TIDMZPHR

RNS Number : 3556Z

Zephyr Energy PLC

14 September 2022

Prior to publication, the information contained within this

announcement was deemed by the Group to constitute inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310. With the publication of

this announcement, this information is now considered to be in the

public domain.

14 September 2022

Zephyr Energy plc

("Zephyr" or the "Company")

Acquisition of infrastructure and additional acreage in the

Paradox Basin

Zephyr Energy plc (AIM: ZPHR) (OTCQB: ZPHRF), the Rocky Mountain

oil and gas company focused on responsible resource development

from carbon-neutral operations, is pleased to announce that it has

entered into a binding agreement (the "Agreement") to acquire a

package of oil and gas assets located on and around the Company's

Paradox project, Utah, U.S. (the "Paradox project") (the

"Acquisition").

Under the Agreement, Zephyr will acquire 21 miles of natural gas

gathering lines, the Powerline Road gas processing plant (the

"Plant", which is not currently in operation), rights of way for

additional gathering lines, active permits, five existing wellbores

and additional acreage (the "New Acreage") which is partly

contiguous to the Company's operated White Sands Unit (the

"WSU").

The consideration for the Acquisition is US$750,000 and will be

satisfied by a payment from Zephyr's existing cash resources and as

the new owner, Zephyr will assume responsibility for all eventual

decommissioning and plugging and abandonment ("P&A")

liabilities for the assets acquired (estimated to be approximately

US$2.5 million in today's terms).

Once the Acquisition is completed (which is expected by 7

October 2022), Zephyr will operate approximately 45,000 gross acres

in the Paradox Basin, the majority in which the Company holds a 75%

or greater working interest.

Overview

The Agreement enables the Company to acquire an asset package

which will allow Zephyr to substantially reduce the capital

required to build the necessary gas export infrastructure for its

forecast gas production from the Paradox project. Given Zephyr's

potential significant gas resource, strong current pricing and

increasing demand for U.S. domestic natural gas, the Board is

delighted to have secured this opportunity ahead of commencing its

further development of the Paradox project.

The assets being acquired under the Agreement include:

o 21 miles of six-inch gas gathering line, with an estimated

replacement cost value of US$8.8 million, which will substantially

reduce the capital and costs required to export the Company's gas

production from the WSU. The acquired gathering lines tie directly

into the Plant.

-- One of the acquired lines passes immediately alongside the

site of the planned State 36-2 well (the first in a series of

Paradox wells to be drilled in the upcoming drilling

programme).

-- Additional rights of way for future pipelines are also

included in the Agreement.

o The Plant, while not currently in operation, is well suited

for brownfield redevelopment and contains useable pre-existing

infrastructure and related permits. This Plant is ideally located

at the head of a 16-inch gas export pipeline recently purchased by

Dominion Energy ("Dominion"), and can also act as a supply base for

other WSU operations. The Plant has an estimated replacement cost

value of US$1.8 million.

o 1,160 acres which comprises the final leasehold acreage parcel

under Zephyr's existing 3D seismic, giving Zephyr a complete and

contiguous 20,000 acres in the WSU with 3D coverage. Zephyr

estimates that this portion of acquired acreage will

contribute:

-- 2 gross drilling locations with 2C contingent resources from

the Cane Creek reservoir of 1.25 million barrels of oil equivalent

with a net present value at a ten per cent. discount rate

("NPV-10") of approximately US$17 million.

o 4,320 additional acres, in locations near to the WSU, which

are not covered by Zephyr's pre-existing 3D seismic data but with

resource upside potential in a success case.

o Five existing vertical wells, four of which were planned for

P&A by the existing owner, all which are expected to have

re-use potential under Zephyr's ownership:

-- The Federal 28-11 well, currently shut in, has near-term

workover potential and is expected to have an initial estimated

proved developed not producing ("PDNP") reserve value of US$0.4

million once the well's gas export is online.

-- Two wells with notable prior observations of hydrocarbons

which may have additional work over or sidetrack potential.

-- Remaining wellbores which have re-use potential as future

salt water disposal and water supply wells, which could

substantially reduce future operating and completion costs (subject

to State approval).

o A full well database from the Operator.

The consideration for the Acquisition is US$750,000 which will

be satisfied by a payment from Zephyr's existing cash resources. As

the new asset owner, Zephyr will assume responsibility for all

eventual decommissioning and P&A liabilities for the assets

acquired (estimated to be approximately US$2.5 million in today's

terms). The Acquisition is expected to complete by 7 October

2022.

Upcoming Investor Presentation

In light of today's Acquisition and the recent Paradox project

acreage acquisition announced on 25 August 2022, and prior to the

commencement of its upcoming Paradox drilling programme, the

Company intends to present detailed development plans and schedules

for the Paradox project at an investor webinar, the date of which

will be announced within the next two weeks.

Colin Harrington, Zephyr's Chief Executive, said: "We've often

compared our Paradox project development to a jigsaw puzzle with a

number of requisite pieces to be assembled prior to the

commencement of commercial production - and today's announcement is

another substantial piece now in place. By acquiring this package

of surface infrastructure, we are moving rapidly from a programme

of value delineation to a tangible development programme which is

expected to facilitate cashflows from the project in a more rapid

timeframe.

"Beyond the additional resources being acquired, today's

Acquisition provides us with several critical benefits. Firstly, it

allows us to greatly reduce the capital needed to build out the gas

infrastructure required to sell produced gas volumes into the

market. Secondly, it completes the acquisition of all key acreage

covered by the WSU 3D. Thirdly, it provides an additional well pad

already tied to the pipeline, which in combination with the New

Acreage will simplify future development drilling. Similarly, the

gas plant, while currently not in use, has excellent potential for

reintroduction to service and can potentially act as a WSU supply

base.

