TIDMTENT

RNS Number : 0666D

Triple Point Energy Transition PLC

19 June 2023

19 June 2023

Triple Point Energy Transition plc

("TENT" or the "Company" or, together with its subsidiaries, the

"Group")

RESULTS FOR THE YEARED 31 MARCH 2023

Transformative year; our new mandate is delivering compelling

opportunities; full capital commitment

9.2% NAV Total Return, full capital commitment, 1.1x cash

dividend cover

The Board of Triple Point Energy Transition plc (ticker: TENT),

the London listed infrastructure investment company supporting the

energy transition, is pleased to announce its audited results for

the year ended 31 March 2023. The Company's focus this year was on

building on its new investment mandate, launched in August 2022, to

seek opportunities in niche and exciting areas of the energy

transition, which offer superior risk adjusted returns and

diversification of revenue sources. TENT has now fully committed

its existing capital, delivered a 9.2% NAV total return and full

cash dividend cover.

31 March 2023 31 March 2022

--------------------------------------- ----------------- -----------------

Net asset value ("NAV") GBP99.4 million GBP96.1 million

NAV per share 99.44 pence 96.12 pence

Dividend declared per share 5.50 pence 5.50 pence

Total NAV return (2) 9.2% 4.9%

Cash dividend cover ratio (1)

(2) 1.1x 0.14x

Capital committed awaiting deployment GBP44.4 million GBP44.9 million

(2 3)

Fully invested portfolio valuation GBP132.1 million GBP123.6 million

(including commitment at cost)

(1)

(1) representative of total cash income, expenditure and

financing costs for the Company and TENT Holdings (the Company's

wholly owned subsidiary), divided by dividends paid in the

financial year to 31 March 2023

(2) alternative performance measure

(3) portfolio commitments will be largely funded by the Group's

undrawn GBP40 million Revolving Credit Facility ("RCF")

Financial Highlights

-- Total NAV return of 9.2% for year ended 31 March 2023 (31 March 2022: 4.9%)

-- Dividends declared in respect of the year ended 31 March 2023

total of 5.50 pence per Ordinary Share, fully covered by operating

cashflow 1.1x (net of expenses and finance costs for TENT and TENT

Holdings, the Company's wholly owned subsidiary)

o Equivalent to a dividend yield of 9% on the share price at 31

March 2023

o Future period earnings will benefit from the deployment of the

outstanding commitment of GBP39.6m into the Battery Energy Storage

Systems ("BESS") portfolio.

-- The Company's strategic focus on investing across the

spectrum of the energy transition has delivered a diversified set

of income streams across the portfolio, and the Company was

unaffected by the Electricity Generator Levy.

-- Weighted average project life remaining of 32 years, driven

by the long project life of the Hydroelectric Portfolio and debt

investments providing long term contractual cashflows, with 92% of

projected underlying income contractually underpinned over a

10-year period and 47% of income linked to inflation.

-- TENT announced on 14 March 2023 that it had completed, via

its wholly owned subsidiary TENT Holdings Limited ("TENT Holdings")

a 12-month extension of its fixed rate GBP40 million Revolving

Credit Facility (RCF) with TP Leasing Limited, extending it to 28

March 2025.

Operational highlights

-- Fully committed capital across a diversified portfolio of

opportunities in the energy transition sector including,

hydroelectric, CHP, BESS and LED.

-- Excellent portfolio performance with all asset classes

contributing positively to the strong financial performance.

-- New technologies added to the portfolio, increasing portfolio diversification, including:

o BESS;

o LED lighting; and

o post-period end, an investment in a renewables development

company, Innova Renewables.

-- The Hydroelectric Portfolio performed marginally below

expectations, however there was good availability during the

financial year taking full advantage of the rainfall in

Scotland.

-- The deployment of the BESS portfolio has progressed well

leading to the accession of two assets in the security of the loan

facility:

o The 20MW site at Oldham is now operational;

o Gerrards Cross is under construction and is anticipated to be

operational in 2023; and

o Two further BESS assets scheduled to become operational in

2024.

-- The CHP portfolio continues to benefit from the volatile gas

and electricity wholesale market, illustrating the resilience of

the economic model of these assets throughout the cycle.

Pipeline Highlights

-- Strong long-term pipeline of potential investment

opportunities worth GBP545 million including both debt and equity

investments.

-- Diverse range of technologies and sectors under

consideration, including solar, wind, battery storage, onsite

generation, energy efficiency, and hydrogen.

-- The pipeline investments currently yield an average return of

9% and cover UK and European markets.

Post Period Highlights

-- The Group committed a GBP5 million fixed rate debt investment

to Innova Renewables, to help fund its development pipeline of

solar, battery and energy storage systems across the UK. The

facility was fully drawn on 3 April 2023.

-- In June 2023, the Group deployed a further GBP3.9 million

into the BESS portfolio, resulting in a total deployment to date of

22%.

-- The Group successfully undertook the first drawdown under the

RCF, partly funding the BESS deployment.

John Roberts, the Company's Chair, commented:

"The year was a transformative period for TENT. In focusing

wholly on niche, but highly attractive, areas of the energy

transition, we believe we have an investment strategy which will

deliver robust shareholder returns throughout the cycle. The

results we are announcing today amply bear out our confidence.

The Company's portfolio now includes 19 investments across

attractive and key energy transition technologies comprising

hydroelectric, battery storage, renewable power, solar and BESS

development and LED lighting. This portfolio has proven its

earnings power with full dividend cover attained on delivering the

Company's dividend target of 5.50 pence per share (equating to a 9%

yield on the share price as at 31 March 2023). This has all been

achieved whilst avoiding any adverse impact from the Government's

electricity generator levy. Further, the Company's long term

revenue cash flows, of which 92% are contractually underpinned,

provide strong visibility on the sustainability of the portfolio's

earnings.

In addition, the Company's significant pipeline of attractive

opportunities currently yield a high return, while further adding

to the high level of diversification already apparent in the

Company's portfolio.

Whilst our share price has been impacted by the same equity

market turbulence that has affected all infrastructure investment

companies, we do not believe that our share price discount to NAV

is an accurate reflection of the clear attractions of the Company's

differentiated strategy. The portfolio enjoys a high level of

underlying committed revenue and we believe this comprises a highly

attractive value opportunity for investors wishing to benefit from

the global energy transition."

For further information, please contact: Triple Point Investment Management

LLP

Jonathan Hick +44 (0) 20 7201

Christophe Arnoult 8989

J.P. Morgan Cazenove (Corporate

Broker)

William Simmonds +44 (0) 20 7742

Jérémie Birnbaum 4000

Akur Limited (Financial Adviser)

Tom Frost

Anthony Richardson +44 (0) 20 7493

Siobhan Sergeant 3631

Buchanan (Financial PR)

Helen Tarbet

Henry Wilson

Hannah Ratcliff +44 (0) 20 7466

Verity Parker 5111

LEI: 213800UDP142E67X9X28

Further information on the Company can be found on its website:

http://www.tpenergytransition.com/

NOTES:

The Company is an investment trust which aims to invest in

assets that support the transition to a lower carbon, more

efficient energy system and help the UK achieve Net Zero.

