TIDMMTC

RNS Number : 5320U

Mothercare PLC

24 November 2023

Mothercare plc

Interim results announcement

Driving the Mothercare brand globally

Mothercare plc ("Mothercare" "the Company" or "the Group"), the

highly trusted British heritage international brand and franchise

operator, that connects with the parents of newborn babies and

children across multiple product categories throughout their early

life as parents, today announces unaudited half year results for

the 26-week period to 23 September 2023 ("H1 FY24"). The

comparative period was a 26-week period to 24 September 2022 ("H1

FY23").

Key Highlights

-- International retail sales by franchise partners of GBP137.2

million (2022: GBP162.1 million), a decrease of 15% on last year

(13% down at constant currency). This reflects difficult trading

conditions in the Middle East which is down 20% on last year, with

continuing operations excluding the Middle East down 6% on last

year at constant currency.

-- Adjusted EBITDA of GBP3.6 million (H1 FY23: GBP3.2 million)

increased by 12%, reflecting tighter control of costs.

-- Group adjusted profit before taxation from operations

increased 17% to GBP3.4 million (H1 FY23: GBP2.9 million).

-- Total Group profit before taxation of GBP2.0 million (H1 FY23: GBP0.8 million).

-- Net debt increased to GBP15.8 million (GBP11.6 million at 24 September 2022).

-- We continue to explore options to further mitigate the

pension scheme current deficit of GBP35 million (at 31 March 2023)

notwithstanding the reduction from GBP124.5 million since March

2020.

Our Group

26 weeks 26 weeks 26 weeks 28 weeks

to to to to

23 Sep 24 Sep 25 Sep 10 Oct

2023 2022 2021 2020

Turnover GBPm 29.0 38.5 41.7 44.4

Adjusted EBITDA (2) GBPm 3.6 3.2 5.6 (0.1)

Adjusted profit from operations (2) GBPm 3.4 2.9 5.2 (1.3)

Adjusted profit before taxation (2) GBPm 1.8 1.7 3.6 (4.4)

Profit for the period GBPm 1.7 0.4 3.6 (13.2)

Adjusted basic earnings per share (2) 0.2p 0.2p 0.9p (1.2)p

Basic earnings per share 0.3p 0.1p 1.0p (3.5)p

------------------------------------------------ --------- --------- -------- --------

Our Franchise partners

26 weeks 26 weeks 26 weeks 28 weeks

to to to to

23 Sep 24 Sep 25 Sep 10 Oct

2023 2022 2021 2020

Worldwide retail sales (1) GBPm 137.2 162.1 184.3 189.2

Online retail sales GBPm 13.7 13.1 17.6 27.1

Total number of stores 500 562 740 793

Space (k) sq. ft. 1,201 1,345 1,967 2,180

--------------------------------- --------- --------- -------- --------

Clive Whiley, Chairman of Mothercare plc, commented:

"These results are testament to our continued drive to preserve

the strength of the Mothercare brand in a fast changing retail and

macroeconomic trading environment. Against significant headwinds in

the Middle East, one of our core markets, we are pleased that our

business model and disciplined approach to cost has resulted in an

increase in profitability for the first half."

Investor and analyst enquiries to:

Mothercare plc Email: investorrelations@mothercare.com

Clive Whiley, Chairman

Andrew Cook, Chief Financial Officer

Deutsche Numis Tel: 020 7260 1000

(NOMAD & Joint Corporate Broker)

Luke Bordewich

Henry Slater

Cavendish Capital Markets Limited Tel: 0 20 7220 0500

(Joint Corporate Broker)

Carl Holmes

Media enquiries to:

MHP Email: mothercare@mhpc.com

Rachel Farrington Tel: 020 3128 8613

Tim Rowntree

Notes

1 - Worldwide retail sales are total franchise partner sales to

end customers (which are estimated and unaudited) .

2 - Adjusted figures are stated before the impact of the

adjusting items set out in note 4.

3 - Net debt is defined as total borrowings, cash at bank and

IFRS 16 lease liabilities.

4 - This announcement contains certain forward-looking

statements concerning the Group. Although the Board believes its

expectations are based on reasonable assumptions, the matters to

which such statements refer may be influenced by factors that could

cause actual outcomes and results to be materially different. The

forward-looking statements speak only as at the date of this

document and the Group does not undertake any obligation to

announce any revisions to such statements, except as required by

law or by any appropriate regulatory authority.

5 - The information contained within this announcement is deemed

by the Company to constitute inside information for the purposes of

the Market Abuse Regulation (EU) No 596/2014. Upon the publication

of this announcement via a Regulatory Information Service, this

inside information is now considered to be in the public

domain.

6 - The person responsible for the release of this announcement

is Lynne Medini, Group Company Secretary at Mothercare plc,

Westside 1, London Road, Hemel Hempstead, HP3 9TD.

7 - M othercare plc's Legal Entity Identifier (" LEI") number is

213800ZL6RPV9Z9GFO74.

Chairman's statement

Trading Update

As noted in our last trading update, our franchise partners'

international retail sales were impacted by the continuing global

economic uncertainty, alongside the need for them to clear old

inventory, decreasing by 15% to GBP137 million for the 26 weeks to

23 September 2023. Online retail sales for the period increased to

10% of total retail sales (H1 FY23: 8%).

