TIDMSKG TIDMSK3

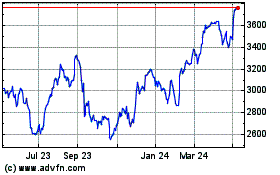

Smurfit Kappa Group plc ('SKG' or 'the Group') today announced

results for the full year ending 31 December 2021.

2021 Full Year | Key Financial Performance Measures

FY FY H2 H2 H1

EURm 2021 2020 Change 2021 2020 Change 2021 Change

Revenue EUR10,107 EUR8,530 18% EUR5,428 EUR4,327 25% EUR4,679 16%

EBITDA (1) EUR1,702 EUR1,510 13% EUR921 EUR775 19% EUR781 18%

EBITDA Margin

(1) 16.8% 17.7% 17.0% 17.9% 16.7%

Operating Profit

before

Exceptional

Items (1) EUR1,073 EUR922 16% EUR596 EUR472 26% EUR477 25%

Profit before

Income Tax EUR913 EUR748 22% EUR500 EUR365 37% EUR413 21%

Basic EPS (cent) 263.9 227.9 16% 144.0 111.1 30% 119.9 20%

Pre-exceptional

Basic EPS

(cent) (1) 274.5 236.9 16% 154.6 120.0 29% 119.9 29%

Free Cash Flow

(1) EUR455 EUR675 (33%) EUR338 EUR437 (23%) EUR117 188%

Return on

Capital

Employed (1) 16.0% 14.6% 14.8%

Net Debt (1) EUR2,885 EUR2,375 22% EUR2,549 13%

Net Debt to 1.7x 1.6x 1.6x

EBITDA (LTM)

(1)

Key Points

-- Revenue growth of 18%

-- EBITDA growth of 13% to EUR1,702 million with an EBITDA margin of 16.8%

-- Corrugated growth of 8%

-- ROCE of 16%

-- Acquisition in Italy ensuring continued security of supply for our

customers

-- Ongoing investment programme meeting customers' needs for innovative and

sustainable packaging

-- Science Based Targets initiative ('SBTi') approval in line with the Paris

Agreement

-- Final dividend increased by 10% to 96.1 cent per share

Performance Review and Outlook

Tony Smurfit, Group CEO, commented:

"I am happy to report that Smurfit Kappa has delivered another

excellent performance in 2021. This was particularly pleasing as

the year was characterised by unprecedented cost inflation. Full

year EBITDA was EUR1,702 million, an increase of 13% on 2020, with

an EBITDA margin of 16.8%. This performance demonstrates the

strength of the integrated model, the quality of our business, our

operational efficiency and increasing geographic and product

diversity. Over the last number of years, the Group has made

significant investments enabling us to meet our customers' need for

resilience, ensuring they have security of supply and access to the

most innovative, sustainable packaging solutions.

"A key differentiating factor for SKG has always been our people

and in a world of significant supply constraints, I am incredibly

proud of how our 48,000 employees have responded to ensure our

customers' needs were met and indeed, continue to be met as we

begin 2022.

"Driven by a number of long-term secular trends, we are

reporting corrugated growth of 8%. This growth is a clear

indication that paper-based packaging, renewable, recyclable and

biodegradable, is the choice of our customers and the end consumer

versus less sustainable alternatives.

"As noted above, 2021 was characterised by significant and

unprecedented cost inflation. These costs, particularly in energy,

recovered fibre and other categories of raw materials, remain at

elevated levels. We expect to continue to recover these costs, with

margin improvement, as we progress through 2022.

"Both our European and Americas businesses delivered excellent

performances in the year. Our European business recorded EBITDA of

EUR1,302 million with an EBITDA margin of 16.6% while our Americas

business recorded EBITDA of EUR441 million with an EBITDA margin of

19.5%.

"Key to the performance of Smurfit Kappa over recent years has

been to invest both organically and through acquisitions to meet

growing customer demand for innovative and environmentally

sustainable packaging solutions. In 2021, we approved 82 new

converting machines and seven new corrugators in our operations

across Europe and the Americas. We also approved material

investments in our paper system to increase efficiency and capacity

and to meet our ambitious sustainability targets.

"In early October, we completed the acquisition of a recycled

containerboard mill in Italy with a capacity of 600,000 tonnes.

This acquisition provides additional security of supply to our

customers. In our Americas region, we continued our geographic

expansion through acquisitions in Mexico and Peru. Our continuing,

customer-led investment in converting assets, the most significant

within the industry, together with our Verzuolo mill, will sustain

a clear competitive advantage for Smurfit Kappa.

"In September, we launched our Green Finance Framework, under

which we issued our dual tranche inaugural green bonds, comprising

EUR500 million 8 year bonds with a coupon of 0.5% and EUR500

million 12 year bonds with a coupon of 1%. Sustainability has

always been at the core of our operations and is now embedded

within our capital structure.

"In December, the Group received approval from SBTi for our

emissions targets. These targets are not only in line with the

Paris Agreement but also industry leading and a further sign of

SKG's leadership in sustainability. That leadership not only

extends through the products we make and how we make them but

through the work we do in the communities in which we operate.

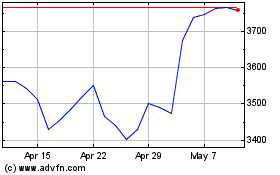

"As we begin the year, current trading is strong and our

integrated paper and packaging system remains effectively sold out.

We continue to see significant opportunities across our geographic

footprint and as such, we are investing to build a platform for

durable growth to meet customer demand. I am proud of how Smurfit

Kappa continues to deliver across all performance measures and

reflecting that confidence and the ever increasing strength of and

prospects for the business, the Board is recommending a 10%

increase in the final dividend to 96.1 cent per share."

About Smurfit Kappa

Smurfit Kappa, a FTSE 100 company, is one of the leading

providers of paper-based packaging solutions in the world, with

approximately 48,000 employees in over 350 production sites across

36 countries and with revenue of EUR10.1 billion in 2021. We are

located in 23 countries in Europe, and 13 in the Americas. We are

the only large-scale pan-regional player in Latin America. Our

products, which are 100% renewable and produced sustainably,

improve the environmental footprint of our customers.

With our proactive team, we relentlessly use our extensive

experience and expertise, supported by our scale, to open up

opportunities for our customers. We collaborate with

forward-thinking customers by sharing superior product knowledge,

market understanding and insights in packaging trends to ensure

business success in their markets. We have an unrivalled portfolio

of paper-based packaging solutions, which is constantly updated

with our market-leading innovations. This is enhanced through the

benefits of our integration, with optimal paper design, logistics,

timeliness of service, and our packaging plants sourcing most of

their raw materials from our own paper mills.

We have a proud tradition of supporting social, environmental

and community initiatives in the countries where we operate.

Through these projects we support the UN Sustainable Development

Goals, focusing on where we believe we have the greatest

impact.

Follow us on LinkedIn, Twitter, Facebook, YouTube.

smurfitkappa.com

Forward Looking Statements

This Announcement contains certain statements that are

forward-looking. Forward-looking statements are prospective in

nature and are not based on historical facts, but rather on current

expectations of the Group about future events, and involve risks

and uncertainties because they relate to events and depend on

circumstances that will occur in the future. Although the Group

believes that current expectations and assumptions with respect to

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to be correct. There

are a number of factors that could cause actual results and

developments to differ materially from those expressed or implied

by the forward-looking statements. Forward-looking statements

should therefore be construed in the light of such factors. You are

cautioned not to place undue reliance on any forward-looking

statements, which speak only as of the date made. Other than in

accordance with legal or regulatory obligations, the Group is not

under any obligation, and expressly disclaims any intention or

obligation, to update or revise any forward-looking statement,

whether as a result of new information, future events or otherwise.

The forward-looking statements in this document do not constitute

reports or statements published in compliance with any of

Regulations 6 to 8 of the Transparency (Directive 2004/109/EC)

Regulations 2007.

