ANZ, Citi, Deutsche Bank Accused of Engaging in Cartel Conduct

June 05 2018 - 4:53AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Australia's antitrust regulator has taken

the unusual step of criminally charging one of the country's

biggest banks and two underwriters of a 2015 fundraising round for

the bank.

It alleges cartel conduct.

Charges related to trading in Australia & New Zealand

Banking Group Ltd. shares by the underwriters were filed Tuesday by

Australia's government prosecutions agency against ANZ, Citigroup

Inc. and Deutsche Bank AG, as well as several senior executives of

all three.

ANZ and each of the individuals named are alleged to have been

knowingly involved in some or all of the conduct, according to the

Australian Competition and Consumer Commission, which has been

investigating the matter for more than two years.

Each of the banks disputes the allegations and said they plan to

defend themselves and their employees.

In 2015, ANZ surprised investors with plans to raise 3 billion

Australian dollars (US$2.29 billion) to meet regulatory demands for

stronger buffers against the risk of future crises. The bulk was

raised through an institutional share placement underwritten by

Citi, Deutsch Bank and the local arm of J.P. Morgan

The placement was completed that August when about 80.8 million

shares were issued.

The competition commission hasn't detailed its allegations, and

on Tuesday said it wouldn't comment further as the matter is now

before the court. The case is listed to be heard by a Sydney court

on July 3.

Investigations by the regulator more commonly lead to civil

action rather than criminal charges, which are usually harder to

prove. Andrew Grant, a lecturer at the University of Sydney

Business School, said the authorities' decision here suggests they

feel their case is strong.

Companies regularly put together syndicates to underwrite large

capital raisings, and Citi said the practice hasn't previously been

considered by an Australian court or addressed in published

regulatory guidance. It denied any wrongdoing and said that if the

regulator believes there are matters to address, they "should be

clarified by law or regulation or consultation."

The regulator alleges the underwriters reached an understanding

on the disposal of shares outstanding in the placement, amounting

to less than 1% of the total, Citi said. It noted that ANZ shares

are bought and sold freely by thousands of investors every day,

including during the period in question.

Last week, ANZ said it believes it acted within the law, and is

cooperating with an investigation by the corporate regulator into

whether it should have said in an August 2015 statement that the

underwriters had bought about 0.9% of the shares issued. Reached

Tuesday, the bank referred back to that earlier statement.

Deutsche Bank said it and the former executive who were charged

acted responsibly and in the interests of clients.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

June 05, 2018 05:38 ET (09:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

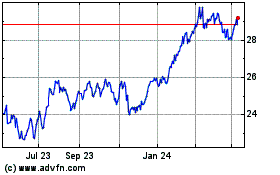

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Feb 2024 to Feb 2025