TIDMGFRD TIDMBVS

RNS Number : 6109S

Galliford Try PLC

07 November 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT

JURISDICTION.

THE COMPANY EXPECTS TO PUBLISH SHORTLY A CIRCULAR IN CONNECTION

WITH THE TRANSACTION. ANY VOTING DECISIONS BY SHAREHOLDERS IN

CONNECTION WITH THE TRANSACTION SHOULD BE MADE ON THE BASIS OF THE

INFORMATION CONTAINED IN THE CIRCULAR.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

7 November 2019

For immediate release

Galliford Try plc

Combination between Bovis Homes and Galliford Try's Linden Homes

and Partnerships & Regeneration divisions

Transformation of Galliford Try into a well-capitalised,

standalone construction-focused group

Further to the announcement on 10 September 2019, the Board of

Galliford Try plc ("Galliford Try") is pleased to announce that it

has entered into an agreement with Bovis Homes Group PLC ("Bovis

Homes") regarding a combination of Bovis Homes and Galliford Try's

Linden Homes and Partnerships & Regeneration divisions (the

"Housing Businesses") (the "Transaction"). The Transaction is

subject to, inter alia, the approval of Galliford Try and Bovis

Homes shareholders.

Key transaction terms

On the basis of the Bovis Homes closing share price on 9

September 2019, being the last business day prior to the

announcement of high-level terms, the Transaction values the

Housing Businesses at GBP1.075 billion.(1) The consideration will

be satisfied through:

i. the issue to Galliford Try shareholders of 63,739,385 new

Bovis Homes shares (in aggregate) (the "Consideration Shares"),

valued at GBP675 million on the basis of the closing price of a

Bovis Homes share on 9 September 2019 (which would equate to

0.57406 Bovis Homes shares for each Galliford Try share based on

111,032,617 Galliford Try shares in issue as at the date of this

announcement);

ii. the payment of GBP300 million in cash to Galliford Try (the "Cash Consideration"); and

iii. the assumption by Bovis Homes of Galliford Try's

obligations under its GBP100 million 10-year debt private

placement.

(1) On the basis of the Bovis Homes closing share price on 6

November 2019, being the last business day prior to this

announcement, the Transaction values the Consideration Shares at

GBP741 million and the Housing Businesses at GBP1.141 billion.

At completion of the Transaction ("Completion"), Bovis Homes

will also assume Galliford Try's rights and obligations under two

of Galliford Try's pension schemes. The Cash Consideration is

subject to customary Completion adjustments.

Benefits of the Transaction

The Galliford Try Board believes the proposed Transaction

will:

-- allow Galliford Try to realise an appropriate premium for the Housing Businesses;

-- result in Galliford Try shareholders having investments in

two focused and well-financed businesses, through their continuing

100% shareholding in Galliford Try, and a 29.3% shareholding in the

enlarged Bovis Homes;

-- create, through the enlarged Bovis Homes, one of the UK's

leading housebuilding businesses; and

-- transform Galliford Try into a well-capitalised, standalone construction-focused group.

In addition, the Bovis Homes Board believes the proposed

Transaction will achieve estimated recurring run-rate pre-tax cost

synergies of at least GBP35 million per annum by the end of the

second full financial year following Completion.

A circular containing further information on the Transaction,

along with notices convening shareholder meetings of Galliford Try,

is expected to be sent to Galliford Try shareholders on 8 November

2019.

For further detail on Bovis Homes and the impact on Bovis Homes

of the Transaction, Galliford Try shareholders should refer to the

announcement of the Transaction released by Bovis Homes today.

Peter Ventress, Chairman of Galliford Try plc, commented:

"This transaction is a positive development which is in the best

interests of both our shareholders and wider stakeholder group. For

Galliford Try, it establishes a focused and well-capitalised

construction business led by a very experienced and dedicated

management team. Supported by a robust order book and strong market

positions in key sectors, Galliford Try will be well positioned for

the future. This transaction also creates one of the UK's leading

Housebuilding and Partnerships businesses with great opportunity

ahead, from which Galliford Try shareholders will benefit through

their continued shareholding."

The person responsible for making this announcement on behalf of

Galliford Try is Kevin Corbett, General Counsel and Company

Secretary. This announcement contains inside information for the

purposes of article 7 of EU Regulation 596/2014.

Enquiries:

Galliford Try plc

Graham Prothero, Chief Executive

Andrew Duxbury, Finance Director 01895 855

Kevin Corbett, General Counsel and Company Secretary 001

Rothschild & Co (Lead Financial Adviser to Galliford

Try)

John Deans

Neil Thwaites

Peter Everest 020 7280 5000

HSBC Bank plc (Joint Financial Adviser, Joint

Sponsor and Joint Corporate Broker to Galliford

Try)

Mark Dickenson

Adam Miller

Keith Welch

Diraj Ramchandani 020 7991 8888

Peel Hunt LLP (Joint Financial Adviser, Joint

Sponsor and Joint Corporate Broker to Galliford

Try)

Charles Batten

Edward Knight

Harry Nicholas 020 7418 8900

Tulchan Communications (PR Adviser to Galliford

Try)

James Macey White

Martin Pengelley

Elizabeth Snow 020 7353 4200

Important Notice

This announcement is for information purposes only and does not

constitute a prospectus or prospectus equivalent document. Nothing

in this announcement shall constitute an offer or invitation to

underwrite, buy, subscribe, sell or issue of the solicitation of an

offer to buy, sell, acquire, dispose or subscribe for shares of any

other securities. Nothing in this announcement should be

interpreted as a term or condition of the Transaction.

