Topps Tiles PLC Response to Media Comment

December 02 2024 - 1:00AM

RNS Regulatory News

RNS Number : 3123O

Topps Tiles PLC

02 December 2024

2

December 2024

Topps Tiles

Plc

Response to Media

Comment

Topps Tiles Plc ("Topps Group", or

the "Group"), the UK's leading tile specialist, notes recent media

comment.

As announced in its 2024 full year

results on 26 November 2024, the Group would note the

following:

|

·

|

Topps Group is continuing to take

market share in a difficult trading environment for RMI and

especially bigger ticket spend:

|

|

|

|

-

|

In FY24, while the substantially

weaker consumer environment saw Topps Group adjusted revenue

decline 5.4% year on year, this was a substantial out-performance

of an overall market which was estimated to be down

10-15%

|

|

|

|

-

|

Since 2019, the UK tile market is

estimated to be down c.20%, whereas Group LFL revenue has remained

flat, and total revenue has increased by 14.9% through successful

inorganic growth such as the Pro-Tiler acquisition

|

|

|

|

-

|

In the first eight weeks of FY25,

Group sales are up 1.2% (excluding CTD)

|

|

|

·

|

The Group announced strong initial

progress against the five growth initiatives underpinning 'Mission

365', its strategic plan over the medium term to grow Group sales

to £365 million, with an adjusted PBT margin of 8-10%

|

|

·

|

Specifically, the Group noted the

development of its trade digital offer; the significant expansion

of its addressable market into hard surface coverings; increased

trade B2B opportunities with the acquisition of CTD Tiles; and

further strong growth in online pureplay, with Pro Tiler revenue up

over 30%

|

|

·

|

Topps Group has invested

significantly in expanding its digital operations over the last

five years and the business is truly omni-channel with 18% of group

revenues coming from online, and investment in the Group's digital

offer for trade customers driving further growth

|

|

·

|

The CTD acquisition is strategically

compelling as it is a trade-focused brand which will significantly

accelerate the Group's growth in the commercial market. The

acquisition was completed after appropriate due diligence with

advisors

|

|

·

|

A clear strategy and robust balance

sheet with £38.7 million cash headroom leaves the Group well placed

to deliver significant medium term growth

|

Paul Forman, Chairman, said: "We

engage with all our larger shareholders on a regular basis and

listen closely to their views. Our strategy was reviewed in April

and presented to shareholders in May, with further updates given

last week. Further expansion of our digital capabilities is at the

heart of many of these growth initiatives. Our latest results show

that we continue to take market share, consistently outperforming

the wider tile market despite very challenging trading conditions.

We believe this demonstrates the effectiveness of our strategy,

which has the full support of the Board."

For further information please

contact:

|

Topps Tiles Plc

|

|

|

Paul Forman, Chairman

Rob Parker, CEO

Stephen Hopson, CFO

|

0116 282

8000

|

|

Citigate Dewe Rogerson

|

|

|

Kevin Smith

|

020 7638

9571

|

Notes to Editors

Topps Tiles Plc is the UK's largest

specialist supplier of tiles and associated products, targeting the

UK domestic and commercial markets and serving homeowners, trade

customers, architects, designers and contractors from 301

nationwide Topps Tiles stores, 30 CTD Tile stores, a range of

direct business to business selling teams, and nine customer-facing

websites: www.toppstiles.co.uk,

www.parkside.co.uk,

www.protilertools.co.uk,

www.northantstools.co.uk,

www.premiumtiletrim.co.uk,

www.warmfloorstore.co.uk,

www.flooringmaterials.co.uk,

www.tilewarehouse.co.uk

and www.ctdtiles.co.uk.

Since opening its first store in

1963, Topps has maintained a simple operating philosophy

‐ inspiring customers with

unrivalled product choice and providing exceptional levels of

customer service. For further information on the Group,

please visit www.toppsgroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

SPCKZMGZNMLGDZM

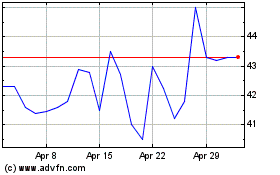

Topps Tiles (LSE:TPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Topps Tiles (LSE:TPT)

Historical Stock Chart

From Dec 2023 to Dec 2024