("Petards"), the AIM quoted developer of

advanced security and surveillance systems, reports its audited

results for the year ended 31 December 2016.

Key points:

-- Financial

o Results for 2016

-- Revenues up 17% to GBP15.3 million (2015: GBP13.1

million)

-- Gross margin up to 36.3% from 35.2% in 2015

-- EBITDA increased 28% to GBP1,621,000 (2015: GBP1,266,000)

-- Operating profit increased 17% to GBP1,095,000 (2015:

GBP935,000 profit)

-- Profit after tax GBP910,000 (2015: GBP765,000 profit)

o Finance

-- Generated GBP1 million of operating cash inflows (2015:

GBP1.2 million)

-- Cash at 31 December 2016 GBP2.3 million (31 Dec 2015: GBP2.5

million) and no bank debt

-- Basic EPS increased 18% to 2.59p earnings per share (2015:

2.19p)

-- Diluted EPS increased 15% to 1.86p earnings per share (2015:

1.62p per share)

-- Operational

o Closing order book GBP20 million (2015: GBP16 million)

o Order book grew by GBP8 million in the second half of 2016

with orders received from Siemens Mobility, Bombardier

Transportation, Greater Western Rail, Hitachi Rail Europe and the

MOD

o Exports increased by 57% to GBP5.3 million and comprise over

one third of Group revenues

o Acquisition of QRO Solutions successfully completed in April

2016 for net cash consideration of GBP239,000 contributing

GBP78,000 to EBITDA before acquisition expenses

o Investment made in

-- Development of eyeTrain range particularly focus on software

features

-- Expansion of the Group's software development personnel and

facilities

-- Outlook

o Current order book includes GBP12 million scheduled for

delivery in 2017

Raschid Abdullah, Chairman of Petards, commented:

"In light of the strength of the Group's order book containing

orders of GBP12 million expected to be shipped and taken to revenue

during 2017, and on-going discussions with both new and existing

customers for further exciting projects, the board remains

confident about the future prospects of the Group for 2017."

Contacts

Petards Group plc www.petards.com

Raschid Abdullah, Chairman Mb: 07768 905004

WH Ireland Limited, Nomad www.whirelandcb.com

and Joint Broker

Mike Coe, Ed Allsopp Tel: 0117 945 3470

Hybridan LLP, Joint Broker www.hybridan.com

Claire Louise Noyce Tel: 020 3764 2341

Chairman's statement

I am very pleased to report to you that the Group has made good

progress during 2016 and achieved many of the operational

improvements set out in my last annual statement.

Petards produced another creditable performance for the year

ended 31 December 2016 with the Group trading strongly, the order

book growing following the receipt of several significant new

contracts, the acquisition of QRO Solutions ("QRO") being

completed, and additional core investment made to strengthen our

software operational capabilities and eyeTrain range of

products.

With revenues up to GBP15.3 million and gross margins up

slightly to 36%, the Group recorded pre-tax profits of GBP925,000

against GBP762,000 for the previous year representing a 21%

increase. Revenues from continuing operations increased by 8%

reflecting additional deliveries of eyeTrain products and up

overall by 17% including a maiden contribution from QRO. Basic

earnings per share improved by 18% to 2.6p with fully diluted

earnings per share increasing to 1.9p against 1.6p in 2015.

The trend of the changing revenue mix towards the Group's

eyeTrain products reported in 2015 continued and these now comprise

around 60% of Group revenues. This strong performance coupled with

reduced levels of revenue from our defence products means that for

the first time the Group's largest customer was from the rail

industry rather than the defence sector.

The cash-generative nature of the business continued with the

Group delivering an operating cash inflow of GBP1 million for the

year. This was ploughed back into the business with significant

investments being made in growing the Group's software

capabilities, people and dedicated testing facilities, in addition

to the acquisition of QRO. Consequently, cash balances at 31

December 2016 remained healthy at GBP2.3 million albeit marginally

lower than the closing balance of GBP2.5 million at 31 December

2015.

These investments flow on from those made in the latter half of

2015 which were approved by the Board last year in order to place

the business in a stronger market position with the integration of

improved technologies. A key part of this strategy covered the

expansion of our product range and enhancing the performance of our

systems in order to support our existing business relationships and

provide growth in our customer base.