Since its IPO in October 2020, the Company has made the

following investments and commitments:

-- Harvest and Glasshouse: provision of GBP21m of senior debt

finance to two established combined heat and power ("CHP") assets,

located on the Isle of Wight, supplying heat, electricity and

carbon dioxide to the UK's largest tomato grower, APS Salads

("APS") - March 2021

-- Spark Steam: provision of GBP8m of senior debt finance to an

established CHP asset in Teesside supplying APS, as well as a

further power purchase agreement through a private wire arrangement

with another food manufacturer - June 2021

-- Hydroelectric Portfolio (1): acquisition of six operational,

Feed in Tariff ("FiT") accredited, "run of the river" hydroelectric

power projects in Scotland, with total installed capacity of 4.1MW,

for an aggregate consideration of GBP26.6m (excluding costs) -

November 2021

-- Hydroelectric Portfolio (2): acquisition of a further three

operational, FiT accredited, "run of the river" hydroelectric power

projects in Scotland, with total installed capacity of 2.5MW, for

an aggregate consideration of GBP19.6m (excluding costs) - December

2021

-- BESS Portfolio: commitment to provide a debt facility of

GBP45.6m to a subsidiary of Virmati Energy Ltd (trading as

"Field"), for the purposes of building a portfolio of four

geographically diverse Battery Energy Storage System ("BESS")

assets in the UK with a total capacity of 110MW - March 2022

-- Energy Efficient Lighting: Funding of c.GBP2.2m to a lighting

solutions provider to install efficient lighting and controls at a

leading logistics company - March 2023

-- Innova: Provision of a GBP5m short term development financing

facility to Innova Renewables, building out a portfolio of Solar

and BESS assets across the UK - March 2023

The Investment Manager is Triple Point Investment Management LLP

("Triple Point") which is authorised and regulated by the Financial

Conduct Authority. Triple Point manages private, institutional, and

public capital, and has a proven track record of investment in

Energy Efficiency and decentralised energy projects.

Following its IPO on 19 October 2020, the Company was admitted

to trading on the Premium Segment of the Main Market of the London

Stock Exchange on 28 October 2022. The Company was also awarded the

London Stock Exchange's Green Economy Mark.

You may view the Annual Report in due course on the Company's

website. http://www.tpenergytransition.com/

Please note that page numbers in this announcement are in

reference to the Annual Report.

Strategic Report

Chair's Statement

Dear Shareholder,

I am pleased to present the results for Triple Point Energy

Transition plc ("TENT" or the "Company") for the year ended 31

March 2023. This is our first set of annual results reported under

our new mandate and name, announced in August 2022, which

consolidated the Company's focus on investing across the energy

sector to support the transition to Net Zero.

Our investment mandate covers three thematic areas:

-- distributed energy generation

-- energy storage and distribution

-- onsite energy generation and lower carbon consumption

This strategy reflects our conviction that a holistic,

system-wide approach to reducing emissions across every part of the

energy sector is vital to supporting the transition to Net Zero and

to delivering attractive returns for our investors. We also believe

that this approach gives us a highly differentiated position in our

sector, offering shareholders exposure to a diversified portfolio

of attractive investments in sectors and investment classes which

are not typically targeted by many other investment trusts.

The past year has been marked by unprecedented challenges and

opportunities in the global energy sector. The devastating war in

Ukraine, which has now entered its second year, and the resulting

energy crisis have exposed the vulnerabilities and risks of relying

on fossil fuels, especially imported gas, for meeting our energy

needs. This has also led to a cost-of-living crisis and inflation

increases, putting pressure on consumers and businesses. At the

same time, the events have triggered a wave of policy and market

developments which are designed to accelerate the energy

transition. The EU's REPowerEU plan, the US Inflation Reduction

Act, China's 14th Five-Year Plan, and other initiatives by major

economies have created a huge investment potential for clean energy

technologies globally, through a strong regulatory framework and

incentives for deployment. Moreover, global investment in clean

energy technologies matched that of fossil fuels for the first time

in 2022, signalling a shift in investor preferences and

expectations.

These global developments have a direct impact on the UK and EU

markets, which are the focus of our mandate. The UK and the EU are

both committed to achieving Net Zero emissions by 2050 and have set

ambitious targets and policies to accelerate the decarbonisation of

their energy systems. The UK's Powering Up Britain, the EU's Green

Deal, and the Glasgow Climate Pact are some of the key initiatives

that demonstrate this commitment and provide a clear direction for

our investment strategy. The UK and the EU are also facing

increasing energy security concerns and rising energy costs, which

create an urgent need for more domestic, diversified, and reliable

sources of energy. This is where our investment portfolio can

provide solutions and value for our shareholders and society.

By investing holistically across the energy sector, in assets

that generate, distribute or conserve electricity or heat, we are

able to capture the opportunities and mitigate the risks arising

from these developments. Our three thematic areas of focus are

complementary and synergistic, as they enable a lower-carbon, more

resilient, and more flexible energy system. They also generate

stable and predictable income for our investors, from long-term

contracts with high-quality counterparties or from wholesale or

merchant markets.

Investment Activity

I am delighted to report that the Company's remaining capital

has been fully committed to a portfolio of broadly diversified

opportunities across the energy transition sector. This achievement

reflects our ability to discern and execute attractive deals in a

competitive market. We have strategically utilised the funds to

invest in multiple asset classes and capital structures, providing

a solid defence against risks and challenges. Importantly we

balance both debt and equity investments to ensure a consistent

income stream, capital preservation, and capital growth.

The Group has continued to advance funds under the GBP45.6

million debt facility to a subsidiary of Virmati Energy Ltd, to

fund a 110MW portfolio of four BESS assets (the "BESS Portfolio").

During the period, GBP6.2 million of the facility was utilised,

with commitment fees being received in respect of the undrawn

balance. Post the balance sheet date, a further GBP3.9 million was

drawn.

The Group has also invested in new asset classes - LED lighting

and solar project development - through debt financing. This

further enhances our diversification, resilience to negative

trends, and participation in innovative technologies.

The Group's GBP2.2 million investment in the installation of new

Light Emitting Diodes ("LEDs") in several warehouses of an

investment-grade global logistics company, has led to a c.58%

reduction in the warehouses' energy consumption.

These investments not only showcase our commitment to advancing

this important energy transition industry but also enable us to

leverage the stability of debt financing to support projects which

reduce energy waste and drive sustainability.

Portfolio Performance

The portfolio continued to deliver a strong performance with all

asset classes contributing positively to the financial performance

of the Company.

The Hydroelectric Portfolio performed marginally below

expectations. The annual generation performance was c.5% lower than

forecast, due to a local grid curtailment of some of the schemes in

March 2023. One scheme has commenced development of water storage

capacity and is progressing to the next stage. This provides the

opportunity to increase the annual generation capacity by 1,250 MWh

and allows the scheme to target periods of peak load generation

through a controlled release of the flow.

The deployment of the BESS Portfolio has progressed during the

year, with the asset located in Oldham now operational and the

asset located in Gerrards Cross under construction and expected to

reach commercial operations in late 2023. The third and fourth

projects are expected to be operational during 2024. Once fully

deployed, the BESS assets will contribute to reduce grid

constraints and allow the inclusion of more renewable energy

generators to the energy mix.

The CHP Portfolio continues to benefit from the volatile gas and

electricity wholesale market which illustrates the resilience of

the economic model of these assets, as they benefit from dual

revenue sources (wholesale market and private offtake of heat and

power).

Financing

The Group, via its wholly owned subsidiary, TENT Holdings

Limited ("TENT Holdings"), has a GBP40 million Revolving Credit

Facility ("RCF") with TP Leasing Limited, and in March 2023, we

completed a 12-month extension of the RCF to 28 March 2025. The

interest rate charged is a fixed rate coupon of 6% pa on drawn

amounts.

