TIDMRGP

RNS Number : 0375A

Ross Group PLC

20 September 2022

Ross Group Plc & Subsidiaries

Annual Report and Financial Statements For the year ended 31

December 2021

For a more printer friendly version please click here

http://www.rns-pdf.londonstockexchange.com/rns/0375A_1-2022-9-20.pdf

LEI: 213800PIS2QRIKPZB546 ROSS GROUP PLC

Page

Company Information 1

Summary and Highlights 2

Chairman's Statement 4

Group Strategic Report 6

Report of the Directors 12

Corporate Governance Statement 15

Directors' Remuneration Report 18

Corporate Social Responsibility 19

Report of the Independent Auditors 20

Consolidated Income Statement 28

Company Income Statement 29

Consolidated Statement of Comprehensive Income 30

Company Statement of Comprehensive Income 31

Consolidated Statement of Financial Position 32

Company Statement of Financial Position 33

Consolidated Statement of Changes in Equity 34

Company Statement of Changes in Equity 35

Consolidated Statement of Cash Flows 36

Company Statement of Cash Flows 37

Notes to the Statement of Cash Flows 38

Notes to the Consolidated Financial Statements 39

Directors: B R Pettitt

S C Mehta BSc (Hons) R E Tamraz

P M Fisher

M J L D'Hombres

Secretary: S C Mehta BSc (Hons)

Registered Office: 71-75 Shelton Street

Covent Garden London

WC2H 9JQ

Registered Number: 00131902 (England and Wales)

Auditors: CBW Audit Limited Chartered Accountants &

Statutory Auditors 66 Prescot Street London

E1 8NN

As we have previously reported in our interim accounts, during

the first half of 2021, Ross Group Plc ("RGP") has been having to

go through the process of restructuring its acquisition of the four

start-up businesses that were completed in 2019 and which are

wholly-owned subsidiaries within Archipelago Aquaculture Group

(AAG) and had amongst other things been primarily subjected to the

Worldwide consequential effects of the COVID Pandemic.

This is therefore the first full year RGP Annual Report that

includes and consolidates the AAG's results, particularly given the

above COVID circumstances.

As a result, there is a fundamental difference in the 2021

results in comparison to its previous year.

RGP has, for many years now, been operating based on a

specialist professional supply chain management model and continues

to do so to date. However, the AAG acquisition subsequently caused

that model to have to be modified; in order to include and

integrate other more specialist supply chain services and

functions, particularly with regard to the requisite research and

development ("R&D") in order to try to provide proof of

pioneering production concepts and then thereafter transition at a

considered viable point in the future into mass production and

sales of product and/or global turn-key projects of hopefully high

quality pharmaceutical grade Chitin.

For our fiscal year 2021, no services or sales of Chitin were

able to be recorded - as all of the R&D and implementation of

pioneering production processes were more than hampered by both

restricted and/or reduced funding from the seller of the AAG

businesses, in combination with the commercial effects of COVID

causing the operations to have to be indefinitely suspended whilst

a review and remedial restructuring took place; resulting in the

renewed and continued Chitin focus through a new venture, namely,

RGP-525.

Production and administration costs have been subsequently

subjected to specific strategic reorganisation, which has resulted

in the further impairment and/or reduction of certain contingent,

capitalized and considerable pre-existing liabilities that the AAG

companies were incurring both in advance of any production and with

all the logistical labour constraints of COVID. The relocation and

centralization of the venture allows for a much more manageable and

efficient operation and overhead structure once a post-Covid norm

can be established.

Your Board of Directors had initially always anticipated and

estimated that it would take a considerable amount of time and

funding in order to get this new technology into mass production

and had initially provisioned for it accordingly. However, the

commercial confluence of COVID and the consequential cashflow

constraints, caused by the lack of the pre-agreed financing from

the seller of the AAG business were both exceptionally unique and

unpredictable.

Our new venture, RGP-525, with the founder of 525 Solutions,

Professor Robin Rogers, who had previously sub-licensed their

proprietary ionic liquid extraction technology, has provided us

with a more viable, cost-effective, supply chain solution that

enables making the best out of a bad set of circumstances. The

Group will also continue in its endeavours to strategically search

for suitable synergistic partners and opportunities.

Throughout this post-acquisition and COVID pandemic period,

there have been considerable costs incurred during development

and/or downsizing of all of the start-up AAG businesses and

management has been extremely diligent in ensuring that such

initial and consequential costings are to now be commensurate with

real-time performance criteria and actual achievements, especially

given the ensuing effects and constraints of COVID and limited

financing calling for a more conservative approach.

Therefore, wherever possible and/or necessary, the Group's

specialist supply chain management experience has been highly

re-focused upon implementing newer strategic disciplines,

procedures and protocols in order to try to provide the best

possible performance in its endeavours over time; hence the

consideration and approval by the Board to the RGP-525 new venture

as an investment holding, thus enabling the Group to seek out other

opportunities, preferably potentially start-up and pre-financed in

a more strategically secured structure.

The resulting loss for the year was GBP2.576m (2020: GBP1.245m)

which duly reflects the respective restructuring, working capital

costs and expenses to date.

2021 2020 2019

GBP 000's GBP 000's GBP 000's

Restated Restated

Revenues - 43 -

Other income 6 136 14,502

Total costs (2,582) (1,424) (17,441)

-------- -------- --------

(Loss) for the year (2,576) (1,245) (2,939)

It is once again my pleasure to report to you on both the

business activities and the financial results of the Ross Group Plc

for the financial year ended 31st December 2021.

Having endured the unprecedented occurrence of COVID and a

number of consequential as well as also some unrelated challenges,

we are pleased and proud to announce that your Board has been able

to respond as best as possible through taking diligent and prudent

measures accordingly.

In addition, the Group is still actively deploying our

specialist supply chain management services on a project-by-project

basis and we are also, particularly at present, evaluating several

strategic start-up opportunities that given a post-COVID pandemic

period are believed to be worthy to explore.

Since becoming Chairman, over 10 years ago, I have always been

mindful - even while our Board of Directors were constantly busy

with such exploratory work - that our operating businesses and

Premium Listing Company status should always be capable of

generating sufficient profit and/or cashflow in order to primarily

cover running costs of the business on a potentially worst-case

scenario. Therefore, through these exceptionally unusual COVID

years we have had to rightfully reorganize and incur such

significant restructuring expenses - which are considered to be

reasonable given our previous many years of careful and

conservative costings.

In this respect, our 2021 result of a GBP2.576m loss (2020:

GBP1.245m loss) is considered by the Board to be both

understandable and justifiable under such circumstances.

There was no revenue in the year. Costs have increased over 2020

and relate predominantly to various restructuring, operational,

accounting and legal costs.

The Board and myself remain satisfied with the ongoing progress

that we have made over this last year's cumulative challenges by

identifying, initiating, and implementing our respective emergency

and/or restructuring strategic plans.

