Coal & Allied: Hunter Valley Residents Have Legitimate Concerns About Mining

April 15 2011 - 12:06AM

Dow Jones News

Residents of Australia's Hunter Valley have legitimate concerns

about planned expansions to coal mining in the world's biggest

export thermal coal basin, according to Coal & Allied

Industries Ltd. (CNA.AU).

Community objections are making it harder to get mining permits

and adding to the time necessary to develop projects, Coal &

Allied Managing Director Bill Champion said Friday.

But these concerns are understandable, he said. "If I was a

resident in (Hunter Valley towns) Singleton or Muswellbrook and I

was hearing these plans to double output from the Hunter, I'd have

to scratch my head and ask how the valley is going to be able to

respond to that, given the stresses already placed on

infrastructure," he said in an interview with Dow Jones

Newswires.

Coal & Allied, 76% owned by Rio Tinto PLC (RIO), is the

largest thermal coal exporter listed on the Australian Securities

Exchange and one of the largest producers in the Hunter Valley.

Australia is the world's largest coal exporter and the Hunter

Valley's mines feed the port of Newcastle, the largest coal export

port in the world.

Champion said demand from major Japanese customers is likely to

be 4 million to 6 million metric tons lower over the course of the

year due to problems restarting power plants after the March 11

Tohoku earthquake, but the slack has been taken up by consumers in

China, South Korea and Taiwan.

"The big uncertainty is whether that's a near-term loss that

might be made up later in the year, or whether you don't get back

until 2012. There are concerns about how quickly the coal-fired

plants that are damaged can come back on line," he said.

Miners have noted a tightening-up of regulations on coal mining

in the Hunter Valley in recent months, amid community objections

from farming and environmental groups and a change of state

government in New South Wales.

On Tuesday, White Energy Co. (WEC.AU) dropped a planned A$500

million acquisition of Cascade Coal Pty. Ltd., a privately held

company with projects in the Bylong Valley in the southwest of the

Hunter.

White Energy cited "significant comment in the local area" and

"a degree of uncertainty" around whether the project would get

necessary permits in justifying the decision.

The conservative Coalition government that won New South Wales

state elections March 26 had pledged to review certain mining

permits granted under the previous government, understood to

include Cascade's main projects.

"There's been a lot of pushback from the community up there,"

said a person familiar with the White Energy deal, who didn't wish

to be named. "Getting a mining license up in today's environment is

a lot more difficult than it was even 12 months ago."

Champion echoed that sentiment. "There's a lot more attention

being put into permitting processes, so it is a lot more work and

that adds a bit of time" to develop projects, he said. "It is a bit

more difficult than it has been. The strength of the voices of

opposition has ramped up significantly."

However, he said he met with state civil servants before Coal

& Allied's annual general meeting Friday and is hopeful the

region will be able to "have its cake and eat it".

"This isn't about one or the other; you have to capture the

economic value (of mining) without disadvantaging the community,"

he said.

Coal & Allied had attributable production of 18.7 million

tons during the 2010 calendar year. Four-fifths of that total was

the thermal coal used in power stations, with the remainder

consisting of semi-soft coking coal, a variety increasingly in

demand in steelmaking.

In a speech to the miner's annual general meeting Friday,

Chairman Chris Renwick said the miner's price settlement for

thermal coal contracts starting from April 1 came in at US$129.85 a

ton, the same as the benchmark price agreement for Australian

thermal coal between Xstrata PLC (XTA.LN) and Japanese

utilities.

Semi-soft coal was priced at US$180 a ton in the first quarter

of 2011 but rose to US$264 for the second quarter to June 30, in

line with the spike in prices of hard coking coal following floods

in Queensland's Bowen Basin, which accounts for around two-thirds

of the seaborne trade in the commodity.

Semi-soft coking coal has traditionally been used in both power

stations and steel blast furnaces, but the boom in heavy industry

in emerging markets in recent years has sharply driven up the price

of harder coking coals through demand from steelmakers, dragging up

the cost of lower-quality coking coals in tandem.

Coal & Allied is now pricing its semi-soft coal at a 20%

discount to benchmark Australian hard coking coals, Champion said.

Anglo American PLC's (AAL.LN) German Creek brand was the first to

settle a price in the second quarter, coming in at US$330/ton.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

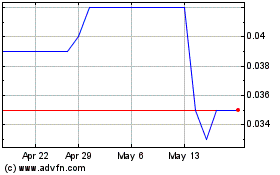

White Energy (ASX:WEC)

Historical Stock Chart

From Jan 2025 to Feb 2025

White Energy (ASX:WEC)

Historical Stock Chart

From Feb 2024 to Feb 2025