TP Leasing Limited is an established private credit and asset

leasing business which is managed by the Investment Manager and, as

a result, is deemed to be a related party as defined in the Listing

Rules. The extension to the RCF was deemed to be a "smaller related

party transaction" for the purposes of LR11.1.10R and, therefore,

was undertaken in accordance with the relevant requirements of the

Listing Rules.

The Group will make use of the RCF to fund its committed

portfolio. The Group will follow a prudent approach to gearing with

a target medium-term gearing of up to 40% of Gross Asset Value

("GAV") and a maximum gearing that will not exceed 45% of GAV at

the time of drawdown, in line with the Company's borrowing

policy.

As at 31 March 2023, the RCF had not been drawn, however it is

expected that the RCF will be fully utilised during 2024.

Financial Results

During the year, TENT achieved a total profit and comprehensive

income of GBP8.8 million (31 March 2022: GBP4.8 million), which is

reflective of the growing investment portfolio that has increased

in value by 14% in the financial year. Further information on

profitability and financial performance can be found on pages 128

to 153.

The Company generated a total NAV return for shareholders of

9.2%, in excess of the Company's target. The NAV per share is 99.44

pence per share as at 31 March 2023 (31 March 2022: 96.12 pence per

share), an annual growth rate of 3.5%, which was made possible

through a combination of robust contractual revenues and the

revaluation of the investment portfolio.

TENT has delivered a dividend of 5.5 pence per share for the

year, which was cash covered 1.1x (31 March 2022: 0.14x). The

enhancement in coverage reflects the full deployment of the IPO

proceeds in the financial year. As a result, cash income generation

has increased approximately 300% to GBP9.0 million (31 March 2022:

GBP2.2 million).

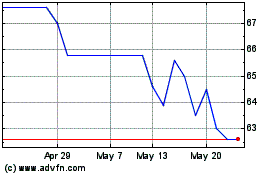

Share Price

During the year, as part of a number of actions to improve the

share price liquidity and attract new investors, the Board decided

to migrate to the Premium Segment of the Main Market of the London

Stock Exchange, having been listed on the Specialist Fund Segment

since the IPO in October 2020. The Company commenced trading on the

Premium Segment on 28 October 2022.

The Board continues to monitor the Company's share price, which

has suffered following the mini budget in September 2022 and in the

higher interest rate environment. At the financial year end, the

Company's share price was 62.5 pence, representing a 37% discount

to NAV (31 March 2022: 84.5 pence, representing a 12% discount to

NAV). The Board believes that the discount to NAV is unwarranted,

is driven in large part by illiquidity of the shares and does not

reflect the quality of the Group's portfolio, the robust nature of

contractual earnings, and the future potential of its strategy.

The Board is concerned by the continuing level of share price

discount to NAV and continues to consider ways to address the

discount.

The Investment Manager has been actively engaging with stock

market analysts, existing and potential new shareholders and has an

active investor relations programme planned for the remainder of

2023.

In accordance with the Investment Management Agreement, the

Investment Manager has used 20% of the annual investment management

fee (net of relevant taxes) to acquire Ordinary Shares in the

Company. The Investment Manager purchased the following Ordinary

Shares during the financial year:

- 28 September 2022 - 41,550 Ordinary Shares at an average price of 80.86 pence per share

- 22 December 2022 - 57,616 Ordinary Shares at an average price of 80.00 pence per share

As at 31 March 2023, including other shares purchased in the

year, the Investment Manager held a total of 1,042,157 Ordinary

Shares in the Company, representing approximately 1.0% of the total

issued share capital.

Dividends

The Board is pleased to confirm the dividend in respect of the

quarter to 31 March 2023 of 1.375 pence per share, payable on or

around 14 July 2023 to holders of Ordinary Shares on the register

on 30 June 2023, bringing the total annual dividend to the target

of 5.50 pence per share. Cash received in the Company's wholly

owned subsidiary TENT Holdings, from the investee companies by way

of distributions, which includes interest and dividends, was GBP9.0

million. After operating and finance costs, the cash flow within

the Company and TENT Holdings was GBP5.9 million, cash covering the

dividends paid during the year of 5.50 pence per share by 1.1x.

The Company has set a dividend target of 5.50 pence per share

for the year ending 31 March 2024(1) .The Company notes that the

deployment of the loans to the BESS Portfolio and Innova is

expected to provide further income with which to cover dividends

over the course of FY24.

Notes:

(1) The dividend and return targets stated are Pounds Sterling

denominated returns targets only and not a profit forecast. There

can be no assurance that these targets will be met, and they should

not be taken as an indication of the Company's expected future

results.

Environmental, Social and Governance ("ESG")

The Company has adopted an approach to ESG which reflects the

importance of sustainability to the investment policy and to

maximise the potential for our ESG considerations to add value to

the portfolio.

Throughout the year there has been a focus on developing

relationships with asset owners (where we have debt investments)

and O&M contractors (where we own the asset) to improve data

collection and identify where discussion may lead to improved

action and ESG management of our portfolio. Climate and Net Zero

analysis are also a key priority with significant time allocated to

the evolution of these activities, which have been captured in our

voluntary reporting against the TCFD framework. The Board continues

to engage fully to support and seek progress on these fast evolving

and important areas. The Sustainability Report contains full

details on the approach including reporting aligned with a range of

relevant industry frameworks and best practice.

Summary & Outlook

The energy market is undergoing a seismic transformation, driven

by the urgent need for decarbonisation and a growing emphasis on

energy security and independence. The Company's broader investment

mandate positions it for success in this rapidly evolving landscape

by diversifying its portfolio across three thematic areas:

distributed energy generation, onsite energy generation and lower

carbon consumption, and energy storage and distribution. This

approach not only mitigates risk and enhances resilience but also

supports the Net Zero pathway, presenting a favourable outlook for

the Company's investment prospects.

The Company is well-positioned to capitalise on the immense

potential arising from the ambitious renewable energy targets and

various legislative initiatives in the UK and EU markets, such as

Powering Up Britain and REPowerEU. These programmes aim to unlock a

vast amount of investments and create a favourable environment for

the growth of clean energy technologies, opening up a market worth

$5.3 trillion across Europe(2) . By investing in innovative

solutions for the decarbonisation of buildings and transport and

leveraging its expertise in cutting-edge sectors such as battery

storage, green hydrogen, and LED lighting, the Company aims to

drive transformative change and contribute to the global shift

towards a low-carbon economy. The Company also intends to pursue

market-driven unsubsidised projects that can offer higher returns

with lower risks, as they are less exposed to policy changes and

provide increased flexibility. These projects further diversify the

Group's portfolio compared to other peers in the space and

differentiate the risk profile.

On behalf of the Board, I remain confident in the Company's

ability to continue generating sustainable income and capital

growth for our shareholders. We would like to extend the Board's

thanks to shareholders for their ongoing support and belief in our

differentiated investment case.

Notes:

(2) Europe's Path to Clean Energy: A $5.3 Trillion Investment

Opportunity | BloombergNEF (bnef.com)

John Roberts

Chair

16 June 2023

Strategy and Business Model

The Company's purpose is to invest into infrastructure assets

that contribute to the energy transition and generate a stable and

growing long-term income stream for investors.

Originate Invest Operate and Hold

optimise

TENT originates TENT invests TENT operate TENT's strategy

Overview across the across the and optimise is to hold

spectrum of capital structure assets based investments

the energy of an energy on a two pronged to maturity.

transition. transition approach.

investment.

