TIDMPET

RNS Number : 3540Q

Petrel Resources PLC

28 June 2022

28 June 2022

Petrel Resources plc

("Petrel" or "the Company")

Audited Results for the Year Ended 31(st) December 2021

Petrel announces its results for the year ended 31(st) December

2021.

A copy of the Company's Annual Report and Accounts for 2021 will

be mailed shortly only to those shareholders who have elected to

receive it and extracts are set out in the announcement below.

Otherwise shareholders will be notified that the Annual Report will

be available on the website at www.petrelresources.com . Copies of

the Annual Report will also be available for collection from the

Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

The Company's Annual General Meeting will be held on 5 August

2022 in the Hotel Riu Plaza The Gresham, 23 O'Connell Street Upper,

Dublin 1, D01 C3W7 at 12.00 pm.

E NDS

For further information please visit http://www.petrelresources.com/ or contact:

Enquiries:

Petrel Resources

David Horgan, Chairman +353 (0) 1 833 2833

John Teeling, Director

Nominated Adviser and Broker

Beaumont Cornish - Nominated Adviser

Roland Cornish

Felicity Geidt +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

Financial PR

BlytheRay

Tim Blythe/Megan Ray +44 (0) 207 138 3206

Teneo

Luke Hogg

Alan Tyrrell

Ciara Wylie + 353 (0) 1 661 4055

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). The person

who arranged for the release of this announcement on behalf of the

Company was Jim Finn, Director.

Chairman's Statement

Highlights

-- Petrel directors agreed to personally purchase a disputed

circa 20% shareholding - this over-hang had confused partners and

constrained Petrel's ability to grow.

-- Petrel's Iraqi business is being re-galvanised, with data

bases being updated, and updated proposals submitted to the

incoming administration.

-- Ratification plan agreed-in-principle with Ghanaian

authorities - though ideally needs recovery of the farm-out market,

to fund an early well.

-- Additional projects being considered to serve surging

commodity demand.

Introduction, Sector Overview and Market Conditions

This is a time of exceptional opportunity in the gas and oil

industries, as well as in critical minerals essential for any green

or cleaner energy transition. There has been a near investors'

strike in oil & gas exploration since 2014, with only limited

appraisal drilling. Meanwhile, demand is bouncing back as the world

recovers from the C-19 pandemic. The result is a supply/demand

imbalance, which - together with geopolitical uncertainties -

drives commodity prices up. The commodity business cycle operates

under its own rules of karma: the longer, and deeper the downturn,

the more vigorous and long-lasting the recovery will be - and vice

versa, as shown by how the 2003 through 2008 boom led to a lengthy

depression till 2021. We aim to fully benefit from this boom, as

shareholders could from the last.

Despite media and official petro-phobia since 2008, oil remains

32% of the global primary energy mix (measured in exajoules) -

albeit down from 40% in 2000. Oil-fired power generation is almost

gone, but petrochemicals are growing. Natural gas continues to grow

strongly, to 24% - while even taboo coal remains 27% of global

primary energy. In no sense, therefore is the oil age ending.

Despite fast growth - especially in liquified natural gas

("LNG") - international gas prices have soared since late 2021 -

especially in Europe and Asia. This is partly due to geopolitical

issues, though an underlying concern is the tightening

supply/demand balance. Under-investment in new gas developments

since 2014 - exacerbated by the C-19 pandemic - have left key

markets under-supplied as gas demand recovers.

Pressure to diversify away from Russian gas (both piped and LNG)

can only be addressed in the short-term by increasing European LNG

imports.

Pipelines from North Africa are subject to their own political

uncertainty (as seen by the shutting of the Algeria-Morocco-Spain

pipeline since September 2021 because of a colonial era territorial

dispute).

Many European countries have outlawed fracking and even

conventional offshore gas exploration. Even if these policies are

reversed (which is still uncertain), it will take time to re-build

confidence among Independent Oil Companies and National Oil

Companies which invested so heavily in European seismic and

drilling, etc. in recent decades - only to have their ability to

monetise their investment by successful developments unilaterally

sabotaged by the State. Once bitten, they will be twice shy.

