Alpha Launches a New Fund Finance Report Revealing the Truth About NAV Facilities and ‘Leverage on Leverage’ Criticism

February 19 2025 - 3:00AM

Business Wire

Alpha Group International plc (LON:ALPH) today announced the

launch of its new fund finance report. Harnessing data from its

Alpha Match platform, this is the only report of its kind to

aggregate heads of terms data to explore the risks of NAV

financing. The findings dispel common assumptions and help to

alleviate concerns around GPs taking on too much debt, as well as

how cautious lenders are when providing these facilities.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250219433701/en/

Alpha Match's new lender book report uses

heads of terms data from loans Alpha Match has placed and

structured over the past 12 months to shine a light on how risky

typical fund finance NAV facilities are. (Graphic: Business

Wire)

The total fund finance market is estimated to be worth $1.2trn,

according to a recent Ares whitepaper. Of that total, NAV lending

represents around $225bn (18.75%), with the bulk of that amount

attributable to secondaries NAV ($175bn), and just $50bn for single

fund NAV facilities – the focus of this report. Furthermore, Ares

estimates that NAV loan usage remains limited at less than 3%.

Despite NAV facilities representing a relatively small

proportion of the fund finance market, the use of these loans has

come under fire in recent years, with the main criticism focused on

what the Bank of England labels as ‘leverage on leverage’. This

resulted in the PRA demanding banks review and assess their current

practices regarding their private markets lending activities. The

Institutional Limited Partners Association (ILPA) also published

NAV guidance to its members, with a particular focus on

communication between LPs and GPs, as well as documentation.

Crucially, all existing reports on the use of NAV facilities

have been based on survey and qualitative research. NAV facilities

have never been tested at scale. Against this backdrop, we have

developed a new report, harnessing data from Alpha Match, to

explore the effects of using a NAV facility during a period of

stress. By aggregating heads of terms data, we are able to explore

the risks of bringing in this particular kind of financing. The

results might surprise you.

The report covers:

- A breakdown of how LTVs vary across facility size

- LTV by the number of assets

- LTV by lender type

- LTV sensitivity testing

Access report

By responding to the leverage on leverage criticism, this report

benefits both fund managers (as borrowers) and their investors in

better understanding the impact of NAV facilities on a fund. It

provides an independent, data-led overview of the current fund

finance market for both GPs and LPs to better understand these

facilities and help with deciding whether or not a NAV loan is

appropriate.

Alpha’s Ben James, Head of Lender Engagement says, “Lenders are

looking at myriad factors when setting the LTV, including the

fund’s portfolio composition, diversification / concentration,

performance, existing leverage levels, realisation certainty and

timeframes, to name but a few. Each lender and individual financing

circumstance will have its own considerations and sensitivities,

meaning lenders structure a financing accordingly to mitigate these

idiosyncratic risks. It is crucial to note that no single financing

situation is the same, both in terms of the lender’s credit

underwrite analysis and the borrower’s purposes for the

financing.”

To find out more about Alpha Match, visit

www.alphagroup.com/match or email match@alphagroup.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219433701/en/

match@alphagroup.com

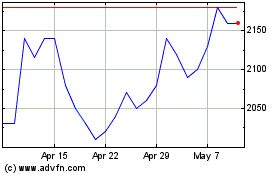

Alpha (LSE:ALPH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Alpha (LSE:ALPH)

Historical Stock Chart

From Feb 2024 to Feb 2025