U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a

registered investment advisory firm with deep expertise in global

markets and specialized sectors from gold mining to airlines, today

announced operating revenues of approximately $11 million for the

fiscal year ended June 30, 2024. The Company reported net income of

$1.3 million, down from $3.1 million in the same period the

previous year, largely due to a decrease in advisory fees stemming

from lower assets under management (AUM). However, net investment

income surged to $2.1 million, a remarkable 578% increase from the

prior 12-month period.

For fiscal year 2024, average AUM stood at $1.9 billion, with

total AUM nearly $1.6 billion as of June 30, 2024, down from $2.4

billion the year prior.

Despite the challenging macroeconomic environment, marked by a

prolonged yield curve inversion—where the two-year Treasury yield

exceeded the 10-year yield—investor sentiment toward the airline

industry has weakened. This inversion, a historical recession

signal, lasted for a record-breaking 783 days before reversing.1

The uncertainty surrounding the inversion led many investors to

reduce exposure to industries like airlines, which are typically

sensitive to economic slowdowns. Despite this, the airline

industry’s fundamentals—marked by robust growth in passengers,

revenue and cash flow—remained strong, although macroeconomic

concerns kept many investors on the sidelines.

Now that the yield curve has normalized, the Company expects a

potential shift in market sentiment, as the reversal could signal

renewed confidence in future economic stability.

“We can’t control external factors like geopolitics, interest

rates, taxes or regulations. However, we do have control over our

internal processes, including robust governance, compliance and our

smart beta 2.0 approach to developing thematic ETF products, which

combines quantitative and fundamental analysis,” says Frank Holmes,

CEO of U.S. Global Investors. “While we cannot directly influence

investor sentiment, we remain optimistic, particularly following

the reversal of the yield curve in September after its historic

783-day inversion. As illustrated in the chart, the correlation

between the inverted yield curve and redemptions in the

U.S. Global Jets ETF (NYSE:

JETS) has been significant.”

Confidence in the Long-Term Outlook for the Airline

Industry

The Company continues to express confidence in the long-term

growth of the airline industry, driven by strong demand for air

travel, lower borrowing costs and a return to pre-pandemic levels

of consumer travel spending. Two years ago, the U.S. Transportation

Security Administration (TSA) was consistently clearing around 2.0

million passengers per day, even surpassing pre-pandemic figures.

In July 2024, the TSA set a new record by screening 3 million

passengers in a single day.2

Additionally, the Company continues to expand its global

presence with a new ETF listing in Colombia this month. Many

countries in Latin America are pursuing robust strategies to expand

tourism, creating jobs and attracting foreign capital. This

strategic move aligns with the Company’s approach to tapping into

high-growth markets, where tourism plays a critical role in driving

economic development.

Leading U.S. airlines, including American Airlines, Delta Air

Lines, United Airlines, and Southwest Airlines, experienced an

average revenue growth of 841% over the four years ending in June

2024, while EBITDA (earnings before interest, taxes, depreciation

and amortization) grew by 178% over the same period, according to

Bloomberg data. Over the past two years, these airlines saw revenue

growth of 61%, with EBITDA doubling by 100%, underscoring the

resilience and growth of the sector.

Review the top holdings in JETS by clicking here.

9.41% Shareholder Yield Exceeds Treasury

Yields

As of the most recent reporting period, the Company’s

shareholder yield—a valuation metric popularized by Cambria Funds

founder Mebane Faber3—was 9.41%,4 more than double the yields on

both five-year and 10-year Treasury bonds. This strong yield

reflects the Board of Directors' commitment to delivering value to

shareholders through a combination of share repurchases and monthly

dividends.

Share Repurchases and Monthly Dividends

Indeed, the Company is committed to returning value to

shareholders. During the fiscal year ended June 30, 2024, the

Company repurchased a total of 767,651 of its own shares at a net

cost of approximately $2.2 million. This marks an 86% jump in

shares repurchased from the same period a year earlier and a nearly

760% increase from fiscal 2022.

As of June 30, 2024, the Board of Directors has authorized a

monthly dividend of $0.0075 per share from July 2024 through

September 2024. The Company has paid a monthly dividend since

2007.

Healthy Liquidity and Capital Resources

As of June 30, 2024, the Company had net working capital of

approximately $38.2 million, a slight increase from the same period

last year. With approximately $27.4 million in cash and cash

equivalents, plus investments in our funds and other securities,

the Company has adequate liquidity to meet its current

obligations.

