Doomsday for Ethereum? ‘A Crash Down To $1,500 Is Coming,’ Says Skeptic, Here’s Why

July 05 2024 - 9:00PM

NEWSBTC

The crypto market is currently navigating through a turbulent

phase, particularly for Ethereum, which has seen a significant

downturn of nearly 15% in its value over the past week. Amid this

negative price performance, Peter Schiff, a well-known economist

and a skeptic of cryptocurrencies, has chosen to add salt to the

wounds by projecting a stark prediction for ETH. According to

Schiff, Ethereum could plummet to as low as $1,500, marking a

substantial decline from its current levels. Related Reading:

Ethereum Dives Below $3K: What’s Next For The Crypto? Shiff’s

Bearish Outlook And Community Reaction Schiff’s prediction comes

when Ethereum is trading below the previous crucial support of

$3,000 mark, a sharp 30% fall from its peak above $4,500 in March.

This decline coincides with heightened speculation surrounding the

potential launch of an Ethereum spot exchange-traded fund (ETF),

which seems to have triggered a premature sell-off among investors

instead of propelling the price. Schiff’s commentary suggests that

the market’s response to the ETF rumors has been to liquidate

positions rather than hold, adding further downward pressure on

Ethereum’s price. He expressed his view on Elon Musk’s social media

platform, X, stating, “It looks like those buying the Ethereum ETF

rumors couldn’t wait for the fact to sell,” indicating a market

driven by speculation rather than sustained investment confidence.

While Schiff’s bearish outlook has garnered attention, it has also

sparked a mix of skepticism and agreement within the crypto

community. Users have expressed varying opinions on social media

platforms, with some questioning the technical basis of Schiff’s

$1,500 target. Others humorously noted that Schiff’s pessimistic

predictions often come at market bottoms, suggesting his views

might inadvertently signal a buying opportunity. For instance, one

user remarked on the irony of Schiff’s timing, indicating that his

bearish predictions could contradict market sentiment indicators.

thx for your inputs you do realize you only become relevant on this

side of twitter as a bottom signal lol youre like those acoustic

wif kids who had a stroke on stage the wif party as a top signal —

agent pretzel (@agent_pretzel) July 5, 2024 Ethereum Faces Critical

Juncture Ethereum is experiencing a significant downturn, trading

at $2,975—a 4.2% drop over the past day. This decline and Bitcoin’s

similar trajectory have led to a 4.1% reduction in the global

cryptocurrency market cap, erasing more than $200 billion in value.

According to Coinglass, this downturn has triggered substantial

losses for traders, with 207,020 liquidations in the past day,

totaling $576.53 million. Ethereum-related liquidations account for

$134.58 million, predominantly from long positions. While Peter

Schiff’s outlook may seem too pessimistic amid these market

conditions, another voice in the crypto analysis sphere, Inspo

Crypto, offers a slightly more moderate view. He notes that

Ethereum’s price has fallen to early May levels and suggests that

the next 8-hour trading window could be crucial in determining the

market’s direction. Related Reading: Analyst Predicts Ethereum

Nosedive, Cautions Investors To Prepare For $2,700 Target If

Ethereum can rise above these levels, it might potentially ease the

bearish trend. However, failure to reach the $3,170 mark (which it

already has) could lead to further declines, possibly down to

$2,700, exacerbating losses across the altcoin market. $ETH has

broken down below $3,170. The next 8 hours (1D candle) will show

whether the bulls have given up or not. If the price retraces back

above, we should consider this a deviation. But if $ETH instead

retests the lower trend channel next at $3,170 unsuccessfully, it

could… pic.twitter.com/1msfKQBf2v — InspoCrypto (@InspoCrypto) July

4, 2024 Featured image created with DALL-E, Chart from TradingView

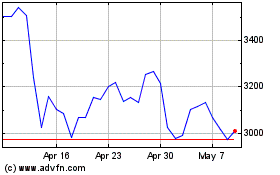

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024