Sabre Insurance Group PLC Trading Update (5737A)

May 25 2023 - 1:00AM

UK Regulatory

TIDMSBRE

RNS Number : 5737A

Sabre Insurance Group PLC

25 May 2023

25 May 2023

Sabre Insurance Group plc

Trading Update

Full year guidance reiterated

Sabre Insurance Group plc (the "Group" or "Sabre"), one of the UK's

leading motor insurance underwriters, today provides an update on

trading for the period from 1 January 2023 to 30 April 2023 ahead

of its Annual General Meeting ("AGM") later this morning. Unaudited Unaudited

4 months 4 months ended

ended

30 Apr 2023 30 Apr 2022

----------------------------------- ------------ ---------------

Gross written premium - Motor GBP47.9m GBP45.3m

Gross written premium - Motorcycle GBP6.3m GBP12.0m

Gross written premium - Taxi GBP4.7m GBP2.5m(1)

----------------------------------- ------------ ---------------

Gross written premium - Total GBP58.9m GBP59.8m

----------------------------------- ------------ ---------------

(1) = Disclosed as part of 'Motor' in the May 2022 trading update

Business highlights for the first four months of 2023

* Gross written premium in Motor has increased year on

year, with profitability in line with expectations

and ahead of the same period last year

* Further progress in improving the profitability of

the Motorcycle business with the current run-rate

performance in-line with expectations and anticipated

to deliver a positive contribution to profit in 2023

* Underwriting actions to improve the profitability of

the Taxi business are anticipated to continue through

2023, reflected in current reduced premium run-rate

of this business

* Ongoing focus on profitability, not volume, with

total policy count of 275k as at 30 April 2023 (31

December 2022: 304k) including 54k motorcycle

policies (31 December 2022: 74k) and 14k taxi

policies (31 December 2022: 12k)

* Whilst core Motor policy count declined early in the

year, we have seen a return to growth in policy count

in recent weeks

* Post-dividend solvency capital ratio at 31 March 2023

of 172% (31 March 2022: 160%)

Market trends

* Claims inflation for 2023 anticipated to remain at

c.10%, as previously guided

* Evidence of positive momentum in market pricing since

late March, with this trend anticipated to continue

in the coming months

Full year guidance reiterated

* High single-digit growth in overall gross written

premium anticipated for the full year

* Low double-digit growth in core Motor business gross

written premium somewhat offset by a reduction in the

Motorcycle and Taxi businesses as underwriting

actions take hold

* Combined operating ratio expected to be between 85%

to 90%

* Expected expense ratio strain in H1, and improvements

on loss ratios throughout 2023 as pricing actions

earn through, means H1 combined operating ratio

likely to be higher than the expected 2023 full year

position

* Note that this guidance is carried forward from

year-end on an IFRS4-equivalent basis

Geoff Carter, Chief Executive Officer of Sabre, commented:

"I am pleased to be able to continue my message of cautious optimism

from our full-year results into our first update for 2023, and indeed

I am feeling slightly more optimistic given strong volumes in recent

weeks.

In particular, we have been encouraged by the trends that we have

been seeing from mid-March and into May. There is clear evidence

that market pricing is improving, and we have seen weekly gross written

premiums across this period in our core Motor business over 20% higher

than the same time last year. We anticipate this trend of improving

market pricing will continue, albeit it is too early to tell what

the pace and trajectory of improvement will be, and are confident

in our ability to continue to grow volumes at the appropriate margin.

We are currently in the fortunate position of making pricing decisions

designed to find an optimal point between volume growth and margin

enhancement.

We expect the loss ratios in the core Motor business to improve

through the rest of 2023, with pricing actions reflecting ongoing

inflation. Volumes for the Taxi business have been suppressed while

this market segment remains challenging. The actions we took last

year and this year to increase the profitability of the Motorcycle

businesses should generate a positive contribution to profit.

If these positive market pricing trends and run-rates continue through

the rest of the year, we anticipate a strong bounce-back in earnings

compared to 2022."

Investor enquiries 01306 747 272

Sabre Insurance Group plc

Geoff Carter / Adam Westwood

Media enquiries 020 7353 4200

Teneo sabre@teneo.com

James Macey White / Eleanor

Pomeroy

LEI Code: 2138006RXRQ8P8VKGV98

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEMFALEDSEFI

(END) Dow Jones Newswires

May 25, 2023 02:00 ET (06:00 GMT)

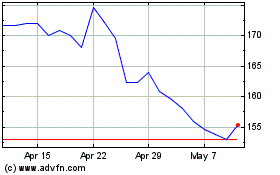

Sabre Insurance (LSE:SBRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

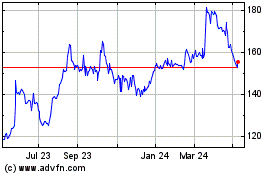

Sabre Insurance (LSE:SBRE)

Historical Stock Chart

From Apr 2023 to Apr 2024