TIDMSRES

RNS Number : 5331S

Sunrise Resources Plc

07 November 2023

7 November 2023

SUNRISE RESOURCES PLC

("Sunrise" or the "Company")

Notice of General Meeting

Proposed Sub-Division of Share Capital

and Cancellation of Deferred Shares

Proposed Issue of Equity & Total Voting Rights

Sunrise Resources plc announces that a General Meeting of

shareholders will be held at 9.00 a.m. on Wednesday 22 November

2022 at The Great Room, Central Court, 25 Southampton Buildings,

London, WC2A 1AL. The Company is calling the General Meeting to

propose the sub-division of its Existing Ordinary Shares into one

New Ordinary Share and One Deferred Share (see definitions

following) and the subsequent Buy Back and cancellation of the

Deferred Shares.

A Shareholder Circular and Notice of General Meeting ("the

Circular") has been published on the Company's website and is being

notified and distributed to shareholders today in line with Company

procedures.

Proposed Sub-Division of Ordinary Shares

The closing mid-market price of the Existing Ordinary Shares as

at Friday 3 November 2023 (being the latest practicable date prior

to printing of the Circular) was 0.07 pence per Existing Ordinary

Share. As the Company is not permitted by law to issue shares at an

issue price which is below their nominal value (being 0.1 pence per

shares) , it is unable, in the present climate, to raise funds by

way of a fresh issue of new Existing Ordinary Shares due to the

fact that the market price of the Existing Ordinary Shares is below

their nominal value. In order to enable the Company to issue shares

in the future at an issue price which exceeds their nominal value,

shareholder approval is being sought to complete a sub-division of

the ordinary share capital of the Company. Each of the Existing

Ordinary Shares will be subdivided into 1 New Ordinary Share and 1

Deferred Share.

The Sub-Division will not of itself affect the value of the

Company's ordinary shares. After the Sub-Division, there will be

the same number of New Ordinary Shares in issue as there are

Existing Ordinary Shares in issue and therefore shareholders'

equity will not be diluted unless a further equity fundraising is

completed by the Company.

The Sub-Division is being proposed as a contingency measure. As

at the date of this announcement the Directors have no intention of

issuing any new equity securities, other than the Buy Back Shares,

assuming the passing of the Resolutions at the General Meeting.

The New Ordinary Shares will have the same rights as those

currently accruing to the Existing Ordinary Shares in issue,

including those relating to voting and entitlement to dividends.

Shareholders will not be issued with a new share certificate for

the New Ordinary Shares and the existing certificates will remain

valid. The Company's International Securities Identification Number

(ISIN) will not change.

Holders of options or warrants over Existing Ordinary Shares

will maintain the same rights as currently accruing to them,

including in relation to any anti-dilution protection, and will not

be issued with new warrant or option certificates.

The Deferred Shares will have no significant rights attached to

them and carry no right to vote or participate in distribution of

surplus assets and will not be admitted to trading on the AIM

market of the London Stock Exchange plc. The Deferred Shares will

effectively carry no value.

Agreement with Towards Net Zero, LLC

Following the Sub-Division, and as disclosed in the Company's

Regulatory News Service announcement of 5 June 2023, the Floor

Price for the convertible security issued to Towards Net Zero, LLC,

as defined in the Company's Regulatory News Service announcement of

30 November 2022, will be reset to the nominal value of the New

Ordinary Shares.

Existing Shareholder Authorities

The authorities granted at the last annual general meeting of

the Company to issue and allot shares pursuant to section 551 of

the Act was referenced to the nominal value of the Existing

Ordinary Shares, meaning that when applied to the New Ordinary

Shares, the Company theoretically would have the ability to issue

more New Ordinary Shares. However, for the avoidance of doubt the

Directors have undertaken that the number of New Ordinary Shares

that can be issued under these authorities will not exceed the

number of Existing Ordinary Shares that could have been issued

notwithstanding the lower nominal value of the New Ordinary

Shares.

Issue of Equity, Buy Back And Cancellation Of Deferred

Shares

Subject to the Sub-Division being approved by shareholders, then

because the Deferred Shares effectively carry no value, and in

order to ensure that the balance sheet of the Company is kept

simple, the Company is seeking shareholder approval to acquire and

cancel the Deferred Shares for GBP1.00 in aggregate.