We will continue to be prudent and focused in our specialist

supply chain service management and also our Board remains

conservatively confident that we will be able to progressively

focus in on identifying and being able to put forward an

appropriate refined start-up strategy of opportunities for the

Board to consider and to hopefully be able to then present to our

Shareholders at some stage in the foreseeable future.

Regarding the continuing subject of Brexit, given our domiciled

departure from the EU, the timing, terms and impact of the United

Kingdom's exit are still considered difficult to predict;

especially with the combined confluence post-COVID and also the

recent predictive effects of the Ukrainian-Russian conflict.

Regardless of the anticipated time scale, terms and conditions of

the United Kingdom's exit from the European Union, the result with

regard to these political and economic events provides an outlook

where it is anticipated that there may be some volatility on the

exchange rate between the Pound Sterling ("GBP") and the Euro

("EUR") and more generally, between the GBP/Pound and other

international currencies such as the US Dollar ("US$").

Because some subsidiaries are presently based both in the United

States and/or also outside of Europe, they are therefore

predominately in a US$ currency environment and while this could

lead to adverse consequences in terms of US$/GBP exchange rates,

our respective subsidiaries and/or joint ventures are not yet fully

trading or selling products, and therefore we do not anticipate any

material negative impact and do not intend to take specific

measures to cover fluctuations of the currency market at this

stage.

Ross Group Plc & Subsidiaries Chairman's Statement

For the year ended 31 December 2021

As always, I would like to particularly personally thank our

Board of Directors, our specialist contractors, consultants and

advisors, for all their excellent support, commitment and hard work

in helping the Group wherever possible towards achieving its

aims.

Again and again, I would also like to personally thank our

extraordinary loyal shareholders for their continued patience,

understanding and support during this extraordinary period in

time.

Sincerely

Barry Richard Pettitt

Chairman & Group Managing Director Ross Group Plc

Date: 2022

The Directors are pleased to present their strategic report of

the Group and the Company for the year ended 31 December 2021.

Background and History

The existing management team that took over control of the Ross

Group Plc approximately thirteen years ago has been consistent in

their prime objective to search for suitable supply chain start-up

opportunities in order to try to build a balance of businesses that

would be commensurate with the respective existing and potential

value of the Group's Premium Listed Main Board status and, as a

result, would also enable the Group to be able to potentially enter

into more mergers and acquisitions in the foreseeable future,

whenever deemed appropriate, that in turn could create a sizeable,

stable and potentially prosperous long term enlarged Group going

forward.

Business Strategy: 2022 Model & Principal Activity

During 2020, Ross Group Plc's Archipelago Aquaculture Group

("AAG") entered into a new venture with 525 Solutions ("525"), a

company that was founded in 2015 by Professor Robin Rogers, who

created, co-patented and licensed the Ionic Liquid extraction

process that was initially exclusively sub- licensed by AAG and who

together in 2018 they had respectively collaborated together to be

able to win the USA environmentally prestigious EPA Green Chemical

Award. Given the constraints of COVID together with an unexpected

reduction of pre-agreed R&D financing, a more refined

restructuring strategy was required, It was therefore the

considered opinion of both Ross Group Plc and 525 that as this

Ionic Liquid extraction process has never yet been mass produced to

such a high grade quality and quantity, there could be significant

synergies in collaborating together in a collaborative strategic

new venture,

in order to try to successfully attain such a World class,

ground-breaking achievement. Therefore, in 2021, RGP-525 - albeit

under unique and challenging COVID circumstances - was duly created

and has endeavoured to continue to further its research and

development as a separate business unit, in which the Group has a

19.9% investment holding, thus enabling Ross Group Plc to maintain

its prime objective to re-focus to search for other suitable supply

chain management opportunities in order to try to build a balance

of businesses that would be commensurate with its respective

existing and/or potential value as a Premium Listed Company on the

Main Board of the London Stock Exchange.

Business Review 2021

The Group as at 31 December 2021 consisted of Ross Group Plc and

three wholly owned subsidiaries; Ross Diversified Trading Limited

("RDT"), Ross Group Plc Inc. and Archipelago Aquaculture Group LLC

("AAG").

AAG continues to contain the start-up businesses of Mari Signum

Limited, Mari Signum Dragon Drying- MS LLC, Mari Signum

Mid-Atlantic LLC and Prometheus Progenitor Genetics Technologies

Limited LLC - all having been initially involved and integrated

within the main Chitin-based business of AAG.

These subsidiaries have strategically been operationally

restructured in favour of combining certain Chitin corporate assets

and equipment with those of 525 Solutions (a company founded by

Professor Robin Rogers, who is the collaborative creator of the

ionic liquid extraction process for Chitin) and, in doing so,

forming a new venture, RGP525 Solutions LLC, in which AAG has an

investment holding of 19.9%.

Whereas the main focus of the Board, throughout the last decade

and to date is to consistently continue to explore various

promising start-up or existing business opportunities around the

World, it is envisioned that through our restructuring efforts in

2021 the ability for us to re-focus on these new endeavours in 2022

should help enable us to be able to provide further opportunities

for consideration in the near future.

Regarding the Group's revenue performance in 2021, while

undergoing the continued restructuring of the Group during the

constraints of COVID and restricted cashflow, all operations were

either suspended and/or wound-down respectively in favour of the

RGP-525 new Venture with 525 Solutions, along with a further

restructuring of AAG in order to accommodate a more enhanced,

efficient and effective separate business unit strategy.

The Directors are confident that, given its reasonably resolute

structure and strategies, the underlying value of the Group should

be able to remain strong and that the Group will hopefully find

success in securing the strategic business that it is currently

seeking.

Regarding the financial position at year-end 2021, the Board can

report that the Group's statement of financial position shows that

through such restructuring efforts total assets are GBP394k

compared to

GBP1,449k in 2020.

It is also worth noting that, in prior years, one of the largest

items in the Group's balance sheet was the long-term

"Interest-bearing loans and borrowings" of GBP6.072m that has since

been restructured into Convertible Loan Debentures, which were

approved by the Board and Shareholders accordingly in 2020 and have

been subsequently restructured in 2021 and extended for up to a

further one to three years (at the Board's discretion) potentially

until 2025. Thus the Group has managed to maintain a relatively

healthy cashflow position through the diminishment of this

liability and also by the issuance of new shares.

Business Outlook

The Board is reasonably confident, notwithstanding the COVID

Pandemic and its subsequent ongoing economic effects, that there

will still be various unique and exciting opportunities ahead -

particularly in the short-term - for its business to be sustained

and/or transformed for potential growth to be considered in the

future.

As at the reporting date, the Group held GBP209k in cash, total

assets of GBP394k and current liabilities of

GBP3,875k, including amounts owed to associated undertakings of

GBP2,335k.