Performance in our Middle Eastern region, especially the Kingdom

of Saudi Arabia, remains challenging having undergone significant

changes in recent years. Fiscal and legislative changes and the

introduction of many new leisure activities competing for

consumers' money is changing consumer behaviour. The shape of our

partner's retail offering in the country is evolving and we remain

confident of the longer-term market opportunity.

It is therefore reassuring to report that our continued focus

upon the necessary adjustments to our supply chain, operations and

administrative costs meant that we generated free cash flow from

operations and increased adjusted EBITDA by 12% to GBP3.6 million

for the six months to 23 September 2023.

We are acutely aware of the ongoing pressure exerted on our

franchise partners' profitability and the consequent need for them

to reduce costs and the levels of investment they can make in their

businesses. This will likely lead to further reductions in our

store footprint in some regions. We are working closely with our

key partners to assist them with their recovery, ultimately

benefitting both our own business and our franchise partners'

businesses when we eventually return to pre pandemic levels of

trading. We do not currently expect our combined efforts to offset

full this impact on the Group results for the financial year to

March 2024 and beyond.

Financing

The Group had net debt of GBP15.8 million on 23 September 2023

(September 2022: GBP11.6 million). This comprised total cash of

GBP4.2 million (September 2022: GBP8.7 million), against lease

liabilities of GBP0.4 million and GBP19.6 million of the Group's

existing loan facility with GB Europe Management Services Limited

("GBB") which remains fully drawn.

We continue to enjoy a strong relationship with GBB and the

Group has received various necessary waivers and adjustments to

covenants in relation to the loan facility from GBB in the past. As

noted in our previous trading update the interest cost on this loan

(currently 19.2%) and the extended time to return to pre-pandemic

retail sales levels means that we will continue to need such

waivers and covenant adjustments to the loan facility to avoid or

remedy breaches of its terms. Accordingly, we are continuing our

refinancing discussions with GBB to vary this debt facility

alongside exploring various financing alternatives. For the

avoidance of doubt, the Group does not require additional liquidity

in our current forecasts. We continue to pursue other options that

would also provide additional liquidity to accelerate business

development.

Growth Opportunities

We have established momentum in improving profitability,

underpinned by a cost base that is now appropriate for the reduced

scale of our business. At the same time we are preserving the

skills and experience necessary to deliver further growth as we

return to more normal pre-pandemic levels of business.

Accordingly, we can now redouble our efforts to capitalise upon

the possibilities to grow the future global presence of the brand.

This includes entering new territories through multiple channels or

a combination thereof via e-commerce (either DTC or marketplaces)

or with partners that would hold the online rights for a territory

and provide the website and full supply chain capability in these

markets. This also opens a window of opportunity for us, via

step-change growth, to bring synergies and enhanced profitability

into our business, as we exploit the core strengths of the Group

across supply, franchisee partnerships and international reach.

Update on Initiatives

Supply chain model

Our efforts to develop our supply chain to reduce cost,

complexity and deliver goods to our franchise partners in the

quickest way led to a further improvement in on-time availability,

with over 85% of our product being delivered direct from our

country of manufacturing to our retail partners' markets. We also

continue to develop our product option framework as we seek to

curtail the impact of input cost inflation.

Enterprise Resource Planning ('ERP') System

Our new ERP system includes a leading product lifecycle

management system integrated with a supply chain and finance system

with portal-based access for both our franchise partners and

manufacturing partners to both input and access information. This

is now due to go live at the beginning of the next financial year,

with the full benefit of the cost savings in the financial year

ending March 2025. We are confident that the final system will

deliver at least the expected benefits and cost savings.

Pension Schemes

The last full actuarial valuation of the schemes was at 31 March

2023 and showed a deficit of GBP35 million, resulting from total

assets of GBP198 million and total liabilities of GBP233 million.

The revised recovery plan agreed with the Trustees includes total

contributions (Deficit Repair Contributions plus costs) in the

financial years to: March 2024 GBP2.4 million; March 2025 GBP2.0

million; March 2026 & 2027 GBP3.0 million; March 2028 &

2029 GBP4.0 million; March 2030 & 2031 GBP5.0 million; March

2032 GBP6.0 million and March 2033 GBP0.5 million aggregating to

fully fund the GBP35 million deficit by July 2032.

We continue to explore options to mitigate the pension scheme

deficit (GBP35 million deficit at 31 March 2023).

Outlook

Our prime goal in recent years has been to protect the

underlying Mothercare brand intellectual property value, for the

benefit of all stakeholders and avoiding unnecessary equity

dilution. We are continuing with our efforts to refinance the Group

and remain in discussions with key stakeholders and financing

partners to ensure that the Group has adequate and appropriate

financing for the future. O ur medium-term guidance for the steady

state operation, in more normal circumstances, is unchanged and we

believe our continuing franchise operations remain capable of

delivering approximately GBP10 million operating profit.

In the interim we remain focused on restoring critical mass and

monetising the Mothercare global brand IP to further free up

cashflow, in addition to the significant reduction in pension

contributions, to invest in the long-term corporate development of

the Group.

This would not have been possible with out the ongoing

commitment and support of all stakeholders, including our

Mothercare colleagues, our franchise partners, our manufacturing

partners, our pension scheme trustees and our shareholders to whom

we are grateful.

