20% Rally Possible For Avalanche If It Surpasses This Key Resistance Level

April 18 2023 - 7:00AM

NEWSBTC

Over the past few weeks, Avalanche has made an impressive recovery

in its price. Last week alone, AVAX surged by 20%, and on the daily

chart, it showed over 4% appreciation. Despite facing a significant

decline last month when its price dropped to $14, AVAX managed to

rally by almost 50%. The technical analysis of the asset has

pointed to significant bullishness, with buying strength increasing

considerably. As demand moved up, so did accumulation. Currently,

Avalanche is sitting underneath a crucial resistance level. If it

manages to surpass this level, the altcoin could attempt another

rally. Related Reading: Binance Coin (BNB) Rallies 8% Ahead Of Hard

Fork Upgrade However, with Bitcoin still hovering below the $30,000

price mark, most altcoins are also resting under crucial resistance

levels. If BTC continues to face downward pressure in the coming

days, it could potentially trigger a pullback in AVAX’s price,

which could create shorting opportunities for investors. The market

capitalization of AVAX also appreciated which indicated an increase

in buyers at press time. Avalanche Price Analysis: One-Day Chart At

the time of writing, AVAX was trading at $21.40 and had

successfully surpassed a crucial resistance level of $21,

demonstrating bullishness on its chart. The next major overhead

resistance for the altcoin is at $21.60, which has been a

multi-month ceiling and is a vital resistance point, given the

significant volume of sell orders in that zone. This area is known

as a supply zone, and if AVAX manages to break through it, the

price could potentially surge past other resistances and reach $25.

However, if the altcoin fails to overcome this resistance level, it

may face a pullback. The support level for AVAX currently stands at

$19.60. A drop below that could drag the price down to $16.

Technical Analysis Following AVAX’s successful trading above the

$21 price mark, buyers have gained confidence, driving the

altcoin’s price momentum in the market. The Relative Strength Index

(RSI) was nearing 80, indicating overbuying tendencies and

suggesting that the altcoin was overvalued at the time of writing.

Typically, an overvalued asset experiences a price pullback. If a

pullback were to occur for AVAX, it could briefly fall to $20

before experiencing another appreciation in value. In line with

increased demand, the altcoin has moved above the 20 Simple Moving

Average line, indicating that buyers are driving the price momentum

in the market. AVAX has been exhibiting bullish indicators that

suggest a potential buy signal for the altcoin. The Moving Average

Convergence Divergence (MACD) formed green signal bars, which are

typically associated with buy signals. This further indicates

positive price momentum for AVAX. Related Reading: OKB Tallies 24%

Increase But Active Addresses Fail To Keep Pace – Here’s Why

Additionally, the Bollinger Bands, which indicate volatility and

price fluctuation, have opened up widely. This suggests that the

altcoin could experience significant price movement and volatility

over the next few trading sessions. Featured Image From UnSplash,

Charts From TradingView.com

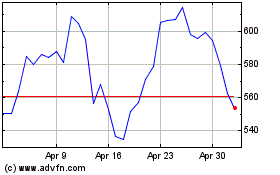

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024