Gold Investors Anticipating Rate Cuts

The price of gold hit a new all-time high price on August 20 of

this year,5 yet investment in gold-backed ETFs has remained muted

as high interest rates in the U.S. deterred some investors from

putting money in a non-interest-bearing asset. However, rates are

widely expected to be lowered starting at the Federal Open Markets

Committee (FOMC) meeting on September 17, a move that should lower

bond yields, weaken the U.S. dollar and potentially boost demand

for gold and gold mining stocks.

Against this background, the Company is happy to see that AUM in

U.S. Global GO GOLD and Precious Metal Miners ETF

(NYSE: GOAU) remained

stable between August 2023 and August 2024. We consider GOAU a

smart beta 2.0 ETF, meaning we believe it combines the benefits of

passive investing and active investing. GOAU provides investors

access to companies engaged in the production of precious metals

either through active (mining or production) or passive (owning

royalties or streams) means.

“De-dollarization, geopolitical tension and concerns over U.S.

debt sustainability continue to drive interest in gold,” says Mr.

Holmes. “With limited alternatives in other major currencies,

central banks have increased their gold reserves, a trend that

could continue given expectations of gold continuing to hit new

all-time highs.”

JETS UCITS ETF Merged with

TRIP

The Company continues to strengthen the global brand of its

U.S. Global Jets ETF (NYSE:

JETS), which trades not just in New York

but also on the Mexican Stock Exchange, the Lima Stock Exchange in

Peru and, effective August 29, 2024, the Colombia Securities

Exchange.

In April, the U.S. Global Jets UCITS ETF merged with the

Travel UCITS ETF

(TRIP) after the Company

acquired the fund from HANetf, Europe’s first and only independent,

full-service provider of UCITS ETFs.

Whereas JETS invests mostly in the airlines industry, TRIP

includes other sectors of the travel industry, such as hotels and

cruise line operators. All combined, the global tourism market is

expected to generate a massive $2 trillion in revenue in 2024,

according to research by IBISWorld.6 This represents 2% of the

global economy, estimated at approximately $105 trillion in

2023.7

Tune In to the Earnings

Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time

on September 11, 2024, to discuss the Company’s key financial

results for the fiscal year. Frank Holmes will be accompanied on

the webcast by Lisa Callicotte, chief financial officer, and Holly

Schoenfeldt, marketing and public relations manager. Click

here to register for the earnings webcast or visit

www.usfunds.com for more information.

Selected Financial Data (unaudited):

(dollars in thousands, except per share

data)

| |

12 months

ended |

| |

6/30/2024 |

6/30/2023 |

|

Operating Revenues |

$ |

10,984 |

|

$ |

15,074 |

| Operating Expenses |

|

11,464 |

|

|

11,549 |

| Operating Income (Loss) |

|

(480 |

) |

|

3,525 |

| |

|

|

| Total Other Income |

|

2,395 |

|

|

558 |

| Income Before Income Taxes |

|

1,915 |

|

|

4,083 |

| |

|

|

| Income Tax Expense |

|

582 |

|

|

934 |

| Net Income |

$ |

1,333 |

|

$ |

3,149 |

| |

|

|

| Net Income Per Share (Basic and

Diluted) |

$ |

0.09 |

|

$ |

0.22 |

| |

|

|

| Avg. Common Shares Outstanding

(Basic) |

|

14,182,300 |

|

|

14,638,833 |

| Avg. Common Shares Outstanding

(Diluted) |

|

14,182,353 |

|

|

14,639,069 |

| |

|

|

| Avg. Assets Under Management

(Billions) |

$ |

1.9 |

|

$ |

2.5 |

About U.S. Global Investors, Inc.The story of

U.S. Global Investors goes back more than 50 years when it began as

an investment club. Today, U.S. Global Investors, Inc.

(www.usfunds.com) is a registered investment adviser that focuses

on niche markets around the world. Headquartered in San Antonio,

Texas, the Company provides investment management and other

services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors

may include certain “forward-looking statements,” including

statements relating to revenues, expenses and expectations

regarding market conditions. You can identify these forward-looking

statements by the use of words such as “outlook,” “believes,”

“expects,” “potential,” “opportunity,” “seeks,” “anticipates” or

other comparable words. Such statements involve certain risks and

uncertainties and should be read with corporate filings and other

important information on the Company’s website, www.usfunds.com, or

the Securities and Exchange Commission’s website at

www.sec.gov.

These filings, such as the Company’s annual report and Form

10-Q, should be read in conjunction with the other cautionary

statements that are included in this release. Future events could

differ materially from those anticipated in such statements and

there can be no assurance that such statements will prove accurate

and actual results may vary. The Company undertakes no obligation

to publicly update or review any forward-looking statements,

whether as a result of new information, future developments or

otherwise.