Contemplation of cancelling all deferred shares, resulting in a

one-off exceptional gain, is currently under consideration by the

Board in order to provide a platform for future investment

opportunities.

The budgets and cashflows set for 2022 & 2023 given ensuing

partial COVID Pandemic provisions, indicate that there are

sufficient working capital reserves, especially given prudent

provisions.

Economic Considerations

In the light of the ongoing COVID pandemic and the uncertainties

this brings, the Directors have also prepared cashflow forecasts to

December 2023. These cashflows have been sensitized to assess the

adequacy of cash available should further COVID restrictions,

global fuel prices, recession and/or inflation impinge the

activities of the Group. Based on the sensitivity testing and

additional resources available the directors are satisfied the

group can continue as a going concern for the foreseeable

future.

Due to the emergency measures implemented by the respective

Governments, which are still ongoing in certain respects, and also

given the subsequent strategic RGP-525 new venture regarding the

development cycle of Chitin, the Group has already taken prudent

steps to minimise the cost exposure of its activities

accordingly.

The Group is regularly reviewing its initial projections and

also aiming to minimise any potential deficits over the next

financial year by trying to reduce all non-essential

expenditure.

Section 172(1) Statement

Within the strategic report for this financial year is the

mandated Section 172(1) Statement which hereby describes how the

Board of Directors have acted in regard to the matters set out in

Section 172(1)(a) to (f) when performing their duties under this

Section.

These duties have included, but are also not necessarily limited

to, their responsibility to earnestly promote the success of the

Group and its companies, to act in the way that he or she considers

to be in good faith and would be most likely to promote the success

of the Group and its companies for the benefits of its shareholders

as a whole, and other stakeholders.

The Directors welcome the opportunity to also engage with our

shareholders and other stakeholders, wherever possible, in

promoting and discussions regarding reasonable, non-price sensitive

information on subjects that are only available within the Public

Domain.

In both the Chairman's Statement and in this Strategic Report,

the Chairman and directors have detailed the matters affecting the

Group during the year particularly the subsequent restructuring of

AAG.

The acquisition of AAG during 2018/2019 together with the

effects of COVID, a reduction of pre-agreed financing from the

seller of AAG and ongoing restructuring implementation have had

significant impacts on the Group and have subsequently resulted in

a consecutive loss for the year.

The details given in these reports, particularly on pages 6

& 7, outline the Directors strategy for the business both in

the short and the longer term.

The main factor facing the Directors is the ongoing financing of

the group and/or any impact that the COVID-19 pandemic may have on

the business. These matters have had due consideration by the

directors and are detailed in the Strategic Review, in the Business

Review 2021, Business Outlook and Corona Virus pandemic

considerations on pages 6 & 7 and Principal Risks and

Uncertainties on page 9.

At the end of last year it was reported that there was only one

employee (excluding the directors) remaining at the year-end (none

UK) and that employee is now on a part-time employment. During the

current year more employees had joined the group as the previously

dormant subsidiary, Ross Diversified Trading Limited had now become

more active, however, it has since been decided to restructure

their employment, respective roles and responsibilities while also

considering other opportunities that may perhaps be presented by

them and/or other parties in the foreseeable future.

The main stakeholders are the shareholders and the directors are

committed to acting in their best interest and communicate to them

at the AGM and through regular correspondence and/or webinars,

whenever deemed relevant, as well as through timely filing of

informative interim and year-end financial statements, stock

exchange announcements and as detailed in the Governance Report on

page 12.

As detailed in the Strategic Report on pages 6 to 11 the

directors are proud of the Group's Premium Listing on the Main

Board of the London Stock Exchange and therefore always have the

desirability of the Group and its companies maintaining a

reputation for high standards of business conduct as also detailed

in the Governance Report on page 15.

As the Group is continuing to be focused on research and

development through its relationship in the RGP-525 new venture

with 525 Solutions and the key relationship with Professor Robin

Rogers, it can confirm that there is little or no impact that the

Group has on its community or environment as detailed on page 10 of

the Strategic Report.

Whilst the Group has sufficient cash and reserves to meet its

current needs as detailed in the Strategic Report on page 7, the

directors are always striving to increase revenue and raise funds

for strategic opportunities they view are beneficial to the Group

shareholders.

Principal Risks and Uncertainties

Notwithstanding the Coronavirus Pandemic, the main risk to the

existing operations of the Group is the possibility of depleting

necessary working capital. The Board is both fully aware of these

risks and, as a result, has always endeavoured to managed its cash

and cashflow as conservatively and prudently as possible; ensuring

that its exposure to any RGP-525 liabilities in this instance are

primarily limited to its initial investment.

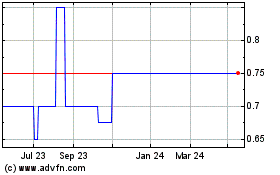

Due to time constraints the company has not been able to publish

the 2021 accounts before the deadline of 30 June 2022. As a result

of this the trading of the company's shares has been suspended on

the London Stock Exchange. It is understood that this suspension

will be removed when the financial statements are published.

In addition, the Board is equally endeavouring to ensure that

funds are being made available to the Group, through the issuance

of new shares and/or other financial instruments, whilst also

exploring other opportunities for future growth.

Your Directors are therefore reasonably confident that the Group

currently has both the financial resources and capability to fund

existing expenses for future growth.

Viability Statement

The Group's business activities, together with the factors

likely to affect the future performance and position are set out in

the Group Strategic Report and Going Concern Statement on pages 6

to 11

Having endured a protracted period of the COVID Pandemic over

the last 2 years, the Group has now begun to take a longer term

view of various post-COVID Pandemic potential factors, ranging from

Global and/or Continental inflation and recession, through to

perhaps other opportunities arising in such markets, for example,

in Crypto exchanges and/or Supply Chain Management (SCM)

services.

Given the current listing of the Group on the Main Board of the

London Stock Exchange and also it's present Premium Listing status,

both of which individually and/or collectively are of considerable

value, the Group believes that it is in a viable position to be

able to enter into either possible start-ups, joint ventures,

mergers and/or acquisitions; any of which would probably involve an

injection of new management and business(es) that could transform

the Group significantly.

In addition, the Group's existing business potential is

presently beginning to take shape in its commodity-based trading

and supply chain management services; with initial contracts being

forecasted and/or envisioned accordingly.

As recently demonstrated, new share issuances have been

successfully placed to date and there seems to be a continued

interest for possible or potential further new share issuances in

the foreseeable future.

Breakdown by sex of directors

At 31 December 2021 there are five directors: five men and no

women.

Environmental matters

1 - UK Companies

In the year under review, the activities of all of the RGP UK

companies (Ross Group, the parent) and Ross Diversified Trading (a

subsidiary) involved no direct manufacturing, mining or materials

processing. The UK based Directors mostly worked from home, made

frequent use of telecoms/remote conferencing to discuss company

business and occasionally met at hired premises.