"The acquired wellbores provide us with multiple re-use options

over the short to medium term. Along with the wells comes a

proprietary well database from the Cane Creek and overlying

reservoirs (including wells with notable hydrocarbon shows and

prior production). Wellbores that do not become work over

candidates have potential as water supply and/or salt water

disposal wells, which can substantially reduce our future operating

and completion costs as the development progresses.

"I would like to take this opportunity to thank our counterparty

in this transaction, as I believe we have jointly created a win-win

situation for both parties through the Agreement. We are now able

to accelerate our Paradox project development without incurring

significant upfront cash costs, and we plan to be proactive

managers of the acquired assets in order to best bring them back

into service. Our aim, as responsible stewards of capital and of

the environment around us, is to minimise surface and environmental

disruption to the greatest extent possible, and making best use of

the existing brownfield infrastructure across our leaseholding is a

key way to achieve this objective.

"Following the significant recent additions to both our land and

infrastructure positions, we plan, in the coming month, to give

Shareholders a comprehensive update on our forthcoming drilling.

It's an exciting time for the Company, filled with short-term

operational activity and long-term strategic potential."

Contacts:

Zephyr Energy plc Tel: +44 (0)20 7225

Colin Harrington (CEO) 4590

Chris Eadie (CFO)

Allenby Capital Limited - AIM Nominated Tel: +44 (0)20 3328

Adviser 5656

Jeremy Porter / Vivek Bhardwaj

Turner Pope Investments - Joint-Broker Tel: +44 (0)20 3657

James Pope / Andy Thacker 0050

Panmure Gordon (UK) Limited - Joint-Broker

John Prior / Hugh Rich / James Sinclair-Ford Tel: +44 (0) 20 7886

/ Harriette Johnson 2500

Celicourt Communications - PR

Mark Antelme / Felicity Winkles

Tel: +44 (0) 20 8434

2643

Notes to Editors

Zephyr Energy plc (AIM: ZPHR) (OTCQB: ZPHRF) is a technology-led

oil and gas company focused on responsible resource development

from carbon-neutral operations in the Rocky Mountain region of the

United States. The Company's mission is rooted in two core values:

to be responsible stewards of its investors' capital, and to be

responsible stewards of the environment in which it works.

Zephyr's flagship asset is an operated 39,473-acre leaseholding

located in the Paradox Basin, Utah which has been assessed by third

party consultants Sproule International to hold, net to Zephyr, 2P

reserves of 2.1 million barrels of oil equivalent ("mmboe"), 2C

resources of 27 mmboe and 2U resources 203 mmboe. Following the

successful initial production testing of the recently drilled and

completed State 16-2LN-CC well, Zephyr is planning a three well

drilling program commencing later this year to further delineate

the scale and value of the project.

In addition to its operated assets, the Company owns working

interests in a broad portfolio of non-operated producing wells

across the Williston Basin in North Dakota and Montana. The

Williston portfolio currently consists of working-interests in over

200 modern horizontal wells which are expected to provide US$35-40

million of revenue, net to Zephyr, in 2022. Cash flow from the

Williston production will be used to fund the planned Paradox Basin

development. In addition, the Board will consider further

opportunistic value-accretive acquisitions.

Glossary of terms

Reserves : Reserves are defined as those quantities of petroleum

which are anticipated to be commercially recovered from known

accumulations from a given date forward.

1P: proven reserves (both proved developed reserves + proved

undeveloped reserves)

2P: 1P (proven reserves) + probable reserves, hence "proved and

probable"

3P: the sum of 2P (proven reserves + probable reserves) +

possible reserves, all 3Ps "proven and probable and possible"

Contingent Resources: Those quantities of petroleum estimated,

as of a given date, to be potentially recoverable from known

accumulations by application of development projects, but which are

not currently considered to be commercially recoverable due to one

or more contingencies.

Contingent Resources may include, for example, projects for

which there are currently no viable markets, or where commercial

recovery is dependent on technology under development, or where

evaluation of the accumulation is insufficient to clearly assess

commerciality. Contingent Resources are further categorised in

accordance with the level of certainty associated with the

estimates and may be sub-classified based on project maturity

and/or characterised by their economic status.

1C: Low estimate of Contingent Resources

2C: Best estimate of Contingent Resources

3C: High estimate of Contingent Resources

Prospective Resources: Those quantities of petroleum which are

estimated, on a given date, to be potentially recoverable from

undiscovered accumulations.

1U: Low estimate of Prospective Resources

2U: Best estimate of Prospective Resources

3U: High estimate of Prospective Resources

Dr Gregor Maxwell, BSc Hons. Geology and Petroleum Geology, PhD,

Technical Adviser to the Board of Zephyr Energy plc, who meets the

criteria of a qualified person under the AIM Note for Mining and

Oil & Gas Companies - June 2009, has reviewed and approved the

technical information contained within this announcement.

Estimates of resources and reserves contained within this

announcement have been prepared according to the standards of the

Society of Petroleum Engineers. All estimates, unless otherwise

noted, are internally generated and subject to third party review

and verification.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDBGDCLXBDGDX

(END) Dow Jones Newswires

September 14, 2022 02:02 ET (06:02 GMT)

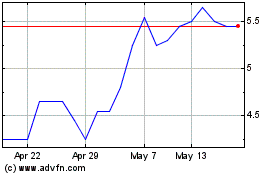

Zephyr Energy (AQSE:ZPHR.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Zephyr Energy (AQSE:ZPHR.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025