TIDMSENX

RNS Number : 6677U

Serinus Energy PLC

27 November 2023

27 November 2023

Press Release

Interim Results for the Nine Months Ended 30 September 2023

Jersey, Channel Islands, 27 November 2023 -- Serinus Energy plc

("Serinus" or the "Company") (AIM:SENX, WSE:SEN) is pleased to

announce its interim results for the nine months ended 30 September

2023.

Financial

-- Revenue for the nine months ended 30 September 2023 was $13.3

million (30 September 2022 - $41.8 million)

-- Funds from operations for the nine months ended 30 September

2023 were $1.2 million (30 September 2022 - $ 11.1 million)

-- EBITDA for the nine months ended 30 September 2023 was $1.2

million ( 30 September 2022 - $12.6 million)

-- Gross profit for the nine months ended 30 September 2023 was

$1.8 million (30 September 2022 - $11.8 million)

-- The Company realised a net price of $ 76.84 /boe for the nine

months ended 30 September 2023 comprising:

o Realised oil price - $78.68/bbl

o Realised natural gas price - $12.03/Mcf

-- The Group's operating netback decreased, in line with

commodity prices, for the nine months ended 30 September 2023 and

was $34.15/boe ( 30 September 2022 - $120.13/boe), comprising:

o Romania operating netback - $4.22/boe ( 30 September 2022 - $195.73/boe)

o Tunisia operating netback - $40.68/boe ( 30 September 2022 - $59.11/boe)

-- Capital expenditures of $5.3 million for the nine months

ended 30 September 2023 ( 30 September 2022 - $8.6 million),

comprising:

o Romania - $0.5 million

o Tunisia - $4.8 million

-- Cash balance as at 30 September 2023 was $1.5 million (31

December 2023 - $4.9 million). As at 15 November 2023, the Group

had cash balances of $3.5 million

Operational

-- Production for nine months ended 30 September 2023 averaged 641 boe/d, comprising:

o Tunisia - 524 boe/d

o Romania - 117 boe/d

-- Production in Chouech Es Saida continues to be stable and

benefits from artificial lift programme

-- Static and dynamic reservoir models of the Sabria field are

being constructed. The study will help inform optimum reservoir

management including potential well workovers and new well

locations

-- Installation of artificial lift in the Sabria W-1 well will

require a sidetrack. The sidetrack design has been completed and

the tender process for the long lead items has commenced

-- The Sabria N-2 well is dewatering at a slow rate and the

Company is in discussions with its partner regarding stimulation

techniques to enhance the dewatering of this well

-- The Company performed a lifting of 56,600 bbls of Tunisian

crude oil at a price of $85.59/bbl in October

-- In October 2023, the Company was granted a further

exploration period on the Satu Mare Concession in Romania by

Romanian National Agency for Mineral Resources ("NAMR"). The

exploration period extension is in two phases. The first phase,

until 27 October 2025, includes the acquisition of 100 kilometres

of 2D seismic. The second optional phase of two years requires the

drilling of one well with no depth obligation

About Serinus

Serinus is an international upstream oil and gas exploration and

production company that owns and operates projects in Tunisia and

Romania.

For further information, please refer to the Serinus website

(www.serinusenergy.com) or contact the following:

Serinus Energy plc

Jeffrey Auld, Chief Executive Officer

Calvin Brackman, Vice President, External

Relations & Strategy +4 4 204 541 7859

Shore Capital (Nominated Adviser & Broker)

Toby Gibbs

Lucy Bowden +44 207 408 4090

Camarco (Financial PR - London)

Owen Roberts +44 203 781 8334

RES Consulting (Financial PR - Warsaw)

Katarzyna Terej +48 602 214 353

Forward Looking Statement Disclaimer

This release may contain forward-looking statements made as of

the date of this announcement with respect to future activities

that either are not or may not be historical facts. Although the

Company believes that its expectations reflected in the

forward-looking statements are reasonable as of the date hereof,

any potential results suggested by such statements involve risk and

uncertainties and no assurance can be given that actual results

will be consistent with these forward-looking statements. Various

factors that could impair or prevent the Company from completing

the expected activities on its projects include that the Company's

projects experience technical and mechanical problems, there are

changes in product prices, failure to obtain regulatory approvals,

the state of the national or international monetary, oil and gas,

financial , political and economic markets in the jurisdictions

where the Company operates and other risks not anticipated by the

Company or disclosed in the Company's published material. Since

forward-looking statements address future events and conditions, by

their very nature, they involve inherent risks and uncertainties,

and actual results may vary materially from those expressed in the

forward-looking statement. The Company undertakes no obligation to

revise or update any forward-looking statements in this

announcement to reflect events or circumstances after the date of

this announcement, unless required by law.

Translation : This news release has been translated into Polish

from the English original.

Serinus Energy plc

Third Quarter Report and Accounts 2023

(US dollars)

Operational UPDATE and Outlook

Serinus Energy plc and its subsidiaries ("Serinus", the

"Company" or the "Group") is an oil and gas exploration, appraisal

and development company. The Group is the operator of all its

assets and has operations in two business units: Romania and

Tunisia.

