Global X Debuts Greece ETF (GREK) - Commodity ETFs

December 08 2011 - 5:05AM

Zacks

Despite its tiny size, the Greek economy has been

front-and-center throughout 2011 thanks to the ongoing debt crisis

plaguing the nation. Public debt as a percentage of GDP and the

budget deficit as a percentage of GDP have both been among the

highest rates in euro zone, creating a devastating situation for

the nation’s ability to participate in the sovereign debt market.

In fact, yields on two-year Greek government debt are now hovering

around the 140% mark, an unsustainable level that is more than 10

times the rate that Greek debt was yielding just 12 months ago.

Yet, for investors seeking to make a play on the Greek economy,

options were (and continue to be) extremely limited. Only a few

U.S. listed-equities offer meaningful exposure to the nation while

ETF exposure is even lighter as only the Guggenheim Shipping ETF

(SEA) allocates a sizable chunk of assets to the highly-indebted

country. Now, for the first time, investors will be able to gain

exposure to the Greek economy via a single ticker thanks to the

brand new fund from Global X (read ETFs vs. Mutual Funds).

It’s All GREK To Me

The new Greece ETF (GREK) from the New York-based issuer will

seek to provide investment results that correspond generally to the

price and yield performance, before fees and expenses, of the

FTSE/ATHEX 20 Capped Index. This benchmark is designed to reflect

the performance of the twenty largest securities listed on the

Athens Stock Exchange and is designed to reflect broad based equity

market performance of the country.

In terms of sector exposure, financials take up just over 35% of

total assets, followed by industrials (22%), and consumer

discretionary firms (18.4%). Top individual components consist of

the National Bank of Greece at 14.4% of the total, which is closely

followed by Coca-Cola HBC (12.7%) and the Greek Organization of

Football Prognostics (12.1%). The fund has a net expense ratio of

69 basis points, a figure that is in line with many smaller

country-specific ETFs (also see Forget FXI: Try These Three China

ETFs Instead).

Greek Economic Situation

The restrictive clauses of euro zone membership at one time

allowed Greece to obtain debt cheaply thanks to the stability of

the bloc and the confidence that it instilled in investors. Those

days are long gone, however, as Greece’s membership in the euro is

preventing the country from devaluing its currency in order to make

debt more manageable, creating a precarious situation for the

nation that could push it towards default. Yet, Greek bond holders,

unsurprisingly, remain staunch opponents of the plan and are

pushing for further measures that will kick the can down the road

and keep Greek bonds out of default. This could be especially

important for many of the euro zone banks which remain holders of

the securities but seem unable to survive a credit event in Greece

or any other number of PIIGS nations (read HDGE: The Active Bear

ETF Under The Microscope).

There are also worries that a Greek default would lead to a

contagion spreading across the common currency area with other weak

members, such as Portugal and even Spain or Italy, coming under

significant pressure in the bond market. While a Portuguese

situation is likely to be an issue on par with Greece, a

Greek-style meltdown in Italy or Spain could take a number of banks

into insolvency and is likely to be at the forefront of

policymakers’ minds as they attempt to stave off a default (see Top

Three Precious Metal Mining ETFs).

Beyond these broad macro issues, which have put the Greek

economy in focus, the timing of the fund’s launch seems impeccable

as it comes right before an EU Summit that could decide the fate of

the euro. Furthermore, the debut of GREK comes just hours after the

ECB cut rates by another quarter of a percent although the central

bank did not discuss any plans for government bond purchases, a

situation that could have definitely been to Greece’s favor. Thanks

to this precarious situation as well as the uncertainty going

forward, Greece’s stock market has been under significant pressure

over the past few years as the total market cap of the Athens stock

exchange has lost about 90% of its value since the peak in

2007.

With this backdrop, the Greek market could be an interesting one

for investors both in terms of long and short plays on the economy.

If one thinks that Greece is destined to leave the euro or that

more austerity pain is in the country’s future, GREK could make for

an interesting short play. On the other hand, long-term investors

could view the fund, at current levels, as an interesting entry

point assuming of course that one is willing to stomach significant

short-term volatility.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

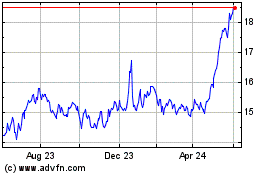

US Global Sea to Sky Car... (AMEX:SEA)

Historical Stock Chart

From Dec 2024 to Jan 2025

US Global Sea to Sky Car... (AMEX:SEA)

Historical Stock Chart

From Jan 2024 to Jan 2025