The Board considers that in such circumstances, the carbon

emissions arising from those Directors' activities (excluding the

Chairman) are minimal.

The Chairman, Mr Barry Richard Pettitt who in the past has

previously travelled extensively around the world, accompanied

occasionally by other directors, had in fact not travelled

internationally at all during 2020 however he has started to travel

more extensively in 2021 in pursuit of new opportunities.

Therefore, the total number of business miles the Ross directors

travelled in 2021 is calculated at 44,443 which, per the conversion

factor taken from the Carbonify.com, website amounts to 23.2 kg

CO2.

2 - US Companies

The acquisition of AAG in January 2019 meant that the Group now

had for the first time in many years research and development

facilities with industrial processing/manufacturing premises. Given

aforesaid circumstances, these were restructured accordingly, as

discussed elsewhere in this report, so that the commercial

production of Chitin - a powerful, natural polymer containing

characteristics with the potential to alter industries and improve

the environment - now forms an integral part of a new venture,

namely, RGP-525 which intends to use its best endeavours to produce

market-ready, premium quality Chitin in an environmentally

conscious manner at some time in the future. This investment is

being monitored and managed through Ross Group PLC Inc., which is

also responsible for the Group's other USA investments and

activities. All US Companies have managed to maintain a minimal

number of employees and/or sub-contractors.

The Board of Directors are very proud to be partly responsible

for such an environmentally friendly new venture operation and

subsidiaries that are also, wherever possible, committed to similar

standards, ethics and governance.

The Board of Directors, who are responsible for the day-to-day

management of the Group, have considered the requirements of the

FCA new Listing Rule to enhance climate- related financial

disclosures for periods beginning on or after I January 2021 and

the associated recommendations of the Task Force on Climate Related

Financial Disclosures (TCFD).

The TCFG recommend disclosures are made specifically in the

areas of governance and risk management with regard to climate

related risks and opportunities and where material the strategy and

metrics and targets used to assess such risks and

opportunities.

The Board at their regular meetings consider all risks and

opportunities facing the Group. The current limited operations of

the Group, in the judgement of the Board, do not give rise to

significant risks and opportunities related to climate - related

matters and the Board have therefore not fully made all disclosures

consistent with the some or all of the TCFD's recommendations and /

or recommended disclosures on the grounds of materiality.

The Board at regular meetings, from a governance perspective,

has continued oversight of operations, they consider any climate

-related matters that may arise from changing activities and any

risks or opportunities that may arise. These matters are considered

for the short, medium and long-term impact they may have and the

Board continues to strive to support a low carbon economy.

From a risk management perspective any opportunities being

considered by the Board must also highlight as part of that due

diligence any risks associated with the opportunity. The impact any

climate- related matters may have resulting from its location,

changing climate conditions we are seeing develop that may impact

the future of such an opportunity be it from rising temperatures

resulting in flood, fire, rising sea levels or such other climate -

related matters, climate related policy or emerging technologies.

The risks are not only considered from the Group's perspective but

from that of our supply chain and customers also. The Board

consider the impact any such risks may also have on our ability to

raise future capital or restructure debt should that be

required.

There are no such climate -related risks identified at this time

and the possible opportunities being considered by the Board be it

through the investment in RGP-525 or other opportunities under

consideration do not give any additional climate - related

risks.

On behalf of the Board

.......................................... Barry Richard Pettitt

- Chairman

Date: 2022

The directors present their report with the financial statements

of the company and the group for the year ended 31 December

2021.

Dividends

No dividends will be distributed for the year ended 31 December

2021.

Events since the end of the year

Information relating to events since the end of the year is

given in the notes to the financial statements.

Directors

B R Pettitt (Chief Executive Officer)

Barry Richard Pettitt, aged 62, was appointed to the board on 22

December 2008 as the CEO of the group and elected as its Chairman

and CEO on 28 April 2009. He has more than 30 years' experience

within the consumer electronics and supply chain management

industries, during which time he successfully started a specialist

supply chain management services company. ISO International

(Holdings) Ltd, which was subsequently purchased by a Hong Kong

Public Company for HK$ 155,000,000 in 2003. In addition, he has

managed a number of Public Company divisions (in the capacities of

President and Managing Director) and successfully relisted a Hong

Kong Public Company, Vision Tech Ltd, as its CEO in 2007. Prior to

that, he was the joint Managing Director of Ross Consumer

International Ltd and a main board director of the Ross Group

(formerly Ross Consumer Electronic Plc) in 1987 after which he has

continued to be a shareholder in Ross Group for the last 34

years.

S C Mehta (Executive Director)

Shashi Mehta, aged 64, was appointed on the board on 22 December

2009. He holds a BSc (Hons) in Manufacturing and has had a

distinguished career in a variety of industrial and manufacturing

trouble- shooting roles. He brings a wealth of experience and

expertise to the Group. He spent many years working for the Ford

Motor Company, and was Operations Manager in Ross Consumer

Electronics during the 1980's.

R E Tamraz (Non- Executive Director)

Roger Tamraz aged 81, was appointed to the Board in December

2020 as a Non-Executive Director. He is an international banker and

venture capital investor who has had an active business career in

banking, oil and gas spanning from Middle East to USA. Fluent in

English, French and Arabic, he was Chairman of Kidder, Peabody

& Co. Middle East. Also has owned and controlled banks in the

Middle East and in the United States; Also, having led the takeover

and then re- built the largest bank in Lebanon, Intra Bank.

P M Fisher

Philip Fisher aged 68, was appointed to the board in February

2021. He was the joint Managing Director of Ross Consumer

International Ltd., a subsidiary of Ross Group (formerly Ross

Consumer Electronic Plc) in 1988/89 and has since maintained an

excellent working relationship with its senior management for many

years. He will oversee new business divisions and/or developments

within the UK.

Newly Elected Directors

M J L d'Hombres (Non- Executive Director)

Marc d'Hombres aged 75, was appointed to the board in December

2021 as a Non-Executive Director. He is a loan and economics

graduate from Paris university and has in-depth experience managing

boutique investment banks and private equity funds. He is well

versed in the African markets and an expert in trade and project

financing.

Financial Instruments

Details of the financial instruments used by the group can be

found in note 22 of the accounts.

Employee Involvement

During the year there was an average of 3 employees, and 5 Main

Board directors.

Directors Interests Directors

Mr Barry Pettitt has from time to time entered into contracts

with Ross Group concerning the provision of professional services

to third parties and/or subsidiaries. Apart from this, no director

had any interests in contracts of significance with the

company.

In accordance with the Articles of Association members will be

asked to confirm the appointment of all directors.

The total number of shares controlled by Barry Pettitt, directly

and indirectly through Lynchwood Nominees Limited (previously Prime

Growth Enterprises Limited) at the date of this report was

27,305,609 (11.72%). Mr Pettitt has sought and obtain Board

approval to specifically negotiate and possibly increase his

shareholding interests as well as to further his loan position with

Group on existing financial instruments

Substantial shareholdings

As at 31 December 2021 the following were registered as being

materially interested in 4% or more of the company's issued share

capital, or being a related shareholder.