Please consider carefully a fund’s investment objectives, risks,

charges and expenses. For this and other important information,

obtain a statutory and summary prospectus for JETS

here, GOAU here and for SEA here. Read it carefully

before investing.Investing involves risk, including the

possible loss of principal. Shares of any ETF are bought and sold

at market price (not NAV), may trade at a discount or premium to

NAV and are not individually redeemed from the funds. Brokerage

commissions will reduce returns. Because the funds concentrate

their investments in specific industries, the funds may be subject

to greater risks and fluctuations than a portfolio representing a

broader range of industries. The funds are non-diversified, meaning

they may concentrate more of their assets in a smaller number of

issuers than diversified funds.

The funds invest in foreign securities which involve

greater volatility and political, economic and currency risks and

differences in accounting methods. These risks are greater for

investments in emerging markets. The funds may invest in the

securities of smaller-capitalization companies, which may be more

volatile than funds that invest in larger, more established

companies.

The performance of the funds may diverge from that of

the index. Because the funds may employ a representative sampling

strategy and may also invest in securities that are not included in

the index, the funds may experience tracking error to a greater

extent than funds that seek to replicate an index. The funds are

not actively managed and may be affected by a general decline in

market segments related to the index.

Airline Companies may be adversely affected by a

downturn in economic conditions that can result in decreased demand

for air travel and may also be significantly affected by changes in

fuel prices, labor relations and insurance costs. Gold, precious

metals, and precious minerals funds may be susceptible to adverse

economic, political or regulatory developments due to concentrating

in a single theme. The prices of gold, precious metals, and

precious minerals are subject to substantial price fluctuations

over short periods of time and may be affected by unpredicted

international monetary and political policies. We suggest investing

no more than 5% to 10% of your portfolio in these

sectors.

Foreign and emerging market investing involves special risks

such as currency fluctuation and less public disclosure, as well as

economic and political risk. By investing in a specific geographic

region, such as China and/or Taiwan, a regional ETFs returns and

share price may be more volatile than those of a less concentrated

portfolio.Cash flow multiples, also known as valuation

multiples, measure the relationship between a company's cash

flow and its market value.

Fund holdings and allocations are subject to change at any time.

Click to view fund holdings for JETS, GOAU and SEA.Distributed

by Quasar Distributors, LLC. U.S. Global Investors is the

investment adviser to JETS, GOAU and SEA.

1 Bilello, C. (2024, September 5). The longest inversion in

history is over - chart of the day (9/4/24). Charlie Bilello’s

Blog.

https://bilello.blog/2024/the-longest-inversion-in-history-is-over-chart-of-the-day-9-4-24#

2 Statement from Secretary Mayorkas on Record Three Million

Screenings by TSA | Transportation Security Administration. (2024,

July 8).

https://www.tsa.gov/news/press/releases/2024/07/08/statement-secretary-mayorkas-record-three-million-screenings-tsa

3 Meb Faber - Shareholder Yield Investing Strategy and Portfolio.

Meb Faber Portfolio | Shareholder Yield.

https://www.validea.com/meb-faber#4 The Company calculates

shareholder yield by adding the percentage of change in shares

outstanding to the dividend yield for the 12 months ending June 30,

2024. The Company did not have debt; therefore, no debt reduction

was included.5 Gold extends record rally on dollar weakness,

rate-cut bets | Reuters.

https://www.reuters.com/markets/commodities/gold-steady-near-record-high-investors-seek-more-fed-cues-2024-08-206

Global tourism - market size, industry analysis, trends and

forecasts (2024-2029). IBISWorld Industry Reports.

https://www.ibisworld.com/global/market-research-reports/global-tourism-industry/#CompetitiveForces7

GDP (current US$). World Bank Open Data.

https://data.worldbank.org/indicator/NY.GDP.MKTP.CD

Contact:Holly SchoenfeldtDirector of

Marketing 210.308.1268hschoenfeldt@usfunds.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/82111e5e-bcef-4f2d-998c-6c67be695c66

https://www.globenewswire.com/NewsRoom/AttachmentNg/f21bbaf8-dee6-4f76-a511-00bca75e82c3

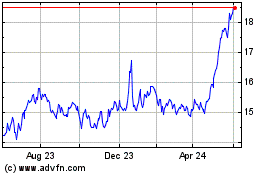

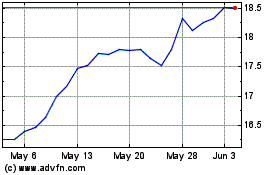

US Global Sea to Sky Car... (AMEX:SEA)

Historical Stock Chart

From Dec 2024 to Jan 2025

US Global Sea to Sky Car... (AMEX:SEA)

Historical Stock Chart

From Jan 2024 to Jan 2025