Contacts

Ciarán Potts Melanie Farrell

Smurfit Kappa FTI Consulting

T: +353 1 202 71 27 T: +353 1 765 08 00

E: ir@smurfitkappa.com E: smurfitkappa@fticonsulting.com

2021 Full Year | Performance Overview

The Group reported EBITDA for the full year of EUR1,702 million,

up 13% on 2020. The Group EBITDA margin was 16.8%, down from 17.7%

in 2020. The result reflects our ability to recover significant

input cost pressure by way of progressive box price increases,

strong box volumes, the resilience and security of supply delivered

by our integrated model alongside the benefits of our

customer-focused innovation and capital spend programme and the

dedication of our 48,000 employees.

In Europe, EBITDA increased by 10% to EUR1,302 million for the

year. The EBITDA margin was 16.6%, down from 17.8% in 2020.

Corrugated demand was up approximately 8% for the year with strong

performances in all countries, illustrating the robust demand

backdrop for our innovative and sustainable product offering.

Corrugated pricing has continued to improve in line with our

expectations.

Our European business continued to build on its strong operating

platform through 2021 with significant corrugated and

containerboard projects announced for France, Germany, the Czech

Republic, Slovakia, Poland and the UK, as well as in our bag-in-box

operation in Spain. These investments in the latest high-tech and

energy efficient machinery, including new corrugators and

converting machines alongside facility expansion projects, will

allow us to increase production output and expand the range of high

value products that we offer to our growing customer base, while

also contributing towards the sustainability goals of the Group and

our customers.

In the Americas, EBITDA increased by 19% on 2020 to EUR441

million. The EBITDA margin was marginally lower at 19.5% in 2021,

compared to 19.7% in 2020. Colombia, Mexico and the US accounted

for over 77% of the region's earnings with strong performances in

all three countries. Volumes for the full year in the Americas were

up 9% year-on-year and as in Europe, the Group continued to build

on its operating platform with significant capacity and

sustainability related investment in the corrugated, containerboard

and speciality businesses across the region. In June and July, we

announced the expansion of our Latin America business with

acquisitions in Peru and Mexico respectively, adding to our

geographic diversity and enhancing our customer offering in these

high growth regions.

Pricing for containerboard in both Europe and the Americas

continued the upward trend through 2021. Initially this was driven

by strong demand and rising recovered fibre prices and

subsequently, in the latter part of the year in Europe, by rising

energy prices. Increasing recovered fibre prices have cost the

Group an additional EUR440 million in 2021 versus the prior year

while rising energy prices have cost the Group an additional EUR235

million versus the prior year.

Demand for containerboard remains strong and we expect the

market to remain tight in the months ahead. The acquisition in

October 2021 of the state-of-the-art Verzuolo mill in Italy brings

600,000 tonnes of containerboard into our integrated system

ensuring we continue to meet our customers' needs and capture

future growth.

The Group reported free cash flow of EUR455 million in the full

year of 2021, down 33% from EUR675 million in 2020. The average

maturity profile of the Group's debt was 5.8 years at 31 December

2021 with an average interest rate of 2.63%. Net debt to EBITDA was

1.7x at the year-end versus 1.6x at the half year and at the end of

December 2020. The Group remains strongly positioned within its

BBB-/BBB-/Baa3 credit rating.

2021 Full Year | Financial Performance

Revenue for the full year was EUR10,107 million, up 18% on the

full year of 2020 on a reported basis and an underlying(2) basis.

Revenue in Europe was up 18%, driven by volume growth and input

cost recovery through progressive box price increases. On an

underlying basis, revenue in Europe was up 17%. In the Americas,

revenue was up 20% on the full year of 2020, or 21% on an

underlying basis.

EBITDA for the full year was EUR1,702 million, up 13% on the

full year of 2020 and ahead of our stated guidance from the third

quarter trading update due to a particularly strong finish to the

year. On an underlying basis, Group EBITDA was up 13% year-on-year,

with Europe up 10% and the Americas up 20%.

Operating profit before exceptional items for the full year of

2021 at EUR1,073 million was 16% higher than EUR922 million for

2020.

There were no exceptional items charged within operating profit

in 2021.

Net exceptional items charged within operating profit in 2020

amounted to EUR31 million. EUR35 million related to reorganisation

and restructuring costs in Europe and the Americas and EUR11

million related to the unique recognition reward given to all

permanent employees. These were partly offset by a EUR15 million

exceptional gain on the UK pension scheme.

Exceptional finance costs of EUR31 million in 2021 represented a

redemption premium of EUR28 million together with the related

accelerated write-off of unamortised debt issue costs of EUR3

million due to the early redemption of bonds.

There were no exceptional finance items charged in 2020.

Pre-exceptional net finance costs at EUR131 million were EUR13

million lower than 2020, reflecting a decrease in both cash

interest and interest cost on net pension liabilities, a decrease

in the foreign currency translation loss on debt along with the

positive swing from a fair value loss on financial

assets/liabilities in 2020 to a gain in 2021, partly offset by the

negative swing from a hyperinflation related net monetary gain in

2020 to a net monetary loss in 2021.

With the EUR151 million increase in operating profit before

exceptional items, combined with the EUR13 million decrease in net

finance costs, the pre-exceptional profit before income tax was

EUR944 million, EUR165 million higher than in 2020.

After exceptional items of EUR31 million, the profit before tax

for the full year of 2021 was EUR913 million compared to a profit

before tax of EUR748 million in 2020. The income tax expense was

EUR234 million compared to EUR201 million in 2020, resulting in a

profit of EUR679 million for 2021 compared to a profit of EUR547

million in 2020.

Basic EPS for the full year of 2021 was 263.9 cent, compared to

227.9 cent in 2020. On a pre--exceptional basis, EPS was 274.5 cent

in 2021, 16% higher than the 236.9 cent in the full year of

2020.

2021 Full Year | Free Cash Flow

Free cash flow in the full year of 2021 was EUR455 million

compared to EUR675 million for 2020, a decrease of EUR220 million.

EBITDA growth of EUR192 million, combined with lower outflows for

cash interest and the absence of an exceptional outflow of EUR18

million in 2021 were more than offset by higher outflows for

capital expenditure, higher tax payments, a higher outflow for the

change in employee benefits and other provisions and a negative

swing in working capital from an inflow in 2020 to an outflow in

2021.

The working capital outflow in 2021 was EUR114 million compared

to an inflow of EUR94 million in 2020. The outflow in 2021 was a

combination of an increase in debtors and stock, partly offset by

an increase in creditors. These increases reflect the combination

of volume growth and higher box prices, higher paper prices and

considerably higher recovered fibre and energy costs. Working

capital amounted to EUR646 million at December 2021 and represented

5.7% of annualised revenue compared to 5.6% at December 2020.

Capital expenditure in 2021 amounted to EUR693 million (equating

to 124% of depreciation) compared to EUR575 million (equating to

104% of depreciation) in 2020.

Cash interest amounted to EUR109 million in 2021 compared to

EUR118 million in 2020, with the decrease primarily relating to a

lower average level of borrowing. The decrease also reflects the

reduction in bond interest payable following the issuance of our

dual tranche inaugural green bond and the repayment of our higher

coupon 2024 bond, in September.

Tax payments of EUR239 million in 2021 were EUR45 million higher

than in 2020 with higher payments in both Europe and the

Americas.

2021 Full Year | Capital Structure

Net debt was EUR2,885 million at the end of December, resulting

in a net debt to EBITDA ratio of 1.7x compared to 1.6x at the end

of June 2021 and December 2020. With net debt to EBITDA at 1.7x,

the strength of the Group's balance sheet continues to secure

long-term strategic flexibility. Given the strong business profile

and ability to consistently deliver substantial free cash flow, the

Group is comfortably operating within its target leverage range of

1.5x to 2.0x.

In September, Smurfit Kappa announced the launch of its Green

Finance Framework with an ISS ESG Second Party Opinion. The Group

subsequently announced the launch and successful pricing of its

inaugural green bond offering, comprising EUR500 million of senior

notes due 2029 and EUR500 million of senior notes due 2033 with

coupons of 0.5% and 1.0% respectively. The coupons achieved for

these tenors were not only the lowest in the Group's history but

also the lowest for a corporate issuer in our rating category.