A circular is expected to be published on 8 November 2019 in

connection with the Transaction (the "Circular"). Copies of the

Circular will, following publication, be available through the

website of Galliford Try at www.gallifordtry.co.uk. Neither the

content of Galliford Try's website nor any website accessible by

hyperlinks on the Company's website is incorporated in, or forms

part of, this announcement.

Galliford Try urges shareholders to read the Circular once

published carefully as it contains important information in

relation to the Transaction. Any vote in respect of resolutions to

be proposed at the shareholder meetings to approve the Transaction

and related matters should be made only on the basis of the

information contained in the Circular.

The information contained in this announcement is for background

purposes only and does not purport to be full or complete. No

reliance may be placed for any purpose on the information contained

in this announcement or its accuracy or completeness. The

information in this announcement is subject to change.

The availability of this announcement and/or the Circular to

shareholders who are not resident in the United Kingdom may be

affected by the laws of the relevant jurisdictions in which they

are resident (including affecting the ability of such shareholders

to vote their shares with respect to the Scheme and the

Transaction). Persons who are not resident in the United Kingdom or

who are subject to the laws and/or regulations of another

jurisdiction should inform themselves of, and should observe, any

applicable requirements. Any failure to comply with any such

restrictions may constitute a violation of the securities laws of

such jurisdiction.

N.M. Rothschild & Sons Limited ("Rothschild & Co"),

which is authorised and regulated by the Financial Conduct

Authority in the United Kingdom, is acting as lead financial

adviser to Galliford Try and for no one else in connection with the

Transaction and will not be responsible to anyone other than

Galliford Try for providing the protections afforded to clients of

Rothschild & Co or for providing advice in relation to the

Transaction, the contents of this announcement or any transaction,

arrangement or other matter referred to in this announcement.

HSBC Bank plc ("HSBC"), which is authorised by the Prudential

Regulation Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority in the United

Kingdom, is acting as joint financial adviser, joint sponsor and

joint corporate broker to Galliford Try and Galliford Try Holdings

plc in connection with the proposed sale of the Disposal Group

(excluding for the avoidance of doubt the associated restructuring)

and admission of the shares in Galliford Try Holdings plc to

trading on the London Stock Exchange's main market for listed

securities and for no one else in connection with the Transaction

and will not be responsible to anyone other than Galliford Try or

Galliford Try Holdings plc for providing the protections afforded

to clients of HSBC or for providing advice in relation to the

Transaction, the contents of this document or any transaction,

arrangement or other matter referred to in this announcement.

Peel Hunt LLP ("Peel Hunt"), which is regulated by the Financial

Conduct Authority in the United Kingdom, is acting as joint

financial adviser, joint sponsor and joint corporate broker to

Galliford Try and Galliford Try Holdings plc in connection with the

proposed sale of the Disposal Group (excluding for the avoidance of

doubt the associated restructuring) and admission of the shares in

Galliford Try Holdings plc to trading on the London Stock

Exchange's main market for listed securities and for no one else in

connection with the Transaction and will not be responsible to

anyone other than Galliford Try or Galliford Try Holdings plc for

providing the protections afforded to clients of Peel Hunt or for

providing advice in relation to the Transaction, the contents of

this document or any transaction, arrangement or other matter

referred to in this announcement.

This announcement has been issued by Galliford Try and is the

sole responsibility of Galliford Try. No representation or

warranty, express or implied, is or will be made as to, or in

relation to, and no responsibility or liability is or will be

accepted by Rothschild & Co, HSBC or Peel Hunt, or by any of

their affiliates or agents as to, or in relation to, the accuracy

or completeness of this announcement or any other written or oral

information made available to any interested party or its advisers,

and any responsibility or liability, whether arising in tort,

contract or otherwise in respect of this announcement or any such

statement, therefore is expressly disclaimed.

Notice to US Shareholders

The issue of the shares in Goldfinch (Jersey) Limited ("New

Topco") and the Consideration Shares relate to shares of a Jersey

company and a UK company respectively and are proposed to be

effected by means of a scheme of arrangement under the laws of

England and Wales. A transaction effected by means of a scheme of

arrangement is not subject to proxy solicitation or tender offer

rules under the US Securities Exchange Act of 1934, as amended.

Accordingly, the scheme of arrangement is subject to the disclosure

requirements, rules and practices applicable in the United Kingdom

to schemes of arrangement, which differ from the requirements of US

proxy solicitation or tender offer rules.

The financial information included in the Circular has been

prepared in accordance with IFRS and thus may not be comparable to

financial information of US companies or companies whose financial

statements are prepared in accordance with generally accepted

accounting principles in the United States.

Neither the shares in New Topco nor the Consideration Shares

have been, and nor will they be, registered under the US Securities

Act of 1933, as amended (the "Securities Act") or under the

securities laws of any state or other jurisdiction of the United

States. Accordingly, neither shares in New Topco nor the

Consideration Shares may be offered, sold, resold, delivered,

distributed or otherwise transferred, directly or indirectly, in or

into the United States absent registration under the Securities Act

or an exemption therefrom. The shares in New Topco and the

Consideration Shares are expected to be issued in reliance upon the

exemption from the registration requirements of the Securities Act

provided by Section 3(a)(10) thereof. Galliford Try shareholders

who are affiliates of New Topco after the scheme of arrangement

becomes effective or affiliates of Bovis Homes after the

Transaction has been completed will be subject to certain US

transfer restrictions relating to the shares in New Topco and the

Consideration Shares received in connection with the scheme of

arrangement and the Transaction, respectively.