In the second half of 2016 the forward order book grew

substantially following receipt of a number of larger contracts

totalling over GBP13 million that were predominantly for eyeTrain

systems. Orders from Bombardier Transportation were followed by

awards from Great Western Railway, Hitachi Rail Europe, Siemens

Mobility and the MOD in the final quarter of the year. Consequently

the Group entered 2017 with an order book of GBP20 million being

23% up on the prior year, of which broadly GBP12 million is

expected to be taken to revenue during 2017.

Following the orders referred to above, around 75% of the

closing order book related to eyeTrain. These include projects that

once completed will result in a substantial increase in software

driven functionality of eyeTrain systems that will provide

significant benefits to train operating companies. With increasing

passenger numbers and capacity constraints, operators are

continually looking for opportunities to increase both capacity and

operating efficiency. We are hopeful this additional eyeTrain

functionality will prove to be another differentiator for Petards

in that market.

The acquisition of QRO in April for a net cash consideration of

GBP239,000, complements the Group's existing presence in the

Emergency Services sector which it serves through its ProVida brand

and is now able to support a broader offering to the police and

security market. This includes 'end-to-end' fixed site, mobile,

re-deployable and hand-held ANPR solutions utilising QRO's

longstanding integration expertise and back office management

software skills. QRO made a maiden contribution to Group EBITDA of

GBP78,000 for the period and the board anticipates that this

contribution will grow steadily as it develops its markets and

products with the support of the Group.

The profitable and cash-generative trading record of the past

three years, a good balance sheet and healthy order book provides a

good foundation on which to continue to develop the Group both

organically and by acquisition. The board continues to evaluate

potential acquisitions which could serve to expand the business and

enhance value for shareholders.

The year was particularly demanding for all of our employees

with substantial new business being won, the expansion of our

facilities and the increase and integration of new staff into our

Gateshead operation. I also welcome the addition of all employees

at QRO to the Group and look forward to working with them.

The Group's performance during the year is the result and

achievement of all our employees and I would therefore like to

express my sincere thanks on behalf of the board and all

stakeholders for their excellent contribution during 2016. Their

effort and commitment is much appreciated and is a key determinant

for the future success of the Group.

In light of the strength of the Group's order book containing

orders of GBP12 million expected to be shipped and taken to revenue

during 2017, and on-going discussions with both new and existing

customers for further exciting projects, the board remains

confident about the future prospects of the Group for 2017.

Raschid Abdullah

Chairman

14 March 2017

Business review

Following the QRO acquisition the Group's operations continue to

be focused upon the development, supply and maintenance of

technologies used in advanced security, surveillance and ruggedized

electronic applications, the main markets for which are:

-- Rail Transport - software driven video and other sensing

systems for on-train applications sold under the eyeTrain brand to

global train builders, integrators and rail operators;

-- Emergency Services - in-car speed enforcement and end-to-end

Automatic Number Plate Recognition ("ANPR") systems sold under the

ProVida and QRO brands to UK and overseas law enforcement agencies;

and

-- Defence - electronic countermeasure protection systems,

mobile radio systems and related engineering services sold

predominantly to the UK Ministry of Defence ("MOD").

The Group continued to make further progress during 2016,

increasing revenues, margins and profitability while significantly

growing its order book by securing a variety of orders from its

blue-chip and international customer base.

Operating review

While the Group's Defence and Emergency Services products made

important contributions to revenues and profits during 2016, the

success of the year was the continued growth in revenues for its

eyeTrain systems which increased significantly. This increase was

achieved across a number of projects amongst which were Thameslink,

South West Trains and Turkey for the train builder Siemens Mobility

("Siemens"). Deliveries on the Thameslink project, which is the

largest rail order secured by the Group to date, reached their peak

during 2016 and are scheduled to be completed by the end of

2017.

In addition to Siemens, other significant projects included

those for Bombardier Transportation ("Bombardier"), Great Western

Railway ("GWR") and Hitachi Rail Europe ("Hitachi").