Despite much wishful thinking, additional hydro and geothermal

potential in Europe is quite limited, while investment in

intermittent renewables generation requires back-up from reliable

generators, of which gas-fired turbines are the most flexible and

efficient.

However, while LNG supplies to Asia have grown by a CAGR of 8%,

there has been LNG under-investment since 2015, exacerbating supply

issues - especially in cold winters, as Asian generator struggle to

displace dirty bituminous coal with clean gas.

This supply constraint is particularly tight in Australia's

North-West Shelf, where several expanding LNG export facilities

urgently need new gas reserves.

LNG is now over half of global traded gas sales, and a third of

European consumption - which will grow as buyers seek to diversify

from dependence on Russian gas.

Meanwhile the Asian market (70% of global LNG deliveries) is

also surging with economic recovery post C-19.

The OPEC+Russia deal has stabilised the oil industry

Despite a hostile environment towards oil, demand recovered

(from the 2019 Sino-American trade war, and demand shock of

Covid-19) during 2021 - despite new virus variants, resulting in

periodic lock-downs. High oil & gas prices in early 2022 led to

some loss of demand, though you could equally remark on how

price-insensitive demand now seems to be - in both developing as

well as developed markets.

The petrochemical industries' success in surging supply (after

brief 2020 shortages) of 'PPE' (Personal Protective Equipment), and

later Plexiglass, illustrate society's ongoing dependence on

petrochemicals, and their petroleum feedstock. There is no

technically and commercially feasible alternative to sterile

packaging for medicines, syringes, drips, PPE and Plexiglass.

Operations

Iraq

Our main focus in the period under review was on re-energising

our Iraqi business. This required resolving an outstanding issue of

circa 20% disputed shareholdings. This has been complicated to

untangle due to an apparent breach of a 2019 lock-in agreement, by

wrongful pledging of these shares, and resulting legal actions.

Though Petrel acted properly throughout, as was confirmed by the

High Court with the award of an open-ended injunction, life must go

on. Counter-parties want certainty of whom they are dealing with,

while expansion plans require higher activity and funding. By

end-May 2022, the complicated issue seems finally resolved, so

Petrel can resume growth. Market endorsement of this deal is shown

by a higher share price and much greater trading volume since April

2022 - despite inflation and geopolitical concerns.

Other constraints on early progress had been the C-19 pandemic -

which had impacted business travel and some Middle Eastern

populations severely - and lengthy Iraqi Government formation

negotiations following end 2021 elections. As of May 2022, the C-19

threat diminishing, while Iraqi government formation talks near

completion.

Accordingly, Petrel is strengthening its Iraqi team, updating

its legacy data-base in the light of advances in geology and

geophysics, as well as surging commodity prices. These have

de-risked many projects - after the bleak depression of 2014

through 2021, and opened many opportunities.

Our Iraqi Director, Riadh Ani has maintained strong

relationships with Ministry of Oil officials. Petrel has monitored

the evolving contracts, and opportunities, even during the darkest

hours of sanctions, invasion, conflict, and Covid-19.

Riadh Ani, is highly regarded as the son of one of the most

successful drillers in history: his father Mahmoud Ahmed had run

Iraq's North Oil Company, and also the State Iraqi Drilling

Company, and in a decades' long drilling career encountered oil

& gas in over 1,000 wells. Only about 12 wells were duds - a

record of exploration and appraisal drilling that is unlikely to be

bettered. This stellar career highlights Iraq's unique petroleum

geology - even compared to neighbouring oil exporters.

Prevailing circumstances obliged Petrel to temporarily

dis-engage from on-the-ground Iraqi operations in 2010. We had seen

the erosion of central government control in the areas of most

interest, and high levels of governance were proving more

challenging to guarantee. The then available Service Contracts

imposed strict legal duties over outcomes that were not then under

operators' realistic control. As a result, some of the

international majors have wearied of Service Contracts that capped

their upside and have sought to improve terms - with some success,

since the oil price falls of 2014, and especially 2020. Others,

like Exxon, have indicated a preference to divest.