ROMANIA

The Group's Romanian operating subsidiary holds the licence to

the Satu Mare concession area, covering approximately 3,000 km(2)

in the north-west of Romania. The Moftinu Gas Development project

began production in 2019. The development project includes the

Moftinu gas plant, and currently has four gas production wells -

Moftinu-1003, Moftinu-1004, Moftinu-1007 and Moftinu-1008. During

the nine months ended 30 September 2023, the Company's Romanian

operations produced a total of 192 MMcf of gas, equating to an

average daily production of 117 boe/day.

The Canar-1 water injection well is currently injecting all

produced water volumes from the Moftinu field. The use of Canar-1

as a water injection well is delivering significant cost savings in

operating expenses due to the elimination of the high costs of

trucking produced water volumes for disposal off-site.

The Company has completed all its commitments under the third

exploration phase of the Satu Mare Concession Agreement, and in

October 2021, received an additional two-year evaluation phase on

the Satu Mare Concession until 27 October 2023. In October 2023,

the Company was granted further exploration phase extension of the

Satu Mare Concession by NAMR. The extension is in two phases. The

first phase of the extension is two years in duration starting on

28 October 2023. The work commitment for the first phase is the

reprocessing of 100 kilometres of legacy 2D seismic as well as a 2D

seismic acquisition program of 100 kilometres including processing

the acquired seismic data. The second phase of the licence

extension is optional and is two years in duration starting on 28

October 2026 with a work commitment of drilling one well within the

concession area with no total drilling depth requirement

stipulated. The greater Moftinu gas field area has been declared a

commercial field and is exempt from this routine licence extension

procedure.

The Company announced on 15 February 2023 that the International

Chamber of Commerce ("ICC") had awarded a decision in favour of

Serinus, confirming that as a result of Oilfield Exploration

Business Solutions S.A. ("OEBS") default under the Joint Operating

Agreement ("JOA") between OEBS and Serinus, OEBS' 40% participating

interest in the Satu Mare Concession in Romania will be transferred

to Serinus. Furthermore, the Company has received in October 2023,

from the Romanian Courts, the recognition of the ICC award.

The Company is currently planning for the workover interventions

in M-1003 and M-1007, scheduled for the first half of 2024. These

interventions are intended to access additional gas volumes in the

Moftinu field.

Tunisia

The Company currently holds two concession areas within Tunisia

- Sabria and Chouech Es Saida. These concession areas both contain

discovered oil and gas reserves and are currently producing. The

largest asset is the Sabria field, which is a large, conventional

oilfield. The Company's independent reservoir engineers have

estimated Sabria to have approximately 445 million barrels of oil

equivalent originally in place. Of this oil in place only 1.6% has

been produced to date due to a low rate of development on the

field. Serinus has spent extensive time studying the best means of

further developing this field and considers this to be an excellent

asset for remedial work to increase production and, on completion

of ongoing reservoir studies, to conduct further development

operations.

The workover to install a pump into the Sabria W-1 well

encountered unexpected conditions as a result of old drilling mud

and tubulars left in the well from operations in 1998. The Company

and its partner, Enterprise Tunisienne D'Activite Petroliere

("ETAP"), suspended the workover and have determined that a

sidetrack is required to complete the operation. The sidetrack

design has been completed and the tender process for the long lead

items has commenced.

The Company and ETAP also conducted workover operations on the

Sabria N-2 well. Workover operations were completed on time and

within budget. The objectives of the workover were to remove

wellbore restrictions, install new production tubing, and remediate

reservoir damage around the wellbore. Wellbore restrictions were

removed and new production tubing was installed. The well will need

further stimulation to clean up the formation damage and

discussions are continuing with the partner on this issue. The well

was drilled in 1980 but was damaged during completion and, although

in proximity to producing wells, in particular the prolific

WIN-12bis well, was not able to flow oil to surface. The Company's

engineering analysis estimates that a successful workover and

recompletion will initially increase gross production from the

Sabria field by approximately 420 boe/d.

Financial Review

Liquidity, Debt and Capital Resources

During the nine months ended 30 September 2023, the Company

invested a total of $5.3 million (2022 - $8.6 million) on capital

expenditures before working capital adjustments. In Romania, the

Group invested $0.5 million (2022 - $6.9 million) on Canar-1 water

injection pump, solar powered radio telecommunication system to the

Moftinu gas plant, and further extension of the Satu Mare

Concession. In Tunisia, the Company invested $4.8 million (2022 -

$1.6 million) of which $3.5 million was invested in workovers on

wells and $1.3 million in capital inventory additions.

The Company's funds from operations for the nine months ended 30

September 2023 were $1.2 million (2022 - $11.1 million). Including

changes in non-cash working capital, the cash flow generated from

operating activities in 2023 was $1.7 million (2022 - $8.7

million). The Company continues to be in a strong position to

expand and continue growing production within our existing resource

base. The Company remains debt-free and has adequate resources

available to deploy capital into both operating business units to

deliver growth and shareholder returns.

($000) 30 September 31 December

Working Capital 2023 2022

----------------------------------- ------------- ------------

Current assets 14,200 16,654

Current liabilities (18,468) (16,571)

----------------------------------- ------------- ------------

Working Capital surplus (deficit) (4,268) 83

----------------------------------- ------------- ------------

Working capital deficit as at 30 September 2023 is $ 4.3 million

(31 December 2022 - $ 0.1 million surplus).