Over recent years the Group's strategy of moving its primary

focus in the rail industry towards being a supplier to major new

train builders, rather than to the train retro-fit and

refurbishment market, has borne fruit. While this segment of the

market has a longer sales and order execution cycle, the result has

been a larger order book which greatly enhances the forward

visibility of revenues. This enables the Group to plan and invest

more effectively and with greater certainty and the investments

made in 2016 in product, people and facilities have been made

against that backdrop.

In the second half of 2016 the Group secured a number of major

projects from existing rail customers. These comprised a good mix

of extensions to existing orders, new projects for classes of train

for which eyeTrain was already specified, new train designs onto

which eyeTrain is to be integrated for the first time, and finally

projects involving the design, development and supply of new

eyeTrain applications. The latter two of these four categories of

order are particularly encouraging as they represent the growth

opportunities of the future.

The number of major train builders across the world is

relatively small and Petards already lists a good number of these

amongst its customers. Nevertheless, the Group is keen to expand

its customer base and efforts to do so will continue in 2017. There

are presently a number of significant sales opportunities being

worked upon, including with new customers, that we anticipate will

result in orders being placed with Petards over the coming

year.

Orders and revenues for Petards' defence related products and

services are driven both by the operational activities of the UK's

armed forces and by periodic upgrades to equipment. Revenues for

these products and services comprise a core of business in respect

of on-going support supplemented by orders for large projects.

While these large projects may arise from either urgent operational

requirements ("UORs") or the on-going development of the MOD's

capabilities, in times such as these when the UK's armed forces are

not deployed on active combat, orders for Petards' products

relating to UORs reduce accordingly. Therefore as expected 2016 saw

a reduction in the level of business in this area and we presently

anticipate a similar situation in 2017.

During the year the GBP4.5 million contract to modify electronic

countermeasures equipment fitted to aircraft within the MOD's

fleet, that had been on-going since mid-2014, was successfully

completed to schedule and budget, albeit that its contribution to

revenues was, as expected, some GBP2.25 million lower than in 2015.

Petards also secured a GBP0.8 million contract from the MOD for the

supply of radio equipment and support services, which was delivered

in the first half of the year. Towards the end of the year the MOD

also renewed for a further three years the Group's contract to

support ALE 47 and M147 threat adaptive countermeasures dispensing

systems which are fitted to Lynx, Puma, Chinook, Merlin, and C130J

aircraft. The core element of the contract is worth in excess of

GBP1.6 million over the three year term. However the Group expects

the value to be significantly higher than this reflecting

additional engineering, repair, refurbishment and manufacturing

activities likely to be provided within the frame of the contract.

The MOD also has the option to extend the contract for a further

two years until 31 December 2021.

As previously reported, revenues for our ProVida products in

2015 benefitted from a large spares order from an export customer.

While 2016 revenues were lower than 2015, increased order activity

from other customers meant that, excluding the impact of the above

spares order, they were ahead of those achieved in 2015.

Petards has operated within the speed enforcement and ANPR

markets for many years and the board has always considered this to

be an interesting sector with scope for the Group to expand its

presence. Therefore it was pleasing to go some way in achieving

this through the acquisition of QRO in April. While QRO's

contribution during the year was relatively modest, it was in line

with the board's expectations and was net of some costs instigated

by QRO's management to better position the business for the

future.

QRO was established over 15 years ago providing end-to-end ANPR

security and speed enforcement solutions to UK police forces and to

integrators serving the police and security markets. As well as

enhancing the Group's product and service offering to those

markets, a feature of QRO's business that did not previously exist

in Petards' portfolio is its strong service-based operation

generating recurring revenues through customer support

contracts.

Closing 2016 with an order book of GBP20 million that was up 23%

on the previous year, the Group has good visibility of earnings for

2017. GBP12 million of that order book is scheduled for delivery in

2017 and its composition is a demonstration of the progress made by

the Group in its move from reliance upon orders that are one-off in

their nature to those arising from the its products being specified

on new build projects.