The shares in Galliford Try Holdings plc ("New Galliford Try")

have not been and are not required to be registered under the

Securities Act. The shares in New Galliford Try should not be

treated as "restricted securities" within the meaning of Rule

144(a)(3) under the Securities Act and persons who receive shares

in New Galliford Try (other than affiliates) may resell them

without restriction under the Securities Act.

For the purposes of qualifying for the exemption from the

registration requirements of the Securities Act afforded by Section

3(a)(10), the Company will advise the Court through counsel that

its sanctioning of the scheme of arrangement will be relied upon by

New Topco and Bovis Homes as an approval of the scheme of

arrangement following a hearing on its fairness to Galliford Try

shareholders.

Each Galliford Try shareholder is urged to consult his or her

independent professional adviser immediately regarding the tax

consequences of the Transaction.

It may be difficult for US Shareholders to enforce their rights

and claims arising out of the US federal securities laws, since New

Galliford Try, Bovis Homes and Galliford Try are located in

countries other than the United States, and some or all of their

officers and directors may be residents of countries other than the

United States. US Shareholders may not be able to sue a non-US

company or its officers or directors in a non-US court for

violations of the US securities laws. Further, it may be difficult

to compel a non-US company and its affiliates to subject themselves

to a US court's judgment.

None of the securities referred to in this announcement have

been approved or disapproved by the US Securities and Exchange

Commission, any state securities commission in the United States or

any other US regulatory authority, nor have such authorities passed

upon or determined the adequacy or accuracy of the information

contained in this document. Any representation to the contrary is a

criminal offence in the United States.

Forward-looking statements

This announcement contains statements which are, or may be

deemed to be, "forward-looking statements" and which are

prospective in nature. All statements other than statements of

historical fact included in this announcement may be

forward-looking statements. They are based on current expectations

and projections about future events, and are therefore subject to

risks and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the

forward-looking statements. Often, but not always, forward-looking

statements can be identified by the use of forward-looking words

such as "plans", "expects", "is expected", "is subject to",

"budget", "scheduled", "estimates", "forecasts", "predicts",

"intends", "anticipates", "believes", "targets", "aims",

"projects", "future-proofing" or words or terms of similar

substance or the negative of such words or terms, as well as

variations of such words and phrases or statements that certain

actions, events or results "may", "could", "should", "would",

"might" or "will" be taken, occur or be achieved. Such statements

are qualified in their entirety by the inherent risks and

uncertainties surrounding future expectations. Such forward-looking

statements involve known and unknown risks and uncertainties that

could significantly affect expected results and are based on

certain key assumptions. Many factors may cause the actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Neither Galliford Try, HSBC or Peel

Hunt, nor any of their respective associates, directors, officers,

employees or advisers, provides any representation, assurance or

guarantee that the occurrence of the events expressed or implied in

any forward-looking statements in this announcement will actually

occur. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

announcement. Other than in accordance with their legal or

regulatory obligations, neither Galliford Try nor HSBC or Peel Hunt

are under any obligation and each expressly disclaims any intention

or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Quantified financial benefits

Statements of estimated cost savings and synergies relate to

future actions and circumstances which, by their nature, involve

risks, uncertainties and contingencies. As a result, the cost

savings and synergies referred to may not be achieved, may be

achieved later or sooner than estimated, or those achieved could be

materially different from those estimated.

Galliford Try plc

Combination between Bovis Homes and Galliford Try's Linden Homes

and Partnerships & Regeneration divisions

Transformation of Galliford Try into a well-capitalised,

standalone construction-focused group

1. Introduction

Further to the announcement on 10 September 2019, the Board of

Galliford Try plc ( "Galliford Try") is pleased to announce that it

has entered into an agreement with Bovis Homes Group PLC ("Bovis

Homes") regarding a combination of Bovis Homes and Galliford Try's

Linden Homes and Partnerships & Regeneration divisions (the

"Housing Businesses" or the "Disposal Group") (the "Transaction").

The Transaction is subject to, inter alia, the approval of

Galliford Try and Bovis Homes shareholders.

On the basis of the Bovis Homes closing share price on 9

September 2019, being the last business day prior to the

announcement of high-level terms, the Transaction values the

Housing Businesses at GBP1.075 billion.(1) The consideration will

be satisfied through:

i. the issue to Galliford Try shareholders of 63,739,385 new

Bovis Homes shares (in aggregate) (the "Consideration Shares"),

valued at GBP675 million on the basis of the closing price of a

Bovis Homes share on 9 September 2019 (which would equate to

0.57406 Bovis Homes shares for each Galliford Try share based on

111,032,617 Galliford Try shares in issue as at the date of this

announcement);

ii. the payment of GBP300 million in cash to Galliford Try (the "Cash Consideration"); and

iii. the assumption by Bovis Homes of Galliford Try's

obligations under its GBP100 million 10-year debt private placement

(the "PP Bond").