Current assets as at 30 September 2023 were $14.2 million (31

December 2022 - $16.7 million), a decrease of $2.5 million. Current

assets consist of:

-- Cash and cash equivalents of $ 1.5 million (31 December 2022 - $4.9 million)

-- Restricted cash of $ 1.1 million (31 December 2022 - $1.1 million)

-- Trade and other receivables of $10.9 million (31 December 2022 - $10.0 million)

-- Product inventory of $ 0.7 million (31 December 2022 - $0.7 million)

Current liabilities as at 30 September 2023 were $18.5 million

(31 December 2022 - $16.6 million), an increase of $1.9 million.

Current liabilities consist of:

-- Accounts payable of $ 13.0 million (31 December 2022 - $9.3 million)

-- Decommissioning provision of $5.4 million (31 December 2022 - $5.1 million)

o Canada - $ 0.8 million (31 December 2022 - $0.8 million) which

is offset by restricted cash in the amount of $ 1.1 million (31

December 2022 - $1.1 million) in current assets

o Romania - $0.5 million (31 December 2022 - $0.5 million)

o Tunisia - $ 4.1 million (31 December 2022 - $3.8 million)

-- Income taxes payable of $nil (31 December 2022 - $1.9 million)

-- Current portion of lease obligations of $ 0.2 million (31 December 2022 - $0.3 million)

Non-current assets

Property, plant and equipment ("PP&E") increased to $ 63.0

million (31 December 2022 - $ 62.3 million), primarily due to

capital expenditures in PP&E of $ 5.3 million offset by

depletion in the period of $ 3.2 million as well as a change in

decommissioning estimates of $ 1.4 million which decreased due to

the higher discount rates applied to the calculation during the

period . Exploration and evaluation assets ("E&E") increased to

$ 10.7 million (31 December 2022 - $ 10.5 million), due to change

in decommissioning estimates. Right-of-use assets decreased to $

0.4 million (31 December 2022 - $ 0.7 million) due to depreciation

in the period.

Financial Review - NINE months ended 30 SEPTEMBER 2023

Funds from Operations

The Group uses funds from operations as a key performance

indicator to measure the ability of the Group to generate cash from

operations to fund future exploration and development activities.

The following table is a reconciliation of funds from operations to

cash flow from operating activities:

Nine months ended 30

September

($000) 2023 2022

------------------------------------ ---------- -----------

Cash flow from operations 1,697 8,713

Changes in non-cash working capital (518) 2,342

------------------------------------ ---------- -----------

Funds from operations 1,179 11,055

------------------------------------ ---------- -----------

Funds from operations per share 0.01 0.10

------------------------------------ ---------- -----------

Romania used funds in operations of $ 0.7 million (2022 -

generated $8.4 million) and Tunisia generated $ 5.8 million (2022 -

$7.1 million). Funds used at the Corporate level were $ 3.9 million

(2022 - $4.4 million) resulting in net funds from operations of $

1.2 million (2022 - $11.1 million).

Production

Nine months ended 30

September 2023 Tunisia Romania Group %

------------------------ -------- -------- ------ -----

Crude oil (bbl/d) 454 - 454 71%

Natural gas (Mcf/d) 415 703 1,118 29%

Condensate (bbl/d) - - - -

------------------------ -------- -------- ------ -----

Total (boe/d) 524 117 641 100%

------------------------ -------- -------- ------ -----

Nine months ended 30

September 2022

Crude oil (bbl/d) 451 - 451 48%

Natural gas (Mcf/d) 395 2,518 2,913 52%

Condensate (bbl/d) - 2 2 0%

------------------------ -------- -------- ------ -----

Total (boe/d) 517 422 938 100%

------------------------ -------- -------- ------ -----

During the nine months ended 30 September 2023 production

volumes decreased by 297 boe/d to 641 boe/d against the comparative

period (2022 - 938 boe/d).

Romania's production volumes decreased by 305 boe/d to 117 boe/d

against the comparative period (2022 - 422 boe/d). Production

continues to reflect the natural decline profile of shallow gas

fields.

Tunisia's production volumes increased by 7 boe/d to 524 boe/d

against the comparative period (2022 - 517 boe/d). Production

remains stable during the nine months of 2023 as a result of the

oil fields' maintenance programme. Ongoing workover programmes

continue in the Chouech Es Saida field, with the aim to optimize

production.

Oil and Gas Revenue

($000)