Competitive

Advantage This enables In certain Firstly, TENT This long-term

the Company technologies seeks to have stewardship

to identify such as CHP exposure to approach enables

the most attractive or BESS, investing strong management TENT to more

risk and return in debt may teams in an successfully

characteristics enable TENT energy sub originate

of opportunities to achieve sector. For opportunities,

across the better risk example, it with a view

energy transition adjusted returns has backed to aligning

space. than equity. one of the interests with

leading renewables project counterparties

This typically In others, developers over the investment

means that inflation protected in the UK, period.

TENT invests contracts in Innova Renewables.

in more niche more established

areas of the technologies, Working with

transition such as hydro-electric a diverse range

and avoids power, may of specialist

areas with offer more management.

elevated valuations, attractive teams across

such as subsidised equity opportunities. a range of

large scale energy sub

UK solar and sectors provides

wind generation. further diversification

to investors.

TENT seeks

to build long-term Secondly, the

partnerships Investment

with developers Manager's inhouse

and partners portfolio management

to secure repeat team actively

deal flow. manages the

investments,

identifying

opportunities

to enhance

performance

and mitigate

risks.

---------------------- ------------------------ ------------------------ ------------------------

Risk Management read more about our rigorous approach to risk management

on page 76

----------------------------------------------------------------------------------------------------

Governance read about our approach to governance on page 88

----------------------------------------------------------------------------------------------------

Changes to the Company's Investment Policy

Following approval at the Company's AGM on 25 August 2022, the

Company revised its Investment Policy, shifting focus from solely

Energy Efficiency investments in the United Kingdom towards a

broader spectrum of Energy Transition Assets in both the UK and

Europe. This revision to the Investment Policy reflects a strategic

adaptation to the evolving energy market and global trends. By

focusing on Energy Transition Assets and expanding its geographical

scope, the Company is positioning itself to capitalise on the

growing demand for sustainable and renewable energy solutions. This

is in line with global efforts to combat climate change and

transition towards a low-carbon economy. It allows the Group to

invest in innovative businesses that are contributing to the energy

transition, thereby potentially enhancing the Company's portfolio

and returns.

Investment Objective

The Company's Investment Objective is to generate a total return

for investors comprising sustainable and growing income and capital

growth.

Investment Policy

The Company intends to achieve its investment objective by

investing in a diversified portfolio of Energy Transition Assets

typically via the acquisition of equity in, or the provision of

debt financing to, the relevant Investee Company. The Company may

invest in opportunities in the United Kingdom (and the Crown

Dependencies) and Europe.

The Group will invest in a range of Energy Transition Assets

which meet the following criteria:

-- contribute towards the energy transition to lower, or zero, carbon emissions

-- are established technologies

-- contribute to the generation of stable and predictable income

across the Company's portfolio, as a whole, arising from:

o long-term revenues based on availability, usage, consumption

or energy savings-based contracts with good quality industrial,

governmental, and corporate Counterparties or off-takers (as

assessed by the Investment Manager's due diligence processes),

including Counterparties which represent multiple end-users; or

o assets with income from wholesale or merchant sources

(including, but not limited to, battery energy storage, pumped

storage or other power storage and discharge systems and renewable

power assets), typically where the Investee Company benefits from

an option to put in place a long term fixed contractual price if it

deems it necessary to do so and where operated by a reputable

operator; and

-- entitle the Company to receive cash flows over the medium to

long-term in Developed Country Currencies. The Company may, but

does not intend to, enter into any currency hedging

arrangements.

The Group's portfolio of Energy Transition Assets will

predominantly comprise operational Energy Transition Assets. It

will invest in either single assets or portfolios of multiple

assets.

Subject to the investment restrictions set out below, the Group

may, also invest in assets that are in the Development Phase or the

Construction Phase, either directly or through funding of a

third-party developer, where such investments will deliver an

attractive risk adjusted return.

In addition, the Company may invest in or acquire minority

interests in companies with a strategy that aligns with the

Company's overarching investment objective, such as developers,

operators or managers of Energy Transition Assets ("Other Related

Companies").

The Group will seek to diversify its commercial exposure through

contractual relationships, directly or indirectly (through the

Investee Company), with a range of different Counterparties and

off-takers, as appropriate to the relevant investment.

Investments may be acquired from a single or a range of vendors

and the Group may also enter into joint venture arrangements

alongside one or more co-investors, where the Group retains control

or has strong minority protections. Recognising the different risk

profiles and business models of the various technologies, the Group

can invest across both debt and equity investments. Debt

investments will include market standard downside protections

including, but not limited to, cash reserve accounts, security and

have robust contractual and covenant protections.

Investment restrictions

The Company will invest and manage its assets with the objective

of spreading risk and, in doing so, will maintain the following

investment restrictions:

-- no single debt commitment or debt investment to fund, via an

Investee Company, one or more Energy Transition Asset(s) will

represent more than 20 per cent. of Adjusted Gross Asset Value. No

single equity investment into an Energy Transition Asset directly

or via an Investee Company, will represent more than 20 per cent.

of Adjusted Gross Asset Value except, where the Group has control

over an Investee Company which holds multiple Energy Transition

Assets and such assets are standalone economic operations, between

which risk can be apportioned separately, this restriction shall

apply to each individual Energy Transition Asset;

-- the aggregate maximum exposure to any Counterparty will not

exceed 20 per cent. of Adjusted Gross Asset Value (and where an

Energy Transition Asset derives revenues from more than one source,

the relevant Counterparty exposure in each case shall be calculated

by reference to the proportion of revenues derived from payments

received from the Counterparty, rather than any other source). This

restriction does not apply to circumstances where all, or

substantially all, of the revenue generated by an Energy Transition

Asset is derived through connection to the wholesale electricity

market, for example, transmission or distribution networks, where

there are multiple potential off-takers;

-- the aggregate maximum exposure to assets in the Development

Phase and the Construction Phase will not exceed, 25 per cent. of

Adjusted Gross Asset Value, provided that, within this limit, the

aggregate maximum exposure to assets in the Development Phase will

not exceed 5 per cent. of Adjusted Gross Asset Value, and the

aggregate exposure to any one Developer will not exceed 10 per

cent. of Adjusted Gross Asset Value. The restriction on

Construction Phase assets will not apply to assets where on-site

commissioning is expected to be completed within a period of three

months and any equipment on order is sufficiently insurance

wrapped;

-- at least 70 per cent. of the value of the Group's portfolio

of Energy Transition Assets will comprise United Kingdom based

investment;

-- the Group will not invest more than 5 per cent. of Adjusted

Gross Asset Value, in aggregate, in the acquisition of minority

stakes in Other Related Companies, and at all times such

investments will only be made with appropriate minority protections

in place;

-- neither the Group nor any of the Investee Companies will

invest in any UK listed closed-ended investment companies; and

-- the Company will not conduct any trading activities which are

significant in the context of the Group as a whole.

Compliance with the above investment limits will be measured at

the time of investment or in the case of commitment at the time of

commitment, and noncompliance resulting from changes in the price

or value of assets following investment will not be considered as a

breach of the investment limits.

For the purposes of the foregoing, the term "Adjusted Gross

Asset Value" shall mean the aggregate value of the total assets of

the Company as determined using the accounting principles adopted

by the Company from time to time as adjusted to include any

third-party debt funding drawn by, or available to, any

unconsolidated Holding Entity.

Borrowing Policy

The Directors intend to use gearing to enhance the potential for

income returns and long-term capital growth, and to provide capital

flexibility. However, the Company will always follow a prudent

approach for the asset class with regards to gearing, and the Group

will maintain a conservative level of aggregate borrowings.

