- Q1 2016 consolidated revenues grew

8x compared to Q1 2015 to €1.1 million

- Solid orders backlog increasing to

€2.4 million, with flagship projects in East Africa, Asia Pacific

and Italy

- New agreement in partnership with

Toshiba to provide 1MW storage system for a Hybrid Power Plant to a

mining site in Australia

- Strong credentials and unique

positioning: framework agreement with Enel and new HyESS

projects in progress leveraging a track record of 44.3MWh energy

storage in 5 continents and a leading technology now compliant with

the latest standards CEI 016

Regulatory News:

The Board of Directors of Electro Power Systems S.A. (Paris:EPS)

(“EPS” or the “Group”, listed on Euronext Paris

EPS:PA) technology pioneer of clean energy storage systems, chaired

by Massimo Prelz Oltramonti, has examined and approved today the

group results for the first quarter of 2016 (unaudited).

“We are very satisfied with the results posted for the first

quarter of 2016, which show the strategic role of the Elvi Energy

acquisition and the soundness of our two-step business strategy to

accelerate the growth, starting from micro grid storage systems to

hydrogen enabled systems. A major contribution to this performance

came from the expansion of our off-grid installations, such as

those in East Africa and Asia-Pacific, which boast abundant

renewable resources. Thanks to our strategy of geographical and

technological diversification and with financial discipline and

strong execution we accelerated our development and strengthened

the foundations for future growth”. – commented Carlalberto

Guglielminotti, Chief Executive Officer of the Group.

FINANCIAL HIGHLIGHTS

In the first quarter of 2016 consolidated revenues amounts to

1,050,253 euros, representing 8x the revenues of the Q1

2015. Growth came from the Group’s activities related to the

off-grid hybrid power plants in Asia-Pacific and East

Africa and from a grid support project in Sardinia within

the Terna network.

The current Group’s orders backlog1 increased

to 2.4 million euros. The conversion of the pipeline,

built with the business strategy effort carried out in 2015 and led

by Giuseppe Artizzu, Executive Director of the Group, has already

started, as proven by the agreement just signed for a 1MW storage

system for a Hybrid Power Plant in Australia in partnership with

Toshiba, whose construction will start in Q3 2016.

At the Group level, and compared to the previous year, the

current 2016 backlog has a deeper diversification in terms of

customer base and confirms the effectiveness of the business

strategy carried out and the effort made in 2015 to focus on the

energy sector, i.e. utilities, grid operators and commercial and

industrial users.

In terms of geography, after a 2015 mainly focused on Italy, the

current backlog and the pipeline have a global and far broader

reach than the year before, namely in 17 countries and in all

continents.

At the end of the first quarter of 2016, the Group had a Net

Financial Position at €5.4 million with Pro-forma Net-Cash2 at €7.6

million, as a result of the significant investments in R&D to

support the expansion strategy and the cash outlay for the MCM

Energy Lab acquisition.

EPS Group at the same time reduced net trade working capital

exposure in the first quarter of 2016 to €0.2 million from €1.0

million at the end of FY2015.

OPERATING HIGHLIGHTS

In the first quarter of 2016 major success was achieved in

the off-grid markets with flagship projects in East Africa and in

the Maldives, where the Group put the first pillar of its rollout

plan.

Leveraging a track record of 44.3MWh energy storage in 5

continents, the Group has achieved a unique positioning: its

leading technology, now compliant with the latest standards CEI 016

All. N-bis, adds a further competitive advantage.

In June 2016 the Group is expected to finalize the commissioning

of the Hybrid Power Plant in Tasmania and a 2MW Hybrid Power

Plant for a luxury resort in the Maldives.

The credibility established with fully-commercial hybrid energy

solutions already in operation in Sub-Saharan Africa and South Asia

makes EPS a concrete technology leader in emerging countries, with

a growing pipeline of projects across South America, Africa and

South-East Asia, where the Group positions as turnkey supplier for

utilities, final users and infrastructure investment funds.

* * *

Effective January 1st, 2015, the French Law n°2014-1662 dated

December 30th, 2014, transposing the European Directive 2013/50/EU,

has removed for French-listed companies the reporting obligation to

disclose quarterly financial results. Therefore, this press release

has been prepared on a voluntary basis in line with EPS’ policy to

provide the market and investors with regular information about the

Group’s financial and operating performances and business prospects

considering the disclosure policy followed by energy peers.

Results are presented for the first quarter of 2016 and for the

first quarter of 2015. Information on liquidity and capital

resources relates to end of the periods as of March 31, 2016, and

December 31, 2015.

Accounts set forth herein have been prepared in accordance with

the evaluation and recognition criteria set by the International

Financial Reporting Standards (IFRS) issued by the International

Accounting Standards Board (IASB) and adopted by the European

Commission according to the procedure set forth in Article 6 of the

European Regulation (CE) No. 1606/2002 of the European Parliament

and European Council of July 19, 2002. These criteria are unchanged

from the 2015 Annual Financial Report filed to the AMF on April 29,

2016, which investors are urged to read. The financial information

of Electro Power Systems SA for the first quarter 2016 consists of

this press release. All legally required disclosures, including the

FY2015 annual financial report is available on the Group website

(www.electropowersystems.com) under "Financial Information" and is

published by Electro Power Systems SA pursuant to the provisions of

Article L. 451-1-2 of the French Monetary and Financial Code and to

the article 222-1 and following of the General Regulation of the

French Financial Markets Authority (AMF).

