TIDM888

RNS Number : 4455Q

888 Holdings plc

18 October 2023

18 October 2023

888 Holdings Plc

("888" or "the Group")

Q3 2023 Trading Update

Q3 actual result in line with September trading update; no

change in full year expectations

888 (LSE: 888), one of the world's leading betting and gaming

companies with internationally renowned brands including William

Hill, 888 and Mr Green, today announces an update confirming its

trading during the three months ended 30 September 2023 ("Q3-23" or

the "Period"). Further detail on the financial results by division

is included as an appendix to this announcement.

Highlights

-- Group: performance in line with 28(th) September 2023 trading

update with revenue of GBP405.0m, down 10% year on year. Trends and

drivers of year-over-year performance are consistent with that

update with significant and ongoing improvements being made to the

sustainability and quality of the mix of the business impacting

performance in the short-term.

-- UK&I Online: continued strong customer engagement with

average monthly actives +17%. Revenue -10% driven by ongoing impact

of safer gambling changes and refined marketing approach, coupled

with lower-than-expected betting net win margin from customer

friendly sports results in September, particularly UK football.

-- Retail: strong underlying performance driven by improved

product offering through investment in SSBTs and gaming cabinets,

partly offset by customer friendly sports results meaning revenue

was +1% year-over-year.

-- International: average monthly actives -2% and revenue -19%

with an ongoing significant impact from compliance changes in

dotcom markets, particularly the Middle East, with a slower

recovery in revenue and customer activity than initially

anticipated.

-- Synergy delivery on track and significant cost savings being

delivered that have helped to partly mitigate the impact of

regulatory and compliance changes.

-- Section8 in-house games successfully integrated into William

Hill online and the initial integration of William Hill's

proprietary global trading platform into 888's in-house platform,

with certain sports now being traded across the group from one

trading engine.

-- Prioritising the safety and wellbeing of the Group's more

than 500 colleagues in Israel and their families following the

outbreak of war post Period end. Activated business continuity

plans, which are working well with no significant impact on

business operations expected.

-- No change to expectations of Q4 revenue being down mid-single

digit and FY23 Adjusted EBITDA Margin of 18-19%.

Per Widerström, CEO of 888, commented:

"I am very excited to have joined the 888 Group as the new CEO.

I have already been struck by the strength of the Group's assets

and its clear potential, as well as the ambition of our team.

I am happy to note that despite the regulatory challenges the

Group has faced this year, the hard work by the team is already

showing signs of results meaning that we head towards the end of

the year with positive momentum, and well placed to grow in the

coming years.

This is a business with a very strong foundation for profitable

growth. But there are clearly also several areas for improvement

which we will focus on to unlock our full potential and drive value

creation. I am looking forward to working closely with our

fantastic people in the Group, the talented executive team and the

Board to ensure we are in the best possible position to deliver our

plans and maximise value creation."

Enquiries and further information:

888 Holdings Plc +44(0) 800 029 3050

Per Widerström, CEO

Vaughan Lewis, Interim CFO and Chief Strategy Officer

Investor Relations ir@888holdings.com

James Finney, Director of IR

Media 888williamhill@hudsonsandler.com

Hudson Sandler

Alex Brennan / Charlotte Cobb / Andy Richards +44(0) 207 796 4133

About 888 Holdings Plc:

888 Holdings plc (and together with its subsidiaries, "888" or

the "Group") is one of the world's leading betting and gaming

companies. The Group owns and operates internationally renowned

brands including William Hill, 888, and Mr Green. In addition, the

Group operates the SI Sportsbook and SI Casino brands in the US in

partnership with Authentic Brands Group.

Incorporated in Gibraltar, and headquartered and listed in

London, the Group operates from offices around the world and

employs over 11,000 people globally.

The Group's mission is to lead the gambling world in creating

the best betting and gaming experiences, bringing unrivalled

moments of excitement to people's day-to-day lives. It achieves

this by developing state-of-the-art technology and content-rich

products that provide fun, fair, and safe betting and gaming

entertainment to customers worldwide.

Find out more at:

http://corporate.888.com/

Important Notices

This announcement may contain certain forward-looking

statements, beliefs or opinions, with respect to the financial

condition, results of operations and business of 888. These

statements, which contain the words "anticipate", "believe",

"intend", "estimate", "expect", "may", "will", "seek", "continue",

"aim", "target", "projected", "plan", "goal", "achieve", words of

similar meaning or other forward looking statements, reflect 888's

beliefs and expectations and are based on numerous assumptions

regarding 888's present and future business strategies and the

environment 888 will operate in and are subject to risks and

uncertainties that may cause actual results to differ materially.

No representation is made that any of these statements or forecasts

will come to pass or that any forecast results will be achieved.