(1) On the basis of the Bovis Homes closing share price on 6

November 2019, being the last business day prior to this

announcement, the Transaction values the Consideration Shares at

GBP741 million and the Housing Businesses at GBP1.141 billion.

At completion of the Transaction ("Completion"), Bovis Homes

will also assume Galliford Try's rights and obligations under two

of Galliford Try's pension schemes.

The Cash Consideration is subject to customary Completion

adjustments.

The Consideration Shares received by Galliford Try shareholders

will rank pari passu in all respects with existing Bovis Homes

shares, save that they will not be entitled to receive the Bovis

Homes second interim dividend, which is expected to be declared in

lieu of the Bovis Homes 2019 final dividend for the year ending 31

December 2019.

Bovis Homes has also announced today a non pre-emptive placing

with institutional investors of up to 13,472,591 new ordinary Bovis

Homes shares (the "Placing Shares") representing up to

approximately 9.99 per cent. of Bovis Homes' existing issued share

capital (the "Bovis Homes Placing"), which is expected to raise

gross proceeds of up to GBP157 million. Bovis Homes proposes to use

the net proceeds of the Bovis Homes Placing and funds to be drawn

down at Completion from its new debt financing to fund the Cash

Consideration.

Bovis Homes and Galliford Try have agreed that conditional upon

Completion, rather than pay the expected special dividend of GBP60

million, Bovis Homes will return value to shareholders by way of a

bonus issue (the "Bovis Homes Bonus Issue") settled at Completion

through the issue of 5,665,723 Bovis Homes ordinary shares to

shareholders on the Bovis Homes register of members as at 6.00 p.m.

on 2 January 2020. This will include holders of the Placing Shares

but exclude recipients of the Consideration Shares. On the basis of

the Bovis Homes closing share price on 6 November 2019, being the

last business day prior to this announcement, the Bovis Homes Bonus

Issue would be for an amount of approximately GBP66 million.

As a result, following Completion, and taking into account the

issue of new Bovis Homes shares under the Bovis Homes Placing and

the Bovis Homes Bonus Issue, Galliford Try shareholders are

expected to own in aggregate approximately 29.3 per cent. of the

enlarged Bovis Homes group.

Up to 2,056,812 additional Galliford Try shares may be issued

prior to Completion based on the vesting and/or exercise of

outstanding share awards under Galliford Try's current LTIP and

Sharesave schemes. If all such awards were to vest and/or be

exercised, and on the basis of 63,739,385 Consideration Shares,

Galliford Try shareholders would be issued approximately 0.56362

Bovis Homes shares per Galliford Try share. 755,960 conditional

awards granted under the LTIP scheme are currently outstanding, the

entitlement to which is subject to certain performance hurdles, and

1,300,852 Galliford Try shares are subject to outstanding Sharesave

options, exercisable at prices in the range of GBP8.23 to

GBP12.3441. This compares to GBP7.42, being the closing price of a

Galliford Try share on the last business day prior to this

announcement.

The Galliford Try and Bovis Homes Boards believe that, following

Completion, the combination of Bovis Homes and the Disposal Group

will create one of the UK's leading housebuilding businesses with

enhanced scale to compete more effectively in the UK private and

affordable housebuilding markets. With a complementary geographical

footprint and strategic land bank, the Bovis Homes Board believes

that the Transaction will generate recurring operational and

procurement run-rate pre-tax cost synergies of at least GBP35

million per annum in the enlarged Bovis Homes group.

The Galliford Try Board believes that the Transaction will also

result in Galliford Try becoming a well-capitalised

construction-focused group (the "Continuing Group"), benefiting

from the recent operational restructuring which refocused the

business to deliver improved future performance. Galliford Try's

strengths in UK building and infrastructure, particularly in the

highways and water sectors, along with the spread of work for both

public and private clients, provide a strong foundation for

Galliford Try's future as an independent construction-focused

group, owned entirely by Galliford Try shareholders.

The Galliford Try Board therefore believes that the Transaction

will result in Galliford Try shareholders having investments in two

distinct, focused and well-financed businesses. The respective

management teams will be able to focus better on each business's

specific requirements and the separate businesses should be well

positioned to attract sector-specific investor interest.

For further detail on Bovis Homes and the impact on Bovis Homes

of the Transaction, Galliford Try shareholders should refer to the

announcement of the Transaction released by Bovis Homes today.

The Transaction constitutes a Class 1 transaction for both

Galliford Try and Bovis Homes under the Listing Rules and is,

therefore, conditional upon the approval of both Galliford Try and

Bovis Homes shareholders. Completion is expected to occur on 3

January 2020.

The Galliford Try Board considers the Transaction to be in the

best interests of Galliford Try and the Galliford Try shareholders

as a whole and unanimously recommends that all Galliford Try

shareholders vote in favour of all resolutions to be proposed at

the Galliford Try shareholder meetings, as the Directors intend to

do in respect of their aggregate shareholdings in Galliford Try

representing approximately 0.1 per cent. of the total voting rights

in Galliford Try as at the date of this announcement. Since Graham

Prothero will join the Bovis Homes Board on Completion, he has not

participated in the Board's decision to approve the Transaction or

to support the Board recommendation to Galliford Try shareholders

to vote in favour of the relevant resolutions.

The Galliford Try Board has received financial advice from N.M.