No of Ordinary % of Issued

Shares Share Capital

Keniworth Capital Limited 40,000,000 17.17%

------------------------ -------------------

Vidacos Nominees Limited 37,033,448 15.89%

------------------------ -------------------

Lynchwood Nominees Limited Des: 2006442 27,078,369 11.62%

------------------------ -------------------

Escalating Investments Limited 22,200,720 9.53%

------------------------ -------------------

Statement of Directors' Responsibilities

The directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have elected to prepare the financial statements in accordance with

International Financial Reporting Standards as adopted by the UK

and the Republic of Ireland. Under company law the directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

company and the group and of the profit or loss of the group for

that period. In preparing these financial statements, the directors

are required to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable and prudent;

- state whether applicable UK Accounting Standards have bene

followed, subject to any material departures disclosed and

explained in the financial statements;

- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the company's and

the group's transactions and disclose with reasonable accuracy at

any time the financial position of the company and the group and

enable them to ensure that the financial statements comply with the

Companies Act 2006. They are also responsible for safeguarding the

assets of the company and the group and hence for taking reasonable

steps for the prevention and detection of fraud and other

irregularities.

Directors' Responsibility Statement

We confirm that to the best of our knowledge:

1. The financial statements, prepared in accordance with

International Financial Reporting Standards as adopted by the UK

and the Republic of Ireland, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

company and the undertakings included in the consideration taken as

a whole; and

2. The management's report, which is incorporated into the

Directors' Report together with the information provided in the

Chairman's Statement, the Strategic Report, includes a fair review

of the development and performance of the business and the position

of the company and the undertakings included in the consolidation

as a whole, together with a description of the principal risks and

uncertainties that they face.

Statement as to disclose of information as Auditors

So far as the directors are aware, there is no relevant audit

information (as defined by Section 418 of the Companies Act 2006)

of which the group's auditors are unaware, and each director has

taken all the steps that he ought to have taken as a director in

order to make himself aware of any relevant audit information and

to establish that the group's auditors are aware of that

information.

Auditors

In accordance with section 485 of the Companies Act 2006, a

resolution proposing that CBW Audit Limited be re-appointed will be

put at the forthcoming Annual General Meeting in 2022.

On behalf of the Board

................................ M J L d'Hombres Director

Date: 2022

Application of The Principles of the UK Corporate Governance

Cod

The group is pleased to present its report on Corporate

Governance and the UK Corporate Governance Code. The board strives

to comply with the high standards set by the UK Corporate

Governance Code as incorporated in the UK Listing Rules of the

Financial Conduct Authority. The Code requires the company to make

a two-part disclosure statement, firstly on how the principles of

the code are applied and secondly confirmation of compliance or

explanation of any reason for deviation from the Code. Throughout

the year the company has complied with the main principles of the

Code.

The Board

There is an effective and appropriately constituted board which

in the year under review consisted of five directors. The Chief

Executive, Mr Pettitt who is normally based overseas, also serves

as Chairman. The board is fully aware that this is contrary to Code

provision A.2.1, which states that the roles of chairman and chief

executive should not be exercised by one individual. The board is

of the opinion that, given the current size of the business, and

also Mr Pettitt's undoubted and considerable knowledge, experience

and contacts in the Group's field of operations that the

shareholders' interests are best served by this arrangement. The

board is active in its management of the group and meets and

confers regularly on business matters arising. These frequent and

robust discussions serve to ensure that no one individual has

unfettered powers of decision.

During 2021 Mr Pettitt was supported by four other directors: Mr

P.M. Fisher being appointed in January 2021 and Mr M J Simon, who

was appointed in April 2009 and retired in December 2021, Mr S C

Mehta who was appointed in December 2009, and Mr R Tamraz being

appointed in December 2020.

Mr Simon who acted as company secretary since April 2009,

resigned on 14 September 2022. Mr S C Mehta was appointed as the

company secretary on 14 September 2022.

One director resigned from the board in December 2021 Mr M J

Simon. One new director was appointed December 2021 Mr M J L

D'Hombres.

The two non-executive directors, Mr D'Hombres and Mr Tamraz, are

considered to be independent as there are no circumstances or

relationships as described by Code provision B.1.1 which apply to

their appointments. The group's definition of a non-executive

director is one who considers the interest of all the shareholders

and this is demonstrated during the board meetings. As part of

their role, the non- executive directors constructively challenge

decisions and help develop strategies and plans for the benefit of

the board.

Board procedure

The board is responsible for decisions concerning strategic and

financial planning and matters involving the overall direction of

the company. Management will seek board approval of the annual

budget and rolling business plan. Reforecasts are presented as

updates to the budget throughout the year to account for variances

and provide forward vision. The operational business decisions are

taken by local management with reference to the board where

necessary.

The board has established several separate committees for the

following: Appointments (Chaired by Mr Pettitt);

Audit & Remuneration (Chaired by Mr D'Hombres); Governance

& Compliance (Chaired by Mr Mehta)

All of the directors are subject to periodic re-election and

also the full board considers all appointments. A director will

require re-election within a maximum period of three years.

Biographies of the board are included in the financial

statements. These indicate a wealth of experience, which is

essential in effectively managing the activities of the group. In

addition to this the board members, wherever deemed appropriate

and/or possible, endeavour to attend relevant seminars and courses

of their respective professional organisations.

Attendance

Board meetings are held regularly throughout the year. Due to

the location of the directors, the meetings are often held

electronically. The board is supplied with all the information

relevant to the meeting in a timely manner and in a form and

quantity appropriate to enable it to discharge its duties during

the meetings.

The board has now established procedures in respect of access to

the company secretary and the directors have access to consult the

company secretary when required.

All shareholders have the opportunity to put forward questions

to the board during the company's Annual General Meeting and the

board communicates with the shareholders via the notices and other

papers relating to the Annual General Meeting. The company also

welcomes and responds wherever possible to communication,

preferably in a written form, from its Shareholders regarding

reasonable, non-price sensitive information requests on subjects

that are only available within the Public Domain.

The company website allows shareholders to contact the directors

by email.

The board has carried out a formal and rigorous annual

evaluation of its performance and of its committees and individual

directors. This evaluation covers contribution, commitment and the

manner in which board related duties have been completed. The

chairman has discussed the review with individual directors where

necessary to ensure the board operates as an effective unit. The

performance review was conducted using recognised evaluation

processes. The independent non- executive director has conducted a

performance review on the chairman which included the consideration

of the views expressed by the executive directors.