Clive Whiley

Chairman

Condensed consolidated income statement

For the 26 weeks ended 23 September 2023

26 weeks ended 23 26 weeks ended 52 weeks

September 2023 24 September 2022 ended

(Unaudited ) (Unaudited) 25 March

2023

(Audited)

Before Adjusted Total Before Adjusted Total Total

adjusted items(1) adjusted items

Note items items (1)

GBP GBP GBP GBP GBP GBP

million million million million GBP million million

million

------------------- ------ --------- --------- ---------------- --------- ----------- ------------- -----------

Revenue 29.0 - 29.0 38.5 - 38.5 73.1

Cost of sales (19.0) - (19.0) (27.5) - (27.5) (52.2)

------------------- ------ --------- --------- ---------------- --------- ----------- ------------- -----------

Gross profit 10.0 - 10.0 11.0 - 11.0 20.9

Administrative

expenses (6.6) 0.2 (6.4) (8.1) - (8.1) (15.7)

Impairment losses

on receivables - - - - - - 0.8

------------------- ------

Profit from

operations 3.4 0.2 3.6 2.9 - 2.9 6.0

Net finance costs 5 (1.6) - (1.6) (1.2) (0.9) (2.1) (3.8)

------------------- ------ --------- --------- ---------------- --------- ----------- ------------- -----------

Profit before

taxation 1.8 0.2 2.0 1.7 (0.9) 0.8 2.2

Taxation 6 (0.3) - (0.3) (0.4) - (0.4) (2.3)

------------------- ------ --------- --------- ---------------- --------- ----------- ------------- -----------

Profit for the

period 1.5 0.2 1.7 1.3 (0.9) 0.4 (0.1)

------------------- ------ --------- --------- ---------------- --------- ----------- ------------- -----------

Profit for the period

attributable to equity

holders of the parent 1.5 0.2 1.7 1.3 (0.9) 0.4 (0.1)

--------------------------- --------- --------- ---------------- --------- ----------- ------------- -----------

Earnings per share

0.3 0.1

Basic 7 p 0.3 p 0.2 p p (0.0)p

0.3 0.1

Diluted 7 p 0.3 p 0.2 p p (0.0)p

------------------- ------ --------- --------- -------------------- ------------- ------- ------------- -----------

(1) Adjusted items included: restructuring costs included in

finance costs and administrative expenses, and property related

income and other restructuring costs included in administrative

expenses. Adjusted items are one-off or significant in nature and

or /value. Excluding these items from the profit metrics provides

readers with helpful additional information on the performance of

the business across the periods because it is consistent with how

business performance is reviewed by the Board and Operating

Board.

Condensed consolidated statement of comprehensive income

For the 26 weeks ended 23 September 2023

26 weeks 26 weeks 52 weeks

ended ended ended

23 September 24 September 25 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

------------------------------------------------ --- --------------- -------------- ------------

Profit/(loss) for the period 1.7 0.4 (0.1)

Items that will not be reclassified

subsequently to the income statement:

Actuarial loss on defined benefit

pension schemes (16.3) (1.1) (4.5)

Deferred tax relating to items not

reclassified 3.1 0.2 1.1

(13.2) (0.9) (3.4)

------------------------------------------------ --- --------------- -------------- ------------

Items that may be reclassified subsequently

to the income statement:

Exchange differences on translation

of foreign operations (0.1) 0.1 -

(0.1) 0.1 -

------------------------------------------------ --- --------------- -------------- ------------

Other comprehensive expense for

the period (13.3) (0.8) (3.4)

------------------------------------------------ --- --------------- -------------- ------------

Total comprehensive expense for

the period wholly attributable to

equity holders of the parent (11.6) (0.4) (3.5)

------------------------------------------------ --- --------------- -------------- ------------

Condensed consolidated balance sheet

As at 23 September 2023

23 September 24 September 25 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

Note GBP million GBP million GBP million

--------------------------------------- ----- ------------------- ------------------- ------------

Non-current assets

Intangible assets 8 6.8 4.5 5.8

Property, plant and equipment 8 0.2 0.2 0.2

Right-of-use assets 0.2 0.7 0.3

Deferred tax assets 2.7 - -

Retirement benefit obligations 10 - 11.8 8.4

9.9 17.2 14.7

--------------------------------------- -----

Current assets

Inventories 0.7 0.6 0.9

Trade and other receivables 5.1 6.9 7.2

Derivative financial instruments 11 0.5 0.2 0.5

Current tax asset 0.5 0.3 0.2

Cash and cash equivalents 4.2 8.7 7.1

11.0 16.7 15.9

--------------------------------------- ----- ------------------- ------------------- ------------

Total assets 20.9 33.9 30.6

--------------------------------------- ----- ------------------- ------------------- ------------

Current liabilities

Trade and other payables (7.5) (10.7) (10.8)

Lease liabilities (0.4) (0.5) (0.3)

Provisions (0.7) (0.9) (0.9)

(8.6) (12.1) (12.0)

--------------------------------------- -----

Non-current liabilities

Borrowings 9 (19.6) (19.3) (19.5)

Lease liabilities - (0.5) (0.2)