Rothschild & Sons Limited ("Rothschild & Co"), HSBC Bank

plc ("HSBC") and Peel Hunt LLP ("Peel Hunt") in relation to the

proposed sale of the Disposal Group (excluding for the avoidance of

doubt the associated restructuring). In providing their advice to

the Galliford Try Board, Rothschild & Co, HSBC and Peel Hunt

have relied upon the Galliford Try Board's commercial assessment of

the proposed sale of the Disposal Group.

2. Background to and reasons for the Transaction

On 4 April 2019, Bovis Homes approached Galliford Try with an

initial proposal to combine the Disposal Group with Bovis Homes.

Following further discussions, Bovis Homes made a revised proposal

which the Galliford Try Board rejected publicly on 28 May 2019 as

it did not believe that the proposal fully reflected the value of

the Disposal Group and the need to ensure that the remaining

Galliford Try Construction business ("Construction") had a viable

capital structure.

Following further engagement, the Galliford Try Board announced

on 10 September 2019 that it had agreed high-level terms with Bovis

Homes on the Transaction, which it believes to be in the best

interests of Galliford Try shareholders and other stakeholders as a

whole for the following principal reasons:

-- the Transaction allows Galliford Try to realise an

appropriate premium for the Disposal Group;

-- with a complementary geographical footprint and strategic

land bank, the Transaction will create one of the UK's leading

housebuilding and partnerships businesses from which Galliford Try

shareholders will benefit through a 29.3 per cent. holding in the

enlarged Bovis Homes group;

-- Bovis Homes expects to generate significant recurring

run-rate pre-tax operational and procurement cost synergies of at

least GBP35 million per annum, which will provide additional value

creation for Galliford Try shareholders through their holding in

the enlarged Bovis Homes group; and

-- the Cash Consideration and the assumption by Bovis Homes of

Galliford Try's obligations under the GBP100 million PP Bond means

that Galliford Try will be a well-capitalised, UK

construction-focused group, strongly positioned for future growth

following the recent restructuring and focus on its core

operations. The Continuing Group will be supported by a robust

order book and GBP41.6 million of PPP assets (Directors' valuation

as at 30 June 2019).

3. Information on the Continuing Group - a well-capitalised, UK construction-focused business

Following Completion, Galliford Try will be a well-capitalised,

UK construction-focused group delivering building and

infrastructure projects for clients in the public, private and

regulated sectors across the UK focusing on building,

transportation, water and environmental under the Galliford Try and

Morrison Construction brands. The Construction business is

organised into the Building, Infrastructure and PPP Investment

divisions. During the financial year ended 30 June 2019, both the

Building and Infrastructure divisions were successful at winning

new work and were appointed to contracts and frameworks worth over

GBP580 million and GBP497 million, respectively.

In April 2019, the Company announced a strategic review of the

Construction business that would reduce the size of the business,

focusing on its key strengths in markets and sectors with

sustainable prospects for profitability and growth. In response to

the conclusions of that strategic review, Construction has

increased its operational focus and simplified its structure. It is

now concentrating on markets and clients with long-term growth and

profitability potential, such as its regional building, highways

and water operations, where it has a track record of success,

supported by a robust tendering process and contract discipline.

The review included an assessment of operational progress and

contract positions throughout the Construction business. As at 30

June 2019, the order book for the Construction business stood at

GBP2.9 billion. Of this, 79 per cent. is in the public sector, 16

per cent. is in the private sector and 5 per cent. is in regulated

industries.

Following Completion, the Galliford Try Board expects Galliford

Try to be well positioned in markets with significant opportunity

and to deliver on clear and identified operational upside

potential. The Galliford Try Board believes the Continuing Group

will:

-- be focused on markets where it has a track record of success

with significant growth potential, underpinned by major long-term,

planned critical public sector, infrastructure and regulatory

spend, as demonstrated by:

o the 2016 National Infrastructure Delivery Plan which sets out

a five-year GBP100 billion investment programme; and

o continued cross-party political commitment to investing in the

UK's public services and infrastructure;

-- be focused on long-term client relationships, with frameworks

representing 79 per cent. of the current GBP2.9 billion order book

demonstrating the high visibility of future revenues, with 88 per

cent. of financial year 2020 revenues already secured;

-- have a highly disciplined approach to risk management in

contract bidding (having already ceased bidding on fixed-price

all-risk major infrastructure projects in 2016), contract delivery

and health & safety, which is embedded in the business from the

bottom up and fundamental to its culture;

-- have a highly experienced senior management team focused on optimising:

o the operational performance of the Construction business,

benefitting from its national scale with local delivery and its

highly skilled workforce; and

o the growth, margin and cash flow potential of the business -

through improved contract discipline the Continuing Group will

target an operating profit margin of over 2 per cent. in the medium

term;

-- have a strong balance sheet, with a significant net cash

position and no significant liabilities in relation to defined

benefit pension schemes, which will allow Galliford Try to:

o demonstrate the Continuing Group's financial capacity,

stability and security, providing a competitive advantage in a

sector where customers and suppliers are increasingly scrutinising

their partners' balance sheet positions;

o take full advantage of business growth opportunities through

the investment required in bid costs and innovation and technology

necessary to enhance the service offering in ways increasingly

demanded by customers; and

o provide flexibility to make selected in-fill acquisitions to

complement the Continuing Group's existing capabilities as

opportunities arise;

-- benefit fully from any future cash receipts from the

realisation of its portfolio of GBP41.6 million of PPP assets

(Directors' valuation as at 30 June 2019) and the settlement of

major claims, including the Aberdeen Western Peripheral Route

claim.