Internal audit and control

The respective responsibilities of the directors and the

auditors in connection with the financial statements are set out in

the audit report. The directors have overall responsibility of the

effectiveness of the group's whole system of internal control,

including financial and other controls, which are designed to

provide reasonable but not absolute assurance against material

misstatement or loss. The key procedures that the directors have

established to provide effective internal financial control are as

follows:

Financial Reporting

There is a comprehensive system for reporting performance.

During the course of the year, a one year rolling budget is

prepared for each company within the group and a consolidated

budget is prepared for the whole group. The board then formally

approves the budgets. The results are then reported regularly to

the board for their consideration and forecasts are revised

accordingly.

Quality and Integrity of Personnel

The integrity of the group is maintained through the appointment

of experienced and professional staff and the application of

appropriate policies and procedures.

Capital Investment

The group has set procedures for capital expenditure. These

include annual budgets, appraisals and review of the required

expenditure, approvals at the right levels of authority and the

commissioning of independent professional advice where

appropriate.

Professional Advice

Professional advice is usually sought on contentious and

disclosure issues, this being as a result of discussions during the

Board Meetings. During the year the Chairman can seek independent

professional advice in relation to matters affecting the group.

The group has an ongoing system for identifying, evaluating and

managing the significant risks faced by the group which has been in

place for the whole of the year under review up to the date of

approval of the annual report and accounts and which is regularly

reviewed by the board to ensure it continues to accord with the UK

Corporate Governance Code. The directors have reviewed the

effectiveness of the system of internal financial control during

the year from information provided by the management and the

group's external auditors. It must be recognised that such a system

can only provide reasonable and not absolute assurance, and in that

context, the review revealed nothing which, in the opinion of the

directors, indicates that the system was inappropriate or

unsatisfactory.

The group has no formal internal audit function and the board

has determined that there is no need for one. The board considers

that internal audit is dealt with in other ways and the situation

is regularly reviewed.

Going Concern

The directors confirm that after making the appropriate

enquiries, they are of the opinion that the group as a whole has

adequate resources to continue in operational existence for the

foreseeable future and therefore have prepared the financial

statements on a going concern basis.

External Audit and Audit Committee

The Audit Committee during 2021 comprised of the non-executive

directors, Mr Simon and Mr D'Hombres, as well as Executive

Directors Mr Mehta and Mr Fisher. The committee was chaired by Mr

Simon until 31 December 2021 when this role was passed to Mr

D'Hombres. It met periodically to review the adequacy of the

group's internal control systems, accounting policies, corporate

governance policies and compliance with applicable accounting

standards and to consider the appointment of the external auditors

and to review their fees. CBW Audit Limited is invited to attend

these meetings. The Audit Committee is authorised by the board to

investigate any activity within its terms of reference and obtain

external professional advice as is necessary.

By order of the Board

...................................... Barry Richard Pettitt

Chairman & Group Chief Executive Officer Date: 2022

The board is pleased to present its remuneration report in

accordance with section 12.43A(c) of The Listing Rules.

The board has in place a remuneration committee, comprising Mr

Michael Simon, non-executive director to 31 December 2021, and Mr B

Pettitt, Chief Executive, to determine the remuneration of the

board. Post year end Mr Tamraz joined the committee following Mr

Simon's resignation.

The company policy during the restructuring period throughout

2021 was to continue to pay directors only a nominal GBP1 salary

(which has been in place since 2008). This policy will be

reconsidered as occasion arises and as the new business

opportunities open to the group are realised. The directors feel it

would be inappropriate to take any reward until that has been

achieved.

Total Total

Name Position Gross Benefits Notice Remuneration Remuneration

salary Pay 2021 2020

B R Pettitt Chairman/ GBP1 Nil Nil GBP1 GBP1

Group Chief

Executive

--------------- ---------- ----------- ------------ --------------- --------------

M J Simon Non- executive GBP1 Nil Nil GBP1 GBP1

Director

--------------- ---------- ----------- ------------ --------------- --------------

S C Mehta Executive GBP1 Nil Nil GBP1 GBP1

Director

--------------- ---------- ----------- ------------ --------------- --------------

R E Tamraz Executive GBP1 Nil Nil GBP1 GBP1

Director

--------------- ---------- ----------- ------------ --------------- --------------

P M Fisher Executive GBP1 Nil Nil GBP1 GBP1

Director

--------------- ---------- ----------- ------------ --------------- --------------

M J L D'Hombres Non- executive Nil Nil Nil Nil Nil

. Director

--------------- ---------- ----------- ------------ --------------- --------------

No director currently has a service contract with a notice

period in excess of 12 months. All executive directors have

contracts that require a notice period of one month. The contracts

of the non-executive directors would normally be renewed for a

period of one year. All directors are presented for re-election by

the members at the Annual General Meeting on a maximum cycle of

three year.

The group does not currently operate a director's share option

scheme or a long-term incentive system. The group also does not

currently have an employees' share scheme or other long-term

incentive.

The board has instructed local management to ensure the

companies address those corporate social responsibilities which are

recognised as being of prime importance. The responsibility for CSR

rests with the Chief Executive Officer, Barry Pettitt, who will

bring to the board's attention any major issues which require their

approval and regularly updates the board on CSR matters. The views

of shareholders and interested external parties are considered when

developing the ongoing policy to CSR.

Figures are available for the board to review to enable them to

assess the trend towards improvement in CSR matters and to direct

the policy towards those areas that require further attention.

For the year ended 31 December 2021

Employees

For several years the only employees of the company were its

directors. This changed with the acquisition of AAG in January

2019. When this happened, the Group inherited 25 employees, this

has now reduced on the reorganisation of AAG.

The group has always taken the view that employees constitute a

group's most valuable asset and therefore it has always been

committed to ensuring they should enjoy the best environment in

which to perform their duties, one of equal opportunity and free

from discrimination and harassment.

For reasons discussed elsewhere, it was not possible to continue

operations with the four businesses of AAG constituted as they

were, and those facilities during and by the year ended 2019 were

suspended. Consequently, at the year-end 2019 there was only one

employee left on the payroll of the AAG companies. During 2021 this

has increased to three and they have been joined by three new

employees in Ross Diversified Trading Limited as this, previously

dormant subsidiary commenced trading in the year 2020. In 2021

trading results proved difficult and numbers have been reduced

again.

The group strongly believes in the future of the AAG technology,

and we have developed a corporate structure to facilitate that

development through the RGP-525 new venture. We will aim to promote

a culture which suits the recruitment and retention of the highest

calibre of staff and to ensure that all staff will be trained to

the appropriate standard required to fully meet their job

specifications.

The health and safety of the employees is paramount to the

group. Staff are issued with data sheets on the handling of any

substances which might be toxic and will be trained in the correct

procedures to follow. Any potential issues can be raised with Mr

Pettitt.

Environment

The board is fully aware of its responsibilities and fully

supports the drive for ongoing improvement in this area. The impact

the group's activities on the environment are regularly assessed to

enable action to be directed at areas where any harmful impact

could be reduced. As noted above the travel and energy use in the

group have been limited over the past two years.