Provisions - (0.6) (0.3)

Retirement benefit obligations 10 (6.0) - -

Deferred tax liabilities - (0.2) (0.4)

(25.6) (20.6) (20.4)

--------------------------------------- ----- ------------------- ------------------- ------------

Total liabilities (34.2) (32.7) (32.4)

--------------------------------------- ----- ------------------- ------------------- ------------

Net (liabilities)/assets (13.3) 1.2 (1.8)

--------------------------------------- ----- ------------------- ------------------- ------------

Equity attributable to equity holders

of the parent

Share capital 89.3 89.3 89.3

Share premium account 108.8 108.8 108.8

Own shares (0.2) (1.0) (0.2)

Translation reserve (3.8) (3.6) (3.7)

Retained deficit (207.4) (192.3) (196.0)

--------------------------------------- ----- ------------

Total equity (13.3) 1.2 (1.8)

--------------------------------------- ----- ------------------- ------------------- ------------

Condensed consolidated statement of changes in equity

For the 26 weeks ended 23 September 2023 (unaudited)

Share Share Own Translation Retained Total

capital premium shares reserve deficit equity

account

GBP million GBP GBP GBP GBP million GBP

million million million million

--------------------------------- ------------ --------- --------- ------------ ------------ -----------

Balance as at 25 March

2023 as previously reported 89.3 108.8 (0.2) (3.7) (196.0) (1.8)

Profit for the period - - - - 1.7 1.7

Other comprehensive income

for the period - - - (0.1) (13.2) (13.3)

--------------------------------- ------------ --------- --------- ------------ ------------ -----------

Total comprehensive income

for the period - - - (0.1) (11.5) (11.6)

Adjustments to equity

for equity-settled share-based

payments - - - - 0.1 0.1

Balance at 23 September

2023 89.3 108.8 (0.2) (3.8) (207.4) (13.3)

--------------------------------- ------------ --------- --------- ------------ ------------ -----------

For the 26 weeks ended 24 September 2022 (unaudited)

Share Share Own Translation Retained Total

capital premium shares reserve deficit equity

account

GBP million GBP GBP GBP million GBP million GBP

million million million

--------------------------------- ------------ --------- --------- ------------ ------------ ---------

Balance as at 25 March

2023 as previously reported 89.3 108.8 (1.0) (3.7) (191.9) 1.5

Profit for the period - - - - 0.4 0.4

Other comprehensive income

for the period - - - 0.1 (0.9) (0.8)

Total comprehensive income

for the period - - - 0.1 (0.5) (0.4)

Adjustments to equity

for equity-settled share-based

payments - - - - 0.1 0.1

Balance at 24 September

2022 89.3 108.8 (1.0) (3.6) (192.3) 1.2

--------------------------------- ------------ --------- --------- ------------ ------------ ---------

For the 52 weeks ended 25 March 2023 (audited)

Share Share Own Translation Retained Total

capital premium shares reserve deficit equity

account

GBP million GBP GBP GBP million GBP million GBP

million million million

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Balance at 26 March 2022 89.3 108.8 (1.0) (3.7) (191.9) 1.5

Items that will not be

reclassified subsequently

to the

income statement - - - - (3.4) (3.4)

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Other comprehensive income - - - - (3.4) (3.4)

Profit for the period - - - - (0.1) (0.1)

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Total comprehensive income - - - - (3.5) (3.5)

Shares transferred to

executive

on vesting - - 0.8 - (0.8) -

Adjustment to equity for

equity-settled share-based

payments - - - - 0.2 0.2

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Balance at 25 March 2023 89.3 108.8 (0.2) (3.7) (196.0) (1.8)

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Condensed consolidated cash flow statement

For the 26 weeks ended 23 September 2023

26 weeks 26 weeks 52 weeks

ended ended ended

Note 23 September 24 September 25 March

2023 2022 2023

(Unaudited) (Unaudited (Audited)

)

GBP million GBP million GBP million

---------------------------------------- ------ --------------- -------------- ------------

Net cash flow from operating

activities 13 (0.3) 2.1 4.3

Cash flows from investing activities

Purchase of property, plant and

equipment (0.1) 0.0 (0.1)

Purchase of intangibles - software (0.6) (0.7) (2.2)

Cash used in investing activities (0.7) (0.7) (2.3)

---------------------------------------- ------ --------------- -------------- ------------

Cash flows from financing activities

Interest paid (1.7) (1.9) (2.8)

Repayments of obligations under

leases (0.2) (0.1) (0.3)

Facility fee paid - - (0.9)

Net cash outflow from financing

activities (1.9) (2.0) (4.0)

--------------- -------------- ------------

Net (decrease)/increase in cash

and cash equivalents (2.9) (0.6) (2.0)

---------------------------------------- ------ --------------- -------------- ------------

Cash and cash equivalents at beginning

of period 7.1 9.2 9.2

Effect of foreign exchange rate

changes - 0.1 (0.1)

---------------------------------------- ------

Cash and cash equivalents at

end of period 4.2 8.7 7.1

---------------------------------------- ------ --------------- -------------- ------------

Notes to the condensed consolidated financial statements

1 General information

The review of the Group's business activities, together with

factors likely to affect its future development, performance and

position are set out in the Financial Highlights and Chairman's

Statement.