Nine months ended 30 September

2023 Tunisia Romania Group %

Oil revenue 9,732 - 9,732 73%

Natural gas revenue 1,203 2,331 3,534 27%

Condensate revenue - - - -

--------------------------------- -------- -------- ------- -------

Total revenue 10,935 2,331 13,266 100%

--------------------------------- -------- -------- ------- -------

Nine months ended 30 September

2022 Tunisia Romania Group %

-------------------------------- -------- -------- ------- -----

Oil revenue 12,569 - 12,569 30%

Natural gas revenue 1,280 27,888 29,168 69%

Condensate revenue - 57 57 1%

-------------------------------- -------- -------- ------- -----

Total revenue 13,849 27,945 41,794 100%

-------------------------------- -------- -------- ------- -----

Realised PricE

Nine months ended 30 September 2023 Tunisia Romania Group

-------------------------------------- ------------ -------- -------

Oil ($/bbl) 78.68 - 78.68

Natural gas ($/Mcf) 10.61 12.92 12.03

Condensate ($/bbl) - - -

-------------------------------------- ------------ -------- -------

Average realised price ($/boe) 76.69 77.52 76.84

-------------------------------------- ------------ -------- -------

Nine months ended 30 September 2022

-------------------------------------- ------------ -------- -------

Oil ($/bbl) 101.04 - 101.04

Natural gas ($/Mcf) 11.88 40.54 36.66

Condensate ($/bbl) - 81.33 81.33

-------------------------------------- ------------ -------- -------

Average realised price ($/boe) 97.29 242.25 162.18

-------------------------------------- ------------ -------- -------

During the nine months ended 30 September 2023 revenue decreased

by $ 28.5 million to $13.3 million (2022 - $41.8 million) as the

Group saw the average realised price decrease to $ 76.84 /boe (2022

- $162.18/boe) and production decline in Romania.

The Group's average realised oil price decreased to $ 78.68 /bbl

(2022 - $101.04/bbl), and average realised natural gas prices

decreased to $ 12.03 /Mcf (30 September 2022 - $36.66/Mcf).

Under the terms of the Sabria Concession Agreement the Group is

required to sell 20% of its annual crude oil production from the

Sabria concession into the local market, which is sold at an

approximate 10% discount to the price obtained on its other crude

sales. The remaining crude oil production was sold to the

international market.

Royalties

Nine months ended 30 September

($000) 2023 2022

--------------------------------------- ------ -------

Tunisia 1,366 1,714

Romania 111 943

--------------------------------------- ------ -------

Total 1,477 2,657

Total ($/boe) 8.55 10.31

Tunisia oil royalty (% of oil revenue) 12.5% 12.4 %

Romania gas royalty (% of gas revenue) 4.7% 3.5 %

--------------------------------------- ------ -------

Total (% of revenue) 11.1% 6.4 %

--------------------------------------- ------ -------

For the nine months ended 30 September 2023 royalties decreased

to $ 1.5 million (30 September 2022 - $ 2.7 million) while the

Group's average royalty rate increased to 11.1 % (30 September 2022

- 6.4 %).

In Romania, during nine months of 2023, the Company incurred a

3.5% royalty rate for gas (30 September 2022 - 3.5%). The royalty

is calculated using a reference price that is set by the Romanian

authorities and not the realised price to the Company. The

reference gas prices during nine months of 2023 remained higher

than the realised prices by 40%. Romanian royalty rates vary based

on the level of production during the quarter. Natural gas royalty

rates range from 3.5% to 13.0% and condensate royalty rates range

from 3.5% to 13.5%.

In Tunisia, royalties vary based on individual concession

agreements. Sabria royalty rates vary depending on a calculation of

cumulative revenues, net of taxes, as compared to cumulative

investment in the concession, known as the "R-factor". As the

R-factor increases, so does the royalty percentage to a maximum

rate of 15%. During the nine months of 2023, the royalty rate

remained unchanged in Sabria at 10% for oil and 8% for gas. Chouech

Es Saida royalty rates are flat at 15% for both oil and gas.

Production Expenses

Nine months ended 30 September

($000) 2023 2022

----------------------------------- ------ ------

Tunisia 3,768 3,720

Romania 2,094 4,424

Canada 31 40

----------------------------------- ------ ------

Group 5,893 8,184

Tunisia production expense ($/boe) 26.43 26.14

Romania production expense ($/boe) 69.64 38.35

----------------------------------- ------ ------

Total production expense ($/boe) 34.14 31.74

----------------------------------- ------ ------

During the nine months ended 30 September 2023 production

expenses decreased by $ 2.3 million to $5.9 million (30 September

2022 - $8.2 million). Per unit production expenses increased to $

34.14/boe (30 September 2022 - $ 31.74/boe ).

Tunisia's production expenses increased by $0.1 million to $ 3.8

million (2022 - $3.7 million), with per unit production expenses

increasing to $ 26.43 /boe (30 September 2022 - $26.14/boe) which

is consistent with the slight increase in production during the

period.

Romania's overall operating costs decreased by $ 2.3 million to

$ 2.1 million (2022 - $ 4.4 million), however per unit production

expenses increased to $ 69.64 /boe (30 September 2022 - $ 38.35

/boe) due to naturally declining production and the impact of

inflation in Romania.

Canada production expenses relate to the Sturgeon Lake assets,

which are not producing and are incurring minimal operating costs

to maintain the property.

Operating Netback

Serinus uses operating netback as a key performance indicator to

assist management in understanding Serinus' profitability relative

to current market conditions and as an analytical tool to benchmark

changes in operational performance against prior periods. Operating

netback consists of petroleum and natural gas revenues less direct

costs consisting of royalties and production expenses. Netback is

not a standard measure under IFRS and therefore may not be

comparable to similar measures reported by other entities .

