Secure Property Dev & Inv PLC Transfer of Romanian property asset to Arcona (4522G)

March 30 2022 - 1:00AM

UK Regulatory

TIDMSPDI

RNS Number : 4522G

Secure Property Dev & Inv PLC

30 March 2022

30 March 2022

Secure Property Development & Investment PLC ('SPDI' or 'the

Company')

Transfer of Romanian property asset to Arcona Property Fund

N.V.

Secure Property Development & Investment PLC (AIM: SPDI),

the AIM-quoted South Eastern European focused property company, is

pleased to announce the transfer of a 21.2% stake in Lelar Holdings

Limited to Arcona Property Fund N.V. ('Arcona') in exchange for the

issue to SPDI of 315,668 new shares in Arcona and 76,085 warrants

over shares in Arcona ('the Transfer'). Lelar Holdings Limited

holds the Delenco Office Building asset in Bucharest

("Delenco").

Delenco is a fully let office building in Bucharest, generating

c.EUR140k lease income monthly, with the main tenant being the

Romanian Telecommunications Regulator ANCOM, which renewed its

lease in June 2021.

Based on the closing price of Arcona's shares on 28 March 2022,

the Transfer values the Delenco stake at c.EUR2.05million

(excluding the issue of the warrants), while based on the current

net asset value per Arcona share, the Transfer values the Delenco

asset stake at EUR3.73 million (excluding the issue of the

warrants). Both valuation numbers exclude past dividends declared

to be distributed to SPDI and deferred capital gains tax shared

with Arcona, together totalling EUR0.52 million. For the year ended

2020, the Company recorded Delenco with an audited net asset value

of EUR4.4 million.

The Transfer represents the commencement of Stage Two of the

previously announced transfer to Arcona of SPDI's property

portfolio, excluding its Greek logistics properties (which has been

separately disposed of), in exchange for new shares and warrants in

Arcona, to create a larger Central and South Eastern European

focused investment vehicle ('the Arcona Transaction').

An additional 3.2% stake in Lelar Holdings Limited will be

contributed to Arcona for an additional proportionate number of APF

shares and warrants next month. Following the transfer of that

additional 3.2% stake, the Company will no longer have a stake in

Lehar Holdings Limited.

The parties intend to complete Stage Two of the Arcona

Transaction in steps over the near to medium term.

Michael Beys, Chairman of the Board of Directors, said; "

Despite a very long wait, we are happy to announce the commencement

of Stage Two of the Arcona Transaction with the completion of the

transfer of the 21.2% interest in Delenco, which will bring the

total number of Arcona Shares issued to SPDI to approximately

909,200 with a current market value of EUR5.9 million, representing

c.60% of SPDI's current market capitalization. We have long said

that the Arcona Transaction was a value trigger event for SPDI

shareholders. With Stage Two expected to be completed in the near

to medium term, we are confident the underlying value of our

portfolio of prime real estate in South Eastern European countries

will soon be clear for all to see."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

* * ENDS * *

Lambros Anagnostopoulos SPDI Tel: +357 22 030783

Rory Murphy Strand Hanson Limited Tel: +44 (0) 20 7409 3494

Ritchie Balmer

Jon Belliss Novum Securities Limited Tel: +44 (0) 207 399 9400

Catherine Leftley St Brides Partners Ltd Tel: +44 (0) 20 7236 1177

Susie Geliher

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSEVDIAFIF

(END) Dow Jones Newswires

March 30, 2022 02:00 ET (06:00 GMT)

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Apr 2024 to May 2024

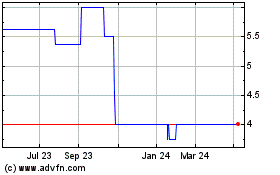

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From May 2023 to May 2024