Many emerging markets have lost their momentum in 2013 and

have largely underperformed since the beginning of the year. In

such a scenario, investment in the frontier market has become one

of the most alluring options among investors seeking strong

returns.

What is a Frontier Market?

Over the past two years, the frontier markets, such as the

Middle East, parts of Southeast Asia, South America, and

sub-Saharan Africa, are gaining popularity over the developed and

developing markets (Time for Frontier Markets ETFs?).

Frontier markets are basically nations less established and

developed than emerging nations. They have lower market

capitalization and liquidity when compared to the more developed

emerging markets, and they are generally at the initial stage of

economic, political and financial development.

Rationale Behind Investment

Additionally, the region is characterized by positive

demography, unleveraged balance sheets and strong consumption

demand. The rising middle class population in the region has

resulted in a strong demand for consumer products as well.

The market's young and expanding population is increasingly

attractive. Frontier markets represent around 6% of the world’s GPD

and 22% of the world population, while approximately 60% of their

citizens are under the age of 30.

The population in the region is not just large and young, but

they are also a cheaper labor force than those found in developed

and emerging markets. Additionally these markets are generally rich

in natural resources and have in demand products in this regard

(Time to Buy Emerging Market ETFs?).

It is expected that the region will grow at an average of 5%

through 2013-2016 on the back of more external inflows and decent

commodity demand. So, those seeking long-term high returns should

look to invest in frontier market ETFs (4 Excellent Dividend ETFs

for Income and Stability).

Risks of Investing in Frontier Market

Though the frontier market provides a good investment strategy

for those looking for lofty returns over the long term, a high

level of volatility and poor liquidity are risks that run high in

these markets. High inflation levels also pose a risk of investing

in these economies, as many have trouble keeping this under

control.

Frontier Market ETFs

Still, we believe that many frontier markets offer up exciting

opportunities to those willing to take on some risk. In light of

this, we highlight three ETFs below which target the frontier

markets around the world:

PowerShares MENA Frontier Countries ETF

(PMNA)

PMNA is based on the NASDAQ OMX Middle East North Africa index,

which seeks to track the performance of liquid companies in MENA

(Middle East and North Africa) frontier countries.

In terms of country exposure, United Arab Emirates (26.5%),

Kuwait (24.4%), Egypt (21.3%) and Qatar (20.6%) account for the

majority of asset holdings.

The fund is heavily tilted towards the financial sector that

makes up about 62% of the assets (Banking ETFs: Laggards or

Leaders?). The top three holdings include National Bank of Abu

Dhabi, Emmar Properties and National Bank of Kuwait.

The fund launched in September 2008 and manages assets of $16.2

million currently. PMNA charges fees of 70 basis points per year

and has a dividend yield of 2.15% as of now. The fund generated a

return of 5.63% in the year-to-date period.

iShares MSCI Frontier 100 Index

(FM)

FM – launched in September 2012 – is the newest product in this

group. It is based on the MSCI Frontier Markets Index, which is

composed of 100 largest securities from the eligible universe,

ranked by float adjusted market capitalization.

The fund manages an asset base of $103.9 million and invests

this asset base in a holding of 102 securities.

In terms of country exposure, Kuwait (27.3%), Qatar (16.6%) and

the Nigeria (13.6%) are in the top three spots. Like PMNA,

financials dominates in terms of sector exposure, accounting for a

whopping 54% of the total assets, while telecoms (13.1%) and

industrials (12.4%) round out the top three (Two Sector ETFs

Posting Incredible Gains).

The fund charges an expense ratio of 79 basis points and pays

out a 30-day SEC yield of 2.14% currently. The fund generated a

return of 13.58% in the year-to-date period.

Guggenheim Frontier Markets ETF

(FRN)

For a moral global approach to frontier market investing,

investors should focus in on Guggenheim’s entrant in the space. The

fund seeks to match the performance of the Bank of New York (BNY)

Mellon New Frontier DR Index, before fees and expenses.

The BNY Mellon describes frontier market countries based on the

GDP growth, per capita income growth, past and expected inflation

rates, privatization of infrastructure and social inequalities.

The top countries included in the ETF are Chile (50.6%),

Colombia (14.38%), Argentina (9.27%) and Egypt (5.97%). These

account for about 80% of the holdings.

The fund is top-heavy with about 61.3% of the assets in the top

10 companies, while EcoPetrol, Enersis and Latam Airlines are the

top three holdings.

With total assets of $145.9 million, the fund is the low cost

choice in the frontier space with an expense ratio of 0.65%. The

fund generated a negative 8.10% return year to date and has an

impressive 3.3% annual dividend yield.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHRS-MSCI F100 (FM): ETF Research Reports

GUGG-FRONTR MKT (FRN): ETF Research Reports

PWRSH-MENA FRON (PMNA): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

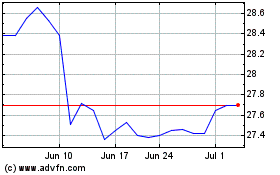

iShares Frontier and Sel... (AMEX:FM)

Historical Stock Chart

From Oct 2024 to Nov 2024

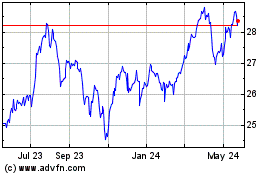

iShares Frontier and Sel... (AMEX:FM)

Historical Stock Chart

From Nov 2023 to Nov 2024