Under the Act a share buy back by a public company (such as the

Company) can only be financed through distributable reserves or the

proceeds of a fresh issue of shares made for the purpose of

financing a share buy back. The Company currently has no

distributable reserves to finance the GBP1.00 consideration payable

for the buy back of the Deferred Shares and, therefore, the buy

back of the Deferred Shares will be financed out of the proceeds of

a fresh issue of 10,000 New Ordinary Shares ("Buy Back Shares")

made for the purpose of financing the Buy Back. Accordingly, the

Company will allot and will issue the Buy Back Shares to Peterhouse

Capital Limited, at a price of 0.07 pence per Buy Back Share (being

the average closing mid-market price of the Existing Ordinary

Shares for the five Business Days ending on Friday 3 November

2023), part of the proceeds of which will be used to fund the

purchase of the Deferred Shares for an aggregate purchase price of

GBP1.00.

The buy back and cancellation of the Deferred Shares can be

effected by way of an off-market buy back agreement to be entered

into between the Company and an appointed representative of the

holders of the Deferred Shares. The Company's entry into the Buy

Back Agreement will require the approval of a resolution of

Shareholders in accordance with section 694(2) of the Act.

Pursuant to the rights attaching to the Deferred Shares, the

Selling Shareholders will irrevocably authorise the Company to

appoint any person to execute a transfer and/or any agreement to

transfer the Deferred Shares to the Company at any time. Under the

terms of the Buy Back Agreement, which will be entered into after

the General Meeting if approved by shareholders, the Company will

purchase and subsequently cancel all of the Deferred Shares, for an

aggregate consideration of GBP1.00, as contemplated by the rights

and obligations attaching to the Deferred Shares as set out in the

Circular. A copy of a draft of the Buy Back Agreement will be

available to view on the Company's website www.sunriseresources.com

and at the Company's registered office for not less than 15 days

ending with the date of the General Meeting and at the General

Meeting itself.

The Company intends to appoint Mr Rodney Venables, the Company

Secretary, as the appointed representative of the Selling

Shareholders to execute the Buy Back Agreement on behalf of the

Selling Shareholders.

Admission to AIM

Application has been made to the London Stock Exchange for

admission of the New Ordinary Shares to trading on AIM. Provided

that the Sub-Division is approved at the General Meeting, it is

expected that the Sub-Division will become effective and admission

of the New Ordinary Shares will take place at 8.00 a.m. on Thursday

23 November 2023.

Application will also be made to the London Stock Exchange for

admission of the Buy Back Shares to trading on AIM. Provided that

the Buy Back is approved at the General Meeting it is expected that

the issue and admission of the Buy Back Shares will take place on

or around 8.00 a.m. on Wednesday 29 November 2023, following which

the total number of New Ordinary Shares in issue in the Company

will be 4,095,062,030 ("Admission").

Total Voting Rights

For the purposes of the Disclosure and Transparency Rules of the

Financial Conduct Authority, the Board of Sunrise hereby notifies

the market that, following Admission, the Company will have

4,095,062,030 shares in issue with each share carrying the right to

one vote. There are no shares currently held in treasury. The total

number of voting rights in the Company will therefore be

4,095,062,030 and this figure may be used by shareholders as the

denominator for the calculations by which they determine if they

are required to notify their interest in, or a change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules.

Board Recommendation

The Board considers the Proposals to be in the best interests of

Shareholders and the Company as a whole and if not put in place the

Company will not be in a position to continue to raise funds to

continue its activities whilst the Existing Ordinary Shares trade

at a price below their nominal value. The Directors therefore

recommend that you vote in favour of the Resolutions, as they

intend to do in respect of their own directly held shareholdings,

which in aggregate amount to 153,846,801 Existing Ordinary Shares

being 3.76 per cent. of the entire issued Existing Ordinary Shares

of the Company as at Friday 3 November 2023 (being the latest

practicable date prior to publication of the Circular).