At 31 December 2021, the Group's average interest rate was 2.63%

compared to 3.13% at 31 December 2020. The reduction in our average

interest rate was primarily due to the refinancing

activity undertaken during the year which comprised of the

repayment of our EUR500 million 2.375% senior notes maturing in

2024 and the issuance of our EUR1 billion dual tranche inaugural

green bonds mentioned above.

The Group's diversified funding base and long-dated maturity

profile of 5.8 years (31 December 2020: 4.9 years) provide a stable

funding outlook. At 31 December 2021, we had a strong liquidity

position of approximately EUR2.52 billion comprising cash balances

of EUR869 million, undrawn available committed facilities of

EUR1,343 million on our Sustainability Linked Revolving Credit

Facility ('RCF') and EUR312 million on our sustainability linked

securitisation facilities.

Dividends

The Board is recommending a 10% increase in the final dividend

to 96.1 cent per share. It is proposed to pay this dividend on 6

May 2022 to all ordinary shareholders on the share register at the

close of business on 8 April 2022, subject to the approval of the

shareholders at the AGM.

2021 Full Year | Sustainability

SKG has continued to make strong progress across our

sustainability targets in 2021. Focusing on delivering sustainable

packaging solutions made in an increasingly sustainable way means

that we also play an integral role in the delivery of not only our

customers' sustainability goals but also those of the end

consumer.

The progress made during 2021 was built upon the achievements

outlined earlier in the year in our 14(th) annual Sustainable

Development Report ('SDR'). It highlights the Group's long-standing

objective to drive change and nurture a greener and bluer planet

through the three key pillars of Planet, People and Impactful

Business. Furthermore, Smurfit Kappa's end-to-end approach to

sustainability is evident in its innovative products and processes

that support customers and positively impact the entire value

chain.

In our 2020 SDR, Smurfit Kappa reported significant progress in

reducing our fossil CO(2) emission intensity. The Group is the

first in our industry to have announced targeting at least net zero

emissions by 2050 and compared to its baseline year 2005, it

reduced its emissions intensity by 37.3% by the end of 2020. The

Group is well on its way to reach our intermediate 2030 target of a

55% reduction, in line with the EU Green Deal objectives. The Group

also made continued progress on a number of its other key

sustainability targets; water discharge, waste to landfill, chain

of custody certification, safety performance and social

projects.

While the SDR has been independently assured since 2009, the

2020 SDR is the Group's first to report in line with

recommendations of the Taskforce for Climate related Financial

Disclosures ('TCFD') and the Sustainable Accounting Standards Board

('SASB') criteria.

Smurfit Kappa has also been contributing towards making the UN

2030 Sustainable Development Goals ('SDGs') a reality since 2015.

This contribution was recognised by the Support the Goals movement

in March when the Group became the first FTSE 100 company to

receive a five-star rating. By committing to these sustainability

targets, the Group's Better Planet Packaging portfolio of

sustainable products will continue to help our customers to deliver

on their own short and long-term sustainability goals.

An illustration of our continued action on CO(2) reduction was

the announcement in June of a significant investment in the Group's

Zülpich mill in Germany aimed at significantly reducing the plant's

CO(2) emissions, saving 55,000 tonnes of CO(2) annually.

Our circular business model which drives positive change from

the responsible sourcing of renewable raw materials to the

sustainable production of recyclable, biodegradable and

fit-for-purpose packaging solutions was the basis of our Green

Finance Framework published in September and supported by a

positive ISS ESG Second Party Opinion. SKG recycles over 6 million

tonnes of predominantly post-consumer materials each year making us

an essential component of the circular economy where legislation is

continuing to be introduced to transition businesses to lower

carbon and more circular business practices. The Group's

sustainable land use has been validated by non-governmental

organisations and third party assessments which, along with our

industry leading chain of custody certification, is a key

differentiator for our customers.

In October, Smurfit Kappa announced a new project at its

Nettingsdorf Paper Mill in Austria that will utilise waste heat

generated at the mill to help power a sustainable district heating

solution for the local community of Ansfelden. Up to 25 megawatts

of heat generated in the production process will now be captured

and converted through the new heat extraction plant. This heat will

be supplied to the district heating network that connects to 10,000

households, providing a sustainable and secure energy source and

demonstrates the positive environmental impact of the collaboration

with the local community.

In December, we had our emissions reduction targets approved by

SBTi as consistent with levels required to meet the goals of the

Paris Agreement and well below 2degC. This third party validation

adds to our existing endorsements from rating providers such as

MSCI, Sustainalytics and ISS ESG.

SKG continues to be listed on various environmental, social and

governance indices and disclosure programmes, such as FTSE4Good,

the Green Economy Mark from the London Stock Exchange, Euronext

Vigeo Europe 120, STOXX Global ESG Leaders, ISS Solactive and

Ethibel's sustainable investment register. SKG also performs

strongly across a number of third party certification bodies,

including MSCI, ISS ESG and Sustainalytics.

2021 Full Year | Commercial Offering and Innovation

The Group continued to deliver innovation for our customers in

2021. This was illustrated by our first virtual Better Planet

Packaging event held in March which hosted over 2,700

attendees.

In April, the Group launched the world's first pre-certified

Frustration Free Packaging ('FFP') compliant solution for Amazon

supply-chains. This means customers can access one of the world's

leading trading platforms quicker and in confidence of meeting

Amazon's strict packaging requirements, a significant advantage as

global e-commerce sales continue to grow.

Also in April, the Group's Brazilian business won a prestigious

Red Dot Award in the area of product design. The packaging

challenge came from Wine & Bite Box to secure and protect

bottles of wine and food for a growing trend of tasting boxes being

delivered to customers for an at home gourmet experience. The award

recognises this packaging as one of the most innovative design

projects in the world.

In October, the Group announced the development of its first

paper-based child lock box for laundry pods. The Click-to-Lock Box

is a 100% paper-based solution which provides a sustainable and

safe alternative to the traditional plastic box for laundry pods.

The new packaging solution reduces CO(2) emissions by 32% during

production and is 100% recyclable and biodegradable.

Also in October, the Group launched a unique range of circular

packaging solutions for the rapidly growing online health and

beauty market. The customisable eHealth & Beauty portfolio

includes sustainable, paper--based packaging solutions ideal for

shipping vulnerable products, such as fragrances, cosmetics, and

skin and hair care products, as well as tamper proof packaging

designed for vitamins, supplements and sports nutrition.

In November, the Group received 13 awards for its creative and

innovative packaging solutions at the year's Flexographic Industry

Association ('FIA') UK awards. Since 2013, Smurfit Kappa has

received 113 FIA awards, illustrating its leadership in the

packaging industry.

The Group was recognised for its work on inclusion and diversity

and as well as for its packaging innovation, sustainability, design

and print with 69 awards in 2021.

The Group continues to experience intense levels of pipeline

development across our business as customers strive for more

sustainable packaging solutions.

Summary Cash Flow

Summary cash flows for the second half and full year are set out in the

following table.

H2 2021 H2 2020 FY 2021 FY 2020

EURm EURm EURm EURm

EBITDA 921 775 1,702 1,510

Exceptional items - (18) - (18)

Cash interest expense (55) (57) (109) (118)

Working capital change 81 126 (114) 94

Capital expenditure (518) (345) (693) (575)

Change in capital creditors 66 33 (14) (18)

Tax paid (117) (96) (239) (194)

Change in employee benefits and other

provisions (38) 7 (81) (20)

Other (2) 12 3 14

Free cash flow 338 437 455 675

Italian Competition Authority fine (124) - (124) -

Share issues (net) - 648 - 648

Purchase of own shares (net) - - (22) (16)

Sale of businesses and investments - - 37 -

Purchase of businesses, investments and

NCI* (394) (4) (449) (25)

Dividends (76) (260) (302) (260)

Derivative termination (payments)/receipts (1) - 9 9

Premium on early repayment of bonds (28) - (28) -

Net cash (outflow)/inflow (285) 821 (424) 1,031

Acquired net debt (12) - (25) (1)

Disposed net cash - - (1) -

Deferred debt issue costs amortised (6) (3) (10) (7)

Currency translation adjustment (33) 64 (50) 85

(Increase)/decrease in net debt (336) 882 (510) 1,108

* 'NCI' refers to non-controlling interests

Additional information in relation to these Alternative

Performance Measures ('APMs') is set out in Supplementary Financial

Information on pages 30 to 37.