The results for the 26 weeks ended 23 September 2023 are

unaudited.

These unaudited condensed consolidated interim financial

statements for the current period and prior financial periods do

not constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for the 2023

financial year has been filed with the Registrar of Companies. The

2023 financial statements are available on the Group's website (

www.mothercareplc.com ). The auditor has reported on these: their

report was unqualified.

2 Accounting Policies and Standards

Basis of preparation

These unaudited condensed consolidated interim financial

statements have been prepared in accordance with the Disclosure and

Transparency Rules of the UK Financial Conduct Authority, and with

IAS 34 'Interim Financial Reporting'. Unless otherwise stated, the

accounting policies applied, and the judgements, estimates and

assumptions made in applying these policies, are consistent with

those described in the Annual Report and Financial Statements 2023.

The financial period represents the 26 weeks ended 23 September

2023. The comparative periods are the 26 weeks ended 24 September

2022 and the 52 weeks ended 25 March 2023.

Going concern

With recent increases in interest rates, the interest rate on

this loan is currently approximately 19.2%, which coupled with the

extended time to return to pre-pandemic retail sales levels,

particularly in our Middle Eastern markets, means the Board's

current forecasts for continuing operations show the Group may

require waivers to future periods' covenant tests. Our current

lender remains supportive, whilst we complete our financing

activities to repay all or part of the facility.

The consolidated financial information has been prepared on a

going concern basis. When considering the going concern assumption,

the Directors of the Group have reviewed a number of factors,

including the Group's trading results and its continued access to

sufficient borrowing facilities against the Group's latest

forecasts and projections, comprising:

-- A Base Case forecast; and

-- A Sensitised forecast, which applies sensitivities against

the Base Case for reasonably possible adverse variations in

performance, reflecting the ongoing volatility in our key

markets.

In making the assessment on going concern the Directors have

assumed that the Group is able to mitigate the material uncertainty

surrounding the Group's ability to successfully complete its

financing activities to repay all or part of the existing facility

and that our current lenders would continue to support us in the

event we required waivers to future period's covenant test, whilst

doing so.

Notes to the condensed consolidated financial statements

2 Accounting Policies and Standards (continued)

Going concern (continued)

The Sensitised scenario assumes the following additional key

assumption:

-- A significant reduction in global retail sales, which may

result from subdued, consumer confidence or disposable income or

through store closures or weaker trading in our markets, throughout

the remainder of FY24 and FY25.

The Board's confidence in the Group's Base Case forecast, which

indicates that the Group will operate with sufficient cash

balances, provided appropriate covenant waivers on our current

facility were agreed, if required prior to the completion of our

funding activities, and the Group's proven cash management

capability, supports our preparation of the financial statements on

a going concern basis.

However, if trading conditions were to deteriorate beyond the

level of risk applied in the Sensitised forecast, or the Group was

unable to execute further cost or cash management programmes, the

Group would at certain points of the working capital cycle require

covenant waivers based on its current facilities agreement. If this

scenario were to crystallise, the Group would need to renegotiate

with its lender in order to secure waivers to potential covenant

breaches and consequential cash remedies or have completed the

current negotiations to amend the covenants or secure additional

funding. Therefore, we have concluded that, in this situation,

there is a material uncertainty in relation to the continued

support of our existing lender, if required, that casts significant

doubt that the Group will be able to operate as a going concern

without potential waivers or revised/ new financing facilities.

Adoption of new IFRSs

The Group early adopted Amendments to IAS1 - Non-current

liabilities with covenants. The adoption had no impact on the

recently issued annual financial statements. Covenants which the

Group must comply with only after the reporting date did not affect

the classification of non-current liabilities at the period end.

The same accounting policies, presentation and methods of

computation are followed in this half yearly report as applied in

the Group's last audited financial statements for the 52 weeks

ended 25 March 2023.

Standards issued but not yet effective

There are no standards issued but not yet effective that have

been identified as expected to have a material impact on the

disclosures or the amounts reported in these financial

statements.

Foreign currency adjustments

Foreign currency monetary assets and liabilities are revalued to

the closing balance sheet rate under IAS21 "The Effects of Changes

in Foreign Exchange Rates".

Taxation

The taxation charge for the 26 week period is calculated by

applying the best estimate of the average annual effective tax rate

expected for the full year to the profit/loss for the period after

adjusting for any significant one-off items, and a tax credit is

recognised only to the extent that the resulting tax asset is more

than likely not to reverse.

Notes to the condensed consolidated financial statements

2 Accounting Policies and Standards (continued)

Retirement benefits

Payments to defined contribution retirement benefit schemes are

charged as an expense as they fall due.

For defined benefit schemes, the cost of providing benefits is

determined using the Projected Unit Credit Method, with actuarial

valuations being carried out at each balance sheet date. Actuarial

gains and losses are recognised in full in the period in which they

occur. They are recognised outside of the income statement and

presented in other comprehensive income.

Past service cost is recognised immediately to the extent that

the benefits are already vested.

The retirement benefit obligation recognised in the balance

sheet represents the present value of the defined benefit

obligation less the fair value of scheme assets. Any asset

resulting from this calculation is limited to past service cost,

plus the present value of available refunds.

The Group has an unconditional right to a refund of surplus

under the rules.