($/boe)

Nine months ended 30 September

2023 Tunisia Romania Group

Sales volume (boe/d) 522 110 632

Realised price 76.69 77.52 76.84

Royalties (9.58) (3.66) (8.55)

Production expense (26.43) (69.64) (34.14)

--------------------------------- -------- -------- --------

Operating netback 40.68 4.22 34.15

--------------------------------- -------- -------- --------

Nine months ended 30 September

2022 Tunisia Romania Group

Sales volume (boe/d) 521 422 944

Realised price 97.29 242.25 162.18

Royalties (12.04) (8.17) (10.31)

Production expense (26.14) (38.35) (31.74)

--------------------------------- -------- -------- --------

Operating netback 59.11 195.73 120.13

--------------------------------- -------- -------- --------

For the nine months ended 30 September 2023 the Group's

operating netback was $ 34.15 /boe (30 September 2022 - $ 120.13

/boe). The decrease is due to lower realised prices and higher per

unit production expenses.

The Company also generated a gross profit of $ 1.8 million (30

September 2022 - $ 11.8 million), largely due to a significant

decrease in the Company's netbacks.

Earnings Before Interest, Taxes, Depreciation and Amortization

("ebitda")

Serinus uses EBITDA as a key performance indicator to assist

management in understanding Serinus' cash profitability. EBITDA is

computed as net profit/loss and adding back interest, taxation,

depletion and depreciation, and amortisation expense. EBITDA is not

a standard measure under IFRS and therefore may not be comparable

to similar measures reported by other entities. During the nine

months ended 30 September 2023 , the Group's EBITDA decreased by $

11.4 million to $ 1.2 million (30 September 2022 - $ 12.6

million).

Nine months ended 30

September

($000) 2023 2022

----------------------------------- ------------ ---------

Net income (loss) (4,559) 3,367

Finance costs, including accretion 1,277 1,313

Depletion and amortization 3,432 4,924

Decommissioning provision recovery (36) (62)

Tax expense 1,112 3,079

----------------------------------- ------------ ---------

EBITDA 1,226 12,621

----------------------------------- ------------ ---------

Windfall Tax

Nine months ended 30

September

($000) 2023 2022

----------------------------------- ---------- -----------

Windfall tax 661 14,233

Windfall tax ($/Mcf - Romania gas) 3.44 20.68

Windfall tax ($/boe - Romania gas) 21.97 124.05

For the nine months ended 30 September 2023 windfall taxes were

$0.7 million (30 September 2022 - $14.2 million). This decrease is

directly related to a combination of lower production and lower

realised gas prices in Romania.

In Romania, the Group is subject to a windfall tax on its

natural gas production which is applied to supplemental income once

natural gas prices exceed 47.53 RON/Mwh. This supplemental income

is taxed at a rate of 60% between 47.53 RON/Mwh and 85.00 RON/Mwh

and at a rate of 80% above 85.00 RON/Mwh. Expenses deductible in

the calculation of the windfall tax include royalties and capital

expenditures limited to 30% of the supplemental income below the

85.00 RON/Mwh threshold.

Depletion and Depreciation

Nine months ended 30 September

($000) 2023 2022

------------------- ------- ------

Tunisia 2,617 2,067

Romania 742 2,763

Corporate 73 94

------------------- ------- ------

Total 3,432 4,924

Tunisia ($/boe) 18.35 14.52

Romania ($/boe) 24.67 23.95

------------------- ------- ------

Total ($/boe) 19.88 19.11

------------------- ------- ------

For the nine months ended 30 September 2023 depletion and

depreciation expense was $3.4 million (30 September 2022 - $4.9

million). The decrease is primarily due to lower production during

the period. Per boe, depletion and depreciation expense increased

to $19.88/boe (30 September 2022 - $19.11/boe), primarily due to

lower reserves in the current period.

General and Administrative ("G&A") Expense

Nine months ended 30

September

($000) 2023 2022

-------------------- ----------- ----------

G&A expense 4,006 4,050

G&A expense ($/boe) 23.20 15.72

For the nine months ended 30 September 2023 G&A expenses

comprised $4.0 million and remained on the level consistent with

the prior year period (30 September 2022 - $4.1 million) regardless

of the current high inflationary environment.

Share-Based Payment

Nine months ended 30 September

($000) 2023 2022

---------------------------- ----- -----

Share-based payment 3 59

Share-based payment ($/boe) 0.02 0.23

During the nine months ended 30 September 2023 share-based

compensation decreased to $nil (30 September 2022 - $0.06 million)

due to lower stock options granted in the preceding 12 months.

Net Finance Expense

Nine months ended 30 September

($000) 2023 2022

--------------------------------------- ------ ------

Interest on leases 34 28

Accretion on decommissioning provision 1,272 753

Foreign exchange and other (29) 532

--------------------------------------- ------ ------

1,277 1,313

--------------------------------------- ------ ------

During the nine months ended 30 September 2023 net finance

expenses stayed constant at $1.3 million (30 September 2022 - $1.3

million).

Taxation

During the nine months ended 30 September 2023 income tax

expense was $1.1 million (30 September 2022 - $3.1 million). The

decrease in the tax expense is directly related to lower taxable

income in Tunisia during the period.

Share Data

As at the date of issuing this report, the following are the

Directors stock options outstanding, LTIP awards, and shares owned

up to the date of this report.

