European Luxury Results Reassure Investors -- Earnings Review

March 21 2019 - 11:31AM

Dow Jones News

--Results reassured investors, easing fears of waning Chinese

demand

--Soft-luxury players did better than companies selling watches

and jewelry

--Results helped boost stock prices but investors remain

cautious

By Cristina Roca

European luxury earnings wrapped up this week with Hermes's

results. Here are some observations and analyst comments:

SOFT LUXURY OUTPERFORMED HARD

Most players in the luxury leather goods, clothing and

accessories market saw unexpectedly resilient demand in the fourth

quarter, Citi analyst Thomas Chauvet said. "Key demand drivers are

still in place to support healthy (albeit normalizing) growth"

going forth, he said.

Many of these soft-luxury players have been outperforming

hard-luxury peers peddling high-end jewelry and watches for the

past few years because they have been more agile in adapting to

changing markets, Mr. Chauvet said.

Brands like Kering's (KER.FR) Gucci have worked to create

entry-level products to attract new customers, for example by

making a smaller, lower-priced version of a popular bag, he

said.

Kering's "scientific and increasingly data-driven approach to

running brands" should also be credited for Gucci's success

alongside product and creativity, Deutsche Bank's Francesca

DiPasquantonio said.

Other soft-luxury companies like LVMH Moet Hennessy Louis

Vuitton SE (MC.FR) also benefited from investment in digital, HSBC

said.

Hard-luxury companies had less buoyant results, being more

sensitive to macroeconomic uncertainty and currency moves, Mr.

Chauvet said. Buyers may choose to hold off on big-ticket purchases

until currencies are more favorable, he added.

REASSURING START TO THE YEAR

Most luxury companies pointed to demand holding up in early

2019, including LVMH, Moncler SpA (MOV.MI), and Hermes

International SCA (RMS.FR). Prada SpA (1913.HK) and Salvatore

Ferragamo SpA (SFER.MI), both in the midst of efforts to turn

around top-line momentum, said like-for-like sales were

positive.

Kering management said January trading was broadly in line with

the fourth quarter for Gucci and demand for the label held strong

with Chinese and American customers, reassuring investors who were

concerned over whether Gucci could sustain its appeal, Mr. Chauvet

of Citi said.

After months of uncertainty on Chinese consumption, current

trends and macro indicators look far more encouraging, Bryan

Garnier analysts said.

"We have the feeling that the first months of this year were

quite robust in Mainland China," they said.

STOCKS REBOUNDED BUT INVESTORS REMAIN CAUTIOUS

Earnings supported good sentiment for the luxury sector and

stocks' valuations have returned to high levels, Berenberg analysts

said, adding however that this leaves little room for error if

conditions deteriorate, notably in China.

Mr. Chauvet differed, saying that although the luxury sector as

a whole is now up 17% year-to-date, its valuation isn't above its

historical average. To a large degree, the rise in luxury stocks

was just the recovery from the troughs of last autumn, when fears

of a sharp slowdown in Chinese demand triggered a sell-off, he

said.

Moncler--a maker of high-end down jackets--got the biggest boost

from earnings, rising 11% after the Italian company reported

substantial fourth-quarter growth, and said it was particularly

satisfied with China. Even with its shares trading at a premium,

Moncler appeals to investors as it looks like a safe bet while the

broader market turns more challenging, Jefferies analyst Flavio

Cereda said.

This season's reporting showed that the concerns about a "hard

landing" in China that gripped the market during the second half of

last year were overdone, Mr. Chauvet said. But the market may need

more time to confirm the trend, Mr. Chauvet said.

Write to Cristina Roca at cristina.roca@dowjones.com

(END) Dow Jones Newswires

March 21, 2019 12:16 ET (16:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

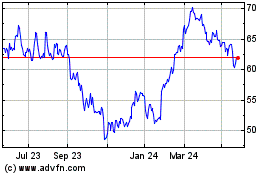

Moncler (BIT:MONC)

Historical Stock Chart

From Dec 2024 to Jan 2025

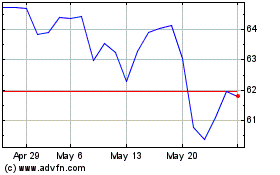

Moncler (BIT:MONC)

Historical Stock Chart

From Jan 2024 to Jan 2025