In consultation with the independent actuaries to the schemes,

the valuation of the pension obligation has been updated to

reflect: current market discount rates; current market values of

investments and actual investment returns; and also for any other

events that would significantly affect the pension liabilities. The

impact of these changes in assumptions and events has been

estimated in arriving at the valuation of the pension

obligation.

Alternative performance measures (APMs)

In the reporting of financial information, the Directors have

adopted various APMs of historical or future financial performance,

position or cash flows other than those defined or specified under

International Financial Reporting Standards (IFRS).

These measures are not defined by IFRS and therefore may not be

directly comparable with other companies' APMs, including those in

the Group's industry.

APMs should be considered in addition to, and are not intended

to be a substitute for, or superior to, IFRS measures.

Purpose

The Directors believe that these APMs assist in providing

additional useful information on the performance and position of

the Group because they are consistent with how business performance

is reported to the Board and Operating Board.

APMs are also used to enhance the comparability of information

between reporting periods and geographical units (such as

like-for-like sales), by adjusting for non-recurring or

uncontrollable factors which affect IFRS measures, to aid the user

in understanding the Group's performance.

Consequently, APMs are used by the Directors and management for

performance analysis, planning, reporting and incentive setting

purposes and have remained consistent with prior year.

Notes to the condensed consolidated financial statements

2 Accounting Policies and Standards (continued)

The key APMs that the Group has focused on during the period are

as follows:

Group worldwide sales

Group worldwide sales are total retail sales from our franchise

partners. Total Group revenue is a statutory number and is made up

of total receipts from our franchise partners, which includes

royalty payments and the cost of goods dispatched to franchise

partners.

Profit/(loss) before adjusted items

The Group's policy is to exclude items that are considered to be

significant in both nature and/or quantum and where treatment as an

adjusted item provides stakeholders with additional useful

information to assess the year-on-year trading performance of

the Group.

3 Segmental information

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reported to the Group's executive decision makers

(comprising the executive directors and operating board) in order

to allocate resources to the segments and assess their performance.

Under IFRS 8, the Group has not identified that its continuing

operations represent more than one operating segment.

The results of franchise partners are not reported separately,

nor are resources allocated on a franchise partner by franchise

partner basis, and therefore have not been identified to constitute

separate operating segments.

Notes to the condensed consolidated financial statements

4 Adjusted items

Due to their significance or one-off nature, certain items have

been classified as adjusted items as follows:

26 weeks 26 weeks 52 weeks

ended ended ended

23 September 24 September 25 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

---------------------------------------------

GBP million GBP million GBP million

--------------------------------------------- --------------- -------------- ------------

Adjusted costs/(income):

Restructuring costs/(income) included

in finance costs - 0.9 1.0

Property related (income)/costs included

in administrative expenses - - 0.2

Restructuring costs/(income) included

in administrative expenses 0.2 - 0.0

Adjusted items before tax 0.2 0.9 1.2

--------------------------------------------- --------------- -------------- ------------

Restructuring costs included in finance costs - GBPNil (H1 FY23:

0.9 million)

In the comparative period, GBP0.5 million of legal and

professional fees were incurred in renegotiating the Group's loan

and a GBP0.4m loss arising from the modification of the loan.

Restructuring costs included in administrative expenses - GBP0.2

million (H1 FY23: GBPNil)

The current year income relates to GBP0.4 million credits

arising in relation to the profit on disposal of Mothercare UK

Limited business which went into administration, this was offset by

GBP0.2m of severance payments made.

5 Net finance costs

26 weeks 26 weeks 52 weeks

ended ended ended

23 September 24 September 25 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

------------------------------------------- --- --------------- -------------- ------------

Interest expense on lease liabilities 0.1 0.1 0.1

Other net interest 1.8 1.3 4.1

------------------------------------------------ --------------- -------------- ------------

Interest payable 1.9 1.4 4.2

------------------------------------------------ --------------- -------------- ------------

Net interest income on liabilities/return

on assets on pension (0.3) (0.2) (0.4)

------------------------------------------------ --------------- -------------- ------------

Net finance costs 1.6 1.2 3.8

------------------------------------------------ --------------- -------------- ------------

Notes to the condensed consolidated financial statements

6 Taxation

26 weeks 26 weeks 52 weeks

ended ended ended

23 September 24 September 25 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

------------------------------------------ --- --------------- -------------- ------------

Current tax - Overseas tax and UK

corporation tax 0.3 0.4 1.1

Deferred tax - UK tax charge for temporary

differences - - 1.2

----------------------------------------------- --------------- -------------- ------------

Total tax charge 0.3 0.4 2.3

----------------------------------------------- --------------- -------------- ------------

In addition to the amount charged to the income statement,

deferred tax credits relating to retirement benefit obligations

amounting to GBP3.1 million has been charged directly to other

comprehensive income (H1 FY23: GBP0.2 million).

