The Marygold Companies, Inc. (“TMC,” or the “Company”) (NYSE

American: MGLD), a diversified global holding firm, today announced

that its Marygold & Co. (“Marygold”) subsidiary has introduced

the latest feature of its recently developed mobile fintech banking

app—a Cash Management Account with a return of up to 6%.

“Launch of the new digital savings Cash Management Account

feature represents an important step in our mission to streamline

and organize clients’ financial lives, in one user-friendly mobile

app,” said Nicholas Gerber, TMC’s and Marygold’s Chief Executive

Officer. “Serving as one of the nation’s newest and most intuitive

money management tools, the Marygold app virtualizes payments,

savings, banking and investing, combining all the services needed

to manage one’s financial life.”

The Company believes the (up to) 6% offering, which will be

available through June 30, 2025, or once a cumulative total of $100

million in assets under management is attained, is among the

highest currently available in the United States. In addition to

the new Cash Management Account, other features of Marygold’s app

include:

- Money Pools: Allowing users to create individual accounts for

each of their financial goals, so they can easily track their

progress. A built-in investment calculator provides suggestions for

pre-set investment portfolios, curated to suit users’ individual

goals.

- Spending Limits: Setting personalized card limits that users

can control. Setting daily, weekly, and monthly limits on cards

tailored toward the unique needs of customers, solidifying their

budgets.

- Money Management Tools: Facilitating one central hub to collate

financial goals, enabling users to have an at-a-glance view of

their savings habits. It also provides the ability to send and

receive money to anyone in the United States, with no need for the

other party to also have the app.

The app was introduced to the U.S. market in late 2023,

developed completely in-house over approximately four years of

dedicated technology investments and testing. Gerber said its

wholly owned subsidiary, Marygold & Co. (UK) Limited, is

preparing to launch a version of the app adapted for the U.K.

banking system in the near-term. The Marygold app is currently

available only to U.S. consumers and can be downloaded in the

AppStore for iPhone and Android cellular phones. For specific

details on the Cash Management Account and other features, visit

www.marygoldandco.com.

About Marygold & Co. and Marygold & Co. (UK)

Marygold & Co., https://marygoldandco.com/, headquartered in

Denver, Colo., is a wholly owned TMC subsidiary established in 2019

to explore opportunities in the financial technology sector.

Marygold & Co. (UK) Limited, https://marygoldandco.uk/, also a

wholly owned TMC subsidiary, was established in the U.K. in 2021

and operates through two UK-based investment advisory business

units: Tiger Financial & Asset Management Limited (“Tiger”),

acquired in 2022, http://www.tfam.co.uk/, and Step-by Step

Financial Planners, acquired in 2024, https://www.sbsfp.co.uk/,

that manage clients’ financial wealth across a diverse product

range.

About The Marygold Companies, Inc.

The Marygold Companies was founded in 1996 and repositioned as a

global holding firm in 2015. The Company currently has operating

subsidiaries in financial services, food manufacturing, printing,

security systems and beauty products, under the trade names USCF

Investments, Marygold & Co., Tiger Financial & Asset

Management Limited, Step By Step Financial Planners, Gourmet Foods,

Printstock Products, Brigadier Security Systems and Original

Sprout, respectively. Offices and manufacturing operations are in

the U.S., New Zealand, U.K., and Canada. For more information,

visit www.themarygoldcompanies.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of U.S. federal securities laws. Words such as

“expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may” “will,” “could,” “should”

“believes,” “predicts,” “potential,” “continue” and similar

expressions are intended to identify such forward-looking

statements. Such forward-looking statements, including, but not

limited to, launching the mobile fintech banking app in the UK,

involve significant risks and uncertainties that could cause the

actual results to differ materially from the expected results and,

consequently, you should not rely on these forward-looking

statements as predictions of future events. These forward-looking

statements and factors that may cause such differences include,

without limitation, satisfaction of customary closing conditions

related to the offering, the expected timing of the closing of the

offering and the risks disclosed in the Company’s Annual Report on

Form 10-K filed with the Securities and Exchange Commission and in

the Company’s other filings with the Securities and Exchange

Commission. The foregoing list of factors is not exclusive. Readers

are cautioned not to place undue reliance upon any forward-looking

statements, which speak only as of the date made. Except as

required by law, the Company disclaims any obligation to update or

publicly announce any revisions to any of the forward-looking

statements contained in this press release.

Banking services provided by Jiko Bank, a division of

Mid-Central National Bank.

INVESTMENT IN T-BILLS: NOT FDIC INSURED; NO BANK

GUARANTEE; MAY LOSE VALUE

All U.S. treasury investments and investment advisory services

provided by Jiko Securities, Inc., a registered broker-dealer,

member FINRA and SIPC. Securities in your account are protected up

to $500,000. For details, please see www.sipc.org.

Jiko Group, Inc. and its affiliates do not provide legal, tax,

or accounting advice. Legal and/or tax advisors should be consulted

before making any financial decisions. This material is not

intended as a recommendation, offer or solicitation for the

purchase or sale of any security or investment strategy. See FINRA

BrokerCheck, Jiko U.S. Treasuries Risk Disclosures, and Jiko

Securities Inc. Form CRS. Marygold & Co. Cash Management

Account & Bonus Program Terms and Conditions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209431371/en/

Media and investors, for more Information, contact: Roger

S. Pondel PondelWilkinson Inc. 310-279-5965 rpondel@pondel.com

Contact the Company: David Neibert, Chief Operations

Officer 949-429-5370 dneibert@themarygoldcompanies.com

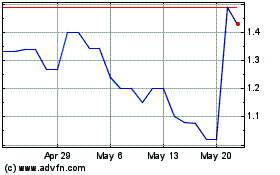

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Nov 2024 to Dec 2024

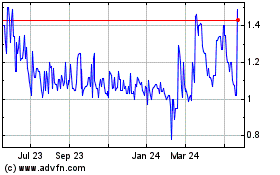

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Dec 2023 to Dec 2024