Funding and Liquidity

The Group's primary sources of liquidity are cash flow from

operations and borrowings under the RCF. The Group's primary uses

of cash are for funding day to day operations, capital expenditure,

debt service, dividends and other investment activity including

acquisitions.

The Group has a EUR1,350 million RCF with a maturity of January

2026, which incorporates five KPIs spanning the Group's

sustainability objectives regarding climate change, forests, water,

waste and people, with the level of KPI achievement linked to the

pricing on the facility. Borrowings under the RCF are available to

fund the Group's working capital requirements, capital expenditure

and other general corporate purposes. At 31 December 2021, the

Group's drawings on this facility were US$8 million, at an interest

rate of 0.754%.

At 31 December 2021, the Group had outstanding EUR250 million

2.75% senior notes due 2025, US$292.3 million 7.50% senior

debentures due 2025, EUR1,000 million 2.875% senior notes due 2026,

EUR750 million 1.5% senior notes due 2027, EUR500 million 0.5%

senior green notes due 2029 and EUR500 million 1.0% senior green

notes due 2033.

At 31 December 2021, the Group had outstanding EUR13 million

variable funding notes ('VFNs') issued under the EUR230 million

trade receivables securitisation programme maturing in November

2026 and EUR5 million VFNs issued under the EUR100 million trade

receivables securitisation programme maturing in January 2026.

Funding and Liquidity (continued)

In April 2021, the Group amended and extended its EUR200 million

2022 trade receivables securitisation programme, which utilises the

Group's receivables in Austria, Belgium, Italy and the Netherlands.

The programme was extended to January 2026 at a reduced facility

size of EUR100 million and with a margin reduction from 1.375% to

1.1%.

In November 2021, the Group amended and extended its EUR230

million 2023 trade receivables securitisation programme, which

utilises the Group's receivables in France, Germany and the UK. The

programme was extended to November 2026, with the facility size

remaining at EUR230 million and with a margin reduction from 1.2%

to 1.1%.

As part of the amendment process for each of these programmes,

the Group further aligned its sustainability ambitions and targets

into its financing by embedding its sustainability targets via KPIs

into the amended and extended trade receivables programme. These

programmes now incorporate five KPIs spanning the Group's

sustainability objectives regarding climate change, forests, water,

waste and people, with the level of KPI achievement linked to the

pricing on the programme.

Following the launch of the Group's Green Finance Framework in

September 2021, the Group issued a EUR1 billion dual tranche

inaugural green bond comprising EUR500 million 0.5% notes maturing

2029 and EUR500 million 1.0% notes maturing 2033.

Additionally, in September 2021, the Group redeemed EUR500

million 2.375% senior notes due 2024.

Market Risk and Risk Management Policies

The Group is exposed to the impact of interest rate changes and

foreign currency fluctuations due to its investing and funding

activities and its operations in different foreign currencies.

Interest rate risk exposure is managed by achieving an appropriate

balance of fixed and variable rate funding. As at 31 December 2021,

the Group had fixed an average of 97% of its interest cost on

borrowings over the following 12 months.

The Group's fixed rate debt comprised EUR250 million 2.75%

senior notes due 2025, US$292.3 million 7.50% senior debentures due

2025, EUR1,000 million 2.875% senior notes due 2026, EUR750 million

1.5% senior notes due 2027, EUR500 million 0.5% senior green notes

due 2029 and EUR500 million 1.0% senior green notes due 2033.

EUR100 million in interest rate swaps converting variable rate

borrowings to fixed rate matured in January 2021.

The Group's earnings are affected by changes in short-term

interest rates on its floating rate borrowings and cash balances.

If interest rates for these borrowings increased by one percent,

the Group's interest expense would increase, and income before

taxes would decrease, by approximately EUR2 million over the

following 12 months. Interest income on the Group's cash balances

would increase by approximately EUR9 million assuming a one percent

increase in interest rates earned on such balances over the

following 12 months.

The Group uses foreign currency borrowings, currency swaps and

forward contracts in the management of its foreign currency

exposures.

Principal Risks and Uncertainties

Risk assessment and evaluation is an integral part of the

management process throughout the Group. Risks are identified,

evaluated and appropriate risk management strategies are

implemented at each level in the organisation.

The Board in conjunction with senior management identifies major

business risks faced by the Group and determines the appropriate

course of action to manage these risks.

The Board regularly monitors all of the Group's risks and

appropriate actions are taken to mitigate those risks or address

their potential adverse consequences.

As part of the year-end risk assessment, the Board has

considered the impact of the COVID-19 pandemic on the principal

risks of the Group. There has been no significant disruption to our

business during 2021 as a result of the pandemic.

For a number of years climate change has been recognised as an

emerging risk for the Group. Following further consideration and

review during 2021, the Board has elevated the potential impact of

climate change in the long-term to a principal risk for the

Group.

The principal risks and uncertainties facing the Group are

summarised below.

-- If the current economic climate were to deteriorate, for example as a

result of geopolitical uncertainty, trade tensions and/or the current

COVID-19 pandemic, it could result in an increased economic slowdown

which if sustained over any significant length of time, could adversely

affect the Group's financial position and results of operations.

-- The cyclical nature of the packaging industry could result in

overcapacity and consequently threaten the Group's pricing structure.

-- If operations at any of the Group's facilities (in particular its key

mills) were interrupted for any significant length of time, it could

adversely affect the Group's financial position and results of

operations.

-- Price fluctuations in energy and raw materials costs could adversely

affect the Group's manufacturing costs.

-- The Group is exposed to currency exchange rate fluctuations.

-- The Group may not be able to attract, develop and retain suitably

qualified employees as required for its business.

-- Failure to maintain good health, safety and employee wellbeing practices

may have an adverse effect on the Group's business.

-- The Group is subject to a growing number of environmental and climate

change laws and regulations, and the cost of compliance or the failure to

comply with current and future laws and regulations may negatively affect

the Group's business.

-- The Group is subject to anti-trust and similar legislation in the

jurisdictions in which it operates.

-- The Group, similar to other large global companies, is susceptible to

cyber-attacks with the threat to the confidentiality, integrity and

availability of data in its systems.

-- The global impact of climate change in the long-term could adversely

affect the Group's business and results of operations.

The principal risks and uncertainties faced by the Group, with

the exception of climate change, were outlined in our 2020 Annual

Report on pages 34--35. The Annual Report is available on our

website; smurfitkappa.com.

Consolidated Income Statement

For the Financial Year Ended 31 December 2021

2021 2020

Unaudited Audited

Pre-exceptional Exceptional Total Pre-exceptional Exceptional Total

EURm EURm EURm EURm EURm EURm

Revenue 10,107 - 10,107 8,530 - 8,530

Cost of sales (7,015) - (7,015) (5,656) - (5,656)

Gross profit 3,092 - 3,092 2,874 - 2,874

Distribution

costs (823) - (823) (725) - (725)

Administrative

expenses (1,196) - (1,196) (1,227) - (1,227)

Other operating

expenses - - - - (31) (31)

Operating profit 1,073 - 1,073 922 (31) 891

Finance costs (148) (31) (179) (179) - (179)

Finance income 17 - 17 35 - 35

Share of

associates'

profit (after

tax) 2 - 2 1 - 1

Profit before

income tax 944 (31) 913 779 (31) 748

Income tax

expense (234) (201)

Profit for the financial year 679 547

Attributable to:

Owners of the parent 679 545

Non-controlling

interests - 2

Profit for the financial year 679 547

Earnings per

share

Basic earnings per share - cent 263.9 227.9

Diluted earnings per share - cent 261.1 225.7

Consolidated Statement of Comprehensive Income

For the Financial Year Ended 31 December 2021

2021 2020

Unaudited Audited

EURm EURm

Profit for the financial year 679 547

Other comprehensive income:

Items that may be subsequently reclassified to profit or

loss

Foreign currency translation adjustments:

- Arising in the financial year 14 (165)

- Recycled to Consolidated Income Statement 1 1

Effective portion of changes in fair value of cash flow

hedges:

- Movement out of reserve (3) 1

- Fair value gain on cash flow hedges - 6

- Related tax - (1)

Changes in fair value of cost of hedging:

- Movement out of reserve (1) (1)

- New fair value adjustments into reserve - 1

11 (158)

Items which will not be subsequently reclassified to

profit or loss

Defined benefit pension plans:

- Actuarial gain/(loss) 177 (9)

- Related tax (32) 7

145 (2)

Total other comprehensive income/(expense) 156 (160)

Total comprehensive income for the financial year 835 387

Attributable to:

Owners of the parent 835 388

Non-controlling interests - (1)

Total comprehensive income for the financial year 835 387

Consolidated Balance Sheet

At 31 December 2021

2021 2020

Unaudited Audited

EURm EURm

ASSETS

Non-current assets

Property, plant and equipment 4,265 3,839

Right-of-use assets 346 311

Goodwill and intangible assets 2,722 2,552

Other investments 11 11

Investment in associates 13 12

Biological assets 103 107

Other receivables 26 28

Derivative financial instruments 2 -

Deferred income tax assets 149 172

7,637 7,032

Current assets

Inventories 1,046 773

Biological assets 10 11

Trade and other receivables 2,137 1,535

Derivative financial instruments 8 38

Restricted cash 14 10

Cash and cash equivalents 855 891

4,070 3,258

Total assets 11,707 10,290

EQUITY

Capital and reserves attributable to owners of the

parent

Equity share capital - -

Share premium 2,646 2,646

Other reserves 260 207

Retained earnings 1,473 917

Total equity attributable to owners of the parent 4,379 3,770

Non-controlling interests 13 13

Total equity 4,392 3,783

LIABILITIES

Non-current liabilities

Borrowings 3,589 3,122

Employee benefits 630 853

Derivative financial instruments 7 17

Deferred income tax liabilities 175 191

Non-current income tax liabilities 17 14

Provisions for liabilities 35 50

Capital grants 24 21

Other payables 11 9

4,488 4,277

Current liabilities

Borrowings 165 154

Trade and other payables 2,563 1,835

Current income tax liabilities 27 7

Derivative financial instruments 14 13

Provisions for liabilities 58 221

2,827 2,230

Total liabilities 7,315 6,507

Total equity and liabilities 11,707 10,290

Consolidated Statement of Changes in Equity

For the Financial Year Ended 31 December 2021

Attributable to owners of the parent

Share Other Retained Non-controlling Total

Equity share capital premium reserves earnings Total interests equity

EURm EURm EURm EURm EURm EURm EURm

Unaudited

At 1 January 2021 - 2,646 207 917 3,770 13 3,783

Profit for the

financial year - - - 679 679 - 679

Other

comprehensive

income

Foreign currency

translation

adjustments - - 15 - 15 - 15

Defined benefit

pension plans - - - 145 145 - 145

Effective portion

of changes in

fair value of

cash flow hedges - - (3) - (3) - (3)

Changes in fair

value of cost of

hedging - - (1) - (1) - (1)

Total

comprehensive

income for the

financial year - - 11 824 835 - 835

Hyperinflation

adjustment - - - 34 34 - 34

Dividends paid - - - (302) (302) - (302)

Share--based

payment - - 64 - 64 - 64

Net shares

acquired by SKG

Employee Trust - - (22) - (22) - (22)

At 31 December

2021 - 2,646 260 1,473 4,379 13 4,392

Audited

At 1 January 2020 - 1,986 351 615 2,952 41 2,993

Profit for the

financial year - - - 545 545 2 547

Other

comprehensive

income

Foreign currency

translation

adjustments - - (161) - (161) (3) (164)

Defined benefit

pension plans - - - (2) (2) - (2)

Effective portion

of changes in

fair value of

cash flow hedges - - 6 - 6 - 6

Total

comprehensive

(expense)/income

for the financial

year - - (155) 543 388 (1) 387

Shares issued - 660 - (12) 648 - 648

Purchase of

non-controlling

interests - - (8) 12 4 (27) (23)

Hyperinflation

adjustment - - - 19 19 - 19

Dividends paid - - - (260) (260) - (260)

Share--based

payment - - 35 - 35 - 35

Net shares

acquired by SKG

Employee Trust - - (16) - (16) - (16)

At 31 December

2020 - 2,646 207 917 3,770 13 3,783

An analysis of the movements in Other reserves is provided in

Note 13.

Consolidated Statement of Cash Flows

For the Financial Year Ended 31 December 2021

2021 2020

Unaudited Audited

EURm EURm

Cash flows from operating activities

Profit before income tax 913 748

Net finance costs 162 144

Depreciation charge 513 514

Amortisation of intangible assets 40 43

Amortisation of capital grants (3) (2)

Share--based payment expense 69 35

Profit on sale of property, plant and equipment (8) (2)

Profit on purchase/disposal of businesses - (4)

Share of associates' profit (after tax) (2) (1)

Net movement in working capital (114) 95

Change in biological assets 7 (6)

Italian Competition Authority fine (124) -

Change in employee benefits and other provisions (81) (7)

Other (primarily hyperinflation adjustments) 5 6

Cash generated from operations 1,377 1,563

Interest paid (152) (122)

Income taxes paid:

Irish corporation tax (net of tax refunds) paid (21) (14)

Overseas corporation tax (net of tax refunds) paid (218) (180)

Net cash inflow from operating activities 986 1,247

Cash flows from investing activities

Interest received 3 3

Business disposals 33 -

Additions to property, plant and equipment and biological

assets (594) (493)

Additions to intangible assets (21) (21)

Receipt of capital grants 5 5

(Increase)/decrease in restricted cash (4) 4

Disposal of property, plant and equipment 16 5

Dividends received from associates 1 1

Purchase of subsidiaries (net of acquired cash) (413) (2)

Deferred consideration paid (35) -

Net cash outflow from investing activities (1,009) (498)

Cash flows from financing activities

Proceeds from issue of new ordinary shares (net) - 648

Proceeds from bond issuance 999 -

Purchase of own shares (net) (22) (16)

Purchase of non-controlling interests - (23)

Decrease in other interest-bearing borrowings (107) (329)

Repayment of lease liabilities (88) (91)

Repayment of borrowings (491) -

Derivative termination receipts 9 9

Deferred debt issue costs paid (12) (2)

Dividends paid to shareholders (302) (260)

Net cash outflow from financing activities (14) (64)

(Decrease)/increase in cash and cash equivalents (37) 685

Reconciliation of opening to closing cash and cash

equivalents

Cash and cash equivalents at 1 January 876 172

Currency translation adjustment (12) 19

(Decrease)/increase in cash and cash equivalents (37) 685

Cash and cash equivalents at 31 December 827 876

An analysis of the net movement in working capital is provided

in Note 11.

Selected Explanatory Notes to the Consolidated Financial

Statements

1. General Information

Smurfit Kappa Group plc ('SKG plc' or 'the Company') and its

subsidiaries (together 'SKG' or 'the Group') primarily manufacture,

distribute and sell containerboard, corrugated containers and other

paper-based packaging products. The Company is a public limited

company with a premium listing on the London Stock Exchange and a

secondary listing on Euronext Dublin. It is incorporated and

domiciled in Ireland. The address of its registered office is Beech

Hill, Clonskeagh, Dublin 4, D04 N2R2, Ireland.

2. Basis of Preparation and Accounting Policies

Basis of preparation and accounting policies

The Consolidated Financial Statements of the Group are prepared

in accordance with International Financial Reporting Standards

('IFRS') issued by the International Accounting Standards Board

('IASB') as adopted by the European Union ('EU'); and those parts

of the Companies Act 2014 applicable to companies reporting under

IFRS.