Financial review

Operating performance

Revenues for the year increased by 17% to GBP15.3 million over

the same period in 2015 (2015: GBP13.1 million) with exports

comprising over a third of the total, up 57% to GBP5.3 million

(2015: GBP3.4 million). Much of the increase in exports related to

shipments to Siemens in Germany. Total revenues included GBP1.2

million from QRO relating to the 8 1/2 month period following its

acquisition by the Group. Revenues excluding QRO were up 8%, with

increased revenues from rail products more than offsetting lower

defence product revenues following the completion of the electronic

countermeasures equipment modification contract for the MOD.

Gross margins in the second half of 2016 showed a slight

improvement over those achieved in both the first half and for 2015

as a whole. Margins for 2016 increased to 36.3% (2015: 35.2%) as a

result of both a better performance from continuing operations and

from the effect of the QRO acquisition.

Earnings before interest, tax, depreciation, amortisation,

acquisition costs and share based payment charges ("EBITDA")

increased to GBP1,621,000, an increase over 2015 of 28% (2015:

GBP1,266,000). Operating profits increased by 17% to GBP1,095,000

(2015: GBP935,000).

Underlying administrative expenses, before the effects of both

the overheads relating to QRO and charges for depreciation and

amortisation of development costs, increased 6% to GBP3.5 million

(2015: GBP3.3 million). After taking those items into account,

reported administrative expenses totalled GBP4.5 million (2015:

GBP3.7 million). Net financial expenses remained similar to those

of the prior year at GBP170,000 (2015: GBP173,000).

Due to the availability of unrecognised brought forward tax

losses and research and development tax credits, the Group incurred

only a small tax charge of GBP15,000 (2015: GBP3,000 tax credit).

Profit after tax increased by 19% to GBP910,000 (2015: GBP765,000)

giving rise to a similar increase in basic earnings per share to

2.59p (2015: 2.19p). Fully diluted earnings per share increased 15%

to 1.86p (2015: 1.62p).

These retained profits resulted in a further bolstering of the

balance sheet with total equity at 31 December 2016 increasing to

GBP4.2 million (31 December 2015: GBP3.2 million).

Acquisition

QRO was acquired on 13 April 2016 for a cash consideration of

GBP1,115,000 although the net cash consideration was only

GBP239,000 as the assets acquired include cash balances of

GBP876,000. Post-acquisition QRO contributed revenues of GBP1.2

million, an EBITDA before acquisition costs of GBP78,000 and an

operating profit GBP41,000 (after charging depreciation and

amortisation for acquired customer and technology related

intangibles).

Research and development

Following a year of relatively light investment, in 2016 the

Group increased its investment in product development. This

investment totalled GBP785,000 (2015: GBP283,000) of which

GBP645,000 was capitalised (2015: GBP66,000). The capitalised costs

relate to the Group's eyeTrain products. It remains that the Group

is committed to developing its products and services to maintain

and grow its market position and service its customers.

Cash and cash flow

The Group's financial position remains robust and at 31 December

2016 it held cash of GBP2.3 million, no bank debt and had

convertible loan notes maturing in September 2018 of GBP1.5 million

(2015: GBP2.5 million cash, no bank debt and loan notes of GBP1.5

million).

Cash flows from operating activities were GBP998,000 (2015:

GBP1,174,000) reflecting the strong operating performance in the

year and net cash receipts of GBP210,000 in connection with

research and development tax credits, offset by an increase in

working capital of GBP643,000.

Osman Abdullah

Chief Executive

Consolidated Income Statement

for year ended 31 December 2016

Note 2016 2015

GBP000 GBP000

Revenue

Continuing 14,062 13,072

Acquisitions 1,249 -

Total 2 15,311 13,072

Cost of sales (9,748) (8,473)

Gross profit 5,563 4,599

Administrative expenses (4,468) (3,664)

EBITDA

Earnings before financial

income and expense, tax, depreciation,

amortisation, acquisition

costs and share based payments 1,621 1,266

Amortisation of intangibles (335) (267)

Depreciation (107) (58)

Exceptional Item: Acquisition

costs (57) -

Share based payment charges (27) (6)

Operating profit

Continuing 1,111 935

Acquisitions 41 -

Exceptional acquisition costs (57) -

Operating profit 1,095 935

Financial income 3 4 3

Financial expenses 3 (174) (176)

