CryptoQuant Analyst Reveals Signal That Shows Bitcoin Is Still Very Bullish

April 29 2024 - 9:00AM

NEWSBTC

The Bitcoin price movement in the past few days after the halving

event has left many investors wanting. Particularly, price data

shows the crypto failed to settle above $65,000 las week. At the

time of writing, Bitcoin is trading at $62,105, down by 2.96% and

6.14% in the past 24 hours and seven days, respectively.

According to a CryptoQuant analyst, Bitcoin’s Adjusted Spent Output

Profit Ratio (aSOPR) is still looking bullish, which could be a

faint signal of the crypto’s price reversing into bullish momentum.

Current State Of Bitcoin As it stands, the price of Bitcoin might

be on the way to registering a new monthly low with the risks of

more downside below $62,000. A recent analysis during the weekend

by Phi Deltalytics, an analyst at CryptoQuant, noted that Bitcoin’s

price trajectory is showing indecisiveness in the short term. His

analysis is based upon the SOPR ratio, one of the lesser-known but

highly useful metrics for analyzing Bitcoin. Related Reading: Brace

For Price Impact: Dogecoin Whales Move Massive 456 Million DOGE To

Exchanges SOPR measures the profit ratio of spent outputs, which

are groups of transactions representing the movement of

coins. Phi’s analysis revealed an interesting indecisiveness

with this metric. According to this metric, Bitcoin’s short-term

Spent Output Profit Ratio (SOPR) has entered into a zone of

indecisiveness, correlating with the current market sentiment.

However, the analyst also noted that the adjusted SOPR continues to

move in a bullish direction, a confluence that warrants careful

planning when entering the market. What Does This Mean for Bitcoin?

This discrepancy with the SOPR and its adjusted ratio means many

short-term holders are now trading Bitcoin at a loss.

Interestingly, another CryptoQuant analysis seems to support this

idea. Specifically, the long-term SOPR to short-term SOPR ratio is

moving in favor of long-term holders, suggesting that long-term

holders are realizing greater profits in contrast to short-term

holders. Hence, there is persistence of bullish momentum with the

adjusted SOPR. A better interpretation of this SOPR ratio is

that the price of Bitcoin has not been favorable for short-term

holders at the current market conditions. Furthermore, it suggests

that the stalling of the upward momentum can be attributed to some

long-term holders cashing out their holdings. According to

Phi Deltalytics, a reversal of the adjusted SOPR into a bearish

signal would finally imply the possibility of a rapid downward

shift in the price of Bitcoin. “The persistence of a bullish aSOPR

amidst wavering short-term SOPR trends gives rise to the

possibility of a rapid downward shift once the aSOPR trajectory

reverses,” the analyst mentioned. Related Reading: XRP Price

Prediction: Analyst Says Prepare For 700% Jump To $4, Here’s When

When Will The Correction End? Bitcoin’s price has been ranging

between $60,000 to $70,000 since it reached a new all-time high.

The much-anticipated break above $74,000 now seems to be taking

forever, and this lackluster action has prompted some analysts to

believe that Bitcoin might have reached its peak in the current

market cycle. However, time can only reveal the crypto’s

price trajectory in the coming months, particularly with the recent

conclusion of another halving event. If halving history repeats

itself, Bitcoin could continue its price surge within the next nine

months. BTC price struggles to hold $62,000 support | Source:

BTCUSD on Tradingview.com Featured image from Barron’s, chart from

Tradingview.com

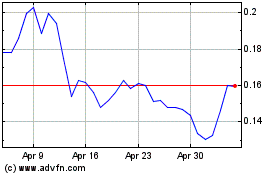

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024