Tanzanian Gold Corporation (TSX:TNX) (NYSE American:TRX) (TanGold

or the Company) today announced that it has entered into a

definitive agreement with a single institutional investor for the

purchase and sale of 17,948,718 of the Company’s common shares at

an effective purchase price of $0.39 per share, in a registered

direct offering. In addition, the Company has also agreed to issue

and sell to the investor warrants to purchase up to an aggregate of

17,948,718 common shares. The warrants will have an exercise price

of $0.44 and will be exercisable at any time upon issuance and will

expire five years thereafter. The offering is expected to close on

or about January 26, 2022, subject to satisfaction of customary

closing conditions.

The common shares and warrants and common shares

issuable thereunder described above are being offered and sold by

the Company in a registered direct offering pursuant to a “shelf”

registration statement on Form F-3 (Registration No. 333- 255526),

including an accompanying prospectus, previously filed with, and

declared effective by, the Securities and Exchange Commission (the

“SEC”) on May 14, 2021. The offering of the common shares and

warrants and common shares issuable thereunder will be made only by

means of a prospectus supplement that forms a part of the

registration statement. A final prospectus supplement and

accompanying prospectus relating to the registered direct offering

will be filed with the SEC and will be available on the SEC's

website located at http://www.sec.gov.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

A.G.P./Alliance Global Partners is acting as the

exclusive placement agent for the offering. McGuireWoods LLP acted

as legal counsel to A.G.P./Alliance Global Partners and Lewis

Brisbois Bisgaard & Smith LLP and Miller Thomson LLP acted as

legal counsel to the Company in connection with the registered

direct offering.

The Company continues to execute its business

plan and this increased liquidity enables the Company to accelerate

its plan, including: (i) the continued buildout of the 1,000+ tpd

processing plant expansion (mine plan represents ~10% of Buckreef

Gold Mineral Resource) which is expected to be completed in

calendar Q2/Q3 2022 and is forecast to produce 15,000 – 20,000

ounces of gold per year; (ii) exploration drilling with the goal of

expanding mineral resources, discovering new mineral resources and

converting mineral resources to mineral reserves, including the

Buckreef Main Zone northeast extension, Buckreef West Zone and the

Anfield Zone; (iii) advancing the metallurgical study for the first

5-7 years of production, one of the longest lead items on the

Sulphide Development Project, which contains ~90% of the Buckreef

Gold Mineral resource. A total of 19 holes (2,367 meters) have been

completed for the metallurgical program and these metallurgical

sample holes have been logged and are in preparation for shipment;

and (iv) general corporate purposes.

About Tanzanian Gold Corporation

TanGold along with its joint venture partner,

STAMICO is advancing a significant gold project at Buckreef in

Tanzania. Buckreef is anchored by an expanded Mineral Resource

published in May 2020. Measured Mineral Resource is 19.98 million

tonnes (“MT”) at 1.99 grams per tonne (“g/t”) gold (“Au”)

containing 1,281,161 ounces (“oz”) of gold and Indicated Mineral

Resource is 15.89 MT at 1.48 g/t gold containing 755,119 ounces of

gold for a combined tonnage of 35.88 MT at 1.77 g/t gold containing

2,036,280 oz of gold. The Buckreef Gold Project also contains an

Inferred Mineral Resource of 17.8 MT at 1.11g/t gold for contained

gold of 635,540 oz of gold. The Company is actively investigating

and assessing multiple exploration targets on its property. Please

refer to the Company’s Updated Mineral Resources Estimate for

Buckreef Gold Project, dated May 15, 2020 and filed under the

Company’s profile on SEDAR on June 23, 2020 (the “Technical

Report”), for more information. Buckreef is being advanced in a

value accretive sustainable manner through:

Expanding Production Profile: A

360 tonne per day (“tpd”) processing plant is being expanded to

1,000+ tpd, enabling a near term production profile of 15,000 -

20,000 oz of gold per year. Positive operating cash flow will be

utilized for value enhancing activities, including exploration and

Sulphide Project Development.

Exploration: Continuing with a

drilling program with the goal of expanding resources, discovering

new resources and converting resources to reserves, by: (i)

step-out drilling in the northeast extension of Buckreef Main; (ii)

infill drilling to upgrade Mineral Resources currently in the

Inferred category in Buckreef Main; (iii) infill drilling program

of Buckreef West; (iv) develop exploration program for the newly

discovered Anfield Zone; (v) upgrade historical mineral resources

at Bingwa and Tembo; (vi) identification of new prospects at

Buckreef Gold Project, and in the East African region.

Sulphide Development Project:

Unlocking the value of the Sulphide Project in which the ‘sulphide

ore’ encompasses approximately 90% of the Resources. It is the goal

of the Company to substantially exceed all metrics as outlined in

the Technical Report, including annual production and strip

ratio.

For further information, please contact Michael Martin, Investor

Relations, m.martin@tangoldcorp.com, 860-248-0999, or visit the

Company website at www.tangoldcorp.com

Andrew M. Cheatle, P.Geo., the Company’s COO and

Director, is the Qualified Person as defined by the NI 43-101 who

has reviewed and assumes responsibility for the technical content

of this press release.

The Toronto Stock Exchange and NYSE American

have not reviewed and do not accept responsibility for the adequacy

or accuracy of this release. Tanzanian Gold Corporation is

providing the reference of the research report in this press

release for information only.

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TanGold management’s

expectations or beliefs regarding future events and include, but

are not limited to, the sale of the common shares and warrants will

be completed and statements with respect to the continued operating

cash flow, expansion of its process plant, estimation of mineral

resources, recoveries, subsequent project testing, success, scope

and viability of mining operations, the timing and amount of

estimated future production, and capital expenditure.

Although TanGold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TanGold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth in

reports that Tanzanian Gold files with the SEC. You can review and

obtain copies of these filings from the SEC's website at

http://www.sec.gov/edgar.shtml .

The information contained in this press release

is as of the date of the press release and TanGold assumes no duty

to update such information.

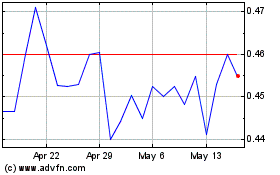

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Jan 2024 to Jan 2025