Our Iraqi colleagues in the Ministry of Oil remained committed,

diligent and supportive, but the political authorities were then

insufficiently supportive of small business. That neglect is

finally changing following the oil price crash and forced output

cuts of 2020. Now licensing terms are being reviewed, and we expect

more economically attractive terms necessary to return Iraqi output

to the pre-C-19 4.7mmbod, and eventually to rival Saudi Arabia and

Russia.

Iraqi fiscal terms have long held development back. Politicians

and even technicians focus on Iraq's excellent geology, without

understanding the equal importance of logistics and finance.

Investors like profits and prefer more to less. They dislike risk,

and prefer less to more. In practice, investors trade risk off

against return. Iraq has low geological risk, but there are

operational, logistical, and OPEC quota uncertainties. An

additional headache is the oil industry's cyclical nature, with

price volatility due to the interaction of low marginal costs of

production and high marginal value in some applications.

The contractual terms available must reflect these objective

facts if Iraq is to fully realise its potential.

Iraq has generally honoured the May 2020 OPEC+ output cuts, with

a promised aggressive 1.07mmbod cut (out of a March 2020 base-line

of 4.65mmbod). However, these aggressive cuts are specifically

designed, as an emergency response to the sharp demand fall which

began in 1(st) quarter 2020, was at its sharpest in the 2(nd)

quarter 2020, and is now steadily recovering through end 2021. The

C-19 demand shock is now over, and pressure is on to deliver

additional supplies. Yet output seems stuck at c.4.4mmcfd, with

minimal gas (so that Iraq imports gas from Iran - despite

discovered gas fields like Siba, Akkaz and flared gas at producing

oil-fields).

While impressive in the circumstances, recent output levels are

only about half Iraq's geological long-term oil production

potential. It takes about 5 years to bring Iraqi discoveries

on-stream, so new exploration and development are needed now.

As the lowest cost producer, Iraq is now well positioned to

exploit this historic opportunity. Petrel has the experience,

contacts and Board commitment to help drive forward the next phase

of Iraqi oil development.

In discussions shortly before the Covid-19 pandemic, the

authorities suggested that Petrel initially target "exploration of

blocks in the western desert of Iraq, and present past studies done

on the Merjan-Kifl-West Kifl discoveries, and Petrel's work on the

Mesozoic and Paleozoic plays in the Western Desert". Larger

companies have also conducted workshops regarding exploration of

Gas Blocks in the western desert of Iraq, but locals tell us that

some have experienced hostility from local communities since 2014,

due to their nationality and hiring of foreign mercenaries. By

contrast, where skills are available, Petrel favours local workers

and suppliers. Petrel has also invested heavily in the training and

development of its Iraqi staff and Ministry officials we have

partnered with. Despite periodic issues with politicians, Iraqis

value longstanding relationships and independence from foreign

players. They want partners, not bosses.

Ghana

Juniors require partners to efficiently provide technology and

capital. Unfortunately the farm-out market cooled after 2008, and

almost vanished from late 2014. The drought was as lengthy and

intense as the prior noughties boom in commodities. Finally, from

late 2021, the commodity markets sharply recovered due to post-C-19

demand surges, and a dawning realisation that there has been

under-investment in exploration, appraisal and development since

2010. The under-investment was exacerbated by outmoded fiscal terms

that failed to align partner interests and resulted in excessive

reliance on slow-moving majors and National Oil Companies (NOCs).

Having stressed our industry for years, the business cycle is now

turning in our favour. Many still under-estimate the critical role

that petroleum will play in developing the world this century, but

that is part of why there are business cycles.

Accordingly, we are again pressing Ghanaian authorities to

complete the ratification of the signed Petroleum Agreement on

offshore Tano 2A Block. Petrel is again ready to deliver on its

demanding work programme - as shown by our sister company's

participation in a similar 2022 well off Australia's north-west

shelf, targeting similar plays in similar aged rocks in comparable

water depths.