Capital allocation framework

Following Completion, Galliford Try's focus on construction will

remove the competition for capital which has existed under the

Galliford Try group's historical mixed business model. The

Galliford Try Board recognises the importance of capital discipline

and following Completion, recognising its construction focus,

Galliford Try will adopt the following capital allocation

framework:

-- Organic growth investments

The Galliford Try Board will prioritise investment in optimising

organic growth opportunities, where contract risk is appropriate to

returns and consistent with the operational expertise of the

business.

-- Regular returns to shareholders

The Board recognises the importance of regular semi-annual

dividends to Galliford Try shareholders in line with its stated

dividend policy, which is set out in more detail below.

-- Acquisitions

The Galliford Try Board believes Galliford Try has a

well-defined and disciplined approach to evaluating any potential

acquisitions. The Galliford Try Board may explore value enhancing

acquisition opportunities consistent with its strategic priorities,

appropriate to its disciplined risk framework and which complement

its existing capabilities.

-- Return of capital

In accordance with its capital allocation priorities, the

Galliford Try Board believes it is appropriate to maintain a strong

and flexible balance sheet, typically maintaining a positive

average group net cash position. Whilst the Galliford Try Board

will necessarily take a conservative approach to balance sheet

strength, where the Board believes it has capital in excess of the

Group's medium-term requirements, it will consider returning such

excess capital to Galliford Try shareholders.

4. Galliford Try dividends

Following Completion, Galliford Try will target a dividend cover

of around three times underlying earnings, provided that such

dividend is at least covered by free cash flow generated in the

period, given the importance to Galliford Try of maintaining a

strong capital base going forward. The first dividend paid under

this policy will be declared with the interim results for Galliford

Try for the half year ending 31 December 2019, with the dividend

based on underlying earnings excluding the contribution of the

Housing Businesses in the period.

The Consideration Shares received by Galliford Try shareholders

will rank pari passu in all respects with existing Bovis Homes

shares, save that they will not be entitled to receive the Bovis

Homes second interim dividend, which is expected to be declared in

lieu of the Bovis Homes 2019 final dividend for the year ending 31

December 2019.

Galliford Try shareholders on the register at 8 November 2019

remain entitled to receive the final dividend of 35.0 pence per

share for the year ended 30 June 2019, as announced by Galliford

Try on 11 September 2019.

5. Galliford Try Board

Graham Prothero, Chief Executive, intends to step down from

Galliford Try on Completion and will become Chief Operating Officer

of Bovis Homes. With effect from Completion, Bill Hocking,

currently Chief Executive of Construction, will be appointed Chief

Executive of the Continuing Group. Bill Hocking has been Chief

Executive of Construction since 1 August 2016. It is expected that

Bill Hocking will enter into a new service agreement, the terms of

which will reflect his appointment as Chief Executive of the

Continuing Group.

6. Galliford Try's current trading, trends, financial position and future prospects

On 11 September 2019, the Company announced its annual results

for the year ended 30 June 2019. The results statement included the

following summary of the significant trends in the financial

performance of the Galliford Try group for this period:

"We continue to make great progress in Linden Homes, focusing on

the benefits of standardising our range and rationalising process.

We are building homes more cost effectively while delivering

well-designed, high quality units which meet our customers' needs,

as reflected in our improving satisfaction scores. We continue to

head towards our target of 80% of completions being Linden

Collection.

Partnerships & Regeneration has continued its excellent

performance with both revenue growth and margin expansion, as we

increase our delivery of affordable new homes. The acquisition of

Strategic Team Group in Yorkshire accelerates our strategy of

targeting growth in key regions around the country. We continue to

see strong demand across the regions, and we are well placed to

respond to this, working alongside Housing Associations, local

authorities and other partners.

Construction's result for the year has been impacted by

challenges with both legacy and some current projects and by the

restructure, which is now complete. The business continues to see

good demand in its Building and Infrastructure divisions and is

focusing on disciplined growth across its core sectors of building,

water and highways, which we believe will deliver improved

margins."

Since 11 September 2019 there has continued to be political and

macroeconomic uncertainty affecting the markets in which Galliford

Try's businesses operate, particularly Linden Homes and

Construction. The Galliford Try Board remains confident in

achieving the group's full year expectations, but anticipates that

the result will be more weighted towards the second half year than

in previous years. Galliford Try is continuing its negotiations

with Transport Scotland in relation to the Aberdeen Western

Peripheral Route claim, and separately its GBP54 million claim for

three contracts with a single client remains ongoing.

7. Information on the Disposal Group

Linden Homes

Linden Homes develops high-quality private and affordable

housing in prime locations with a commitment to providing excellent

customer service, primarily for first-time buyers and families. It

has 10 divisions with a strong presence in the South and East of

England and a growing presence in other regions of the UK. Linden

Homes acquires prime sites with good transport links and local

amenities, where it can create communities that people aspire to

live in.

For the financial year ended 30 June 2019, Linden Homes

completed 3,229 units, of which 2,227 were private housing and

1,002 were affordable housing, with an average selling price of

GBP284,000. At 9 September 2019, Linden Homes had a land bank of

12,600 plots representing around 3.5 years' supply, with an average

gross margin of 24.4 per cent., and a strategic land portfolio

comprising 2,850 acres, sufficient to generate 13,240 plots.