7 Earnings per share

26 weeks 26 weeks 52 weeks

ended ended ended

23 September 24 September 25 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

million million million

-------------------------------------------- --- --------------- -------------- ------------

Weighted average number of shares in

issue for the purpose of basic earnings

per share 563.8 563.8 563.8

Dilutive potential ordinary shares 6.9 1.8 -

-------------------------------------------------

Weighted average number of shares in

issue for the purpose of diluted earnings

per share 570.7 565.6 563.8

-------------------------------------------------

GBP million GBP million GBP million

-------------------------------------------- --- --------------- -------------- ------------

Profit for basic and diluted earnings

per share 1.6 0.4 (0.1)

Adjusted items 0.2 0.9 1.2

Tax effect of adjusted items - - -

Adjusted earnings 1.4 1.3 1.1

------------------------------------------------- --------------- -------------- ------------

GBP million GBP million GBP million

-------------------------------------------- --- --------------- -------------- ------------

Pence Pence Pence

-------------------------------------------- ---

Basic earnings per share 0.3 0.1 (0.0)

Basic adjusted earnings per share 0.3 0.2 0.2

Diluted earnings per share 0.3 0.1 (0.0)

Diluted adjusted earnings per share 0.3 0.2 0.2

------------------------------------------------- --------------- -------------- ------------

The total dividend for the period is nil pence per share (H1

FY23: nil pence per share).

Notes to the condensed consolidated financial statements

8 Tangible fixed assets and Software assets

There were no additions to Right-of-use assets in the

period.

Capital additions of GBP1.1 million were made during the period

(H1 FY23: GBP1.0 million). These comprised tangible fixed assets of

GBP0.1 million (H1 FY23: GBP0.0 million) and software assets of

GBP1.0 million (H1 FY23: GBP1.0 million).

9 Borrowings

The carrying value of the Group's outstanding borrowings at 23

September 2023 was GBP19.6 million (25 March 2023: GBP19.5 million)

. The Group is required to achieve certain royalty targets under

its covenants and, due to the extended time to return to

pre-pandemic retail sales levels, will have difficulty achieving

its targets. Accordingly, refinancing discussions are ongoing with

the lender to vary the debt facility.

The credit facility of GBP19.6 million (25 March 2023: GBP19 .5

million) is secured on the shares of specified obligor subsidiaries

and the assets of the Group not already pledged. The Group also

holds a financial asset of GBP0.5 million (25 March 2023: GBP0. 5

million) reflecting the expected proceeds from the wind-down of the

UK operations by the administrators of Mothercare UK Ltd and

Mothercare Business Services Limited.

10 Retirement benefit schemes

The Group has calculated the value of its pension liability

under IAS 19 as at 23 September 2023. The FY23 year end assumptions

have been rolled forward and updated for changes in market rates

over the current interim period.

For the two schemes, based on the actuarial assumptions from the

actuarial valuations carried out as of March 2023 and using the

rolled forward assumptions referred to above, a net liability of

GBP6.0 million (H1 FY23: GBP11.8 million asset) has been

recognised. The swing to a liability position was mainly due to

returns on the assets being lower than expected at the start of the

year resulting in an asset experience loss.

11 Financial instruments: fair value disclosures

The Group held the following financial instruments at fair value

at 23 September 2023.

Fair value Fair value Fair value

measurements measurements measurements

at 23 September at 24 September at 25

2023 2022 March

(Unaudited) (Unaudited) 2023

(Audited)

GBP million GBP million GBP million

----------------------------------- ----------------- ----------------- --------------

Current financial assets:

Derivative financial instruments:

Financial asset 0.5 0.2 0.5

0.5 0.2 0.5

-------------------------------------- ----------------- ----------------- --------------

Notes to the condensed consolidated financial statements

11 Financial instruments: fair value disclosures (continued)

The Group's financial asset (Level 3 within the IFRS 7

hierarchy) represents a right, arising under the sales purchase

agreement with the administrators of MUK, to receive the proceeds

of the wind-up of the UK retail store estate and website operations

as repayment for the Group's secured borrowings. It has been

estimated by the administrators that the Group will receive GBP0.5

million (H1 FY23: GBP0.2 million). Many of the outflows which would

impact the valuation of this financial asset are finalised, with

the final repayment being dependent on the amounts to be received

back by the merchant acquirer and final settlement of VAT.

The Directors consider that the carrying value amounts of

financial assets and financial liabilities recorded at amortised

cost in the financial statements are approximately equal to their

fair values.

12 Share-based payments

A charge is recognised for share-based payments based on the

fair value of the awards at the date of grant, the estimated number

of shares that will vest and the vesting period of each award. The

total net charge for share-based payments under IFRS 2 is GBP0.1

million (H1 FY23: GBP0.1 million).

13 Notes to the cash flow statement

26 weeks 26 weeks 52 weeks

ended ended ended

23 September 24 September 25 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

-------------------------------------------------- --------------- -------------- ------------

Profit from operations 3.6 2.9 6.0

Adjustments for:

Depreciation of property, plant and

equipment and right of use assets 0.1 0.3 0.4

Amortisation of intangible assets 0.1 0.1 0.1

(Loss)/gain on non-cash foreign currency

adjustments (0.1) 1.4 0.1

Share-based payments 0.1 0.1 0.2

Movement in provisions (0.5) (1.1) (1.4)

Net gain on financial derivative instruments - - (0.3)

Payments to retirement benefit schemes (2.4) (1.3) (2.2)

Charge in respect of retirement benefit

schemes 0.7 1.0 2.1

-------------------------------------------------- --------------- --------------

