Australia Backs Down on Limiting Gas Exports -- Update

September 27 2017 - 2:36AM

Dow Jones News

By Robb M. Stewart and Rob Taylor

MELBOURNE, Australia--Australia's government held back from

imposing curbs on exports of liquefied natural gas after producers,

including Royal Dutch Shell PLC, agreed to put more gas into the

domestic market to ease energy shortages.

The decision, which followed a meeting between Prime Minister

Malcolm Turnbull and energy companies, came just days after an

Australian regulator warned that gas shortages in 2018 could be

three times worse than previously thought. Experts had warned the

export curbs risked damaging the country's standing as a

destination for investment, while having a limited impact on local

gas supply and prices.

Mr. Turnbull said the energy companies had promised to fill a

supply shortage that the Australian Energy Market Operator

estimated would be up to 107 petajoules in 2018--or enough gas to

generate electricity for roughly 5 million Australian homes for a

year--and 102 petajoules in 2019.

"They have given us a guarantee that they will offer to the

domestic market," he said. "They have stated that they will provide

a similar guarantee over two years."

The energy companies, which also include Santos Ltd. and Origin

Energy Ltd., agreed to make regular reports to regulators on sales

and market prices, a move that Mr. Turnbull said would help to

improve transparency.

Zoe Yujnovich, chairwoman of Royal Dutch Shell's Australian arm,

said the company had established a new unit in Melbourne to sell

gas from eastern Australia's Queensland state.

"The company is committed to understanding demand in the market,

securing gas supply and selling more gas to customers," she said

Wednesday.

Australia, the world's second-largest exporter of LNG, has

grappled with blackouts in recent years as energy demand soared and

there wasn't enough gas to maintain electricity supply.

Australia now exports so much LNG that it may overtake No. 1

exporter Qatar within several years. It exported 62% of its gas

production last year, according to the BP Statistical Review of

World Energy.

Yet its policy makers didn't ensure enough gas would remain at

home. As exports increased from three new LNG facilities in

Queensland, some state governments let aging coal plants close and

accelerated a push toward renewable energy because of environmental

concerns. That left the regions more reliant on gas for power,

especially when intermittent sources such as wind and solar weren't

sufficient.

Shortages have sent domestic gas prices surging this year in

some markets in eastern Australia, driving up household energy

bills and sending the government's popularity plummeting to

near-record lows in opinion polls. They have also caused widespread

pain for industry: Australia's largest aluminum smelter cut

production and laid off workers because it said it couldn't secure

enough cheap energy.

Rod Sims, chairman of the Australian Competition and Consumer

Commission, said in a speech last week that none of the steps taken

by energy companies to support the domestic market had made serious

inroads into the supply problem, noting that Australian natural-gas

prices remained at around all-time highs.

"There is no point in Australia becoming the world's biggest LNG

exporter if the domestic market misses out," Josh Frydenberg,

minister for energy and the environment, said Wednesday.

Imposing export curbs, however, would have been a risky move for

the government because they would have weighed on Australia's

reputation, dented state tax revenue and potentially encouraged

producers to leave gas in the ground, said Saul Kavonic, an analyst

at consultancy Wood Mackenzie in Australia.

Santos, which operates an LNG plant in Queensland, has said the

best way to bring more gas to the domestic market is to scale back

restrictions on exploration and development that are in place in

several states.

Write to Robb M. Stewart at robb.stewart@wsj.com and Rob Taylor

at rob.taylor@wsj.com

(END) Dow Jones Newswires

September 27, 2017 03:21 ET (07:21 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

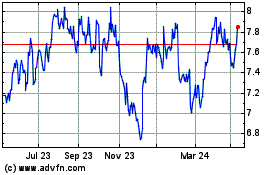

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

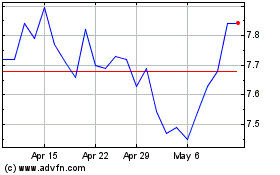

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025