Therefore, Petrel Resources plc continues to progress its

interests in Iraq, and Ghana, maintaining cordial relations with

the relevant authorities in both countries, while continuing to

operate efficiently on minimal expenditure.

Additional projects

We reluctantly dropped our offshore Ireland interests due to the

withdrawal of government support for new oil and gas exploration,

and development. This despite the attractive economics of gas &

oil plays identified - resulting from record gas prices and

geopolitical fears about the continued reliable supply of Russian

and North African gas. These issues were communicated by Petrel via

the media and directly to decision-makers from 2011 to date, and

may finally be getting some traction - though Petrel will need

reassurance by such policy errors will not recur before returning

to work in the European offshore.

David Horgan

Chairman

27 June 2022

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2021

2021 2020

EUR EUR

Administrative expenses (322,077) (399,133)

Impairment of exploration and evaluation assets - (51,552)

-------------------- ----------

Operating loss (322,077) (450,685)

-------------------- ----------

Loss before taxation (322,077) (450,685)

Income tax expense - -

-------------------- ----------

Loss for the financial year (322,077) (450,685)

Other comprehensive income - -

-------------------- ----------

Total comprehensive income for the financial year (322,077) (450,685)

==================== ==========

Earnings per share attributable to the ordinary equity holders of the parent 2021 2020

Cents Cents

Profit or loss

Loss per share - basic and diluted (0.21) (0.29)

==================== ==========

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2021

Assets 2021 2020

Non-current assets EUR EUR

Intangible assets 933,167 931,967

------------ ------------

Current assets 933,167 931,967

Trade and other receivables 25,663 34,994

Cash and cash equivalents 101,843 333,900

------------ ------------

Liabilities 127,506 368,894

Current liabilities

Trade and other payables (792,430) (710,541)

------------ ------------

Total liabilities (792,430) (710,541)

------------ ------------

Net assets 268,243 590,320

------------ ------------

Equity

Share capital 1,962,981 1,962,981

Capital conversion reserve fund 7,694 7,694

Capital redemption reserve 209,342 209,342

Share premium 21,786,011 21,786,011

Share based payment reserve 26,871 26,871

Retained deficit (23,724,656) (23,402,579)

------------ ------------

Total equity 268,243 590,320

------------ ------------

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEARED 31 DECEMBER 2021

Capital Capital Share

Redemption Conversion Based

Share Share Reserve Reserve Payment Translation Retained

Capital Premium fund Reserve Reserve Deficit Total

EUR EUR EUR EUR EUR EUR EUR EUR

At 1 January

2020 1,866,827 21,601,057 209,342 7,694 26,871 376,154 (23,328,048) 759,897

Issue of

shares 96,154 184,954 - - - - - 281,108

Total comprehensive

income

for the

financial

year - - - - - - (450,685) (450,685)

Transfer

of reserves - - - - - (376,154) 376,154 -

--------- ---------- ----------- ----------- -------- ----------- ------------ ---------

At 31

December

2020 1,962,981 21,786,011 209,342 7,694 26,871 - (23,402,579) 590,320

--------- ---------- ----------- ----------- -------- ----------- ------------ ---------

Total comprehensive

income

for the

financial

year - - - - - - (322,077) (322,077)

--------- ---------- ----------- ----------- -------- ----------- ------------ ---------

At 31

December

2021 1,962,981 21,786,011 209,342 7,694 26,871 - (23,724,656) 268,243

========= ========== =========== =========== ======== =========== ============ =========

Share premium

Share premium reserve comprises of a premium arising on the

issue of shares. Share issue expenses are expensed through the

Statement of Comprehensive Income when incurred.

Capital redemption reserve

The Capital redemption reserve reflects nominal value of shares

cancelled by the Company.