Forward-looking statements involve inherent known and unknown

risks, uncertainties and contingencies because they relate to

events and depend on circumstances that may or may not occur in the

future and may cause the actual results, performance or

achievements of 888 to be materially different from those expressed

or implied by such forward looking statements. Many of these risks

and uncertainties relate to factors that are beyond 888's ability

to control or estimate precisely, such as future market conditions,

currency fluctuations, the behaviour of other market participants,

the actions of regulators and other factors such as 888's ability

to continue to obtain financing to meet its liquidity needs,

changes in the political, social and regulatory framework in which

888 operates or in economic or technological trends or conditions.

Past performance of 888 cannot be relied on as a guide to future

performance. As a result, you are cautioned not to place undue

reliance on such forward-looking statements. The list above is not

exhaustive and there are other factors that may cause 888's actual

results to differ materially from the forward-looking statements

contained in this announcement. Forward-looking statements speak

only as of their date and 888, its respective parent and subsidiary

undertakings, the subsidiary undertakings of such parent

undertakings, and any of such person's respective directors,

officers, employees, agents, affiliates or advisers expressly

disclaim any obligation to supplement, amend, update or revise any

of the forward-looking statements made herein, except where it

would be required to do so under applicable law. No statement in

this announcement is intended as a profit forecast or a profit

estimate and no statement in this announcement should be

interpreted to mean that the financial performance of 888 for the

current or future financial years would necessarily match or exceed

the historical published for 888

Appendix: Divisional Summary

Q3 2023

UK&I Online Retail International Group

Unaudited Q3 Q3 % Q3 Q3 % Q3 Q3 % Q3 Q2 %

GBPm 2023 2022 Change 2023 2022 Change 2023 2022 Change 2023 2022 Change

------------ ------ ------ -------- ---------- ---------- -------- ---------- ---------- -------- --------- --------- --------

Average

monthly

actives

(000s) 1,186 1,014 +17% 492 503 -2% 1,679 1,517 +11%

Sportsbook

stakes 607.0 674.5 -10% 394.0 379.6 +4% 248.2 305.9 -19% 1,249.2 1,360.0 -8%

Sportsbook

net

revenue

margin 9.0% 9.8% -0.8ppt 17.9% 18.5% -0.6ppt 7.2% 7.6% -0.4ppt 11.4% 11.7% -0.3ppt

Betting

revenue 54.4 65.8 -17% 70.4 70.1 +0% 17.9 23.2 -23% 142.6 159.0 -10%

Gaming

revenue 102.8 108.6 -5% 55.2 54.0 +2% 104.3 127.7 -18% 262.4 290.4 -10%

Total

revenue 157.2 174.4 -10% 125.6 124.1 +1% 122.2 150.9 -19% 405.0 449.4 -10%

Year to Date ("YTD") 2023

UK&I Online Retail International Group

Unaudited YTD YTD % YTD YTD % YTD YTD % YTD YTD %

GBPm 2023 2022 Change 2023 2022 Change 2023 2022 Change 2023 2022 Change

------------ --------- --------- ------- --------- --------- ------- ---------- ---------- ------- --------- --------- -------

Average

monthly

actives

(000s) 1,211 1,080 +12% 522 523 -0% 1,733 1,604 +8%

Sportsbook

stakes 1,991.9 2,306.9 -14% 1,240.0 1,221.3 +2% 832.7 1,012.8 -18% 4,064.5 4,541.0 -10%

Sportsbook

net

revenue

margin 9.6% 8.9% 0.7ppt 18.8% 18.2% 0.7ppt 8.2% 7.0% 1.2ppt 12.1% 11.0% 1.1ppt

Betting

revenue 190.6 205.5 -7% 233.6 221.9 +5% 68.2 70.8 -4% 492.4 498.2 -1%

Gaming

revenue 302.4 339.8 -11% 171.5 165.7 +4% 320.2 389.0 -18% 794.1 894.5 -11%

Total

revenue 493.0 545.2 -10% 405.1 387.6 +5% 388.5 459.8 -16% 1,286.5 1,392.7 -8%

Note: Subtotals, totals, and percentage changes have been

calculated based on the underlying numbers. Any differences due to

rounding.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPGPCUUPWGRM

(END) Dow Jones Newswires

October 18, 2023 02:00 ET (06:00 GMT)

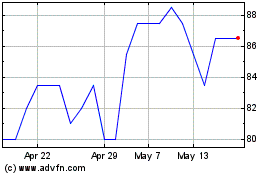

888 (AQSE:888.GB)

Historical Stock Chart

From Mar 2024 to Apr 2024

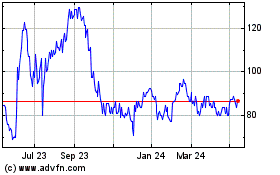

888 (AQSE:888.GB)

Historical Stock Chart

From Apr 2023 to Apr 2024