BlackRock has one of the most comprehensive and diverse

investment platforms in the industry, providing investors with

choice to meet their investment objectives. Investors are

continuing to turn to BlackRock to unlock the full potential of

their portfolios, as reflected by $1.9 trillion of net inflows in

the past five years globally.1

In the U.S., BlackRock offers over 600 mutual funds and ETFs for

investors to access different market exposures.2 As we evolve our

platform and launch new strategies, we also constantly assess the

regulatory and operating environment as well as how our funds are

meeting investors’ investment objectives. Today, BlackRock is

announcing the upcoming liquidation of 15 U.S.-domiciled mutual

funds and ETFs.

Fund

Name

Last

Trading Date

Liquidation Date3

BlackRock Future Climate and Sustainable

Economy ETF (NYSE: BECO)

8/12/2024

8/15/2024

BlackRock Future Tech ETF (NYSE: BTEK)

8/12/2024

8/15/2024

BlackRock Liquid Environmentally Aware

Fund4

N/A

9/5/2024

TempFund4

N/A

9/5/2024

BlackRock Sustainable Advantage CoreAlpha

Bond Fund

N/A

8/13/2024

BlackRock Sustainable International Equity

Fund

N/A

8/13/2024

BlackRock Sustainable Low Duration Bond

Fund

N/A

8/13/2024

BlackRock Sustainable US Growth Equity

Fund

N/A

8/13/2024

iShares Currency Hedged MSCI Germany ETF

(Nasdaq: HWEG)

8/12/2024

8/15/2024

iShares Frontier and Select EM ETF (NYSE:

FM)

See below

iShares Gold Strategy ETF (Cboe: IAUF)

8/12/2024

8/15/2024

iShares International Developed Property

ETF (NYSE: WPS)

8/12/2024

8/15/2024

iShares MSCI International Size Factor ETF

(NYSE: ISZE)

8/12/2024

8/15/2024

iShares USD Systematic Bond ETF (Nasdaq:

USBF)

8/12/2024

8/15/2024

iShares Virtual World and Life Multisector

ETF (NYSE: IWFH)

8/12/2024

8/15/2024

BlackRock continues to expand its active ETF platform, managing

$30 billion in AUM, as investors seek new access points to active

management globally. In addition, BlackRock’s sustainable investing

platform has grown sevenfold to over $800 billion in assets over

the last five years and includes over 450 products globally. The

firm’s industry-leading transition investing platform now manages

over $100 billion in AUM globally. 5

As described in the prospectuses, investors will incur

management fees until the liquidations are complete. In addition to

the management fee, investors who opt to sell an ETF will bear the

usual transaction and commissions costs in the secondary market. In

both cases, investors may see a capital gain or loss on their

investment.

iShares Frontier and Select EM ETF

BlackRock has also announced the liquidation of the iShares

Frontier and Select EM ETF (NYSE: FM). Over the past 12 years since

the fund's inception, BlackRock has provided investors access to

new and expanding corners of the capital markets, and several of

these frontier market countries have been elevated to emerging

market status. Select portions of the remaining smaller universe of

frontier markets have experienced persistent liquidity challenges,

and as a result, there will be an extended liquidation period for

the fund.

BlackRock currently expects that the fund will cease trading and

no longer accept creation and redemption orders after market close

on or around March 31, 2025; however, this date is subject to

change. During the extended liquidation period, the fund will not

be managed in accordance with its investment objective and

policies, as the fund will sell down its assets, as determined by

BlackRock, where possible and hold the proceeds of such sales in

cash and cash equivalents. Proceeds of the liquidation are expected

to be sent to shareholders on or around three days after the last

trading date. The Fund’s website will be updated upon the

determination of such dates.

Money Market Funds

The liquidations of TempFund, a series of BlackRock Liquidity

Funds, and the BlackRock Liquid Environmentally Aware Fund, a

series of BlackRock Funds, are driven by new amendments to Rule

2a-7, the principal rule governing U.S. Money Market Funds, adopted

by the Securities and Exchange Commission on July 12, 2023, among

other operational considerations.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1300+ exchange traded funds (ETFs) and $3.75

trillion in assets under management as of March 31, 2024, iShares

continues to drive progress for the financial industry. iShares

funds are powered by the expert portfolio and risk management of

BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or www.blackrock.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible loss of

principal.

This information should not be relied upon as research,

investment advice, or a recommendation regarding any products,

strategies, or any security in particular. This material is

strictly for illustrative, educational, or informational purposes

and is subject to change. This material does not constitute any

specific legal, tax or accounting advice. Please consult with

qualified professionals for this type of advice.

The BlackRock Funds are not sponsored, endorsed, issued, sold or

promoted by MSCI Inc., nor does this company make any

representation regarding the advisability of investing in the

Funds. BlackRock is not affiliated with MSCI Inc.

The iShares and BlackRock Funds are distributed by BlackRock

Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc. or its affiliates. All rights reserved.

iSHARES and BLACKROCK are trademarks of BlackRock,

Inc. or its affiliates. All other trademarks are those of their

respective owners.

1 BlackRock, as of March 31, 2024

2 BlackRock, as of May 31, 2024

3 Proceeds of the liquidation are scheduled to be sent to the

shareholders on or around Liquidation Date.

4 The BlackRock Wealth Liquid Environmentally Aware Fund and

offshore Institutional Cash Series (ICS) Liquid Environmentally

Aware Funds are not impacted and will remain open to eligible

investors.

5 BlackRock, as of June, 5, 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240607459139/en/

MEDIA: Joanna Yau joanna.yau@BlackRock.com

646.856.7274

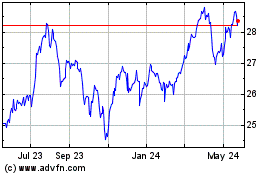

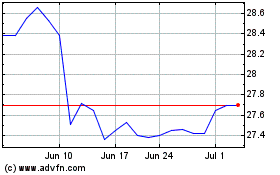

iShares Frontier and Sel... (AMEX:FM)

Historical Stock Chart

From Oct 2024 to Nov 2024

iShares Frontier and Sel... (AMEX:FM)

Historical Stock Chart

From Nov 2023 to Nov 2024