TSX-V: CWV: Crown Point Energy Inc. (“Crown

Point”, the

“Company” or

“we”) today announced its unaudited financial and

operating results for the three months and year ended December 31,

2024.

All dollar figures are expressed in

United States dollars (“USD”) unless otherwise stated.

In the following discussion, the three months

and the year ended December 31, 2024 may be referred to as “Q4

2024” and “2024”, respectively. The comparative three months and

year ended December 31, 2023 may be referred to as “Q4 2023” and

“2023”, respectively.

Q4 2024 SUMMARY

During Q4 2024, the Company:

- Reported net cash

used in operating activities of $1.5 million and funds flow

provided by operating activities of $1.0 million;

- Earned $19.6

million of oil and natural gas sales revenue on total average daily

sales volumes of 3,335 BOE per day. The increase in comparison to

previous quarters is due to the oil sales volumes from the Santa

Cruz Concessions (as defined below) since the closing date on

October 31, 2024;

- Received an average

of $2.52 per mcf for natural gas and $71.67 per bbl for oil;

- Reported an

operating netback of $3.96 per BOE1;

- Obtained $13.9

million of working capital and overdraft loans, issued $22 million

principal amount of unsecured fixed-rate Series VI Notes payable

and repaid $5.5 million of notes payable and $1.2 million of

working capital and overdraft loans;

- Reported loss

before taxes of $3 million and a net loss of $3.1 million;

- Reported a working

capital deficit2 of $28.8 million;

- Completed the

acquisition of a 100% operating interest in the Piedra Clavada and

Koluel Kaike hydrocarbon exploitation concessions (the “Santa Cruz

Concessions”) from Pan American Energy S.L., Sucursal Argentina for

$25.8 million in cash payments plus in-kind contingent

consideration payable over a 14-year period; and

- Completed the

acquisition of a 13.5926% non-operating participating interest in

the TDF Concessions (as defined below) from an arm’s length party

for $0.8 million in cash payments.

SUBSEQUENT EVENTS

Subsequent to December 31, 2024 the Company:

- Obtained working

capital and overdraft loans for a total amount of $6.06 million,

repaid $4.14 million on working capital loans and renewed a loan

for $1 million.

- Repaid $5.5 million

of principal installments on the Series IV and Series III

Notes.

OPERATIONAL UPDATE

Santa Cruz Concessions

During Q4 2024, Piedra Clavada Concession oil

production averaged 2,043 bbls of oil per day and Koluel Kaike

concession oil production averaged 1,187 bbls of oil per day.

_________________________________

1 Non-IFRS financial ratio. See “Non-IFRS and

Other Financial Measures”.2 Capital management measure. See

“Non-IFRS and Other Financial Measures”.

Tierra del Fuego Concessions (“TDF” or

“TDF Concessions”)

During Q4 2024, San Martin oil production

averaged 464 (net 224) bbls of oil per day; Las Violetas concession

natural gas production averaged 8,290 (net 4,007) mcf per day and

associated oil production averaged 218 (net 76) bbls of oil per

day.

Mendoza Concessions

During Q4 2024, the UTE carried out three

workovers on oil wells and one workover in an injector well in the

CH Concession. Oil production for Q4 2024 averaged 884 (net 442)

bbls of oil per day from the CH Concession and 125 (net 62) bbls of

oil per day from the PPCO Concession.

OUTLOOK

The Company’s capital spending for fiscal 2025

is budgeted at approximately $28.2 million, of which $25.5 million

is allocated to the Santa Cruz Concessions for well workovers,

facilities improvements and a drilling campaign comprised of 7

wells; $0.7 million is for improvements to facilities in the TDF

Concessions, $1.2 million is for well workovers, facilities

improvements and optimization in the Mendoza Concessions, and $0.8

million is for testing of the gas bearing sandstone layers of the

Neuquen Group at CLL.