As at 30 June 2019, the gross assets of Linden Homes were

GBP1,244.4 million. Linden Homes' operating profit (including share

of joint ventures profit before interest and tax, but excluding

amortisation) for the year ended 30 June 2019 was GBP160.5

million.

Partnerships & Regeneration

Partnerships & Regeneration is Galliford Try's specialist

affordable housing and regeneration business. It delivers

mixed--tenure solutions working with housing associations, local

authority and private sector partners, combining contracting,

land-led contracting and mixed-tenure development with a proven

track record of delivery and quality. During the financial year

ended 30 June 2019, Partnerships & Regeneration completed 1,178

units at an average selling price of GBP217,000. Notable current

projects include partnerships with:

-- Homes England to deliver 885 homes across the UK under the Delivery Partner Panel;

-- Enfield Council to build the first 725 homes at the GBP6.0

billion Meridian Water development in the Lea Valley; and

-- Ealing Council to create a new mixed-use scheme, including 470 homes.

As at 30 June 2019, the gross assets of Partnerships &

Regeneration were GBP412.5 million. Partnerships &

Regeneration's operating profit (including share of joint ventures

profit before interest and tax, but excluding amortisation) for the

year ended 30 June 2019 was GBP34.8 million.

Key Individuals

Andrew Hammond, Chief Executive of Linden Homes, is a key

individual of Linden Homes. Stephen Teagle, Chief Executive of

Partnerships & Regeneration, is a key individual of

Partnerships & Regeneration. Each of Andrew Hammond and Stephen

Teagle will be joining Bovis Homes on Completion.

8. Summary of the principal terms of the Transaction

The Transaction will be undertaken pursuant to the terms of a

sale and purchase agreement entered into by Galliford Try and Bovis

Homes on 7 November 2019 and related agreements. In order to

implement the Transaction, it will be necessary for the Galliford

Try group to carry out a restructuring, including a scheme of

arrangement made under Part 26 of the Companies Act (the "Scheme")

in order to enable Galliford Try shareholders to receive the

benefit of the Transaction in a tax efficient manner whilst

simultaneously ensuring that Galliford Try receives the relevant

cash proceeds to support the Continuing Group after Completion. The

material steps of the restructuring are summarised below.

Restructuring

A new Jersey registered company ("New Topco") will be

incorporated, which will hold the entire issued share capital of

Galliford Try. The insertion of New Topco will be effected by way

of the Scheme. Under the terms of the Scheme, all existing

Galliford Try shares will be cancelled and Galliford Try

shareholders will receive one New Topco A share for every Galliford

Try share that they hold.

Upon the Scheme becoming effective, Galliford Try will transfer

the entire issued share capital of Galliford Try Homes Limited

("Homes Limited") to New Topco such that it becomes a subsidiary of

New Topco. Galliford Try will retain a special share in Homes

Limited in order to facilitate the payment of the post-Completion

adjustment described below.

New Topco will undertake a bonus issue of shares to Galliford

Try shareholders such that each Galliford Try shareholder will

receive one New Topco B share for each New Topco A share that they

hold. The New Topco B shares are to be issued to facilitate the

demerger of the Continuing Group, as described in the paragraph

immediately below. The New Topco A shares will carry an entitlement

to the returns in New Topco attributable to Linden Homes. The New

Topco B shares will carry an entitlement to the returns

attributable to the Continuing Group and Galliford Try Partnerships

Limited ("Partnerships Limited").

New Topco will then undertake a reduction of capital pursuant to

which each of the New Topco B shares will be cancelled. The

reduction of capital will be satisfied by the transfer of the

entire issued share capital of Galliford Try to Galliford Try

Holdings plc ("New Galliford Try"). New Galliford Try is a company

which has been incorporated for the purposes of holding the

Continuing Group after Completion and which will, following

Completion, be owned entirely by Galliford Try shareholders. In

exchange for the shares in Galliford Try, New Galliford Try will

issue New Galliford Try shares to Galliford Try shareholders on the

basis of one New Galliford Try share for every New Topco B share

held by that Galliford Try shareholder. Application will be made

for the entire issued share capital of New Galliford Try to be

admitted to listing on the premium segment of the Official List and

to the London Stock Exchange's main market for listed securities

with effect from 8.00 a.m. on 3 January 2020.

Sale of the Disposal Group

Bovis Homes will acquire all of the shares in New Topco (being

the New Topco A shares following cancellation of the New Topco B

shares) from Galliford Try shareholders in exchange for the issue

of the Consideration Shares, pursuant to the mandatory transfer

provisions in the New Topco articles of association. Galliford Try

shareholders will receive their pro rata proportion of

Consideration Shares based on their holding of New Topco A shares

(which will be equal to their pro rata holding of Galliford Try

shares immediately before the Scheme becomes effective). Bovis

Homes will then acquire the entire issued share capital of

Partnerships Limited in consideration for the payment of the Cash

Consideration to Galliford Try and the assumption by Bovis Homes of

Galliford Try's obligations under the GBP100 million PP Bond.

The sale and purchase agreement contains a customary

post-Completion adjustment mechanism that is based on the level of

Tangible Gross Asset Value ("TGAV") of Homes Limited and

Partnerships Limited delivered as part of the Transaction on the

date of Completion. The price payable by Bovis Homes for the

special share in Homes Limited will be determined by reference to

the TGAV of Homes Limited as determined pursuant to that

adjustment.