Gearing will be employed either at the level of the Company, at

the level of any Holding Entity or at the level of the relevant

Investee Company and any limits set out in this document shall

apply on a look-through basis. The Company's target medium term

gearing for the Wider Group will be up to 40 per cent. of Gross

Asset Value, calculated at the time of drawdown.

The Group may enter into borrowing facilities at a higher level

of gearing at the Investee Company or Holding Entity, provided that

the aggregate borrowing of the Wider Group shall not exceed a

maximum of 45 per cent. of Gross Asset Value, calculated at the

time of drawdown.

Debt may be secured with or without a charge over some or all of

the Wider Group's assets, depending on the optimal structure for

the Group and having consideration to key metrics including lender

diversity, cost of debt, debt type and maturity profiles.

Intra-group debt between the Company and (i) Holding Entities

and/or (ii) Investee Companies subsidiaries will not be included in

the definition of borrowings for these purposes.

Hedging and Derivatives

The Company will not employ derivatives for investment purposes.

Derivatives may however be used for efficient portfolio

management.

The Wider Group will only enter into hedging contracts (in

particular, in respect of inflation, interest rate, currency,

electricity price and commodity price hedging) and other derivative

contracts when they are available in a timely manner and on

acceptable terms. The Company reserves the right to terminate any

hedging arrangement in its absolute discretion. Any such hedging

transactions will not be undertaken for speculative purposes. The

Company can, but does not intend to, enter into any currency

hedging.

Cash management

The Company may hold cash on deposit for working capital

purposes and awaiting investment and, as well as cash deposits, may

invest in cash equivalent investments, which may include government

issued treasury bills, money market collective investment schemes,

other money market instruments and short-term investments in money

market type funds ("Cash and Cash Equivalents"). There is no

restriction on the amount of Cash and Cash Equivalents that the

Company may hold and there may be times when it is appropriate for

the Company to have a significant Cash and Cash Equivalents

position.

Key Performance Indicators ("KPIs")

The Company sets out below its KPIs which it uses to track the

performance of the Company over time against the objectives as

described in the Strategic Report on pages 14 to 85.

The Board believes that the KPIs detailed below provide

shareholders with sufficient information to assess how effectively

the Company is meeting its objectives. The Board monitors these

KPIs on an ongoing basis.

KPI AND DEFINITION RELEVANCE TO PERFORMANCE COMMENT

STRATEGY

Dividends per The dividend The Company is The Company's

share (share) reflects the paying a 5.50 target was to

(3) Company's ability pence per share pay a dividend

Dividends paid to deliver a dividend in respect of 5.50 pence

to shareholders low-risk income of the year ended per share in

and declared in stream from the 31 March 2023 respect of the

relation to the portfolio. (5.50 pence per year to 31 March

year. share for the 2023, which it

period to 31 achieved.

March 2022).

----------------------------- --------------------------- ------------------------

Total NAV return The total NAV 9.2% (4.9% for Total NAV return

(%) (4) return measure the year to 31 for the year

NAV growth and highlights the March 2022). ended 31 March

dividends paid gross return 2023 is 1.2%

per share in the to investors above the target

year. including dividends of 7% - 8%. NAV

paid. return was generated

through dividends

paid of 5.7%

and capital growth

of 3.5%.

----------------------------- --------------------------- ------------------------

NAV per share The NAV per share 99.44 pence per NAV of GBP99.5

(pence) shows our ability share. (96.12 million or 99.44

NAV divided by to grow the portfolio pence per share pence per share

number of shares and to add value for the year as at 31 March

outstanding as to it throughout to 31 March 2022). 2023.

at the period the lifecycle

end. of our assets.

----------------------------- --------------------------- ------------------------

Cash dividend Reflects the 1.1x. The Company has

cover (3,4) Company's ability The Company delivered successfully

Operational cash to cover its a dividend for paid a cash covered

flow divided by dividends from the year cash dividend and

dividends paid the income received covered 1.1x has experienced

to shareholders in its wholly (0.14x for the the advantages

during the year. owned subsidiary, year to 31 March of a full year

TENT Holdings, 2022). of income since

from the portfolio the IPO proceeds

companies. were fully deployed

and committed.

----------------------------- --------------------------- ------------------------

Contractual Revenue The forecasted 92% of forecasted The Group has

Average percentage revenue contractually income is contractually stable and predictable

of underlying underpinned and underpinned and income stream

forecast income due to the Group due to the Group from interest

contractually encompassing over the next payments and

underpinned over two key components: 10 years. government subsidies,

the next 10 years. interest payments ensuring the

on debt facilities financial stability

and government and growth of

subsidies received the organisation.

by the equity

investee companies.

----------------------------- --------------------------- ------------------------

Ongoing Charges Ongoing charges 1.94% annualised Company level

Ratio ("OCR") shows the effect (1.38% for the budgets are approved

(4) of the operational year to 31 March annually by the

Annualised ongoing expenses incurred 2022). Board and actual

charges (i.e., by the Company. spend is reviewed

excluding acquisition quarterly. This

costs and other is a key measure

non-recurring of our operational

items, such as performance.

the premium listing Keeping costs

application costs) low supports

divided by the our ability to

average published pay dividends.

undiluted NAV The increase

in the period, in OCR has mainly

calculated in been driven by

accordance with the increase

Association of in management

Investment Companies fees. In the

guidelines. prior financial

year, the management

fee calculation

was 0.9% of deployed

IPO proceeds

until 10 December

2021. At this

date 75% of net

IPO proceeds

had been deployed

and the investment

management fee

calculation changed

to 0.9% of NAV.

----------------------------- --------------------------- ------------------------

Avoided emissions A measure of 27,112 tonnes The tCO(2) avoided

(4) our success in CO(2) avoided has increased

The carbon emissions investing in in the year ended compared to end

avoided by the projects that 31 March 2023 of year 2022

Company's investments. have a positive (17,074 tonnes as expected,

environmental CO(2) avoided due to continued

impact through for the year deployment and

a decrease in to 31 March 2022). the inclusion

CO(2) emissions of full-year

compared to an data for the

equivalent asset. Hydroelectric

Portfolio.

----------------------------- --------------------------- ------------------------

Gross loan to The LTV measures 0% (0% for the The Group will

value ("LTV") the prudence year to 31 March follow a prudent

(4) of our financing 2022). approach to gearing

The proportion strategy, balancing with a target

of our GAV that the potential medium-term target

is funded by borrowings. amplification gearing of up

of returns and to 40% of GAV

portfolio diversification and a maximum

that come with gearing that

using debt against will not exceed

the need to successfully 45% of GAV, at

manage risk. the time of drawdown.

On full drawdown

of the RCF, the

gross LTV is

expected to be

around 30%, based

on prevailing

NAV and all the

existing commitments.

----------------------------- --------------------------- ------------------------

Notes:

(3) Investors should note that references to "dividends" and

"distributions" are intended to cover both dividend income and

income which is designated as an interest distribution for UK tax

purposes and therefore subject to the interest streaming regime

applicable to investment trusts.

(4) Alternative Performance Measure.

Investment Manager's Report

Review of the Period

The past year has been significant for the Company, marked by

fully committing all of the Group's remaining capital, broadening

of the Company's investment mandate with the change in Company name

to reflect this, as well as the migration of the Company's shares

to trading on the Premium Segment of the Main Market of the London

Stock Exchange. These events reflect our strategic vision and

ambition to drive sustainable growth and positive impacts in

today's challenging energy market.

