Bitcoin Price Supported By All-Stablecoins Cash Inflow – Data Reveals Strong Correlation

December 03 2024 - 12:30PM

NEWSBTC

Bitcoin has entered a period of calm after a turbulent decline from

$99,000 to $90,000 over just three days. Currently trading above

$95,000, the leading cryptocurrency holds a pivotal level that will

likely dictate its next move. This key zone will determine whether

Bitcoin regains upward momentum or seeks lower-level liquidity to

establish stronger support. Related Reading: XRP Reaches 6-Year

High – Whales And STH Accumulate Together Despite the recent

volatility, market participants remain optimistic, as on-chain data

provides fresh insights. According to CryptoQuant, a notable uptick

in stablecoin transfer volumes has coincided with Bitcoin’s price

action. This metric often signals increased purchasing power

entering the market, a potential precursor to renewed buying

interest in Bitcoin. As Bitcoin consolidates above $95,000, traders

and investors closely monitor its ability to reclaim psychological

resistance at $100,000. Conversely, losing support could push BTC

to retest lower levels near $90,000 or even deeper liquidity

zones. Bitcoin And Stablecoins: What They Have In Common?

Bitcoin has achieved a remarkable milestone, staying less than 1%

away from the coveted $100,000 mark, driven by a wave of

institutional and retail buying. This historical rally reflects a

growing global demand, with investors from various countries

utilizing stablecoins to purchase BTC. Stablecoins have emerged as

the preferred bridge, enabling seamless transactions across borders

and currencies. According to CryptoQuant analyst Axel Adler, the

recent surge in stablecoin transfer volumes coincided with

Bitcoin’s price ascent. This trend highlights stablecoins’

significant role in providing liquidity and driving market

momentum. Cash inflows through stablecoins create robust support

for Bitcoin’s price, allowing it to maintain upward pressure even

as it nears critical psychological levels. The correlation between

stablecoin activity and Bitcoin price action offers valuable

insights into market dynamics. Increased stablecoin transfers often

signal heightened demand for Bitcoin, providing a reliable

indicator of potential price movements. This interplay is

particularly relevant in identifying periods of high buying

pressure, as stablecoins facilitate quick and efficient market

participation. Related Reading: Dogecoin Ready To Hit $1 – Price

Struggles To Break Above Major Resistance As Bitcoin approaches the

$100,000 milestone, the continued influx of stablecoin-driven

liquidity underscores the asset’s global appeal and resilience.

Whether this momentum leads to a breakout above $100,000 or a

period of consolidation, the role of stablecoins in fueling demand

will remain pivotal in shaping Bitcoin’s price trajectory. BTC

Price Nears Critical Zone Bitcoin currently holds above the crucial

$95,000 level, a price that will play a decisive role in its

short-term trajectory. This level acts as a psychological and

technical support zone that could propel BTC toward the

long-anticipated $100,000 milestone this week or delay the

breakthrough until next year. For Bitcoin to breach $100K, the

$95,000 level must hold for several days, allowing sufficient time

to fuel demand and attract fresh liquidity. Sustained buying

pressure around this range will likely enable BTC to break above

the key psychological barrier, continuing its historic rally.

However, the bullish momentum faces risks. A failure to hold the

$95,000 level would expose BTC to a retest of $92,000, another

critical support. Losing both levels could trigger a significant

correction, sending Bitcoin to lower demand zones around $85,000 or

sub-$ sub-$80,000. This move would sharply reverse its recent

rally, shaking market confidence. Related Reading: Cardano

Transactions Rise To Multi-Year Highs – Metrics Support Bullish

Outlook The coming days will be pivotal as traders watch for

sustained support above $95,000. Bitcoin’s ascent to $100,000 could

soon materialize if the bulls defend this level effectively.

Otherwise, the market might brace for a deeper retracement before

regaining its upward momentum. Featured image from Dall-E, chart

from TradingView

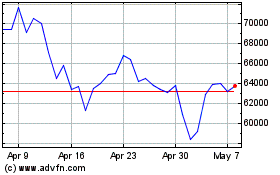

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024