Profit before tax 925 762

Income tax 4 (15) 3

Profit for the year attributable

to equity shareholders of

the parent 910 765

Earnings per share (pence) 8

Basic 2.59 2.19

Diluted 1.86 1.62

Consolidated Statement of Comprehensive Income

for year ended 31 December 2016

2016 2015

GBP000 GBP000

Profit for the year 910 765

Other comprehensive

income

Items that may be reclassified

to profit:

Currency translation on foreign - -

currency net investments

Total comprehensive

income for the year 910 765

Statement of Changes in Equity

for year ended 31 December 2016

Currency

Share Share Merger Equity Special Retained translation Total

capital premium reserve reserve reserve earnings differences equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January

2015 6,651 25,192 1,075 204 - (30,510) (211) 2,401

Profit for

the year - - - - - 765 - 765

Total comprehensive

income - - - - - 765 - 765

Equity-settled

share based

payments - - - - - 6 - 6

Conversion

of

convertible

loan notes 1 14 - (1) - - - 14

Capital reduction (6,303) (25,192) (1,075) - 8 32,562 - -

At 31 December

2015 349 14 - 203 8 2,823 (211) 3,186

At 1 January

2016 349 14 - 203 8 2,823 (211) 3,186

Profit for

the year - - - - - 910 - 910

Total comprehensive

income - - - - - 910 - 910

Equity-settled

share based

payments - - - - - 27 - 27

Arising on

payment of

non-consenting

creditors - - - - (8) 8 - -

Conversion

of

convertible

loan notes 8 54 - (3) - - - 59

At 31 December

2016 357 68 - 200 - 3,768 (211) 4,182

Consolidated Balance Sheet

at 31 December 2016

Note 2016 2015

GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 456 247

Goodwill 707 401

Other intangible assets 1,285 902

Deferred tax assets 364 429

2,812 1,979

Current assets

Inventories 1,953 2,168

Trade and other receivables 2,398 1,861

Cash and cash equivalents 2,322 2,478

6,673 6,507

Total assets 9,485 8,486

EQUITY AND LIABILITIES

Equity attributable to equity holders

of the parent

Share capital 7 357 349

Share premium 68 14

Equity reserve 200 203

Special reserve - 8

Currency translation reserve (211) (211)

Retained earnings 3,768 2,823

Total equity 4,182 3,186

Non-current liabilities

Interest-bearing loans and

borrowings 5 1,540 1,543

1,540 1,543

Current liabilities

Interest-bearing loans and

borrowings 7

Other trade and other payables 3,756 3,757

3,763 3,757

Total liabilities 5,303 5,300

Total equity and liabilities 9,485 8,486

Consolidated Statement of Cash Flows

for year ended 31 December 2016

Note 2016 2015

GBP000 GBP000

Cash flows from operating

activities

Profit for the year 910 765

Adjustments for:

Depreciation 107 58

Amortisation of intangible

assets 335 267

Financial income 3 (4) (3)

Financial expense 3 174 176

Equity settled share-based

payment expenses 27 6

Income tax charge/(credit) 15 (3)

Operating cash flows before

movement in working capital 1,564 1,266

Change in trade and other

receivables (224) 1,138

Change in inventories 241 (729)

Change in trade and other

payables (660) (195)

Cash generated from operations 921 1,480

Interest received 4 3

Interest paid (137) (146)

Tax received/(paid) 210 (163)

Net cash from operating activities 998 1,174

Cash flows from investing

activities

Acquisition of property,

plant and equipment (266) (118)

Capitalised development expenditure (645) (66)

Acquisition of subsidiary 6 (239) -

Cash deposits held in escrow - 54

Net cash outflow from investing

activities (1,150) (130)

Cash flows from financing

activities

Finance lease repayments (4) -

Net cash outflow from financing

activities (4) -

Net (decrease)/increase in

cash and cash equivalents

in the year (156) 1,044

Cash and cash equivalents

at 1 January 2,478 1,434

Cash and cash equivalents

at 31 December 2,322 2,478

1 Basis of preparation and status of financial information

The financial information set out in this statement has been

prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards as

adopted by the EU ("adopted IFRSs"), IFRIC interpretations and the

Companies Act 2006 applicable to companies reporting under IFRS. It

does not include all the information required for full annual

accounts.