A diversified mandate provides numerous advantages, such as

greater flexibility to invest in a wide array of opportunities and

the ability to adapt to market changes. This diversification

mitigates risk and allows us to stay competitive in the face of

emerging technologies and regulatory shifts.

The Group's strategic investments are unaffected by the

Electricity Generator Levy. Our successful transactions to date

have demonstrated the Investment Manager's expertise, showcasing

our experience in managing a range of asset classes and capital

structures, whilst building a compelling pipeline. In the deals

closed to date, 92% of the Group's revenues are contracted for the

next ten years, with 47% of the Group's revenues being linked to

inflation, providing a high level of visibility and security over

the Group's income stream.

As we continue to expand our portfolio, during the financial

year we have ventured into new asset classes and capital

structures, for example receivables financing of LED lighting and

solar and BESS project development through a debt structure. These

investments not only underscore our commitment to advancing

innovative technologies but also allow us to leverage the stability

of debt financing to support projects that drive energy transition

and sustainability, whilst generating ongoing contractual returns

for the Group at an attractive risk adjusted rate.

The investment trust market as a whole has had a challenging

year, and this compounded with the scale and illiquidity of the

Company's shares has driven its discount to NAV. We do not believe

that the Company's discount to NAV is reflective of the quality of

the Group's portfolio.

Investments

LED

During the period, the Group's lighting service partner

completed multiple projects installing LED lighting at logistics

warehouses, totalling c.GBP2.2 million. Starting in September 2022,

the Group has received monthly repayments for its fixed rate

receivables financing, with "hell or high water"(5) income

contracted over the next five years.

Solar Development Financing

In March 2023 the Group committed to providing a GBP5 million

development debt facility to Innova Renewables Limited, ("Innova"),

part of the Innova group, one of the UK's leading solar and BESS

developers and operators. The facility will be used to develop

ground-mounted solar and BESS assets across the UK. The facility

has a 12-month term and delivers fixed rate contractual returns to

investors that are materially higher than the Group's target return

of 7-8% pa, reflecting the flexibility of the Group's investment

strategy. The facility was fully drawn on 3 April 2023.

BESS Portfolio

In March 2022, the Group committed GBP45.6 million fixed rate

debt facility to fund a portfolio of four geographically diverse

BESS assets in the UK. The debt facility is provided to a

subsidiary of Virmati Energy Ltd and GBP6.3 million was drawn at 31

March 2023, with a further drawdown subsequent to the balance sheet

date of GBP3.9 million, resulting in 78% of the facility remaining

undrawn. It is expected that the facility will be fully drawn in

2024.

Portfolio Overview

Tech Exposure(6)

CHP 19.0% 25.1

Hydro 41.1% 54.3

BESS 34.5% 45.6

LED 1.6% 2.1

Development 3.8% 5.0

Total 100% 132.1

Investment Type(6)

Debt 58.9% 77.8

Equity 41.1% 54.3

Total 100% 132.1

Lifecycle Stage(6)

Operating 66.4% 87.7

Construction 3.7% 4.9

Commitments awaiting

deployment 26.1% 34.5

Development 3.8% 5.0

Total 100% 132.1

Asset Exposure(6)

Harvest 7.0% 9.2

Glasshouse 6.9% 9.2

Spark Steam 5.1% 6.7

Achnacarry 18.5% 24.4

Choire A Bhalachain 3.4% 4.6

Elementary Energy 2.6% 3.4

Ladaidh 6.1% 8.1

Luaidhe 3.6% 4.7

Phocachain 6.9% 9.1

BESS Drawn 4.7% 6.2

BESS Commitment 29.8% 39.4

LED 1.6% 2.1

Development 3.8% 5.0

Total 100% 132.1

Underlying Counterparty

Exposure(6)

Non-Investment Grade

(Unrated) 57.4% 75.7

Investment Grade (Rated) 42.6% 56.3

Total 100% 132.1

Notes:

5 With an absolute payment obligation.

(6) Weighted on the sum of underlying portfolio held at fair

value and commitments waiting deployment held at cost.

Portfolio performance

CHP Portfolio

In 2021 the Group made fixed rate debt investments into a

portfolio of three Combined Heat and Power ("CHP") Energy Service

Centre Companies ("ESCos) which deliver heat and power to

glasshouses leased by a large-scale tomato grower. These ESCos have

continued to perform above the budget in the financial year. This

demonstrates the benefits of the economic model underlying these

projects, which generate revenues from both the wholesale

electricity market and/or direct offtake of heat and power by the

glasshouse occupiers.

The benefit of the CHP assets' business model is that it has two

countercyclical sources of revenue, thereby providing a stable

income which, in turn, underpins the loan repayments to the Group,

as highlighted this year. Under ordinary conditions, where energy

prices are lower than they are currently, the revenues generated by

the CHP projects are predominantly from the demand from the tomato

producers which purchase the heat and power produced by the CHP

assets to operate their glasshouses. However, during times of

higher energy prices, the electricity produced by the CHP assets

during peak load periods is able to be exported and provides the

projects with significant revenues from the wholesale electricity

market instead.

In December 2022, following a difficult trading period, the

company leasing the glasshouses underwent a change of ownership

resulting in a stronger counterparty for the Group. The

recapitalised tomato grower has boosted the management team to

support and reposition the business. This provided an opportunity

for the Group to renegotiate some of the terms of the facility

agreement and introduce more reporting requirements.

The duality of the model also underpins the dual purpose of the

assets in supporting the grid by providing electricity during the

peak demand periods and supporting the UK local food supply at a

time when both sectors were challenged by their respective

constraints.

This year, the CHP Portfolio avoided 18,098 tCO(2) equivalent

emissions(7) .

Hydroelectric Portfolio

The financial year ended 31 March 2023 marked the first full

year of ownership of the Hydroelectric Portfolio. During the

period, the nine hydroelectric schemes performed below expectation.

The annual generation performance of the portfolio was closely

aligned to the long-term energy yield forecast, with a variance of

less than 5%. The marginal variance was due to a temporary period

of curtailment imposed on certain schemes by the local grid

operator in March 2023.

Portfolio performance since the commissioning of the nine assets

has been reliable and closely corroborates with the power

generation forecasts based on historical rainfall data.

Accordingly, the average annual generation performance over the

last six years is within 1% of the P50 estimate.

With the current high level of technical availability and

reliable forecasting at our disposal, it has become imperative for

us to focus on pursuing optimisation to maximise the scheme's

potential. Loch Blair is the largest generator of the Hydroelectric

Portfolio in MWh per year and we have focused on optimising this

scheme. The optimisation will involve construction of a small dam

upstream of the intake. The reservoir created will attenuate peak

rainfall which combined with a control of the release of the flow

feeding the existing plant will increase the annual generation.

This will enable the scheme to target the peak load period of the

tariff in the PPA, increasing revenues from the power

wholesale.

All Feed-in-Tariff revenues enjoy annual indexation to UK RPI.

This has resulted in Feed in Tariff rates being adjusted upwards by

RPI of 13.40% in 2023. 3.00% is forecast from 2024 to 2031 and

2.40% is forecast thereafter, which has given an uplift to revenues

and underpins the highly defensive and attractive nature of this

portfolio.

Considering the robustness of our projected revenues, which are

safeguarded by a dependable generation forecast and the Feed-in

Tariff, our management team is actively evaluating prospects to

enhance profitability related to the sale of electricity in the

wholesale market, with various options available.

The portfolio generated 18,965 MWh of renewable energy and

avoided 8,866 tCO(2) equivalent emissions. Please see page 51 of

the Sustainability Report for further detail.