The group has worked with its suppliers during the year to

ensure the products used in manufacturing and any waste arising

from the use of those products have a minimal impact on the

environment. The use of energy is closely monitored, and the

available controls are used to good effect to reduce consumption

where possible.

Customers

Customer satisfaction is one of the main targets for the group

and this is aided by a rigorous quality policy. The Quality

procedures adopted by the group require the recording of customer

feedback and measures our performance against customer expectation.

The group strives to meet the demands of its customers, but also

ensures that solutions to their requirements are designed with

efficiency.

Local Community

The group seeks to inter act with the local community and

develop close relationships within its area of operation. It has

established links with the local schools and colleges.

Commitment

The group will continue to enhance its approach to CSR to ensure

that it supports the principles as it expands its range of

activities and welcomes any suggestions on how it can improve in

this area.

Opinion

We have audited the financial statements of Ross Group Plc (the

'parent company') and its subsidiaries (the 'group') for the year

ended 31 December 2021 which comprise the group and parent

company's Income Statements, Statements of Comprehensive Income,

Statements of Financial Position, Statements of Changes in Equity,

Statements of Cash Flows and notes to the consolidated financial

statements, including a summary of significant accounting policies.

The financial reporting framework that has been applied in their

preparation is applicable law and International Financial Reporting

Standards (IFRSs) as adopted by the United Kingdom.

In our opinion the financial statements:

- give a true and fair view of the state of the group's and of

the parent company's affairs as at 31 December 2021 and of the

group's and the parent company's loss for the year then ended;

- have been properly prepared in accordance with IFRSs as adopted by the United Kingdom; and

- have been prepared in accordance with the requirements of the

Companies Act 2006 and, as regards the group financial statements,

Article 4 of the IAS regulation.

Separate opinion in relation to IFRSs as issued by the IASB

As explained in note 2 to the group financial statements, the

group in addition to complying with its legal obligation to apply

IFRSs as adopted by the United Kingdom, has also applied IFRSs as

issued by the International Accounting Standards Board (IASB).

In our opinion the group financial statements give a true and

fair view of the consolidated financial position of the group as at

31 December 2021 and of its consolidated financial performance and

its consolidated cash flows for the year then ended in accordance

with IFRSs as issued by the IASB.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the group

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard as applied to listed public interest

entities, and we have fulfilled our other ethical responsibilities

in accordance with these requirements. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Material uncertainty related to going concern

We draw attention to note 2 in the financial statements, which

indicates that there are events or conditions identified that may

cast significant doubt on the entity's ability to continue as a

going concern. The Company's listing with the London Stock Exchange

is currently suspended, which creates uncertainty in respect of the

timing of its re-listing. This unknown time frame has an effect on

future trading and cash flows. In addition to this, the Company and

Group have presented a loss for the year ended 31 December 2021,

and, at the balance sheet date, both have net current liabilities.

As stated in note 2, these events or conditions, along with the

other matters as set forth in note 2, indicate that a material

uncertainty exists that may cast significant doubt on the company's

ability to continue as a going concern. Our opinion is not modified

in respect of this matter.

In auditing the financial statements, we have concluded that the

directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate. Our

evaluation of the directors' assessment of the entity's ability to

continue to adopt the going concern basis of accounting

included

- Obtaining management's assessment of going concern of the

Group and challenged the appropriateness of the assumptions used by

utilising our knowledge of the Group gained throughout the audit

and obtaining further corroborative audit evidence.

- Analysing forecasts prepared by management covering a period

to 31 December 2023, which have been flexed using different

variables for events over the corresponding period.

- Reviewing minutes of meetings of the Board for any factors that may affect going concern.

- Assessing the wider macro-economic environment over the

period, in particular with respect of COVID-19 and Brexit.

- Considered publicly available information to identify if there

is anything to contradict the assessment made by management, or if

there are any indicators of potential risk to the group of

industry.

- Assessing the appropriateness of going concern disclosure.

In relation to the entity's reporting on how they have applied

the UK Corporate Governance Code, we have nothing material to add

or draw attention to in relation to the directors' statement in the

financial statements about whether the director's considered it

appropriate to adopt the going concern basis of accounting.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Our approach to the audit

Tailoring of the audit scope

We tailored the scope of our audit to ensure that we performed

enough work to be able to give an opinion on the financial

statements as a whole, taking into account the structure of the

group and the company, the accounting processes and controls, and

the industry in which they operate

The group consists of the parent company and a subsidiary

incorporated in the UK, for which a full scope audits were

conducted, and an American based group (AAG), which consists of

five companies and Ross Group Plc Inc. All subsidiaries were

considered to be significant components, therefore audit work was

completed on material balances. These group companies are listed in

note 12 of the financial statements. There were no acquisitions

during the reporting period, therefore the scope has not changed

significantly compared to the prior period.

Procedures have been conducted on a group level to ensure the

amounts brought into the consolidation are not materially

misstated.

Materiality

The scope of our audit was influenced by our application of

materiality. We set certain quantitative thresholds for

materiality. These, together with qualitative considerations,

helped us to determine the scope of our audit and the nature,

timing and extent of our audit procedures on the individual

financial statement line items and disclosures and in evaluating

the effect of misstatements, both individually and in aggregate on

the financial statements as a whole.

Key Audit Matter How our scope addressed this

matter

Revenue recognition

Revenue is recognised in accordance Performed substantive testing.

with the accounting policy set We tested a sample of transactions

out in the notes to the consolidated from the point of origin, which

financial statements (set out were the original contracts,

in note 2). The accounting policy and traced these to the financial

contains a number of judgements statements. Revenue of Ross Diversified

with regards to revenue earned Trading (RDT) tested substantively

from contracts. This is considered per the above. However, it was

to be a significant risk due to found that there was no further

it often being contingent on external trading income to be recognised

variables. in the year, which is consistent

with understanding of the business.

Assessed whether income transactions

were recorded in compliance with

IFRS 15 and constitute an agent

or principal relationship. Assessed

the appropriateness of the related

disclosures in the financial

statements and consider them

to be reasonable.

The key observations with regards

to these risks were that we concurred

that revenue had been recognised

in accordance with IFRS 15 Revenue

from contracts with customersand

is materially appropriate or

accurate.

------------------------------------------------

Non-compliance with laws and

regulations Ross Group Plc has Performed testing to ensure that

a premium listing on the London the parent company is up to date

Stock Exchange, and therefore with relevant fees due to regulators.

needs to comply with a high level Performed testing to ensure that

of regulation. Non- compliance all returns are submitted in

with these laws and regulation accordance with requirements

could result in the parent company and within the specified timescales.

being de- listed from the London Performed a detailed analysis

Stock Exchange, which would threaten of the relevant laws and regulations

the group and parent company's and discussed with management

ability to continue. This is considered to outline the control processes

to be a significant risk. to ensure compliance with these

rules.