*****

About Electro Power Systems

Electro Power Systems (EPS) is the pioneer of

technology-neutral, integrated hybrid energy storage solutions for

grid support in developed economies and off-grid power generation

in emerging countries. The Group’s mission is to unlock the energy

transition, by mastering the intermittency of renewable energy

sources. Through the seamless integration of the world best battery

technologies to provide flexibility, and the Group’s unique

hydrogen and oxygen storage platform suitable for longer autonomy

without resorting to diesel or gas-fueled generators, the group’s

technologies enable renewable energies to power 24/7 communities in

a completely cleaner and less expensive solution.

EPS is today listed on the French regulated market of

Euronext, and part of the CAC® Mid & Small and

CAC® All-Tradable indices: with headquarters in

Paris, R&D and manufacturing in Italy.

The Group has installed in aggregate 3MW of hydrogen systems,

8.7MW of Hybrid Power Plants, and 44.3MWh of energy storage

capacity, for a total power output of 21.1MW deployed in 21

countries worldwide, including Europe, USA, Australia, China, Asia

and Africa.

For more information www.electropowersystems.com

*****

Forward looking statements

This announcement includes statements that are, or may be deemed

to be, forward looking statements. These forward looking statements

can be identified by the use of forward looking terminology,

including the verbs or terms “anticipates”, “believes”,

“estimates”, “expects”, “intends”, “may”, “plans”, “build-up”,

“under discussion” or “potential customer”, “should” or “will”,

“projects”, “backlog” or “pipeline” or, in each case, their

negative or other variations or comparable terminology, or by

discussions of strategy, plans, objectives, goals, future events or

intentions. These forward looking statements include all matters

that are not historical facts. They appear throughout this

announcement and include, but are not limited to, statements

regarding the Group’s intentions, beliefs or current expectations

concerning, among other things, the Group’s results of business

development, operations, financial position, prospects, financing

strategies, expectations for product design and development,

regulatory applications and approvals, reimbursement arrangements,

costs of sales and market penetration.

By their nature, forward looking statements involve risk and

uncertainty because they relate to future events and circumstances.

Forward looking statements are not guarantees of future performance

and the actual results of the Group’s operations, and the

development of the markets and the industry in which the Groups

operates, may differ materially from those described in, or

suggested by, the forward looking statements contained in this

announcement. In addition, even if the Group’s results of

operations, financial position and growth, and the development of

the markets and the industry in which the Group operates, are

consistent with the forward looking statements contained in this

announcement, those results or developments may not be indicative

of results or developments in subsequent periods. A number of

factors could cause results and developments of the Group to differ

materially from those expressed or implied by the forward looking

statements including, without limitation, general economic and

business conditions, the global energy market conditions, industry

trends, competition, changes in law or regulation, changes in

taxation regimes, the availability and cost of capital, the time

required to commence and complete sell cycles, currency

fluctuations, changes in its business strategy, political and

economic uncertainty. The forward-looking statements herein speak

only at the date of this announcement.

1 Backlog means (i) invoices already issued in 2016 but not yet

recorded as “Revenues” in Q1, plus (ii) purchase orders received as

at the date hereof, plus (iii) revenues already contracted or

expected to be generated in 2016 based on current arrangements with

customers.

2 The bridge from the €5.4 million Net Financial Position as at

31 March 2016, to the €7.6 million Pro-forma Net Cash results from

(i) the addition of the €1.4 million capital increase reserved to

the former Elvi Energy shareholders and current management, which

will take place in 2016 and will be financed by the portion of the

proceeds of the Elvi Energy acquisition which has been put in

escrow for this purpose, and (ii) the addition of €0.82 millions of

VAT receivables that will be set-off during the first half of

2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160513005773/en/

For Electro Power Systems S.A.Media RelationsAlessia Di

DomenicoHead of Global Media Relations+39 02 45435516Mobile +39 337

1645567add@eps-mail.comorInvestor RelationsFrancesca

CoccoVice President Investor Relations+33 (0) 970 467 135 -Mobile

+39 347 7056719fc@eps-mail.comorPress & Media -

FranceCaroline Lesageclesage@actus.frAlexandra Prisa+33 1

53673679 /+ 33 1 53673690aprisa@actus.fr

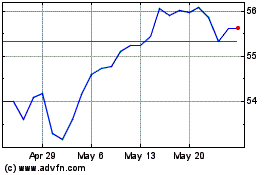

WisdomTree US LargeCap (AMEX:EPS)

Historical Stock Chart

From Feb 2025 to Mar 2025

WisdomTree US LargeCap (AMEX:EPS)

Historical Stock Chart

From Mar 2024 to Mar 2025