SUMMARY OF UNAUDITED FINANCIAL

INFORMATION

|

(expressed in $, except shares outstanding) |

December

312024(unaudited) |

December 312023 |

|

Current assets |

28,129,766 |

|

7,636,408 |

|

|

Current liabilities |

(56,945,822 |

) |

(19,422,342 |

) |

|

Working capital (1) |

(28,816,056 |

) |

(11,785,934 |

) |

| Exploration and evaluation

assets |

14,052,021 |

|

14,103,353 |

|

| Property and equipment |

175,506,640 |

|

45,834,731 |

|

| Total assets |

218,188,749 |

|

67,785,665 |

|

| Non-current financial

liabilities (1) |

31,945,591 |

|

18,317,856 |

|

| Share capital |

56,456,328 |

|

56,456,328 |

|

| Total

common shares outstanding |

72,903,038 |

|

72,903,038 |

|

|

(expressed in $, except shares outstanding) |

Three months ended |

Year ended |

|

|

December 31 |

December 31 |

|

|

2024 |

|

2023 |

|

2024(unaudited) |

2023 |

|

|

Oil and natural gas sales revenue |

19,580,949 |

|

5,530,896 |

|

36,827,158 |

|

26,766,228 |

|

| (Reversal) Impairment of

property and equipment |

- |

|

(3,050,000 |

) |

- |

|

(3,050,000 |

) |

| Loss before taxes |

(3,047,172 |

) |

(2,379,953 |

) |

(13,013,738 |

) |

(10,130,991 |

) |

| Net loss |

(3,121,431 |

) |

(2,096,083 |

) |

(9,145,821 |

) |

(8,127,632 |

) |

| Net loss per share (2) |

(0.04 |

) |

(0.03 |

) |

(0.13 |

) |

(0.11 |

) |

| Net cash (used) provided by

operating activities |

(1,529,817 |

) |

1,339,967 |

|

(4,391,237 |

) |

3,793,538 |

|

| Net cash per share – operating

activities (1)(2) |

(0.02 |

) |

0.02 |

|

(0.06 |

) |

0.05 |

|

| Funds flow (used) provided by

operating activities |

991,927 |

|

2,109,498 |

|

(1,093,965 |

) |

1,608,310 |

|

| Funds flow per share –

operating activities (1)(2) |

0.01 |

|

0.03 |

|

(0.02 |

) |

0.02 |

|

| Weighted average number of

shares – basic and diluted |

72,903,038 |

|

72,903,038 |

|

72,903,038 |

|

72,903,038 |

|

(1) We adhere to International Financial

Reporting Standards (“IFRS”) however the Company

also employs certain non-IFRS measures to analyze financial

performance, financial position, and cash flow. “Working capital”

is a capital management measure. “Non-current financial

liabilities” is a supplemental financial measure. “Net cash per

share – operating activities” is a supplemental financial measure.

“Funds flow per share – operating activities” is a supplemental

financial measure. See “Non-IFRS and Other Financial

Measures".(2) All per share figures are the same for the

basic and diluted weighted average number of shares outstanding in

the periods. The effect of options is anti-dilutive in loss

periods. Per share amounts may not add due to rounding.

Sales Volumes

|

|

Three months ended |

Year ended |

|

|

December 31 |

December 31 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Total sales volumes (BOE) |

306,807 |

117,252 |

676,990 |

525,115 |

|

Crude oil bbls per day |

2,868 |

840 |

1,296 |

915 |

|

NGL bbls per day |

17 |

25 |

18 |

19 |

|

Natural gas mcf per day |

2,698 |

2,458 |

3,217 |

3,023 |

|

Total BOE per day |

3,335 |

1,275 |

1,850 |

1,438 |

Operating Netback (1)