The Circular is available for download from the Company

Documents section of the Company's website at the following URL:

https://www.sunriseresourcesplc.com/aim-rule-26#companyDocuments

A letter or email, depending on individual preference, has been

sent to registered shareholders to notify them of the publication

of the Circular.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Publication of this Circular Tuesday 7 November 2023

Latest time and date for receipt 9.00 a.m. Monday 20 November 2023

of proxy appointments

General Meeting 9.00 a.m. Wednesday 22 November

2023

Announcement of the results Wednesday 22 November 2023

of the General Meeting

Record Date 6.00 p.m. Wednesday 22 November

2023

Effective time of the Sub-Division, 8.00 a.m. Thursday 23 November

issue of the New Ordinary Shares 2023

and admission to trading on

AIM

Issue of the Buy Back Shares 8.00 a.m. Wednesday 29 November

and admission to trading on 2023

AIM

Completion of the Buy Back On or around Wednesday 29 November

2023

If any of the details contained in the timetable above should

change, the revised times and dates will be notified to Shareholders

by means of an announcement through the Regulatory News Service.

All references to time and dates in this Circular are to time

and dates in London.

DEFINITIONS

Act Companies Act 2006 (as amended)

Buy Back the proposed buy back of the Deferred

Shares (conditional upon the passing

of the Resolutions)

Buy Back Agreement the agreement between Company and the

appointed representative of the Selling

Shareholders pursuant to which the Buy

Back will be effected (assuming that

the Resolutions are passed at the General

Meeting)

Buy Back Shares the 10,000 new New Ordinary Shares to

be subscribed for to finance the Buy

Back (assuming that Resolution 1 is

passed at the General Meeting and the

Sub-Division takes place)

Company or Sunrise Sunrise Resources plc, registered in

England & Wales with company number

05363956

Deferred Shares deferred shares of 0.099 pence each

in the capital of Company resulting

from the Sub-Division (and each being

a Deferred Share

Directors or Board the directors of the Company from time

to time

Document or Circular The circular being distributed to shareholders

including the Notice

ordinary shares of 0.1 pence each in

Existing Ordinary Shares the capital of Company

General Meeting the General Meeting of the Company to

be held at 9.00 a.m. on Wednesday 22

November 2023, notice of which is set

out at the end of this Circular, and

any adjournment thereof

New Ordinary Shares ordinary shares of 0.001 pence each

in the capital of Company resulting

from the Sub-Division

Notice the notice of General Meeting which

is set out at the end of this Circular

Record Date 6.00 p.m. on Wednesday 22 November 2023

being the record date and time for the

purpose of the Sub-Division

Resolutions the resolutions to be proposed at the

General Meeting as set out in the Notice

Selling Shareholders the holders of the Deferred Shares,

being the holders of the Existing Ordinary

Shares as at the Record Date (assuming

that Resolution 1 is passed at the General

Meeting and the Sub-Division takes place)

Shareholders the holders of the Existing Ordinary

Shares on the Record Date

Sub-Division the sub-division of the existing share

capital of the Company such that each

Existing Ordinary Share is sub divided

into one New Ordinary Share and one

Deferred Share

_________________________________________________________________________

Further information:

Sunrise Resources plc Tel: +44 (0)1625 838 884

Patrick Cheetham, Executive

Chairman

Tel: +44 (0)207 628 3396

Beaumont Cornish Limited

Nominated Adviser

James Biddle/Roland Cornish

Tel: +44 (0)207 469 0930

Peterhouse Capital Limited

Broker

Lucy Williams/Duncan Vasey

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 which forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEQLFBXFLFFBQ

(END) Dow Jones Newswires

November 07, 2023 02:00 ET (07:00 GMT)

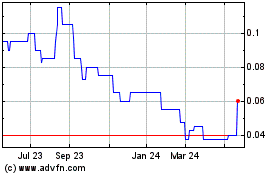

Sunrise Resources (AQSE:SRES.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

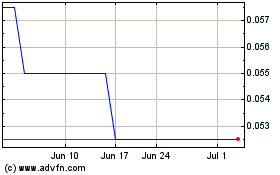

Sunrise Resources (AQSE:SRES.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024