The total generation of the portfolio remains under the

threshold of the Electricity Generation Levy and therefore the

Group will not be subject to the increased tax rate in the coming

years.

BESS Portfolio

The BESS Portfolio has a total capacity of 110MW. The first BESS

asset, located in Oldham, a one-hour duration battery project,

reached its Commercial Operation Debut ("COD") on 1 December 2022.

It is located in the North of England and has a total capacity of

20MW.

The second asset, at Gerrards Cross, located at the border of

Greater London, is also a one hour duration 20MW project and is

under construction with the COD expected in late 2023. The

remaining two BESS assets are located in Scotland (two-hour

duration battery; total capacity 50MW) and Wales (two-hour duration

battery; total capacity 20MW) and are expected to commence

construction in summer 2023 and to be operational in 2024.

While these projects are greenfield projects, the construction

risk is mitigated through the modular nature of the design where

high value components (the batteries) are manufactured off-site and

delivered ready to install. This reduces the risk of interface

issues and construction delay. The bespoke elements of the

projects, mainly the power step-up and export to the grid, are

similar to other renewable energy and conventional generation

projects. Given the relatively conservative loan to cost ratio the

construction risks are substantially borne by the equity

investors.

Notes :

(7) details of calculation can be found in Annex 1 - Reporting

Principles and Methodologies

Portfolio Valuation

The Investment Manager is responsible for conducting the fair

market valuation of the Group's investments. The Company engages

Mazars LLP as an external, independent, and qualified valuer to

assess the validity of the discount rates used by the Investment

Manager in the determination of fair value. During the financial

year the Company transitioned to reporting quarterly financial

updates and portfolio valuations, reporting for the periods 30

September, 31 December and 31 March in 2022/23.

For non-market traded investments (being all the investments in

the current portfolio), the valuation is based on a discounted cash

flow ("DCF") methodology and adjusted in accordance with the

International Private Equity Valuation Guidelines where appropriate

to comply with IFRS 13, given the special nature of portfolio

investments.

The valuation of each investment within the portfolio is

determined through the application of a suitable discount rate,

which accounts for the perceived risk to the investment's future

cash flows and by applying this discount rate, the present value of

the investment's expected cash flows is derived. The Investment

Manager exercises its judgement in assessing the expected future

cash flows from each investment based on the project's expected

life and the financial model produced by each project entity. In

determining the appropriate discount rate, the Investment Manager

considers the relative risks associated with the revenues. For the

year ending 31 March 2023, the discount rates range from 5.6% to

8.3% pa. (31 March 2022: range from 5% to 8%).

The valuation of the portfolio by the Investment Manager and

reviewed and supported by the Directors as at 31 March 2023 was

GBP90.1 million (31 March 2022: GBP78.8 million).

Valuation movements

Although UK gilt rates have increased over the past 12 months,

the CHP Portfolio has been held at par during the financial year.

This is supported by the underlying trading performance of the

portfolio, exceeding budget for the second year in a row at a

revenue and profit level, which flowed through to higher debt

servicing cover ratios. Furthermore, during the financial year, the

borrowers' on-site customer was acquired and benefited from a cash

injection and balance sheet restructure. This reduction in

counterparty risk broadly offset increased movements in the

risk-free rate and the Company believes the discount rate applied

is consistent with market pricing for investments of this

nature.

During the financial year, the Group deployed 13.7% of the

committed debt proceeds into the BESS portfolio and it is expected

that during 2023 and 2024 the remaining commitment will be

drawn.

The valuation of the debt financing for the receivables from the

energy-efficient lighting portfolio has largely stayed consistent

throughout the financial year, with only a negligible change. This

stability reflects the high quality of the counterparties involved

and the associated risk-return ratio.

Due to the debt investments being valued at or close to par, the

fair value movements observed during the financial year primarily

stem from the equity investment into the Hydroelectric Portfolio. A

breakdown of the movement in the Directors' portfolio valuation is

detailed and explained below.

Valuation Movement in the year to 31 March 2023

(GBPmillions)

The opening valuation as at 31 March 2022 was GBP79.0 million.

When considering the in year cash investments through the Company's

wholly owned subsidiary, the rebased valuation was GBP86.5 million.

Each movement between the valuation at the start of the financial

year and the rebased valuation is considered in turn below:

Inflation

The war in Ukraine, in addition to the multiple primary impacts

felt in Ukraine itself, has driven an increase in energy and

commodity prices. This, along with supply chain bottlenecks has

continued to place significant upward pressure on inflation.

During the financial period, inflation forecasts for 2022 and

2023 have increased significantly and as a result have caused a

valuation uplift of GBP4.6 million. The methodology adopted in

relation to inflation, for both RPI and CPI, follows the latest

available (March 2023) Office for Budget Responsibility forecast

for the 12 months from the 31 March 2023 valuation date.

Thereafter, a long-term 3.00% assumption is made in relation to

RPI, dropping to 2.40% in 2031 to reflect the 0.60% reduction as

RPI is phased out and replaced with CPI.

The Company's long-term assumption for CPI remains at 2.25%. We

also model a power curve indexation assumption, as wholesale power

prices are not intrinsically linked to consumer prices, of

3.00%.

Power Prices

The valuation as at 31 March 2023 applies long-term, forward

looking power prices from a leading third-party consultant. A blend

of the two most recent quarters' central case forecasts are taken

and applied, consistent with the approach applied in previous

periods. The Company adopts this approach due to the

unpredictability and fluctuations in power price forecasts. Where

fixed price arrangements are in place, the valuation model reflects

this price for the relevant time period and subsequently reverts to

the power price forecast using the methodology described. The

updated power price forecast has been accretive to the valuation of

the Hydroelectric Portfolio by GBP2.0 million in the year ended 31

March 2023. The Company notes that the outlook for power prices is

expected to decline over the course of FY24, however the power

price forecast for the Hydroelectric Portfolio are underpinned by

the Feed-in-Tariff export rate.

Discount Rates

A range of discount rates are used when calculating the fair

value of the portfolio valuations and are representative of the

view of the Investment Manager and Board, who benefit from

Company's independent valuer's guidance. The discount rates are

indicative of the rate of return in the market for assets with

similar characteristics and risk profiles. The weighted average

discount rate of the investments made as at 31 March 2023 is 6.6%,

an increase of 46 basis points since 31 March 2022. The weighted

average discount rate of the deployed and committed portfolio as at

31 March 2023 is 7.2%.

During the financial year, the discount rate increase has caused

a reduction in the valuation in the Hydroelectric Portfolio of

GBP3.0 million. The discount rate movement is reflective of the

significant increase in gilt yields since the prior financial year,

and although the yields fell between the peak in September 2022 and

the year end, they remain higher than they were at the start of the

financial year.

Investment Obligations

At 31 March 2023, the Group had two outstanding investment

commitments totalling GBP44.4 million, one in relation to the BESS

Portfolio which has a total capacity of 110MW and a second with a

leading solar, battery and energy storage systems developer for a

12-month development finance facility.

The committed investment into the BESS Portfolio totals GBP45.6

million, via a fixed rate debt facility, of which GBP6.2 million

has been drawn and GBP39.4 million remains committed at the

financial year end, with a further GBP3.9 million being deployed in

June 2023.

The solar PV development finance fixed rate debt facility with

Innova is for GBP5.0 million and was fully drawn on 3 April

2023.