The financial information in this report has been prepared in

accordance with the Group's accounting policies. Full details of

the accounting policies adopted by the Group are contained in the

Consolidated Financial Statements included in the Group's Annual

Report for the year ended 31 December 2020 which is available on

the Group's website; smurfitkappa.com. The accounting policies

adopted by the Group and the significant accounting judgements,

estimates and assumptions made by management in the preparation of

the Group financial information are consistent with those described

and applied in the Annual Report for the year ended 31 December

2020. No additional significant accounting judgements, estimates

and assumptions were identified for the Group as a result of the

elevation by the Board of the potential impact of climate change in

the long-term to a principal risk for the Group. A number of

changes to IFRS became effective in 2021, however, they did not

have a material effect on the Consolidated Financial Statements

included in this report.

Impact of COVID-19

The Group has again considered the impact of the COVID-19

pandemic with respect to all judgements and estimates it makes in

the application of its accounting policies. This included assessing

the recoverability of trade receivables and inventory. The Group's

customers primarily operate in the FMCG sector, which has proved

resilient during the COVID-19 pandemic to date. There has been no

significant deterioration in the aging of trade receivables or

extension of debtor days in the period. As a result of these

reviews, there was no material change in the trade receivables or

inventory provisions. The Group also assessed non-financial assets

for indicators of impairment. No impairments were identified. The

Group tested goodwill for impairment at 31 December 2021. The

impact of COVID-19 was considered when preparing cash flow

forecasts for each cash generating unit ('CGU'). The testing did

not result in an impairment.

Going concern

The Group is a highly integrated manufacturer of paper-based

packaging solutions with leading market positions, quality assets

and broad geographic reach. The financial position of the Group,

its cash generation, capital resources and liquidity continue to

provide a stable financing platform.

The Directors have assessed the principal risks and

uncertainties outlined on page 10, which include the deterioration

of the current economic climate due to the COVID-19 pandemic. There

has been no significant disruption to our business to date as a

result of the pandemic. The Group took into consideration the

potential impact of the pandemic and the effect that it could have

on the Group's financial position and results of operations. The

Group continues to have significant headroom in relation to its

financial covenants.

The Group's diversified funding base and long-dated maturity

profile of 5.8 years at 31 December 2021 provide a stable funding

outlook. At 31 December 2021, the Group had a strong liquidity

position of approximately EUR2.52 billion comprising cash balances

of EUR869 million (including EUR14 million of restricted cash),

undrawn available committed facilities of EUR1,343 million under

its RCF and EUR312 million under its sustainability linked

securitisation facilities. At 31 December 2021, the strength of the

Group's balance sheet, a net debt to EBITDA ratio of 1.7x (31

December 2020: 1.6x) and its BBB-/BBB-/Baa3 credit rating,

continues to secure long-term strategic flexibility.

2. Basis of Preparation and Accounting Policies (continued)

Having assessed the principal risks facing the Group, together

with the Group's forecasts and significant financial headroom, the

Directors believe that the Group is well placed to manage these

risks successfully and have a reasonable expectation that the

Company, and the Group as a whole, have adequate resources to

continue in operational existence for the foreseeable future. For

this reason, they continue to adopt the going concern basis in

preparing the Consolidated Financial Statements.

Statutory financial statements and audit opinion

The financial information presented in this preliminary release

does not constitute full statutory financial statements. The Annual

Report and Financial Statements will be approved by the Board of

Directors and reported on by the Auditor in due course.

Accordingly, the financial information is unaudited. Full statutory

financial statements for the year ended 31 December 2020 have been

filed with the Irish Registrar of Companies. The audit report on

those statutory financial statements was unqualified.

This preliminary release was approved by the Board of

Directors.

3. Segment and Revenue Information

The Group has identified operating segments based on the manner

in which reports are reviewed by the chief operating decision maker

('CODM'). The CODM is determined to be the executive management

team responsible for assessing performance, allocating resources

and making strategic decisions. The Group has identified two

operating segments: 1) Europe and 2) the Americas.

The Europe and the Americas segments are each highly integrated.

They include a system of mills and plants that primarily produce a

full line of containerboard that is converted into corrugated

containers within each segment. In addition, the Europe segment

also produces other types of paper, such as solidboard, sack kraft

paper and graphic paper; and other paper-based packaging, such as

solidboard packaging and folding cartons; and bag-in-box packaging.

The Americas segment, which includes a number of Latin American

countries and the United States, also comprises forestry; other

types of paper, such as boxboard, sack paper and graphic paper; and

paper-based packaging, such as folding cartons and paper sacks.

Inter--segment revenue is not material. No operating segments have

been aggregated for disclosure purposes.

Segment profit is measured based on EBITDA.

3. Segment and Revenue Information (continued)

FY 2021 FY 2020

Europe The Americas Total Europe The Americas Total

EURm EURm EURm EURm EURm EURm

Revenue and results

Revenue 7,847 2,260 10,107 6,645 1,885 8,530

EBITDA 1,302 441 1,743 1,180 372 1,552

Segment

exceptional

items - - - (19) (12) (31)

EBITDA after

exceptional

items 1,302 441 1,743 1,161 360 1,521

Unallocated centre costs (41) (42)

Share-based payment

expense (69) (37)

Depreciation and

depletion (net) (520) (508)

Amortisation (40) (43)

Finance costs (179) (179)

Finance

income 17 35

Share of

associates'

profit

(after tax) 2 1

Profit before income tax 913 748

Income tax

expense (234) (201)

Profit for the financial

year 679 547

H2 2021 H2 2020

Europe The Americas Total Europe The Americas Total

EURm EURm EURm EURm EURm EURm

Revenue and results

Revenue 4,198 1,230 5,428 3,377 950 4,327

EBITDA 711 230 941 605 194 799

Segment

exceptional

items - - - (19) (12) (31)

EBITDA after

exceptional

items 711 230 941 586 182 768

Unallocated centre costs (20) (24)

Share-based payment

expense (41) (26)

Depreciation and

depletion (net) (263) (256)

Amortisation (21) (21)

Finance costs (106) (94)

Finance

income 8 18

Share of

associates'

profit

(after tax) 2 -

Profit before income tax 500 365

Income tax

expense (129) (96)

Profit for the financial

period 371 269

3. Segment and Revenue Information (continued)

Revenue information about geographical areas

The Group has a presence in 36 countries worldwide. The

following information is a geographical revenue analysis about

country of domicile (Ireland) and countries with material

revenue.

2021 2020

EURm EURm

Ireland 109 111

Germany 1,403 1,207

France 1,094 969

Mexico 992 850

The Netherlands 924 760

United Kingdom 901 743

Other Europe - eurozone 2,147 1,796

Other Europe - non-eurozone 1,233 1,029

Other Americas 1,304 1,065

Total revenue by geographical area 10,107 8,530

Revenue is derived almost entirely from the sale of goods and is

disclosed based on the location of production.

Disaggregation of revenue

The Group derives revenue from the following major product

lines. The economic factors which affect the nature, amount, timing

and uncertainty of revenue and cash flows from the sub categories

of both paper and packaging products are similar.

2021 2020

Paper Packaging Total Paper Packaging Total

EURm EURm EURm EURm EURm EURm

Europe 1,328 6,519 7,847 1,005 5,640 6,645

The Americas 213 2,047 2,260 207 1,678 1,885

Total revenue by product 1,541 8,566 10,107 1,212 7,318 8,530

Packaging revenue is derived mainly from the sale of corrugated

products. The remainder of packaging revenue is comprised of

bag-in-box and other paper-based packaging products.

4. Exceptional Items

2021 2020

EURm EURm

The following items are regarded as exceptional in nature:

Redundancy and reorganisation costs - 35

Recognition reward - 11

Gain on UK pension scheme - (15)

Exceptional items included in operating profit - 31

Exceptional finance costs 31 -

Exceptional items included in net finance costs 31 -

Total exceptional items 31 31

There were no exceptional items within operating profit in

2021.

Exceptional finance costs of EUR31 million in 2021 represented a

redemption premium of EUR28 million together with the related

accelerated write-off of unamortised debt issue costs of EUR3

million due to the early redemption of bonds.

