Prudential Drives Profit in Asia, Says Demerger is On Track -- Update

August 08 2018 - 7:25AM

Dow Jones News

(Adds details and background throughout, CEO and analyst

comments; updates share price)

By Adam Clark

Prudential PLC's (PRU.LN) first-half results helped bolster its

planned demerger of its U.K. and European operations, with growth

coming from a focus on its health and protection business in

Asia.

The FTSE 100 insurer said Wednesday that it increased its

insurance margins in Asia by 17% with its focus on increasing the

quality of returns. The higher margin more than outweighed a fall

in new business sales to drive a 14% increase in regional operating

profit to 1.02 billion pounds ($1.31 billion) in constant

currency.

Asian growth helped drive Prudential's overall 9% rise in

interim operating profit to GBP2.41 billion, although currency

headwinds held it back to a 2% rise at actual exchange rates.

The international financial-services group said in March that it

would split its operations to create an independent

savings-and-investment provider in the U.K. and Europe, which

currently operates under the name M&G Prudential. Prudential

PLC will continue to focus on high-growth opportunities in Asia,

the U.S. and Africa.

Chief Executive Mike Wells told reporters on a conference call

that the timeline for the demerger is yet to be determined, as

Prudential restructures its debt among the regional operations.

Both businesses are set to remain headquartered in the U.K. and

listed on the London Stock Exchange, although Hong Kong's Insurance

Authority will take over supervision of the ongoing Prudential PLC

demerger

Analysts at UBS said operating profit was 7% ahead of consensus

estimates, mainly due to the one-off release of provisions.

M&G Prudential increased its operating profit by 4% to

GBP778 million, as healthy net inflows in its asset management

business belied the recent gloom in the sector. M&G asset

management received external net inflows of GBP3.5 billion and

PruFund net inflows came to GBP4.4 billion.

In the U.S., operating profit rose 2% at constant exchange rates

to GBP1.00 billion. Prudential's Jackson operation, which sells

annuities, increased its fee income by 13% from higher account

balances.

Post-tax profit fell 10% to GBP1.36 billion, including a GBP513

million loss on the reinsurance of U.K. annuity liabilities.

Prudential declared an interim dividend of 15.67 pence a share,

up 8% from a year earlier. The company said its capital surplus

stood at GBP14.4 billion at the end of the half, equivalent to a

Solvency II cover ratio of 209%.

Shares at 1153 GMT were up 2.7%, at 1,804.50 pence.

Write to Adam Clark at adam.clark@dowjones.com

(END) Dow Jones Newswires

August 08, 2018 08:10 ET (12:10 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

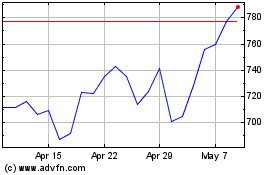

Prudential (LSE:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

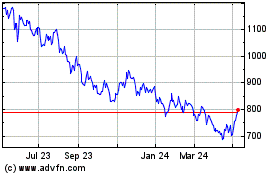

Prudential (LSE:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025