|

|

Three months ended |

Year ended |

|

|

December 31 |

December 31 |

|

|

2024 |

2023 |

2024(unaudited) |

2023 |

|

|

|

Per BOE |

|

|

Per BOE |

|

|

Per BOE |

|

|

Per BOE |

|

|

Oil and natural gas sales revenue ($) |

19,580,949 |

|

63.82 |

|

5,530,896 |

|

47.17 |

|

36,827,158 |

|

54.40 |

|

26,766,228 |

|

50.97 |

|

|

Export tax ($) |

(112,047 |

) |

(0.37 |

) |

(125,304 |

) |

(1.07 |

) |

(421,356 |

) |

(0.62 |

) |

(503,268 |

) |

(0.96 |

) |

|

Royalties and turnover tax ($) |

(3,430,729 |

) |

(11.18 |

) |

(961,852 |

) |

(8.20 |

) |

(6,475,746 |

) |

(9.57 |

) |

(4,519,702 |

) |

(8.61 |

) |

|

Operating costs ($) |

(14,822,678 |

) |

(48.31 |

) |

(3,356,776 |

) |

(28.63 |

) |

(28,941,451 |

) |

(42.75 |

) |

(18,405,512 |

) |

(35.05 |

) |

|

Operating netback (1) ($) |

1,215,495 |

|

3.96 |

|

1,086,964 |

|

9.27 |

|

988,605 |

|

1.46 |

|

3,337,746 |

|

6.35 |

|

|

|

|

|

|

|

|

|

|

|

(1) “Operating netback” is a non-IFRS measure. “Operating

netback per BOE” is a non-IFRS ratio. See “Non-IFRS and Other

Financial Measures”.

The Company’s audited consolidated comparative

financial statements for the year ended December 31, 2024 and

related management’s discussion and analysis

(“MD&A”) will be filed with Canadian

securities regulatory authorities in due course and will be made

available under the Company’s profile at www.sedarplus.ca and on

the Company’s website at www.crownpointenergy.com.

About Crown PointCrown Point Energy Inc. is an

international oil and gas exploration and development company

headquartered in Buenos Aires, Argentina, incorporated in Canada,

trading on the TSX Venture Exchange and operating in Argentina.

Crown Point’s exploration and development activities are focused in

four producing basins in Argentina, the Golfo San Jorge basin in

the Province of Santa Cruz, the Austral basin in the province of

Tierra del Fuego, and the Neuquén and Cuyo (or Cuyana) basins in

the province of Mendoza. Crown Point has a strategy that focuses on

establishing a portfolio of producing properties, plus production

enhancement and exploration opportunities to provide a basis for

future growth.

AdvisoryPreliminary Financial

Information: The Company's expectations for our financial results

for the three months and year ended December 31, 2024 contained

herein are based on, among other things, our anticipated financial

results for the year ending December 31, 2024. The Company's

anticipated financial results are unaudited and preliminary

estimates that: (i) represent the most current information

available to management as of the date hereof; (ii) are subject to

completion of audit and/or review procedures that could result in

significant changes to the estimated amounts; and (iii) do not

present all information necessary for an understanding of the

Company's financial condition as of, and the Company's results of

operations for, such periods. The anticipated financial results are

subject to the same limitations and risks as discussed under

“Forward-Looking Information” below. Accordingly, the Company's

anticipated financial results for such periods may change upon the

completion and approval of the financial statements for such

periods and the changes could be material.

Non-IFRS and Other Financial Measures:

Throughout this press release and in other materials disclosed by

the Company, we employ certain measures to analyze financial

performance, financial position, and cash flow. These non-IFRS and

other financial measures do not have any standardized meaning

prescribed by IFRS and therefore may not be comparable to similar

measures provided by other issuers. The non-IFRS and other

financial measures should not be considered to be more meaningful

than financial measures which are determined in accordance with

IFRS, such as net income (loss), oil and natural gas sales revenue

and net cash (used) provided by operating activities as indicators

of our performance.

“Funds flow per share – operating activities” is

a supplemental financial measure. Funds flow per share – operating

activities is comprised of funds flow provided (used) by operating

activities divided by the basic and diluted weighted average number

of common shares outstanding for the period. See “Summary of

Financial Information”.