The financial information does not constitute the Company's

statutory accounts for the years ended 31 December 2016 or 31

December 2015 but is derived from those accounts. Statutory

accounts for 2015 have been delivered to the registrar of

companies, and those for 2016 will be delivered in due course. The

auditor has reported on those accounts; his reports were (i)

unqualified, (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without

qualifying his report and (iii) did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

2 Segmental information

The analysis by geographic segment below is presented in

accordance with IFRS 8 on the basis of those segments whose

operating results are regularly reviewed by the Board of Directors

(the Chief Operating Decision Maker as defined by IFRS 8) to make

strategic decisions, to monitor performance and to allocate

resources.

The Board of Directors regularly reviews the Group's performance

and balance sheet position for its entire operations as a whole.

The Board receives financial information, assesses performance and

makes resource allocation decisions for its UK based business as a

whole and therefore the directors consider the Group to have only

one segment in terms of products and services, being the

development, supply and maintenance of technologies used in

advanced security, surveillance and ruggedised electronic

applications.

As the Board receives revenue, EBITDA and operating profit on

the same basis as set out in the Consolidated Income Statement no

further reconciliation is considered to be necessary.

Revenue by geographical destination can be analysed as

follows:

2016 2015

GBP000 GBP000

United Kingdom 9,990 9,684

Continental Europe 4,929 2,552

Rest of World 392 836

______ ______

Rest of World 15,311 13,072

______ ______

Included in the above amounts are revenues of GBP8,178,000

(2015: GBP8,192,000) in respect of construction contracts. The

balance comprises revenue from sales of goods and services.

3 Financial income and expense

2016 2015

GBP000 GBP000

Recognised in profit or loss

Interest on bank deposits 4 3

Financial income 4 3

GBP000 GBP000

Interest expense on financial liabilities

at amortised cost 159 151

Net foreign exchange loss 15 25

Financial expenses 174 176

4 Taxation

Recognised in the income statement

2016 2015

GBP000 GBP000 GBP000 GBP000

Current tax (credit)/expense

Adjustments in respect

of prior years (41) 10

Total current tax (41) 10

Deferred tax expense/(credit)

Origination and reversal

of temporary differences 17 (1)

Recognition of previously

unrecognised tax losses (51) (43)

Utilisation of recognised

tax losses 192 170

Adjustment in respect

of prior years (102) (179)

Tax rate change - 40

Total deferred tax 56 (13)

Total tax charge/(credit)

in income statement 15 (3)

Reconciliation of effective tax rate

2016 2015

GBP000 GBP000

Profit before tax 925 762

Tax using the UK corporation tax

rate of 20% (2015: 20.25%) 185 154

Non-deductible expenses 54 44

Fixed asset differences 2 2

Utilisation of tax losses (26) (25)

Effect of tax losses generated in

year not provided for in deferred

tax - 15

Recognition of previously unrecognised

tax losses (38) (21)

Change in unrecognised temporary

differences (2) (43)

Adjustments in respect of prior

years (143) (169)

Effect of rate change (17) 40

Total tax charge/(credit) 15 (3)

5 Interest-bearing loans and borrowings

This note provides information about the contractual terms of

the Group's non-current interest-bearing loans and borrowings,

which are measured at amortised cost.

2016 2015

GBP000 GBP000

Non-current liabilities

Convertible loan

notes 1,521 1,543

Finance lease liabilities 19 -

1,540 1,543

The convertible loan notes of GBP1 each, carry a fixed interest

rate of 7% per annum and are convertible into ordinary shares of 1p

each at any time prior to maturity. The conversion price is 8p as

compared to the market price at 31 December 2016 of 27.38p.

Interest is paid quarterly and the loan notes mature on 10

September 2018.

At 31 December 2016 the nominal value of the outstanding loan

notes was GBP1,579,909 (2015: GBP1,641,711).