Operating cash flow before movement

in working capital 1.6 3.4 5.0

Decrease in inventories 0.7 1.1 1.1

Decrease in receivables 1.5 0.2 0.9

Decrease in payables (3.7) (1.9) (1.4)

Cash generated from operations 0.1 2.8 5.6

-------------------------------------------------- --------------- -------------- ------------

Income taxes paid (0.4) (0.7) (1.3)

-------------------------------------------------- --------------- -------------- ------------

Net cash flow from operating activities (0.3) 2.1 4.3

Analysis of net debt

25 March Non-cash 23 September

2023 Cash Foreign movements 2023

flow exchange

GBP million GBP million GBP million GBP million GBP million

--------------------------- ------------ ------------ ------------ ------------ ---------------

Cash and cash equivalents 7.1 (2.9) - - 4.2

IFRS 16 lease liabilities (0.5) 0.1 - - (0.4)

Term loan (19.5) - - (0.1) (19.6)

Net debt (12.9) (2.8) - (0.1) (15.8)

--------------------------- ------------ ------------ ------------ ------------ ---------------

Notes to the condensed consolidated financial statements

14 Related party transactions

Transactions between the Group and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note. Transactions between the Group and its

joint ventures and associates are disclosed below.

Trading transactions:

There was no revenue earned from related parties in the current

or prior period.

Risk management framework

A risk management framework is in place which is appropriate for

the size and complexity of the business with consideration to its

AIM listing, future partner and system developments and Brand

promotion and evolution.

MGB maintains its risk management function in line with the

Quoted Companies Alliance Corporate Governance Code (QCA Code)

complying with AIM Rule 26. The Audit & Risk Committee provides

oversight, as to the overall suitability and effectiveness of the

risk management approach and is accountable and supported by the

Board. The Operating Board formally reviews, discusses and

documents the Principal Risks to the business at least annually.

The Risk Committee, which is chaired by the CFO, sits quarterly to

understand existing and developing issues, and MGB Senior Managers

contribute to and update Operational Risk registers, as a minimum

also quarterly. All colleagues recognise their responsibility to

proactively identify and manage risk and opportunity in their daily

activities and planning.

Principal risks and uncertainties

Reviewed, discussed and agreed by the Operating Board annually,

MGB Principal Risks are designed to promote strategic success and

improve future performance, the impact of operational risks on

these determines the focus for senior management and their teams.

The following risks have been agreed:

-- Liquidity

-- Dependency on a small number of partners

-- Pension scheme funding

-- Global economic and political conditions

-- ERP system

-- Regulatory and legal

-- Brand, reputation and relationships

-- Personnel and talent

Directors' Responsibility statement

The Directors are responsible for preparing the Interim Results

for the 26-week period ended 23 September 2023 in accordance with

applicable law, regulations and accounting standards. The Directors

confirm that to the best of their knowledge the condensed

consolidated interim financial statements have been prepared in

accordance with IAS 34: 'Interim Financial Reporting', and that the

interim management report includes a fair review of the information

required by DTR 4.2.7R and DTR 4.2.8R, namely:

-- an indication of the important events that have occurred

during the first 26 weeks of the financial year and their impact on

the condensed consolidated interim financial statements, and a

description of the principal risks and uncertainties for the

remaining 26 weeks of the financial year; and

-- material related party transactions in the first 26 weeks of

the year and any material changes in the related party transactions

described in the last annual report.

The Directors of Mothercare plc are listed on page 56 of the

Mothercare plc Annual Report and Financial Statements 2023. A list

of directors is maintained on the Mothercare plc website at:

www.mothercareplc.com. With the exception of today's announcement,

there have been no changes since the publication of the Annual

Report.

By order of the Board

Clive Whiley Andrew Cook

Chairman Chief Financial Officer

24 November 2023

Shareholder information

Financial calendar

2024

--------------------------------------------------------- ----------

Preliminary announcement of results for the 53 weeks September

ending 30 March 2024

Issue of report and accounts September

Annual General Meeting September

Announcement of interim results for the 26 weeks ending November

28 September 2024

--------------------------------------------------------- ----------

Registered office and head office

Westside 1, London Road, Hemel Hempstead, Hertfordshire HP3

9TD

www.mothercareplc.com

Registered number 1950509

Group Company Secretary

Lynne Medini

Registrars

Administrative enquiries concerning shareholders in Mothercare

plc for such matters as the loss of a share certificate, dividend

payments or a change of address should be directed, in the first

instance, to the registrars:

Equiniti Limited

Aspect House, Spencer Road, Lancing, West Sussex BN99 6DA

Telephone 0371 384 2013

Overseas +44 (0)121 415 7042

www.shareview.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAFFDALSDFAA

(END) Dow Jones Newswires

November 24, 2023 02:00 ET (07:00 GMT)

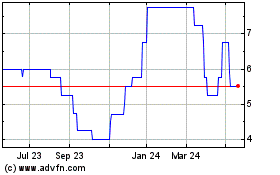

Mothercare (AQSE:MTC.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

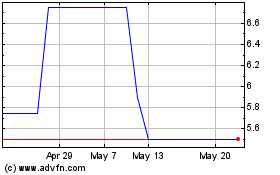

Mothercare (AQSE:MTC.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025