Capital conversion reserve fund

The ordinary shares of the company were renominalised from

EUR0.0126774 each to EUR0.0125 each in 2001 and the amount by which

the issued share capital of the company was reduced was transferred

to the capital conversion reserve fund.

Share based payment reserve

The share based payment reserve arises on the grant of share

options under the share option plan.

Translation Reserve

The translation reserve arises from the translation of foreign

operations. A transfer from the translation reserve to retained

deficit occurred during the prior during the prior year related to

a balance on reserves linked to assets no longer held by the

group.

Retained deficit

Retained deficit comprises of losses incurred in the current and

prior years.

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE FINANCIAL YEARED 31 DECEMBER 2021

2021 2020

EUR EUR

Cash flows from operating activities

Loss for the year (322,077) (450,685)

Impairment charge - 51,552

Foreign exchange (9,622) 4,623

--------- ---------

Operating cashflow before movements in working capital: (331,699) (394,510)

Decrease in trade and other payables 81,889 80,656

Increase in trade and other receivables 9,331 3,042

--------- ---------

Cash used in operations (240,479) (310,812)

--------- ---------

Net cash used in operating activities (240,479) (310,812)

--------- ---------

Investing activities

Payments for exploration and evaluation assets (1,200) -

Receipts for exploration and evaluation assets - 450

--------- ---------

Net cash (used in) / generated from investing activities (1,200) 450

--------- ---------

Financing activities

Shares issued - 281,108

--------- ---------

Net cash generated from financing activities - 281,108

--------- ---------

Net cash decrease in cash and cash equivalents (241,679) (29,254)

Cash and cash equivalents at the beginning of year 333,900 367,777

Exchange gains / (loss) on cash and cash equivalents 9,622 (4,623)

--------- ---------

Cash and cash equivalents at the end of the year 101,843 333,900

--------- ---------

NOTES:

1. ACCOUNTING POLICIES

There were no changes in accounting policies from those used to

prepare the Group's Annual Report for financial year ended 31

December 2020. The financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union and in accordance with the

provisions of the Companies Act 2014.

2. LOSS PER SHARE

(i) Loss per share

Basic loss per share is computed by dividing the loss after

taxation for the year attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted loss per share is computed by

dividing the loss after taxation for the year by the weighted

average number of ordinary shares in issue, adjusted for the effect

of all dilutive potential ordinary shares that were outstanding

during the year.

The following tables set out the computation for basic and

diluted earnings per share (EPS):

2021 2020

Cents Cents

Loss per share - basic and diluted (0.21) (0.29)

(ii) Reconciliation of earnings used in calculating earnings per share

2021 2020

EUR EUR

Loss from continuing operations attributable

to the ordinary equity holders of the Company:

Loss for the year (322,077) (450,685)

(iii) Denominator

2021 2020

Number Number

For basic and diluted EPS 157,038,467 153,961,544

3. GOING CONCERN

The Group incurred a loss for the financial year of EUR322,077

(2020: loss of EUR450,685) and had net current liabilities of

EUR664,924 (2020: EUR341,647) at the balance sheet date. These

conditions as well as those noted below, represent a material

uncertainty that may cast significant doubt on the Group and

Company's ability to continue as a going concern.

Included in current liabilities is an amount of EUR767,531

(2020: EUR677,531) owed to key management personnel in respect of

remuneration due at the balance sheet date. Key management have

confirmed that they will not seek settlement of these amounts in

cash for a period of at least one year after the date of approval

of the financial statements or until the Group has generated

sufficient funds from its operations after paying its third party

creditors.

The Group and Company had a cash balance of EUR101,843 (2020:

EUR333,900) at the balance sheet date. The directors have prepared

cashflow projections for a period of at least twelve months from

the date of approval of these financial statements which indicate

that additional finance may be required to fund working capital

requirements and develop existing projects. As the Group is not

revenue or cash generating it relies on raising capital from the

public market.

These conditions as well as those noted below, represent a

material uncertainty that may cast significant doubt on the Group

and Company's ability to continue as a going concern.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include the adjustments that would

result if the Group and Company were unable to continue as a going

concern.