“Net cash per share – operating activities” is a

supplemental financial measure. Net cash per share – operating

activities is comprised of net cash provided (used) by operating

activities divided by the basic and diluted weighted average number

of common shares outstanding for the period. See “Summary of

Financial Information”.

“Non-current financial liabilities” is a

supplemental financial measure. Non-current financial liabilities

is comprised of the non-current portions of trade and other

payables, notes payable and lease liabilities as presented in the

Company’s consolidated statements of financial position. See

“Summary of Financial Information”.

“Operating Netback” is a non-IFRS measure.

Operating netback is comprised of oil and natural gas sales revenue

less export tax, royalties and turnover tax and operating costs.

Management believes this measure is a useful supplemental measure

of the Company’s profitability relative to commodity prices. See

“Operating Netback” for a reconciliation of operating netback to

oil and natural gas sales revenue, being our nearest measure

prescribed by IFRS.

“Operating netback per BOE” is a non-IFRS ratio.

Operating netback per BOE is comprised of operating netback divided

by total BOE sales volumes in the period. Management believes this

measure is a useful supplemental measure of the Company’s

profitability relative to commodity prices. In addition, management

believes that operating netback per BOE is a key industry

performance measure of operational efficiency and provide investors

with information that is also commonly presented by other crude oil

and natural gas producers. Operating netback is a non-IFRS measure.

See "Operating Netback" for the calculation of operating netback

per BOE.

“Working capital” is a capital management

measure. Working capital is comprised of current assets less

current liabilities. Management believes that working capital is a

useful measure to assess the Company's capital position and its

ability to execute its existing exploration commitments and its

share of any development programs. See “Summary of Financial

Information” for a reconciliation of working capital to current

assets and current liabilities, being our nearest measures

prescribed by IFRS.

Abbreviations and BOE Presentation: “bbl” means

barrel; “bbls” means barrels; “BOE” means barrels of oil

equivalent; “mcf” means thousand cubic feet; “mmcf” means million

cubic feet, “NGL” means natural gas liquids; “UTE” means Union

Transitoria de Empresas, which is a registered joint venture

contract established under the laws of Argentina; “WI” means

working interest. All BOE conversions in this press release are

derived by converting natural gas to oil in the ratio of six mcf of

gas to one bbl of oil. BOE may be misleading, particularly if used

in isolation. A BOE conversion ratio of six mcf of gas to one bbl

of oil (6 mcf: 1 bbl) is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. Given that the value

ratio based on the price of crude oil as compared to natural gas in

Argentina from time to time may be different from the energy

equivalency conversion ratio of 6:1, utilizing a conversion on a

6:1 basis may be misleading as an indication of value.

Forward-looking Information: This document

contains forward-looking information. This information relates to

future events and the Company’s future performance. All information

and statements contained herein that are not clearly historical in

nature constitute forward-looking information. Such information

represents the Company’s internal projections, estimates,

expectations, beliefs, plans, objectives, assumptions, intentions

or statements about future events or performance. This information

involves known or unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking information.