Share Options LTIP Awards Shares

Executive Directors:

Jeffrey Auld - 3,153,603 1,338,875

Non-Executive Directors:

Jim Causgrove - - 290,000

Lukasz Redziniak - - 302,000

Jon Kempster [1] - - 60,261

-------------------------- --------------- ------------ ----------

- 3,153,603 1,991,136

------------------------------------------ ------------ ----------

As of the date of issuing this report, management is aware of

the following shareholders holding more than 5% of the ordinary

shares of the Group, as reported by the shareholders to the Group:

CRUX Asset Management (8.42%), Michael Hennigan (7.94%), Xtellus

Capital Partners Inc (7.44%), Quercus TFI SA (7.18%), Marlborough

Fund Managers (5.48%), and Spreadex LTD (4.10%).

The Directors are responsible for the maintenance and integrity

of the corporate and financial information on the Group's website.

Legislation in Jersey governing the preparation and dissemination

of financial statements may differ from legislation in other

jurisdictions.

Foreign Currency Translation

Foreign currency translation occurs from the revaluation from

fluctuations in the foreign exchange rates in entities with a

different functional currency than the reporting currency (USD).

The revaluation of the condensed consolidated interim statement of

financial position to the period-end rates resulted in a loss of

$0.1 million (30 September 2022 - loss of $3.4 million) through

Other comprehensive loss.

Going Concern

The Group's business activities, together with the factors

likely to affect its future development and performance are set out

in the Operational Update and Outlook. The financial position of

the Group is described in these condensed consolidated interim

financial statements.

The Directors have given careful consideration to the

appropriateness of the going concern assumption, including cashflow

forecasts through the going concern period and beyond, planned

capital expenditure and the principal risks and uncertainties faced

by the Group. This assessment also considered various downside

scenarios including oil and gas commodity prices and production

rates. Following this review, the Directors are satisfied that the

Group has sufficient resources to operate and meet its commitments

as they come due in the normal course of business for at least 12

months from the date of these condensed consolidated interim

financial statements. Accordingly, the Directors continue to adopt

the going concern basis for the preparation of these condensed

consolidated interim financial statements.

Declarations of the Board of Directors Concerning Accounting

Policies

The Board of Directors of the Company confirms that, to the best

of their knowledge, the condensed consolidated interim financial

statements together with comparative figures have been prepared in

accordance with applicable accounting standards and give a true and

fair view of the state of affairs and the financial result of the

Group for the period ended 30 September 2023.

The Financial Review in this report gives a true and fair view

of the situation on the reporting date and of the developments

during the period ended 30 September 2023 and include a description

of the major risks and uncertainties.

Serinus Energy plc

Consolidated Interim Statement of Comprehensive Loss

(US$ 000s, except per share amounts)

Nine months ended 30

September

------------------------------------------------------ ----- -----------------------

Note 2023 2022

------------------------------------------------------ ----- ----------- ----------

Revenue 13,266 41,794

------------------------------------------------------ ----- ----------- ----------

Cost of sales

Royalties (1,477) (2,657 )

Windfall tax (661) (14,223)

Production expenses (5,893) (8,184)

Depletion and depreciation (3,432) (4,924)

Total cost of sales (11,463) (29,988)

------------------------------------------------------ ----- ----------- ----------

Gross profit 1,803 11,806

General and Administrative expenses (4,006) (4,050)

Share-based payment expense (3) (59)

Total administrative expenses (4,009) (4,109)

Decommissioning provision recovery 36 62

Operating income (loss) (2,170) 7,759

Finance expense (1,277) (1,313)

------------------------------------------------------ ----- ----------- ----------

Net income before tax (3,447) 6,446

Tax expense (1,112) (3,079)

------------------------------------------------------ ----- ----------- ----------

Income (loss) after taxation attributable to

equity owners of the parent (4,559) 3,367

Other comprehensive loss

Other comprehensive loss to be classified

to profit and loss in subsequent periods:

Foreign currency translation adjustment (70) (3,441)

------------------------------------------------------ ----- ----------- ----------

Total comprehensive loss for the period attributable

to equity owners of the parent (4,629) (74)

------------------------------------------------------ ----- ----------- ----------

Earnings (loss) per share:

Basic 4 (0.04) 0.03

Diluted 4 (0.04) 0.03

------------------------------------------------------ ----- ----------- ----------

The accompanying notes on pages 15 to 16 form part of the

condensed consolidated interim financial statements

Serinus Energy plc

Condensed Consolidated Interim Statement of Financial

Position

(US$ 000s, except per share amounts)

30 September 31 December

As at 2023 2022

---------------------------------------------- -------------- -------------

Non-current assets

Property, plant and equipment 63,049 62,311

Exploration and evaluation assets 10,722 10,529

Right-of-use assets 369 688

----------------------------------------------- -------------- -------------

Total non-current assets 74,140 73,528

----------------------------------------------- -------------- -------------

Current assets

Restricted cash 1,128 1,088

Trade and other receivables 10,865 10,007

Product inventory 748 705

Cash and cash equivalents 1,459 4,854

----------------------------------------------- -------------- -------------

Total current assets 14,200 16,654

----------------------------------------------- -------------- -------------

Total assets 88,340 90,182

----------------------------------------------- -------------- -------------

Equity

Share capital 401,426 401,426

Share-based payment reserve 25,560 25,557

Treasury shares (458) (455)

Accumulated deficit (390,915) (386,356)