In 2020, exceptional items charged within operating profit

amounted to EUR31 million of which EUR35 million related to

redundancy and reorganisation costs in both Europe and the Americas

and EUR11 million related to a company-wide COVID-19 employee

recognition reward, partly offset by a EUR15 million gain on the UK

pension scheme as a result of future pension increases being linked

to CPIH instead of RPI.

There were no exceptional finance items in 2020.

5. Finance Costs and Income

2021 2020

EURm EURm

Finance costs:

Interest payable on bank loans and overdrafts 25 29

Interest payable on leases 10 10

Interest payable on other borrowings 86 89

Exceptional finance costs associated with debt restructuring 31 -

Foreign currency translation loss on debt 15 36

Fair value loss on derivatives not designated as hedges 2 1

Fair value loss on financial assets/liabilities - 2

Net interest cost on net pension liability 7 12

Non monetary loss - hyperinflation 3 -

Total finance costs 179 179

Finance income:

Other interest receivable (3) (3)

Foreign currency translation gain on debt (12) (29)

Fair value gain on derivatives not designated as hedges - (1)

Fair value gain on financial assets/liabilities (2) (1)

Net monetary gain -- hyperinflation - (1)

Total finance income (17) (35)

Net finance costs 162 144

6. Income Tax Expense

Income tax expense recognised in the Consolidated Income

Statement

2021 2020

EURm EURm

Current tax:

Europe 189 127

The Americas 76 49

265 176

Deferred tax (31) 25

Income tax expense 234 201

Current tax is analysed as follows:

Ireland 28 21

Foreign 237 155

265 176

Income tax recognised in the Consolidated Statement of

Comprehensive Income

2021 2020

EURm EURm

Arising on defined benefit pension plans 32 (7)

Arising on derivative cash flow hedges - 1

32 (6)

The income tax expense for the financial year 2021 is EUR33

million higher than in the comparable period in 2020. This mainly

arises from higher profitability and other timing items in Europe

and the Americas.

The movement in deferred tax from a net expense of EUR25 million

in 2020 to a credit of EUR31 million in 2021 includes the effects

of the reversal of timing differences on which deferred tax has

been previously recorded, the recognition of tax benefits on losses

and other investment tax credits partly offset by the negative

impact of increases in tax rates in a number of countries.

In 2021, there is a lower net tax credit of EUR4 million on

exceptional items compared to a EUR9 million tax credit in the

prior year.

7. Employee Benefits -- Defined Benefit Plans

The table below sets out the components of the defined benefit

cost for the year:

2021 2020

EURm EURm

Current service cost 37 34

Actuarial (gain)/loss arising on other long-term employee benefits (1) 1

Past service cost - UK(1) - (15)

Past service cost - other (4) 3

Gain on settlement (3) (2)

Net interest cost on net pension liability 7 12

Defined benefit cost 36 33

(1) Future pension increases are now linked to CPIH instead of

RPI in the UK which resulted in an exceptional income in past

service cost for the Group of EUR15 million in 2020.

Analysis of actuarial gains/(losses) recognised in the

Consolidated Statement of Comprehensive Income:

2021 2020

EURm EURm

Return on plan assets (excluding interest income) 110 170

Actuarial gain due to experience adjustments 6 34

Actuarial gain/(loss) due to changes in financial assumptions 54 (224)

Actuarial gain due to changes in demographic assumptions 7 11

Total gain/(loss) recognised in the Consolidated Statement of

Comprehensive Income 177 (9)

The amounts recognised in the Consolidated Balance Sheet were as

follows:

2021 2020

EURm EURm

Present value of funded or partially funded obligations (2,384) (2,529)

Fair value of plan assets 2,276 2,224

Deficit in funded or partially funded plans (108) (305)

Present value of wholly unfunded obligations (520) (546)

Amounts not recognised as assets due to asset ceiling (2) (2)

Net pension liability (630) (853)

8. Earnings per Share ('EPS')

Basic

Basic EPS is calculated by dividing the profit attributable to

owners of the parent by the weighted average number of ordinary

shares in issue during the year less own shares.

2021 2020

Profit attributable to owners of the parent (EUR million) 679 545

Weighted average number of ordinary shares in issue (million) 257 239

Basic EPS (cent) 263.9 227.9

Diluted

Diluted EPS is calculated by adjusting the weighted average

number of ordinary shares outstanding to assume conversion of all

dilutive potential ordinary shares. These comprise deferred and

performance shares issued under the Group's long-term incentive

plans. Where the conditions governing exercisability and vesting of

these shares have been satisfied as at the end of the reporting

period, they are included in the computation of diluted earnings

per ordinary share.

2021 2020

Profit attributable to owners of the parent (EUR million) 679 545

Weighted average number of ordinary shares in issue (million) 257 239

Potential dilutive ordinary shares assumed (million) 3 2

Diluted weighted average ordinary shares (million) 260 241

Diluted EPS (cent) 261.1 225.7

Pre-exceptional

2021 2020

Profit attributable to owners of the parent (EUR million) 679 545

Exceptional items included in profit before income tax (EUR

million) 31 31

Income tax on exceptional items (EUR million) (4) (9)

Pre-exceptional profit attributable to owners of the parent (EUR

million) 706 567

Weighted average number of ordinary shares in issue (million) 257 239

Pre-exceptional basic EPS (cent) 274.5 236.9

Diluted weighted average ordinary shares (million) 260 241

Pre-exceptional diluted EPS (cent) 271.6 234.6

9. Dividends

The following dividends were declared and paid by the Group.

2021 2020

EURm EURm

Final: paid 87.4 cent per ordinary share on 7 May 2021 (2020: no

final dividend was paid in 2020) 226 -

Interim: paid 29.3 cent per ordinary share on 22 October 2021

(2020: paid 80.9 cent per ordinary share on 11 September 2020 and

a further 27.9 cent on 11 December 2020) 76 260

302 260

The Board is recommending a 10% increase in the final dividend

to 96.1 cent per share (approximately EUR250 million). It is

proposed to pay this dividend on 6 May 2022 to all ordinary

shareholders on the share register at the close of business on 8

April 2022, subject to the approval of the shareholders at the

AGM.

10. Property, Plant and Equipment

Land and buildings Plant and equipment Total

EURm EURm EURm

Financial year ended

31 December 2021

Opening net book

amount 1,090 2,749 3,839

Reclassifications 63 (64) (1)

Additions 1 570 571

Acquisitions 73 186 259

Depreciation charge (56) (369) (425)

Retirements and

disposals (9) (17) (26)

Hyperinflation

adjustment 4 10 14

Foreign currency

translation

adjustment 9 25 34

At 31 December 2021 1,175 3,090 4,265

Financial year ended

31 December 2020

Opening net book

amount 1,106 2,814 3,920

Reclassifications 73 (68) 5

Additions 1 465 466

Acquisitions 2 1 3

Depreciation charge (56) (373) (429)

Retirements and

disposals (1) (2) (3)

Hyperinflation

adjustment 2 6 8

Foreign currency

translation

adjustment (37) (94) (131)

At 31 December 2020 1,090 2,749 3,839

11. Net Movement in Working Capital

2021 2020

EURm EURm

Change in inventories (246) 14

Change in trade and other receivables (492) 22

Change in trade and other payables 624 59

Net movement in working capital (114) 95

12. Analysis of Net Debt

2021 2020

EURm EURm

Revolving credit facility -- interest at relevant interbank rate

(interest rate floor of 0%) + 0.65%(1) (2) 2 89

US$292.3 million 7.5% senior debentures due 2025 (including

accrued interest) 260 240

Bank loans and overdrafts 101 83

EUR100 million receivables securitisation VFNs due 2026

(including accrued interest)(3) 4 4

EUR230 million receivables securitisation VFNs due 2026(4) 11 11

EUR500 million 2.375% senior notes due 2024 (including accrued

interest)(5) - 501

EUR250 million 2.75% senior notes due 2025 (including accrued

interest) 251 251

EUR1,000 million 2.875% senior notes due 2026 (including accrued

interest) 1,007 1,005

EUR750 million 1.5% senior notes due 2027 (including accrued

interest) 747 746

EUR500 million 0.5% senior green notes due 2029 (including

accrued interest)(6) 495 -

EUR500 million 1.0% senior green notes due 2033 (including

accrued interest)(6) 496 -

Gross debt before leases 3,374 2,930

Leases 380 346

Gross debt including leases 3,754 3,276

Cash and cash equivalents (including restricted cash) (869) (901)

Net debt including leases 2,885 2,375

1. The Group's RCF has a maturity of January 2026. At 31 December 2021, the

following amounts were drawn under this facility:

1. Revolver loans - EUR7 million

2. Drawn under ancillary facilities and facilities supported by

letters of credit -- nil

3. Other operational facilities including letters of credit - nil

2. Following the upgrade to Baa3 and BBB- by Moody's and Standard & Poor's

respectively in February 2021, the margin on the RCF reduced from 0.817%

to 0.65%.