In addition, this document may contain forward-looking

information attributed to third party industry sources. Crown Point

believes that the expectations reflected in this forward-looking

information are reasonable; however, undue reliance should not be

placed on this forward-looking information, as there can be no

assurance that the plans, intentions or expectations upon which

they are based will occur. This press release contains

forward-looking information concerning, among other things, the

following: under “Q4 2024 Summary”, the Company’s expectations

regarding the Company’s go forward obligations in connection with

the Santa Cruz Concessions; under “Outlook”, our estimated capital

expenditure budget for fiscal 2025, and the capital expenditures

that we intend to make in, amongst other things, our concessions

during such period; and under “About Crown Point”, all elements of

the Company’s business strategy and focus. The reader is cautioned

that such information, although considered reasonable by the

Company, may prove to be incorrect. Actual results achieved during

the forecast period will vary from the information provided in this

document as a result of numerous known and unknown risks and

uncertainties and other factors. A number of risks and other

factors could cause actual results to differ materially from those

expressed in the forward-looking information contained in this

document including, but not limited to, the following: that the

Company is unable to truck oil to the Enap refinery and/or the Rio

Cullen marine terminal and/or that the cost to do so rises and/or

becomes uneconomic; that the price received by the Company for its

oil is at a substantial discount to the Brent oil price; that the

Company is not able to meet its obligations as they become due and

continue as a going concern; risks associated with the insolvency

and/or bankruptcy of our joint venture partners and/or the

operators of the concessions in which we have an interest,

including the risk that any such insolvency and/or bankruptcy has

an adverse effect on one of our UTEs, one of our concessions and/or

the Company; and the risks and other factors described under

“Business Risks and Uncertainties” in our MD&A and under “Risk

Factors” in the Company’s most recently filed Annual Information

Form, which is available for viewing on SEDAR+ at www.sedarplus.ca.

With respect to forward-looking information contained in this

document, the Company has made assumptions regarding, among other

things: the ability and willingness of OPEC+ nations and other

major producers of crude oil to balance crude oil production levels

and thereby sustain higher global crude oil prices; that our joint

venture partners and the operators of our concessions that we do

not operate will honour their contractual commitments in a timely

fashion and will not become insolvent or bankrupt; the impact of

inflation rates in Argentina and the devaluation of the Argentine

peso against the USD on the Company; the impact of increasing

competition; the general stability of the economic and political

environment in which the Company operates, including operating

under a consistent regulatory and legal framework in Argentina;

future oil, natural gas and NGL prices (including the effects of

governmental incentive programs and government price controls

thereon); the timely receipt of any required regulatory approvals;

the ability of the Company to obtain qualified staff, equipment and

services in a timely and cost efficient manner; drilling results;

the costs of obtaining equipment and personnel to complete the

Company’s capital expenditure program; the ability to operate the

projects in which the Company has an interest in a safe, efficient

and effective manner; that the Company will not pay dividends for

the foreseeable future; the ability of the Company to obtain

financing on acceptable terms when and if needed and continue as a

going concern; the ability of the Company to service its debt

repayments when required; field production rates and decline rates;

the ability to replace and expand oil and natural gas reserves

through acquisition, development and exploration activities; the

timing and costs of pipeline, storage and facility construction and

expansion and the ability of the Company to secure adequate product

transportation; currency, exchange, inflation and interest rates;

the regulatory framework regarding royalties, taxes and

environmental matters in Argentina; and the ability of the Company

to successfully market its oil and natural gas products. Management

of Crown Point has included the above summary of assumptions and

risks related to forward-looking information included in this

document in order to provide investors with a more complete

perspective on the Company’s future operations. Readers are

cautioned that this information may not be appropriate for other

purposes. Readers are cautioned that the foregoing lists of factors

are not exhaustive. The forward-looking information contained in

this document are expressly qualified by this cautionary statement.

The forward-looking information contained herein is made as of the

date of this document and the Company disclaims any intent or

obligation to update publicly any such forward-looking information,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable Canadian securities

laws.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

For inquiries please contact:

Gabriel Obrador

President & CEO

Ph: (403) 232-1150

Crown Point Energy Inc.

gobrador@crownpointenergy.com

Marisa Tormakh

Vice-President, Finance & CFO

Ph: (403) 232-1150

Crown Point Energy Inc.

mtormakh@crownpointenergy.com

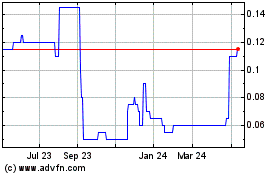

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Feb 2025 to Mar 2025

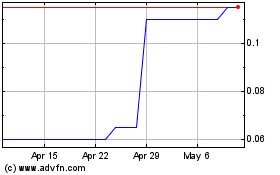

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Mar 2024 to Mar 2025