Fully invested portfolio valuation

The valuation of the portfolio on a fully invested basis can be

derived by adding the valuation at 31 March 2023 and the expected

outstanding commitments are as follows:

GBP million

Underlying Portfolio valuation as at

31 March 2023 87.7

Valuation of TENT Holdings Limited as

at 31 March 2023 2.4

Future investments committed at cost 44.4

------------

Portfolio valuation once fully invested 134.5

------------

Key Sensitivities

The following chart illustrates the sensitivity of the Company's

NAV per share to changes in key input assumptions (with labels

indicating the impact on the NAV in pence per share of the

sensitivities). The total portfolio is affected by changes in the

discount rate, whereas the other sensitivities pertain only to the

Hydroelectric Portfolio.

For each of the sensitivities, it is assumed that potential

changes occur independently of each other with no effect on any

other base case assumption, and that the number of investments in

the portfolio remains static throughout the modelled life.

Financial Review

The Company applies IFRS 10 and qualifies as an investment

entity. IFRS 10 requires that investment entities measure

investments, including subsidiaries that are themselves investment

entities, at fair value except for subsidiaries that provide

investment services which are required to be consolidated.

The Company's single, wholly owned subsidiary, TENT Holdings, is

the ultimate holding company for all the Company's investments.

It is, itself, an investment entity and is therefore measured at

fair value.

NAV

The Company's NAV and investment portfolio valuations are now

calculated on a quarterly basis on 30 June, 30 September, 31

December and 31 March each year. Valuations are prepared by the

Investment Manager and reviewed by Mazars LLP. The other assets and

liabilities of the Company are calculated by the Administrator. The

NAV is reviewed and approved by the Board. All variables relating

to the performance of the underlying assets are reviewed and

incorporated in the process of identifying relevant drivers of the

DCF valuation.

NAV Bridge for the year ended 31 March 2023 (GBPmillions)

The movement in NAV was driven by investment income of GBP7.3

million representing the interest and dividend income to TENT, via

TENT Holdings, the Company's sole wholly owned subsidiary through

which investments are purchased and measured at fair value. Income

was offset by investment management fees and other expenses, as

well as dividends paid to investors. The Investment portfolio

benefited from an increase in valuation, resulting in an unrealised

fair value gain of GBP4.0 million. The NAV at 31 March 2023 has

increased by GBP3.3 million.

Operating Results

The profit before tax of the Company has increased by 85% during

the financial year to GBP8.8 million (31 March 2022: GBP4.8

million), with earnings per share of 8.81 pence (31 March 2022:

4.76 pence).

Operating Expenses and Ongoing Charges

The operating expenses for the year ended 31 March 2023 amounted

to GBP2.5 million (31 March 2022: GBP1.3 million). During the

financial year the Company incurred one-off expenditure of GBP0.6

million in relation to the application to trading on the Premium

Segment of the Main Market of the London Stock Exchange.

During the financial year the management fee was calculated

based on NAV and in the prior financial year the management fee was

partly calculated in reference to deployed funds. In accordance

with the terms of the Investment Management Agreement once 75% of

the net IPO proceeds were deployed (achieved in December 2021), the

annual fee is calculated based on the Net Asset Value of the

Company.

The Company's OCR is 1.94% (31 March 2022: 1.38%). The primary

factor contributing to the increase is the management fee charge,

as described above. The ongoing charge ratio has been calculated as

an annualised ongoing charge (excluding non-recurring items),

divided by the average Net Asset Value in the period. With the

exception of the management fee, the operating expenses of the

Company are predominantly fixed and predetermined. As a result, as

the scale of the fund increases, the Operating Cost Ratio (OCR) is

expected to decline.

Cash Dividend Cover

The Company measures dividend cover on a look through basis, by

consolidating the income and operating expenses of its sole wholly

owned subsidiary, TENT Holdings. The below table summarises the

cash income, cash expenses and finance costs incurred by the

Company and TENT Holdings in the financial year ended 31 March

2023. The cash flow statement for the Company alone does not

capture the total income and expenses of the Group as the interest

income, financing costs and further expenses are received and paid

for by TENT Holdings.

In the year, the Company has delivered a cash dividend cover of

1.1x (2022: 0.14x). However, it is important to note that this

calculation includes one-off expenditure associated with the

migration to trading to the Premium Segment of the Main Market of

the London Stock Exchange and excluding the impact of this

exceptional one-off expenditure, the dividend cover increases to

1.2x.

The below table outlines the cash income and expenditure of the

Company and its wholly owned subsidiary TENT Holdings:

31 March 2023

GBPmillions

Consolidated cash income 9.0

Consolidated operating Cash Expenses and

Finance Costs (3.0)

Dividends paid per Statement of Changes in

Equity 5.5

Cash dividend cover 1.1x

-------------

Gearing and Liquidity

At the year ending 31 March 2023, the Group had cash balances of

GBP11.2 million (31 March 2022: GBP17.4 million).

The Group has a committed GBP40 million RCF in place and intends

utilise the facility to fund the commitments to the BESS

Portfolio.

Environmental, Social and Governance

The Investment Manager is committed to promoting ESG when

assessing investment opportunities and has been a signatory to the

United Nations' Principles for Responsible Investing ("PRI") since

2019.

In addition, the Investment Manager is a certified B Corp which

formalises its consideration of social and environmental

impact.

We have continued to focus on our ESG impact through the TENT

portfolio and during the year we enhanced the portfolio from an ESG

perspective through, for example, health and safety audits

conducted across the assets.

The overall TENT portfolio generated 18,965 MWh of renewable

energy and avoided 27,122 tonnes of CO(2) in the year ended 31

March 2023.

The Group targets a wide range of assets that contribute to

energy transition and the Investment Manager and Board believe that

TENT's investments are well-aligned to the energy transition

through the resulting avoided carbon. The Company also recognises

the importance of continuing to reduce the emissions intensity of

assets and will continue to track a pathway to Net Zero and will

report on reduction in emissions intensity of the assets each year,

along with continued reporting of avoided emissions. The Investment

Manager, with the oversight of the Board, has also conducted

extensive analysis to determine its ability to set an overarching

Net Zero target, to reduce its emissions intensity in line with the

accepted scientific consensus on reducing global temperature rises

to 1.5degc. At this time there is currently no established

methodology, or combination of methodologies, available to show the

Net Zero alignment of the diversified asset base that the Company

holds. The Investment Manager will continue to actively monitor

this position for future reporting.

Pipeline

Sector Pipeline % of Total Pipeline Weighted Average

GBPmillions Return

Distributed 55 10% 6.4%

------------- -------------------- -----------------

Efficient Storage 254 47% 7.6%

------------- -------------------- -----------------

Onsite Generation/Demand

Reduction 236 43% 10.6%

------------- -------------------- -----------------

Total 545 100% 8.8%

------------- -------------------- -----------------

The current pipeline comprises opportunities that would deliver

an average yield of 8.8%, indicating a high potential to further

support the dividend cover and deliver a progressive dividend

return to shareholders. The pipeline includes both debt and equity

opportunities, covering a range of technologies and sectors in the

Company's three thematic areas. Potential investments include BESS,

onsite generation, low-carbon energy consumption, and green

hydrogen.

The pipeline also includes early-stage development, mid-stage

development, pre-construction projects, and operational assets.

This means that the Company can use the pipeline to select a

balanced set of investments to deliver attractive risk-adjusted

returns to investors while also considering risk-return profiles

and time horizons. By investing a small part of the portfolio in

early-stage development, the Company can create value by taking

projects from concept to consent, capturing a larger proportion of

the project margin.

The pipeline includes several joint venture opportunities,

outright project purchases, and alternative debt funding