6 Acquisition

On 13 April 2016, the Group acquired the entire issued share

capital of QRO Solutions Limited ("QRO"). QRO provides 'end-to-end'

ANPR, security and speed enforcement solutions to UK police forces

and to integrators serving the police and security markets. Its

systems integration expertise enables it to offer fixed site,

mobile, re-deployable and hand-held ANPR systems which can be

integrated into its own back office management suite of software;

Check-IT ANPR, Check-IT CSGS, Check-IT Handheld and Multimedia

Vault. It comes to the Group with a strong service based operation,

well established in its field, profitable, cash generative with

recurring revenues and complements Petards' existing Emergency

Services ProVida brand.

Internal cash resources funded the purchase consideration of

GBP1,115,000. At the time of acquisition, QRO's balance sheet

included net cash balances of GBP876,000. No contingent

consideration was payable resulting in a net cash consideration for

the acquisition of GBP239,000.

In the period to 31 December 2016, QRO contributed revenue of

GBP1,249,000 and operating profit of GBP41,000 to the Group's

results.

The acquisition had the following effect on the Group's assets

and liabilities at the acquisition date:

Pre-acquisition Fair Recognised

carrying value value on

amount adjustments acquisition

GBP'000 GBP'000 GBP'000

Net assets acquired

Intangible assets

Technology assets - 41 41

Customer order book - 32 32

Property, plant &

equipment 50 - 50

Inventories 26 - 26

Trade and other receivables 333 - 333

Hire purchase contract

obligations (30) - (30)

Trade and other payables (537) (4) (541)

Income tax

(payable)/receivable (20) 51 31

Deferred tax (9) - (9)

______ ______ ______

Net identified assets

and liabilities (187) 120 (67)

______ ______ ______

Goodwill on acquisition 306

______

Total cash consideration 239

______

Cash flow

Consideration paid

in cash 1,115

Cash acquired (876)

______

Net cash flow 239

______

Pre-acquisition carrying amounts were determined based on

applicable IFRSs, immediately prior to the acquisition. The values

of assets and liabilities recognised on acquisition are the

estimated fair values. The goodwill arising on acquisition can be

attributed to a multitude of assets that cannot be readily

separately identified for the purposes of fair value

accounting.

The Group incurred acquisition related costs of GBP57,000 that

are included within administrative expenses.

7 Share capital

At 31 At 31

December December

2016 2015

No. No.

Number of shares in issue

- allotted, called up and

fully paid

Ordinary shares of 1p each 35,707,101 34,934,579

GBP000 GBP000

Value of shares in issue - allotted,

called up and fully paid

Ordinary shares of 1p each 357 349

The Company's issued share capital comprises 35,707,101 ordinary

shares of 1p each all of which have equal voting rights.

During the year the Company issued 772,522 ordinary 1p shares

following conversion of GBP61,802 convertible loan notes at a

conversion price of 8p each.

8 Earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing the profit

for the year attributable to the shareholders by the weighted

average number of shares in issue in the year.

2016 2015

GBP000 GBP000

Earnings

Profit for the year 910 765

'000 '000

Number of shares

Weighted average

number of ordinary

shares 35,199 34,858

Basic earnings per

share (pence) 2.59 2.19

Diluted earnings per share

Diluted earnings per share assumes conversion of all potentially

dilutive ordinary shares, which arise from both convertible loan

notes and share options, and is calculated by dividing the adjusted

profit for the year attributable to the shareholders by the assumed

weighted average number of shares in issue. The adjusted profit for

the year comprises the profit for the year attributable to the

shareholders after adding back the interest on convertible loan

notes of GBP150,000 for 2016 (2015: GBP150,000).

2016 2015

GBP000 GBP000

Adjusted earnings

Profit for the year 1,060 915

'000 '000

Number of shares

Weighted average

number of ordinary

shares 56,881 56,268

Diluted earnings

per share (pence) 1.86 1.62

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JJMBTMBABTMR

(END) Dow Jones Newswires

March 14, 2017 03:01 ET (07:01 GMT)

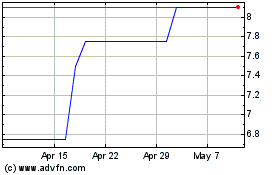

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

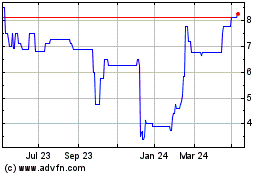

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024