S & U PLC Update on Advantage Finance Limited

October 29 2024 - 9:00AM

RNS Regulatory News

RNS Number : 0759K

S & U PLC

29 October 2024

29 October 2024

S&U

plc

("S&U" or "the Group")

Update on Advantage Finance

Limited

S&U, the specialist motor and

property financier, today notes the recent Court of Appeal

decisions on Johnson and Wrench v Firstrand Bank Limited and

Hopcraft v Close Brothers Limited, the implications of which it is

considering. These decisions provide guidance for lower courts on

the subject of commissions disclosure in the financial services

industry. They unexpectedly overturned hitherto received

judicial positions on the duties of motor dealers, credit brokers

and lenders to disclose and obtain consent for the payment of

commission. The Group also notes the intention of those companies

to appeal those decisions to the UK Supreme Court.

The Court of Appeal decisions set a

higher bar for the disclosure of, and consent to, the existence,

nature, and quantum of any commission paid than that required by

current FCA rules, as adhered to by regulated motor finance firms

including the Group's motor finance subsidiary Advantage Finance

Limited ("Advantage Finance"). However, the Court of Appeal

recognised the 'tensions' between previous lower court judgements

on the extent of commission disclosure in the cases of 'Hurstanger'

and 'Wood'. It therefore called for 'a definitive announcement to

be made by the Supreme Court about the circumstances in which the

payment of a commission …. will give rise to a liability …. on the

part of the payer.' It is therefore unsurprising that it is the

intention of the companies involved to appeal the judgement to the

UK Supreme Court.

In the meantime, S&U notes that

these decisions do not specifically relate to 'difference in

charges' models of commission (currently the subject of an FCA

review) in which Advantage Finance has never been

engaged.

Given the Court of Appeal's judgement

and its implications for the whole of the financial services

industry, S&U is aware that it has been the subject of urgent

discussions between the FLA, the FCA and the Government, and looks

for an expeditious resolution to the issue.

The Group will update the market, if

and as appropriate.

ENDS

For further information, please

contact:

|

Enquiries

Anthony Coombs

|

S&U plc

|

c/o SEC Newgate

|

|

Financial Public

Relations

Bob Huxford, Molly Gretton, Harry

Handyside

|

SEC Newgate

|

020 7653 9848

|

|

Broker

Andrew Buchanan, Oliver

Jackson

|

Peel Hunt LLP

|

020 7418 8900

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

UPDFLFSLIDLAFIS

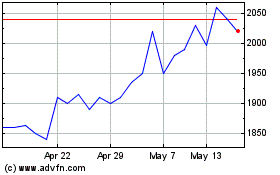

S & U (LSE:SUS)

Historical Stock Chart

From Jan 2025 to Feb 2025

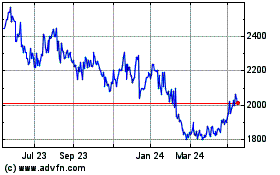

S & U (LSE:SUS)

Historical Stock Chart

From Feb 2024 to Feb 2025