Completion of the Transaction is subject to the satisfaction or

waiver (where capable of waiver) of certain conditions under the

sale and purchase agreement. Galliford Try and Bovis Homes also

have certain termination rights. Further details are set out in the

circular which is expected to be sent to Galliford Try shareholders

on 8 November 2019.

Transfer of the Group's pension schemes

At Completion, Bovis Homes will also assume Galliford Try's

rights and obligations under two of Galliford Try's pension

schemes, being the Galliford Try Final Salary Pension Scheme and

the Galliford Try (Holdings) Limited Pension & Assurance

Scheme. The schemes have combined membership of approximately 2,059

individuals and have combined assets of approximately GBP244.8

million. The remaining pension scheme, being the Galliford Try

Special Scheme, will remain with Galliford Try. The Galliford Try

Special Scheme currently has only five members and is in the

process of being wound up.

Timing

Subject to the satisfaction or waiver (where capable of waiver)

of all applicable conditions under the sale and purchase agreement,

each of the steps of the restructuring (including the Scheme) is

expected to be implemented and to become effective after the close

of trading on the London Stock Exchange on 2 January 2020.

Completion of the Transaction pursuant to the sale and purchase

agreement and admission of the New Galliford Try shares and the

Consideration Shares, respectively, is expected to occur not later

than 8.00 a.m. on 3 January 2020.

New Galliford Try shares

New Galliford Try will publish a prospectus in relation to the

admission of the New Galliford Try shares on or around 25 November

2019. Application will be made to the FCA for the New Galliford Try

shares to be admitted to the premium listing segment of the

Official List, and to the London Stock Exchange's main market for

listed securities. It is currently expected that admission of the

New Galliford Try shares will become effective at 8.00 a.m. on 3

January 2020.

Consideration Shares

Bovis Homes will publish a prospectus in relation to the

admission of the Consideration Shares on 7 November 2019 and the

Galliford Try Board has been informed that application will be made

to the FCA for the Consideration Shares to be admitted to the

premium listing segment of the Official List, and to the London

Stock Exchange's main market for listed securities. It is currently

expected that admission of the Consideration Shares will become

effective at 8.00 a.m. on 3 January 2020.

9. Use of proceeds and financial effects of the Transaction on the Continuing Group

The cash proceeds arising from the Transaction are expected to

be approximately GBP300 million, adjusted based on the TGAV of the

Disposal Group at Completion with up to GBP25 million of this

adjustment amount deferred to April 2020. There will also be an

assumption by Bovis Homes of Galliford Try's obligations under the

GBP100 million PP Bond. The combination of the net cash proceeds

and the assumption of obligations by Bovis Homes under the PP Bond

will result in the Continuing Group having a well-capitalised

balance sheet by reducing indebtedness and providing a net cash

position upon Completion. The Galliford Try Directors intend that

the net cash proceeds of the Transaction will be used to prepay and

cancel the outstanding amount under the Galliford Try group's main

syndicated bank facility as well as to finance the ongoing working

capital requirements of the Continuing Group.

Financial effects of the Transaction on the Continuing Group

In the financial year ended 30 June 2019, the Disposal Group

contributed revenue of GBP1.44 billion, approximately half of

Galliford Try's total revenue. Construction contributed revenue of

approximately GBP1.42 billion to Galliford Try.

In the financial year ended 30 June 2019, Galliford Try

generated pre-exceptional operating profits (including share of

joint ventures' profit) of approximately GBP177 million. The

Disposal Group contributed pre-exceptional operating profits

(including share of joint ventures' profit) of approximately GBP195

million. Construction contributed a pre--exceptional operating loss

(including share of joint ventures' profit) of approximately GBP18

million, reflecting GBP33 million of write downs taken on a number

of contracts following the strategic review of the Construction

business undertaken in the year.

10. Impact of the Transaction on shareholders

Upon Completion, Galliford Try shareholders will hold the entire

issued share capital of New Galliford Try in the same proportions

that they hold their Galliford Try ordinary shares as at the record

time for the Scheme. In addition, Galliford Try shareholders will

also receive the Consideration Shares on a pro rata basis by

reference to their holdings of Galliford Try ordinary shares as at

the record time for the Scheme.

11. Galliford Try shareholder approvals

The Transaction is conditional, among other things, upon the

approval of Galliford Try shareholders. Notices convening those

shareholder meetings to be held at the offices of CMS Cameron

McKenna Nabarro Olswang LLP at Cannon Place, 78 Cannon Street,

London EC4N 6AF are expected to be sent to Galliford Try

shareholders on 8 November 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISFSASDWFUSEIF

(END) Dow Jones Newswires

November 07, 2019 02:01 ET (07:01 GMT)

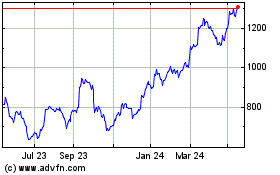

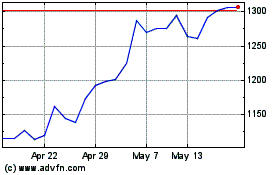

Vistry (LSE:VTY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vistry (LSE:VTY)

Historical Stock Chart

From Feb 2024 to Feb 2025