4. INTANGIBLE ASSETS

Exploration and evaluation assets

EUR

Cost:

At 1 January 2020 983,969

Disposals (450)

Impairment (51,552)

At 31 December 2020 931,967

Additions 1,200

At 31 December 2021 933,167

Net book value EUR

At 1 January 2020 983,969

At 31 December 2020 931,967

At 31 December 2021 933,167

Segmental Analysis 2021 2020

EUR EUR

Ghana 933,167 931,967

Iraq - -

933,167 931,967

Exploration and evaluation assets relate to expenditure incurred

in exploration in Ghana. The directors are aware that by its nature

there is an inherent uncertainty in Exploration and evaluation

assets and therefore inherent uncertainty in relation to the

carrying value of capitalized exploration and evaluation

assets.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanian government.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

-- licence obligations;

-- exchange rate risks;

-- uncertainty over development and operational costs;

-- political and legal risks, including arrangements with

Governments for licences, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- financial risk management; and

-- ability to raise finance.

Directors' remuneration of EURNil (2020: EURNil) and salaries of

EURNil (2020: EURNil) were capitalised as exploration and

evaluation expenditure during the financial year.

5. OTHER PAYABLES

2021 2020

EUR EUR

Amounts due to key personnel 767,531 677,531

Accruals 16,500 25,000

Other payables 8,399 8,010

------- -------

792,430 710,541

======= =======

It is the Group's normal practice to agree terms of

transactions, including payment terms, with suppliers. It is the

Group's policy that payments are made between 30 - 45 days and

suppliers are required to perform in accordance with the agreed

terms. The Group has financial risk management policies in place to

ensure that all payables are paid within the credit timeframe.

Key management personnel have confirmed that they will not seek

settlement in cash of the amounts due to them in relation to

remuneration for a period of at least one year after the date of

approval of the financial statements or until the Group has

generated sufficient funds from its operations after paying its

third party creditors.

6. SHARE CAPITAL

Authorised 2021 2021 2020 2020

Number EUR Number EUR

Shares treated as equity

Ordinary shares of EUR0.0125

each 800,000,000 10,000,000 800,000,000 10,000,000

Issued and fully paid

2021 2021 2021 2020 2020 2020

Number Share Share Number Share Share

Capital Premium Capital Premium

At 1 January and

31 December 157,038,467 1,962,981 21,786,011 157,038,467 1,962,981 21,786,011

7. POST BALANCE SHEET EVENTS

There were no material post balance sheet events affecting the

Company or Group.

8. ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held on 5 August

2022 in the Hotel Riu Plaza The Gresham, 23 O'Connell Street Upper,

Dublin 1, D01 C3W7 at 12.00 pm.

9. GENERAL INFORMATION

The financial information set out above does not constitute the

Company's financial statements for the year ended 31 December 2021.

The auditors have reported on 2021 financial statements; their

report was unqualified. The financial statements for 2021 will be

delivered to the Companies Registration Office.

The financial information for 2020 is derived from the financial

statements for 2020 which have been delivered to the Companies

Registration Office. The auditors have reported on 2020 statements;

their report was unqualified with an emphasis of matter in respect

of considering the adequacy of the disclosures made in the

financial statements concerning the valuation of intangible assets,

investment in subsidiaries and amounts due by group

undertakings.

A copy of the Company's Annual Report and Accounts for 2021 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise shareholders will be notified that the Annual

Report will be available on the website at www.petrelresources.com

. Copies of the Annual Report will also be available for collection

from the Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUPCQUPPGAM

(END) Dow Jones Newswires

June 28, 2022 02:00 ET (06:00 GMT)

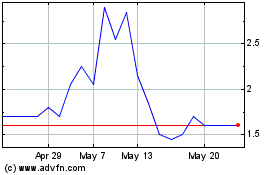

Petrel Resources (AQSE:PET.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Petrel Resources (AQSE:PET.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024