They key observation with regards

to this risk was that the parent

company is generally compliant

with the requirements of the

London Stock Exchange. It is

noted that the Company is not

currently compliant with the

London Stock Exchange rules with

regards to the filing of the

financial statements, and the

shares are currently suspended.

------------------------------------------------

Key Audit Matter How our scope addressed this

matter

Going concern

The group is considered by the In order to address this risk,

board to be a going concern, and a detailed review of going concern

the accounts have been prepared was conducted, which involved

as appropriate on this basis, reviewing management's forecasts

and therefore this judgement should for the period up to December

be assessed. As the majority of 2023, and challenging the assumptions

the group companies do not trade made in preparation of this.

or generate revenues, and the Sensitivity analysis was conducted,

group is in a net liabilities and a 'worse' case scenario was

position, there is a risk of material assessed to consider the impact

uncertainty relating to going of this. Detailed discussions

concern, compounded with the current have been had with management

economic climate as a result of on future plans, review of board

COVID-19. meeting minutes, and review of

the appropriateness of the going

concern disclosure in note 2.

The application of materiality

is not as applicable in this

area since this relates to the

overall appropriateness of applying

the going concern principle.

The key observations with regards

to this risk are that due to

the suspension of the shares

with the London Stock Exchange,

and the lack of financial support

for the Company, there is a material

uncertainty relating to going

concern.

-----------------------------------------------

Accounting estimates

We will assess the impairments We obtained an understanding

made by management to ensure that of the impairment process and

investments and fixed assets are evaluated the impairment methodology

not materially misstated in the and, tested the accuracy and

financial statements. completeness of the impairment

review assessments. We gathered

evidence from third parties,

where possible, to corroborate

cost assumptions included in

calculations for future activity

of operations for the forecasts.

For those assets or investments

impaired previously, we evaluated

the actual results and the assumptions

made and considered if reversals

were required. We checked the

recoverability of the receivables

in AAG's accounts to gain direct

written confirmations on the

existence of these assets from

third parties. And obtained evidence

from third parties of financial

stability and ability to repay

to test recoverability. We enquired

management regarding the intention

of the group balances, and whether

these should be netted off.

-----------------------------------------------

Our application of materiality

Based on our professional judgement, we determined materiality

for the financial statements as a whole as follows: group and

parent company materiality for the financial statements as a whole

at

GBP29,100 and GBP26,300 respectively, which is based on 2% of

loss before tax after the removal of exceptional items at the

planning stage. Materiality has been set using this measure as this

is considered to represent the most appropriate measure of

underlying performance, which is the most sensitive measure being a

listed group. The group and parent company performance materiality

adopted is 50% of this figure, which was calculated as GBP14,500

and GBP13,100 respectively. This is deemed by the audit team to be

an appropriate level to identify material errors, which is used for

a high-risk audit. The materiality at completion has been assessed

and it was noted that the loss before tax had increased as a result

of an audit adjustment, however it was concluded that materiality

should not be amended. Materiality has influenced our workings not

only for the key audit matters but also for the rest of the work

performed during the audit. Anything below GBP1,450 and GBP1,300

was considered trivial from a group and parent company perspective

respectively.

We agreed with the audit committee that we would report to them

misstatements identified during our audit above GBP1,450 or

GBP1,300 as appropriate as well as misstatements below that amount

that, in our view, warranted reporting for qualitative reasons.

Other information

The other information comprises the information included in the

annual report other than the financial statements and our auditor's

report thereon. The directors are responsible for the other

information contained within the annual report. Our opinion on the

financial statements does not cover the other information and,

except to the extent otherwise explicitly stated in our report, we

do not express any form of assurance conclusion thereon. Our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

course of the audit, or otherwise appears to be materially

misstated. If we identify such material inconsistencies or apparent

material misstatements, we are required to determine whether this

gives rise to a material misstatement in the financial statements

themselves. If, based on the work we have performed, we conclude

that there is a material misstatement of this other information, we

are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act

2006

In our opinion, the part of the directors' remuneration report

to be audited has been properly prepared in accordance with the

Companies Act 2006. In our opinion, based on the work undertaken in

the course of the audit:

- the information given in the strategic report and the

directors' report for the financial year for which the financial

statements are prepared is consistent with the financial statements

and those reports have been prepared in accordance with applicable

legal requirements;

- the information about internal control and risk management

systems in relation to financial reporting processes and about

share capital structures, given in compliance with rules 7.2.5 and

7.2.6 in the Disclosure Rules and Transparency Rules sourcebook

made by the Financial Conduct Authority (the FCA Rules), is

consistent with the financial statements and has been prepared in

accordance with applicable legal requirements; and

- information about the company's corporate governance code and

practices and about its administrative, management and supervisory

bodies and their committees complies with rules 7.2.2, 7.2.3 and

7.2.7 of the FCA Rules.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the group and

the parent company and its environment obtained in the course of

the audit, we have not identified material misstatements in;

- the strategic report or the directors' report; or

- the information about internal control and risk management

systems in relation to financial reporting processes and about

share capital structures, given in compliance with rules 7.2.5 and

7.2.6 of the FCA Rules.

We have nothing to report in respect of the following matters in

relation to which the Companies Act 2006 requires us to report to

you if, in our opinion:

- adequate accounting records have not been kept by the parent

company, or returns adequate for our audit have not been received

from branches not visited by us; or

- the parent company financial statements and the part of the

directors' remuneration report to be audited are not in agreement

with the accounting records and returns; or

- certain disclosures of directors' remuneration specified by law are not made; or

- we have not received all the information and explanations we require for our audit; or

- a corporate governance statement has not been prepared by the parent company.

Corporate governance statement

The Listing Rules require us to review the directors' statement

in relation to going concern, longer- term viability and that part

of the Corporate Governance Statement relating to the group's

compliance with the provisions of the UK Corporate Governance

Statement specified for our review.

Based on the work undertaken as part of our audit, we have

concluded that each of the following elements of the Corporate

Governance Statement is materially consistent with the financial

statements or our knowledge obtained during the audit:

- Directors' statement with regards the appropriateness of

adopting the going concern basis of accounting and any material

uncertainties identified (set out on page 10);

- Directors' explanation as to its assessment of the entity's

prospects, the period this assessment covers and why they period is

appropriate (set out on page 13).

- Directors' statement is fair, balanced and understandable (set out on page 14);

- Board's confirmation that it has carried out a robust

assessment of the e-merging and principal risks (set out on page

14);

- The section of the annual report that describes the review of

effectiveness of risk management and internal control systems (set

out on page 13); and;

- The section describing the work of the audit committee (set out on page 14).

Responsibilities of directors

As explained more fully in the directors' responsibilities

statement set out on page 11, the directors are responsible for the

preparation of the financial statements and for being satisfied