Cumulative translation reserve (3,442) (3,372)

Total equity 32,171 36,800

----------------------------------------------- -------------- -------------

Liabilities

Non-current liabilities

Decommissioning provision 23,887 24,046

Deferred tax liability 12,048 10,942

Lease liabilities 408 465

Other provisions 1,358 1,358

----------------------------------------------- -------------- -------------

Total non-current liabilities 37,701 36,811

----------------------------------------------- -------------- -------------

Current liabilities

Current portion of decommissioning provision 5,365 5,085

Current portion of lease liabilities 151 280

Accounts payable and accrued liabilities 12,952 11,206

----------------------------------------------- -------------- -------------

Total current liabilities 18,468 16,571

----------------------------------------------- -------------- -------------

Total liabilities 56,169 53,382

----------------------------------------------- -------------- -------------

Total liabilities and equity 88,340 90,182

----------------------------------------------- -------------- -------------

The accompanying notes on pages 15 to 16 form part of the

condensed consolidated interim financial statements

Serinus Energy plc

Condensed Consolidated Interim Statement of Changes in

Shareholder's Equity

(US$ 000s, except per share amounts)

Share-based Accumulated

Share payment Treasury Accumulated other comprehensive

capital reserve Shares deficit loss Total

----------------------------- --------- ------------ --------- ------------ --------------------- --------

Balance at 31 December

2021 401,426 25,487 (121) (387,986) (1,374) 37,432

----------------------------- --------- ------------ --------- ------------ --------------------- --------

Loss for the period - - - 3,367 - 3,367

Other comprehensive loss

for the period - - - - (3,441) (3,441)

----------------------------- --------- ------------ --------- ------------ --------------------- --------

Total comprehensive loss

for the period - - - 3,367 (3,441) (74)

Transactions with equity

owners

Share-based payment expense - 59 - - - 59

Shares purchased to be

held in Treasury - - (202) - - (202)

----------------------------- --------- ------------ --------- ------------ --------------------- --------

Balance at 30 September

2022 401,426 25,546 (323) (384,619) (4,815) 37,215

----------------------------- --------- ------------ --------- ------------ --------------------- --------

Balance at 31 December

2022 401,426 25,557 (455) (386,356) (3,372) 36,800

----------------------------- --------- ------------ --------- ------------ --------------------- --------

Comprehensive loss for

the period - - - (4,559) - (4,559)

Other comprehensive loss

for the period - - - - (70) (70)

----------------------------- --------- ------------ --------- ------------ --------------------- --------

Total comprehensive loss

for the period - - - (4,559) (70) (4,629)

Transactions with equity

owners

Share-based payment expense - 3 - - - 3

Shares purchased to be

held in Treasury - - (3) - - (3)

----------------------------- --------- ------------ --------- ------------ --------------------- --------

Balance at 30 September

2023 401,426 25,560 (458) (390,915) (3,442) 32,171

----------------------------- --------- ------------ --------- ------------ --------------------- --------

The accompanying notes on pages 15 to 16 form part of the

condensed consolidated interim financial statements

Serinus Energy plc

Condensed Consolidated Interim Statement of Cash Flows

(US$ 000s, except per share amounts)

Nine months ended 30

September

Note 2023 2022

--------------------------------------------------- ----- ---------- -----------

Operating activities

Income (loss) for the period (4,559) 3,367

Items not involving cash:

Depletion and depreciation 3,432 4,924

Share-based payment expense 3 59

Tax expense 1,112 3,079

Accretion expense on decommissioning provision 1,272 753

Foreign exchange loss (gain) (20) 68

Other income (25) (3)

Decommissioning provision recovery (36) (62)

Income taxes paid - (1,130)

Funds from operations 1,179 11,055

Changes in non-cash working capital 5 518 (2,342)

--------------------------------------------------- ----- ---------- -----------

Cashflows from operating activities 1,697 8,713

--------------------------------------------------- ----- ---------- -----------

Financing activities

Lease payments (12) (355)

Shares purchased to be held in treasury (194) (202)

Cashflows used in financing activities (206) (557)

--------------------------------------------------- ----- ---------- -----------

Investing activities

Capital expenditures 5 (4,925) (7,476)

Cashflows used in investing activities (4,925) (7,476)

--------------------------------------------------- ----- ---------- -----------

Impact of foreign currency translation on

cash 39 (324)

--------------------------------------------------- ----- ---------- -----------

Change in cash and cash equivalents (3,395) 356

Cash and cash equivalents, beginning of period 4,854 8,429

--------------------------------------------------- ----- ---------- -----------

Cash and cash equivalents, end of period 1,459 8,785

--------------------------------------------------- ----- ---------- -----------

The accompanying notes on pages 15 to 16 form part of the

condensed consolidated interim financial statements

Serinus Energy plc

Notes to the Condensed Consolidated Interim Financial

Statements

(US$ 000s, except per share amounts, unless otherwise noted)

1. General information

Serinus Energy plc and its subsidiaries are principally engaged

in the exploration and development of oil and gas properties in

Tunisia and Romania. Serinus is incorporated under the Companies

(Jersey) Law 1991. The Group's head office and registered office is

located at 2(nd) Floor, The Le Gallais Building, 54 Bath Street,

St. Helier, Jersey, JE1 1FW.