3. In April 2021, the Group amended and extended its EUR200 million 2022

trade receivables securitisation programme, which utilises the Group's

receivables in Austria, Belgium, Italy and the Netherlands. The programme

was extended to January 2026 at a reduced facility size of EUR100 million

and with a margin reduction from 1.375% to 1.1%. As part of the amendment

process, the Group further aligned its sustainability ambitions and

targets into its financing by embedding its sustainability targets via

KPIs into the amended and extended trade receivables securitisation

programme.

4. In November 2021, the Group amended and extended its EUR230 million 2023

trade receivables securitisation programme, which utilises the Group's

receivables in France, Germany and the UK. The programme was extended to

November 2026 at the same facility size of EUR230 million and with a

margin reduction from 1.2% to 1.1%. As part of this amendment process the

Group also embedded its sustainability targets via KPIs into the amended

and extended trade receivables securitisation programme.

5. In September 2021, the Group redeemed the EUR500 million 2.375% senior

notes due 2024.

6. In September 2021, following the launch of the Group's Green Finance

Framework, the Group issued its inaugural green bond. The EUR1 billion

dual tranche green bond comprised EUR500 million 0.5% senior notes

maturing 2029 and EUR500 million 1.0% senior notes maturing 2033.

13. Other Reserves

Other reserves included in the Consolidated Statement of Changes

in Equity are comprised of the following:

Cash Foreign Share-

Reverse flow Cost of currency based

acquisition hedging hedging translation payment Own FVOCI

reserve reserve reserve reserve reserve shares reserve Total

EURm EURm EURm EURm EURm EURm EURm EURm

At 1 January 2021 575 4 2 (556) 241 (49) (10) 207

Other

comprehensive

income

Foreign currency

translation

adjustments - - - 15 - - - 15

Effective portion

of changes in

fair value of

cash flow

hedges - (3) - - - - - (3)

Changes in fair

value of cost of

hedging - - (1) - - - - (1)

Total other

comprehensive

(expense)/income - (3) (1) 15 - - - 11

Share--based

payment - - - - 64 - - 64

Net shares

acquired by SKG

Employee Trust - - - - - (22) - (22)

Shares

distributed by

SKG Employee

Trust - - - - (12) 12 - -

At 31 December

2021 575 1 1 (541) 293 (59) (10) 260

At 1 January 2020 575 (2) 2 (387) 215 (42) (10) 351

Other

comprehensive

income

Foreign currency

translation

adjustments - - - (161) - - - (161)

Effective portion

of changes in

fair value of

cash flow

hedges - 6 - - - - - 6

Total other

comprehensive

income/(expense) - 6 - (161) - - - (155)

Purchase of

non-controlling

interest - - - (8) - - - (8)

Share--based

payment - - - - 35 - - 35

Net shares

acquired by SKG

Employee Trust - - - - - (16) - (16)

Shares

distributed by

SKG Employee

Trust - - - - (9) 9 - -

At 31 December

2020 575 4 2 (556) 241 (49) (10) 207

14. Business Combinations

The acquisitions completed by the Group during the year,

together with percentages acquired and completion dates were as

follows:

-- Cartones del Pacifico, (100%, 1 June 2021) a paper-based packaging

company in Peru;

-- Cartonbox, (100%, 5 July 2021), a folding carton company in Mexico; and

-- Verzuolo, (100%, 8 October 2021), a containerboard mill in Northern

Italy.

The table below reflects the provisional fair values of the

identifiable net assets acquired in respect of the acquisitions

completed during the year. The initial assignment of fair values to

identifiable net assets acquired has been performed on a

provisional basis in respect of the Verzuolo acquisition given the

timing of closure of the transaction. Any amendments to fair values

will be made within the twelve month period from the date of

acquisition, as permitted by IFRS 3, Business Combinations and

disclosed in the 2022 Annual Report.

Verzuolo Other Total

EURm EURm EURm

Non-current assets

Property, plant and equipment 231 28 259

Right-of-use assets 1 5 6

Intangible Assets - 19 19

Deferred income tax asset 2 - 2

Current assets

Inventories 14 8 22

Trade and other receivables 3 14 17

Cash and cash equivalents - 1 1

Non-current liabilities

Employee benefits (4) - (4)

Deferred income tax liabilities - (7) (7)

Borrowings - (11) (11)

Current liabilities

Borrowings - (15) (15)

Trade and other payables (9) (18) (27)

Net assets acquired 238 24 262

Goodwill 119 33 152

Consideration 357 57 414

Settled by:

Cash 357 57 414

The principal factors contributing to the recognition of

goodwill are the realisation of cost savings and other synergies

with existing entities in the Group which do not qualify for

separate recognition as intangible assets.

None of the goodwill recognised is expected to be deductible for

tax purposes.

Net cash outflow arising on acquisition EURm

Cash consideration 414

Less cash & cash equivalents acquired (1)

Total 413

The gross contractual value of trade and other receivables as at

the respective dates of acquisition amounted to EUR17 million. The

fair value of these receivables is estimated at EUR17 million (all

of which is expected to be recoverable).

Acquisition-related costs of EUR1 million were incurred and are

included within administrative expenses in the Consolidated Income

Statement.

The Group's acquisitions in 2021 have contributed EUR73 million

to revenue and a EUR7 million loss after tax. The proforma revenue

and profit after tax of the Group for the year ended 31 December

2021 would have been EUR10,358 million and EUR674 million

respectively, had the acquisitions taken place at the start of the

reporting period.

There have been no acquisitions completed subsequent to the

balance sheet date which would be individually material to the

Group, thereby requiring disclosure under either IFRS 3 or IAS 10,

Events after the Balance Sheet Date.

Supplementary Financial Information

Alternative Performance Measures

The Group uses certain financial measures as set out below in

order to evaluate the Group's financial performance. These

Alternative Performance Measures ('APMs') are not defined under

IFRS and are presented because we believe that they, and similar

measures, provide both SKG management and users of the Consolidated

Financial Statements with useful additional financial information

when evaluating the Group's operating and financial

performance.

These measures may not be comparable to other similarly titled

measures used by other companies, and are not measurements under

IFRS or other generally accepted accounting principles, and they

should not be considered in isolation or as substitutes for the

information contained in our Consolidated Financial Statements.

Please note where referenced 'CIS' refers to Consolidated Income

Statement, 'CBS' refers to Consolidated Balance Sheet and 'CSCF'

refers to Consolidated Statement of Cash Flows.

The principal APMs used by the Group, together with

reconciliations where the non-IFRS measures are not readily

identifiable from the Consolidated Financial Statements, are as

follows:

A. EBITDA

Definition

EBITDA is earnings before exceptional items, share-based payment

expense, share of associates' profit (after tax), net finance

costs, income tax expense, depreciation and depletion (net) and

intangible assets amortisation. It is an appropriate and useful

measure used to compare recurring financial performance between

periods.

Reconciliation of Profit to EBITDA

2021 2020

Reference EURm EURm

Profit for the financial year CIS 679 547

Income tax expense (after exceptional items) CIS 234 201

Exceptional items charged in operating profit CIS - 31

Net finance costs (after exceptional items) Note 5 162 144

Share of associates' profit (after tax) CIS (2) (1)

Share-based payment expense Note 3 69 37

Depreciation, depletion (net) and amortisation Note 3 560 551

EBITDA 1,702 1,510