Serinus is a publicly listed company whose ordinary shares are

traded under the symbol "SENX" on AIM and "SEN" on the WSE.

2. Basis of presentation

The condensed consolidated interim financial statements have

been prepared in accordance with International Financial Reporting

Standards ("IFRS") and their interpretations issued by the

International Accounting Standards Board ("IASB") as adopted by the

United Kingdom applied in accordance with the provisions of the

Companies (Jersey) Law 1991.

These condensed consolidated interim financial statements are

expressed in U.S. dollars unless otherwise indicated. All

references to US$ are to U.S. dollars. All financial information is

rounded to the nearest thousands, except per share amounts and when

otherwise indicated.

Information about significant areas of estimation uncertainty

and critical judgements in applying accounting policies that have

the most significant effect on the amounts recognised in the

condensed consolidated interim financial statements are described

in Note 5 to the consolidated financial statements for the year

ended 31 December 2022. There has been no change in these areas

during the nine months ended 30 September 2023.

Going Concern

The Group's business activities, together with the factors

likely to affect its future development and performance are set out

in the Operational Update and Outlook. The financial position of

the Group is described in these condensed consolidated interim

financial statements and in the Financial Review.

The Directors have given careful consideration to the

appropriateness of the going concern assumption, including cashflow

forecasts through the going concern period and beyond, planned

capital expenditure and the principal risks and uncertainties faced

by the Group. This assessment also considered various downside

scenarios including oil and gas commodity prices and production

rates. Following this review, the Directors are satisfied that the

Group has sufficient resources to operate and meet its commitments

as they come due in the normal course of business for at least 12

months from the date of these condensed consolidated interim

financial statements. Accordingly, the Directors continue to adopt

the going concern basis for the preparation of these condensed

consolidated interim financial statements.

3. Significant accounting policies

The condensed consolidated interim financial statements have

been prepared following the same basis of measurement, accounting

policies and methods of computation as described in the notes to

the consolidated financial statements for the year ended 31

December 2022. There has been no change to the accounting policies

or the estimates and judgements which management are required to

make in the period. The business is not subject to seasonal

variations. Information in relation to the operating segments and

material primary statement movements can be found within the

management discussion at the front of this report.

While the financial figures included within these condensed

consolidated interim financial statements have been computed in

accordance with IFRS's applicable to interim periods, this report

and financial statements do not contain sufficient information to

constitute an interim financial report as set out in IAS34 Interim

Financial Reporting.

4. Earnings per share

Nine months ended 30 September

($000's, except per share amounts) 2023 2022

-------------------------------------- -------- --------

Income (loss) for the period (4,559) 3,367

Weighted average shares outstanding:

Basic 113,097 114,714

Diluted 113,097 114,714

-------------------------------------- -------- --------

Income per share - Basic and diluted (0.04) 0.03

-------------------------------------- -------- --------

In determining diluted net loss per share, the Group assumes

that the proceeds received from the exercise of "in-the-money"

stock options are used to repurchase ordinary shares at the average

market price.

5. Supplemental cash flow disclosure

Nine months ended 30 September

2023 2022

------------------------------------------ ------ --------

Cash provided by (used in):

Trade and other receivables (845) (3,085)

Product inventory (43) (19)

Accounts payable and accrued liabilities 1,403 764

Restricted cash 3 (2)

------------------------------------------ ------ --------

Changes in non-cash working capital from

operating activities 518 (2,342)

------------------------------------------ ------ --------

The following table reconciles capital expenditures to the cash

flow statement:

Nine months ended 30 September

2023 2022

------------------------------------------ ------ --------

PP&E additions 5,313 4,402

E&E additions - 4,221

------------------------------------------ ------ --------

Total capital additions 5,313 8,623

Changes in non-cash working capital from

investing activities (388) (1,147)

------------------------------------------ ------ --------

Total capital expenditures 4,925 7,476

------------------------------------------ ------ --------

6. Prior year comparatives

The prior year comparatives have been reclassified to align with

the current year disclosure. These reclassifications are

immaterial.

7. Subsequent event

On 31 October 2023, the Company announced that it was granted

exploration phase extension of the Satu Mare Concession in Romania

by Romanian National Agency for Mineral Resources ("NAMR"). The

extension is in two phases with the first phase being mandatory

till 27 October 2025, and the second phase being optional for

further two years in duration.

In Romania, the Company continues to pursue its process of

challenging the non- applicability of the Solidarity Tax for the

year ended 31 December 2022. In the first quarter of 2023, the

Company has received a legal opinion detailing the legal arguments

of the non-applicability of the Solidarity Tax, has submitted a

Petition to the Romanian Government and has engaged in formal

discussions with the Romanian Fiscal Authorities, in order to

obtain a derogation of this Tax.

[1] Shares held by Catherine Kempster (the spouse of Jon

Kempster)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTFEDSUIEDSEEF

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

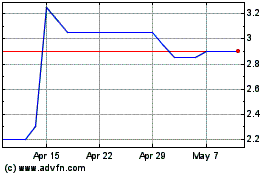

Serinus Energy (LSE:SENX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Serinus Energy (LSE:SENX)

Historical Stock Chart

From Apr 2023 to Apr 2024